Risks Increase If Investors Have Had Their Fill Of US Equities

Market Insights for April 20, 2023

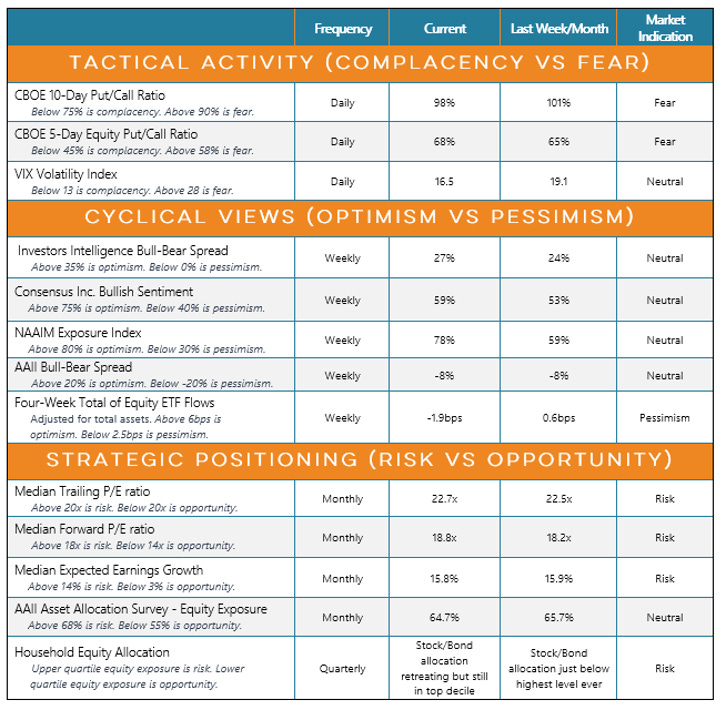

Our sentiment summary table looks across multiple timeframes and shows a mixed picture of investor attitudes and appetites.

Key takeaways: The collapse in the VIX (especially with it occurring in the absence of broad market strength) warns of dangerous complacency, while the weekly surveys show that we may be getting the bulls needed to produce a bull market. Longer-term, decreased investor appetite for expensive and over-owned US equities is a risk for stocks. From a weight of the evidence perspective, sentiment is neutral.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.