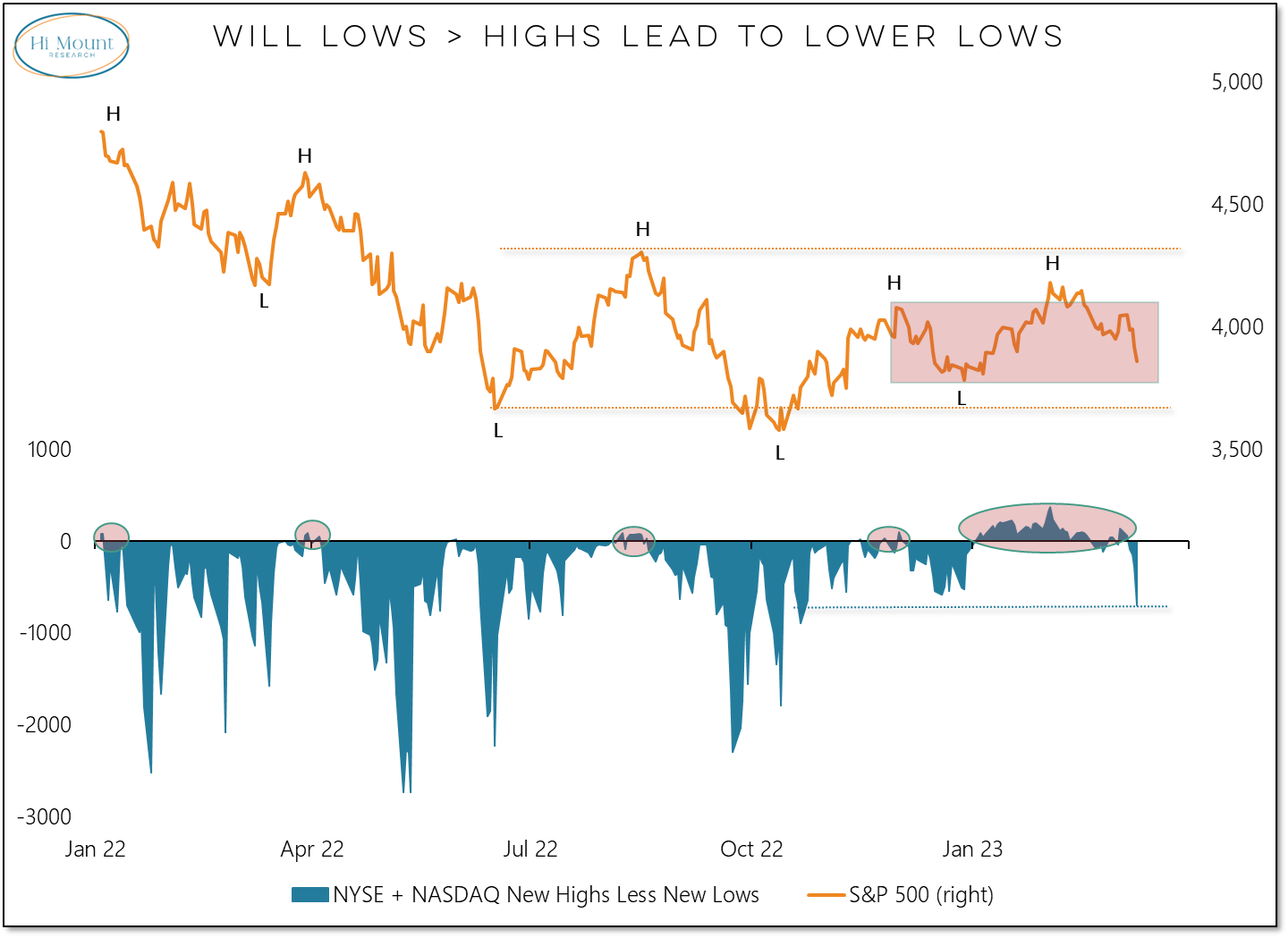

The news isn’t the headlines, it’s what beneath the surface. Between Thursday’s 15-to-1 downside volume day and Friday’s surge in new lows, the message from the market last week was that the favorable tailwinds that emerged at the beginning of the year have faded and stocks are facing an important test of strength. Bank collapses & Fed bailouts add to the noise and increase the risk.

