S&P 500 Gets Back In Gear With Median Stock

Price action is bullish even as more central banks raise rates

Ready to learn more about Hi Mount Research? Register for your free online account and then ask for a chance to preview subscriber-only content.

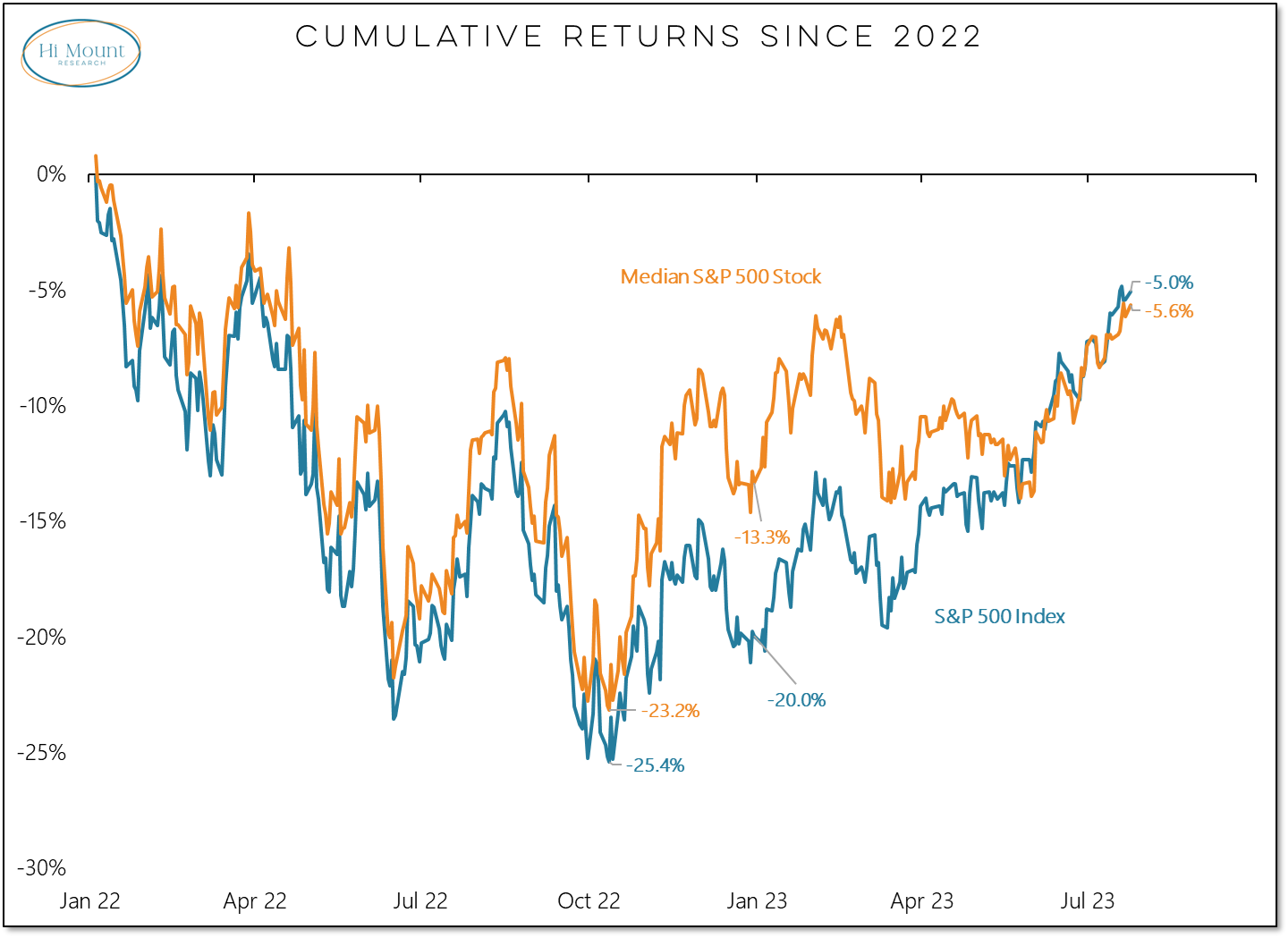

Key Takeaway: Year-to-date gains in the S&P 500 have been fueled by remarkable strength out of the largest stocks. Zooming out to early 2022 shows that it's the index itself (and its mega-cap drivers) that have just now caught up to the median stock in the S&P 500.

More context: The median stock spent the first five months of this year consolidating the move off its 2022 lows. The mega-caps were the laggards and coming into this year, the S&P 500 was still 20% off its high while the median stock in the index was only in a 13% drawdown. Now the megas have caught up to the median and the move toward new recovery highs has resumed for the index and beneath the surface.

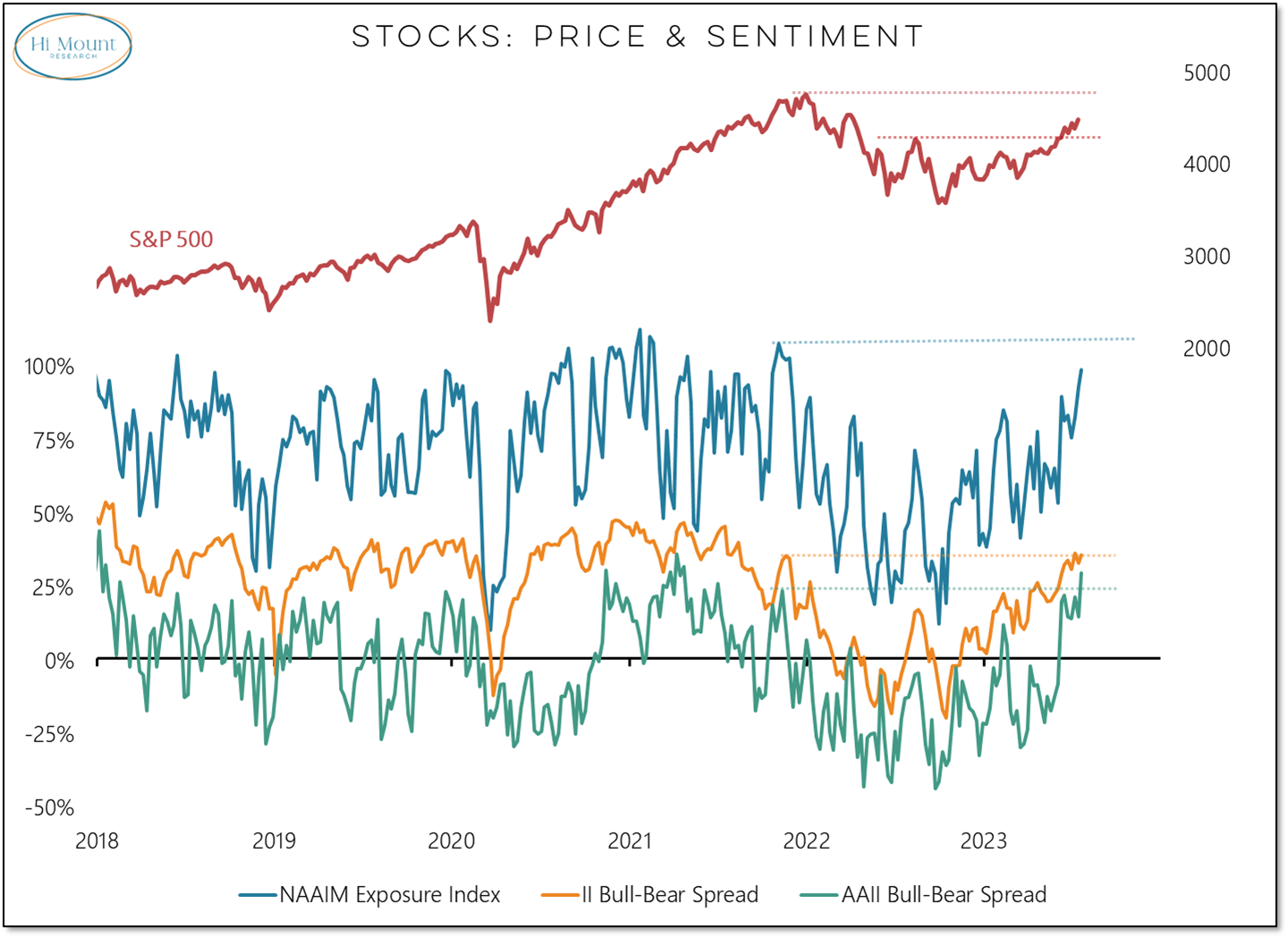

Headwinds, however, continue to blow. Sentiment has moved quickly from widespread pessimism to excessive optimism.