More Context: The S&P 500 made a higher in early February but has been under pressure since then. Last week’s selling pressure produced the first 3% down week of 2023 and sent new lows to their most extreme level since October. Absent a quick change in character, the S&P 500 is poised to follow the Dow Industrials in testing its December lows. While higher highs are characteristic of bull markets, lower lows are not.

In our Market Notes we look at the downward pressure on stocks, where we see opportunity for exposure, and how the Fed could approach next week’s FOMC meeting in light of recent data, messages, and developments.

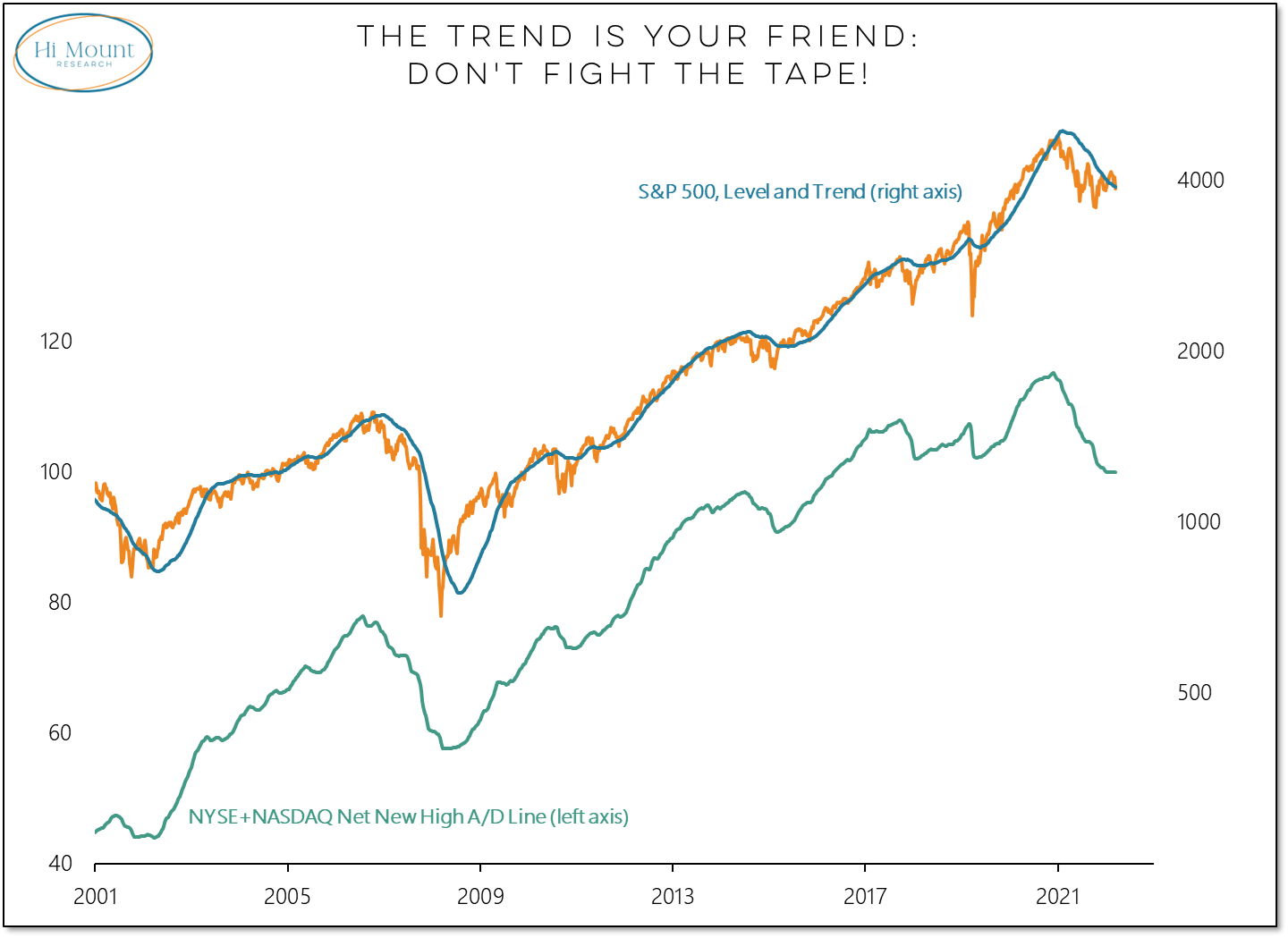

The tape turned higher earlier this year new highs exceeded new low. But the long-term trend on the S&P 500 never did. Now, with new highs contracting and new lows expanding, the tape is deteriorating.

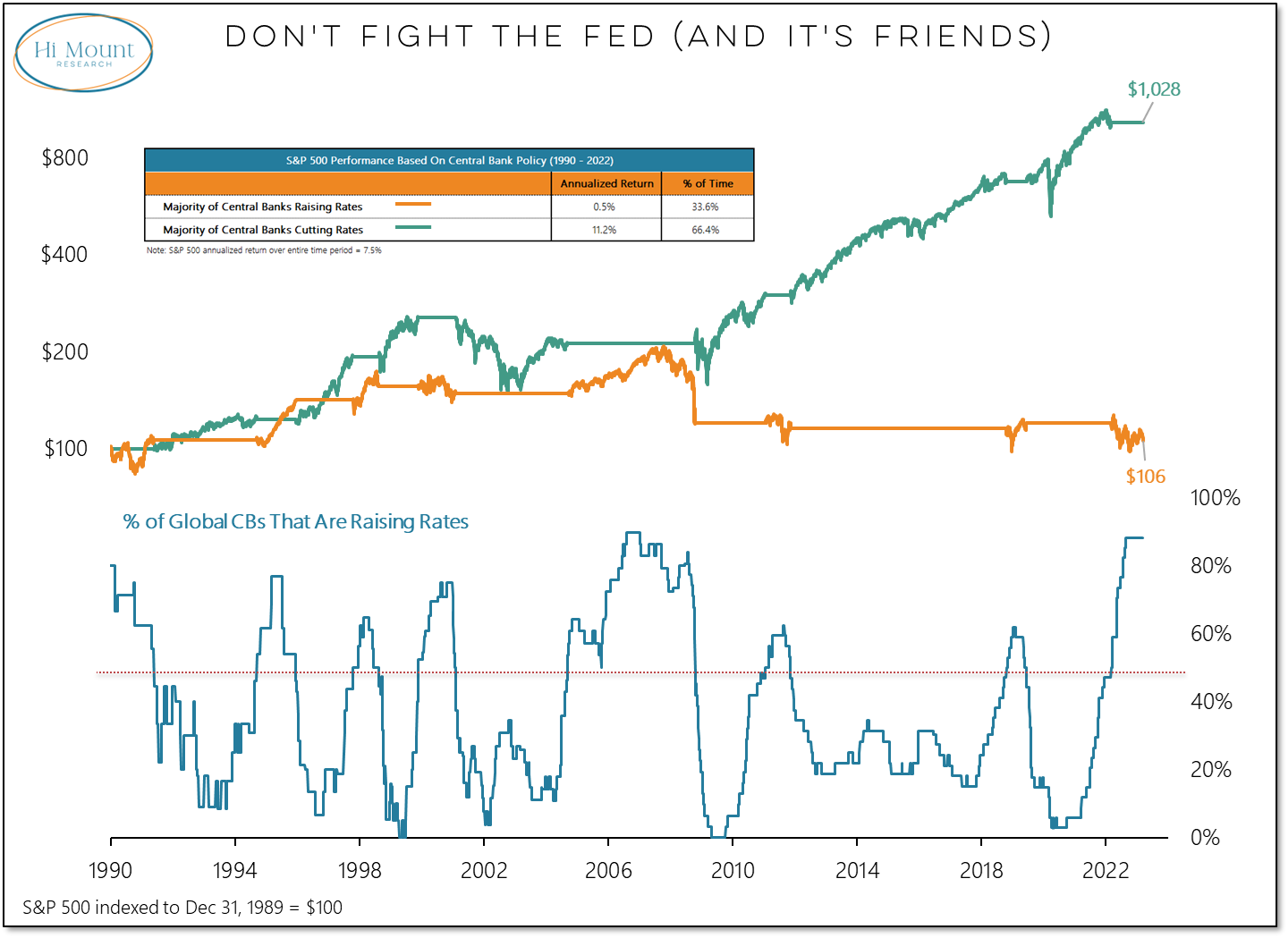

“Don’t fight the tape” and “Don’t fight the Fed” were mantras that were with odds with each earlier this year. That’s not so much the case now with the net new high A/D line turning lower and the Fed (and other central banks) still in tightening mode. As far as the March FOMC meeting is concerned, I don’t think Powell would have raised the