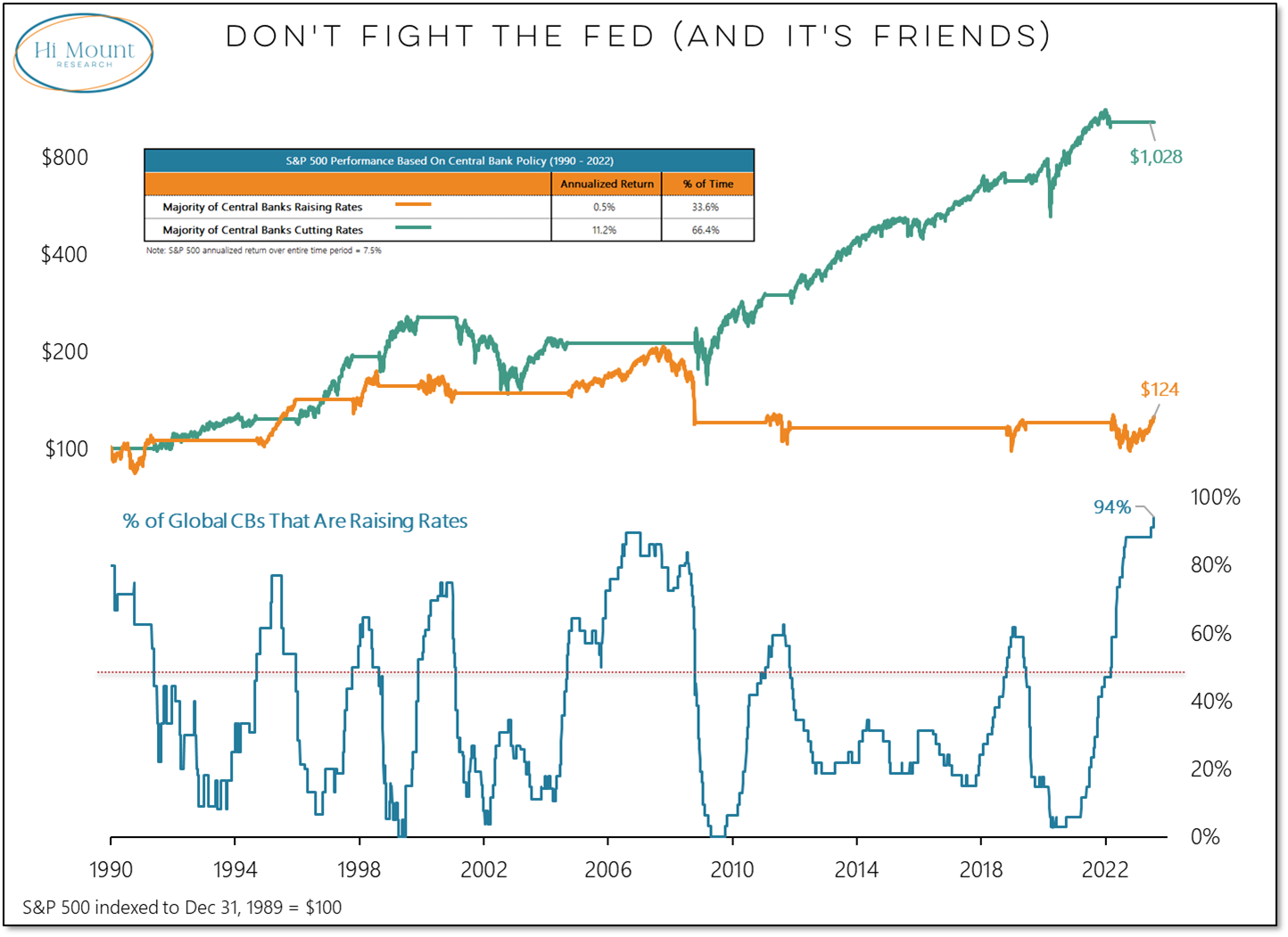

Central banks keep raising rates. With Russia and Turkey raising rates this month, 94% of global central banks are now in tightening mode. Stocks usually struggle to hold on to strength when a majority of central banks are raising rates.