possibility of a 50 basis point rate hike if such move was not under serious consideration.

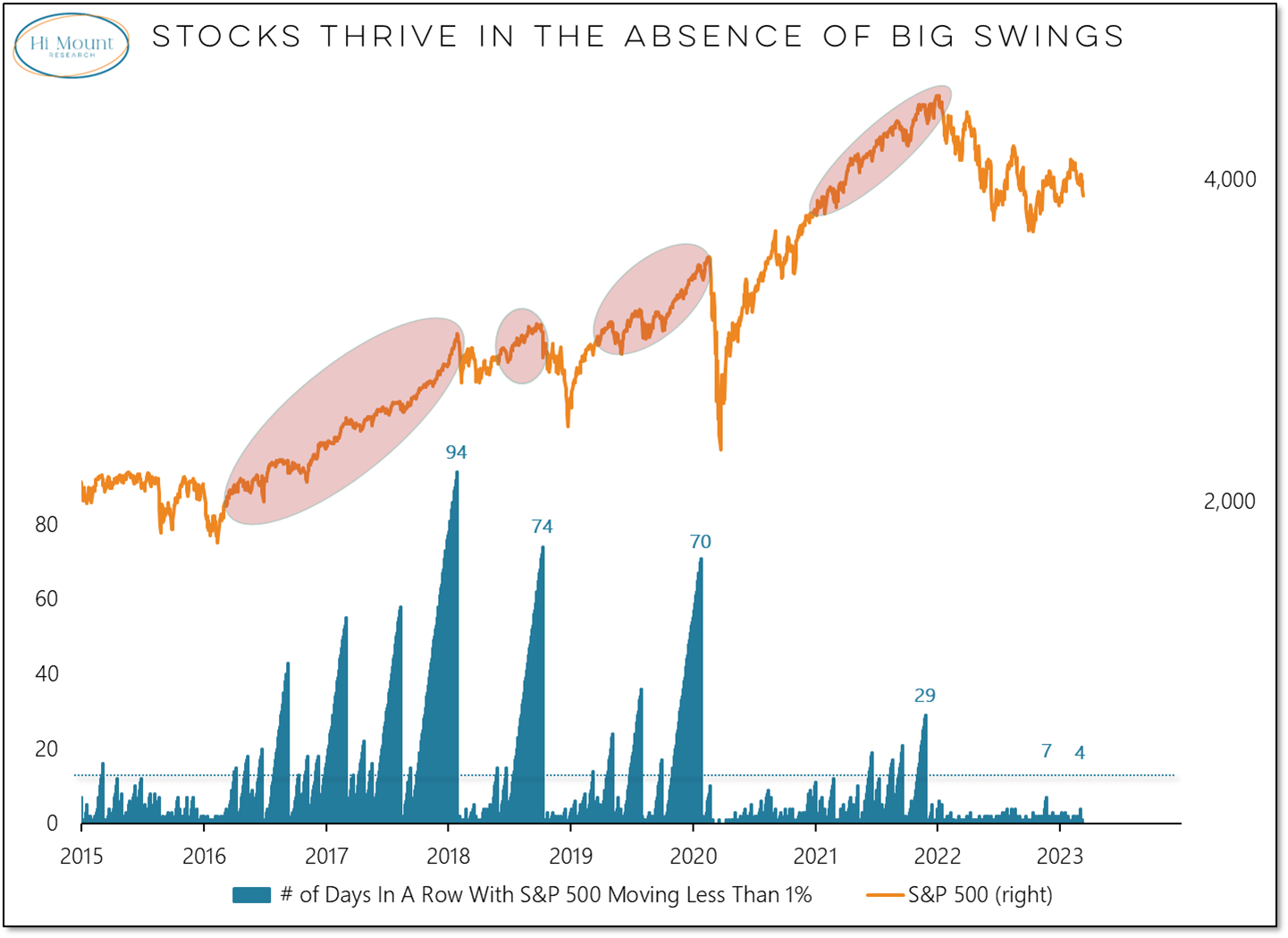

Seeing new highs eclipse new lows earlier this year suggested a change in market tone, volatility persisted and stocks have struggled to string together a series of relatively quiet days. That’s not what is typical in periods of sustained strength.

Persistent volatility and trend weakness comes on the heels of one of the strongest periods for stocks in decades. Over the past decade, investor became conditioned to sustained upside interrupted by only the briefest of downturns. Similar peaks in the past led to a decades-worth of sideways market action.

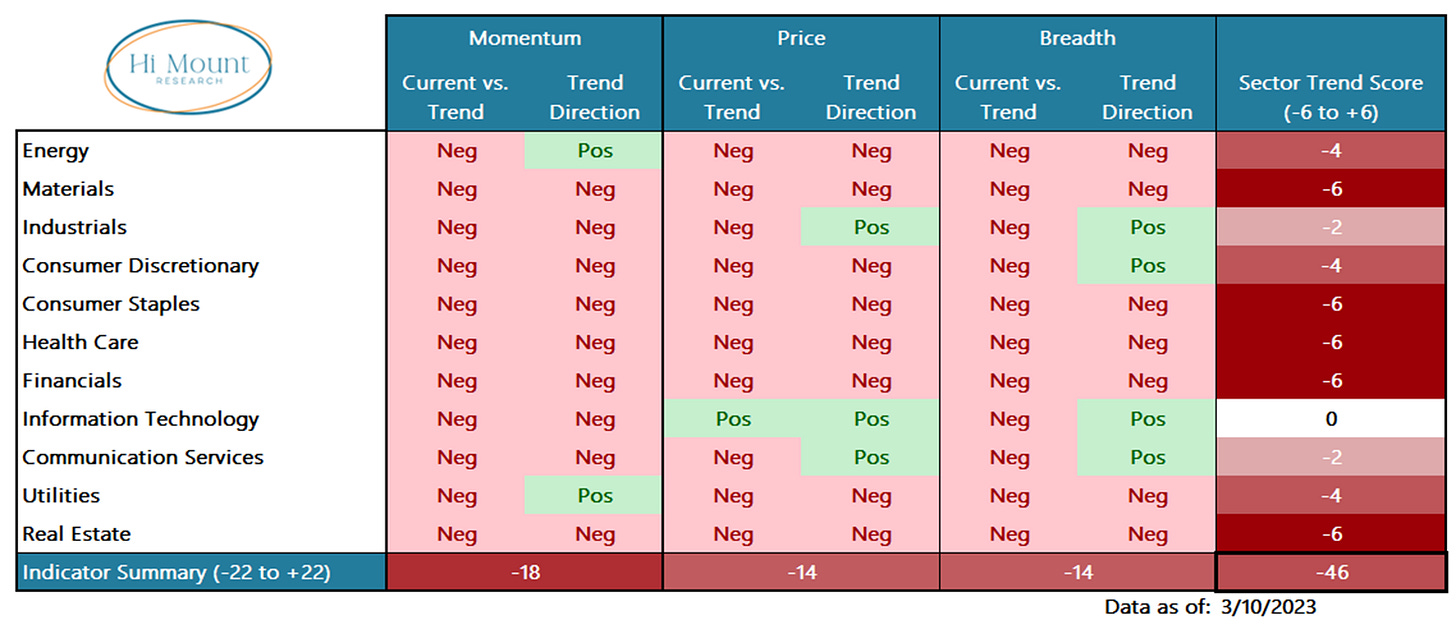

On a short-term basis, our sector-level trend indicators continue to deteriorate. When these trends turned negative last year, lower lows for the S&P 500 tended to follow. During last year’s market weakness investors were able to find relatively safe harbor in the Energy sector. That is not proving to be the case so far in 2023.