Concerns about both sentiment and liquidity are mitigated from a tactical perspective as long as the tape remains strong. For now, we are seeing more stocks make new highs than new lows and all of the sectors in the S&P 500 are above their 200-day averages. But if the tape fails to hold the line, our tactical focus will have to turn to not fighting the Fed.

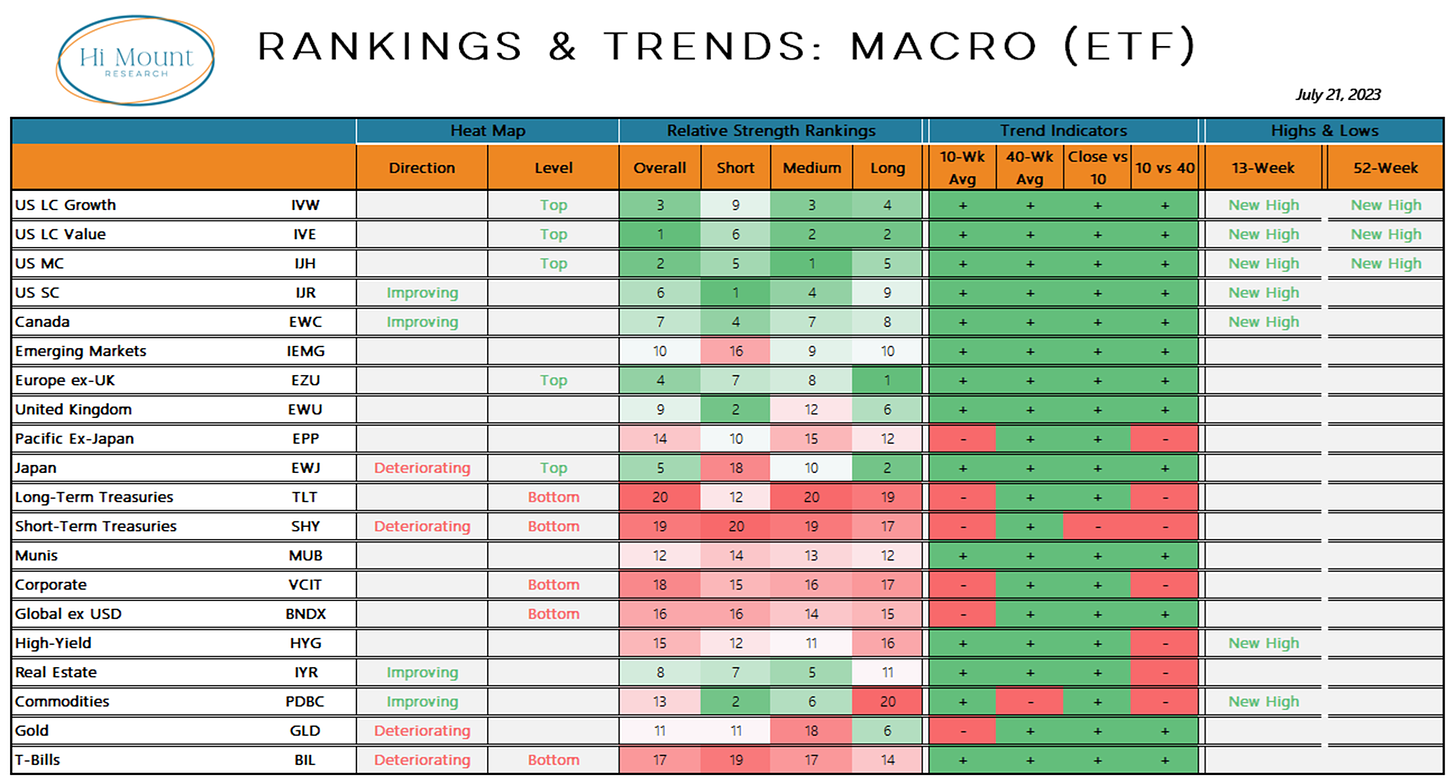

For now our tactical focus on current leadership and those areas with improving trends. Small-caps, Canada and Commodities are catching our attention.

Go Deeper: Portfolio Applications subscribers can download our latest Weekly Chart Pack and also review this week's Relative Strength Rankings and Asset Allocation Model updates.