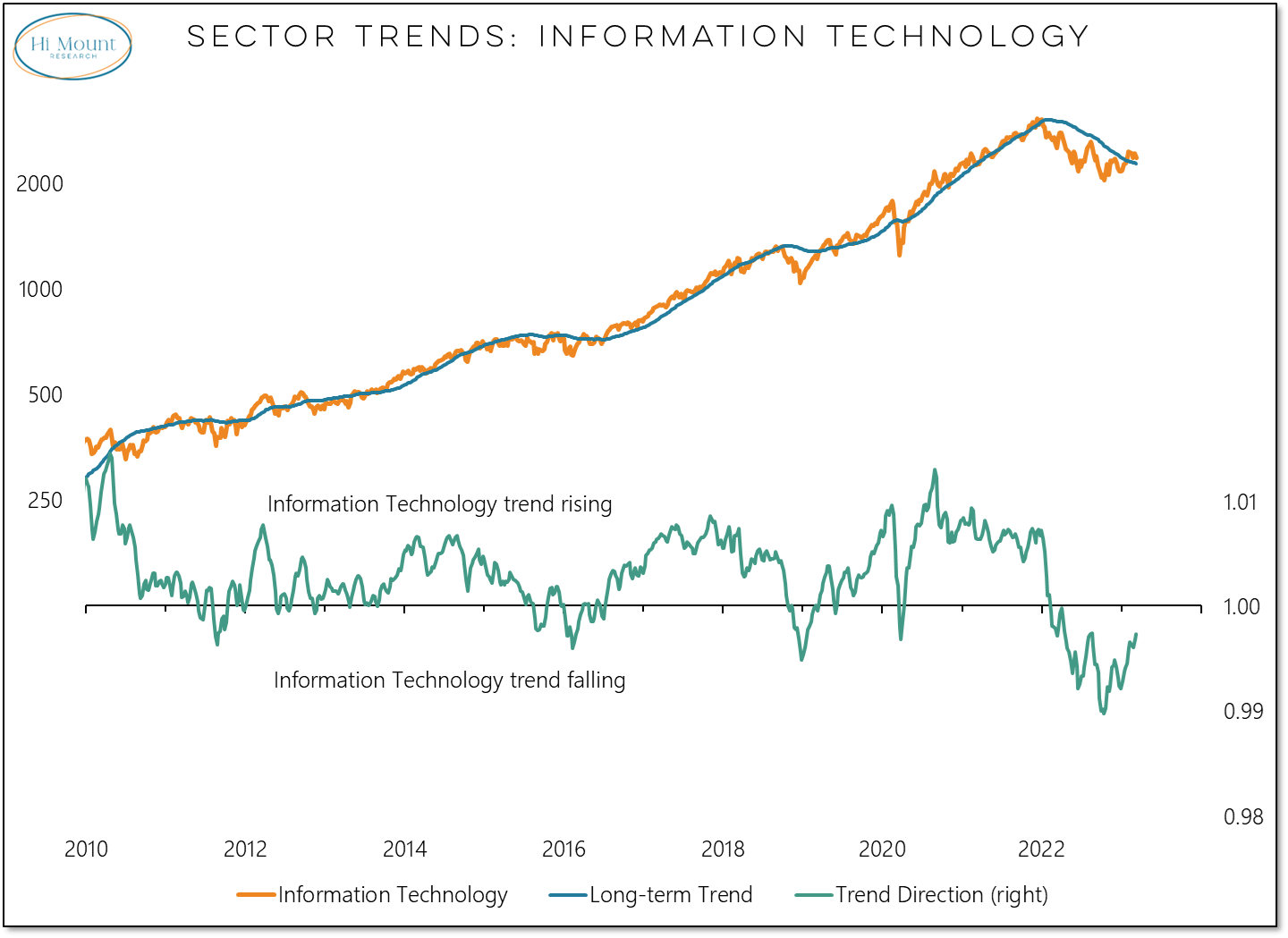

The sector with the best trend scores is Information Technology. It has also moved to the top of this week’s relative strength rankings. The challenge is that on a longer-term basis, the sector remains in a protracted down-trend (the longest in more than a decade). This makes it difficulty to see Tech as flight to safety alternative in the current environment.

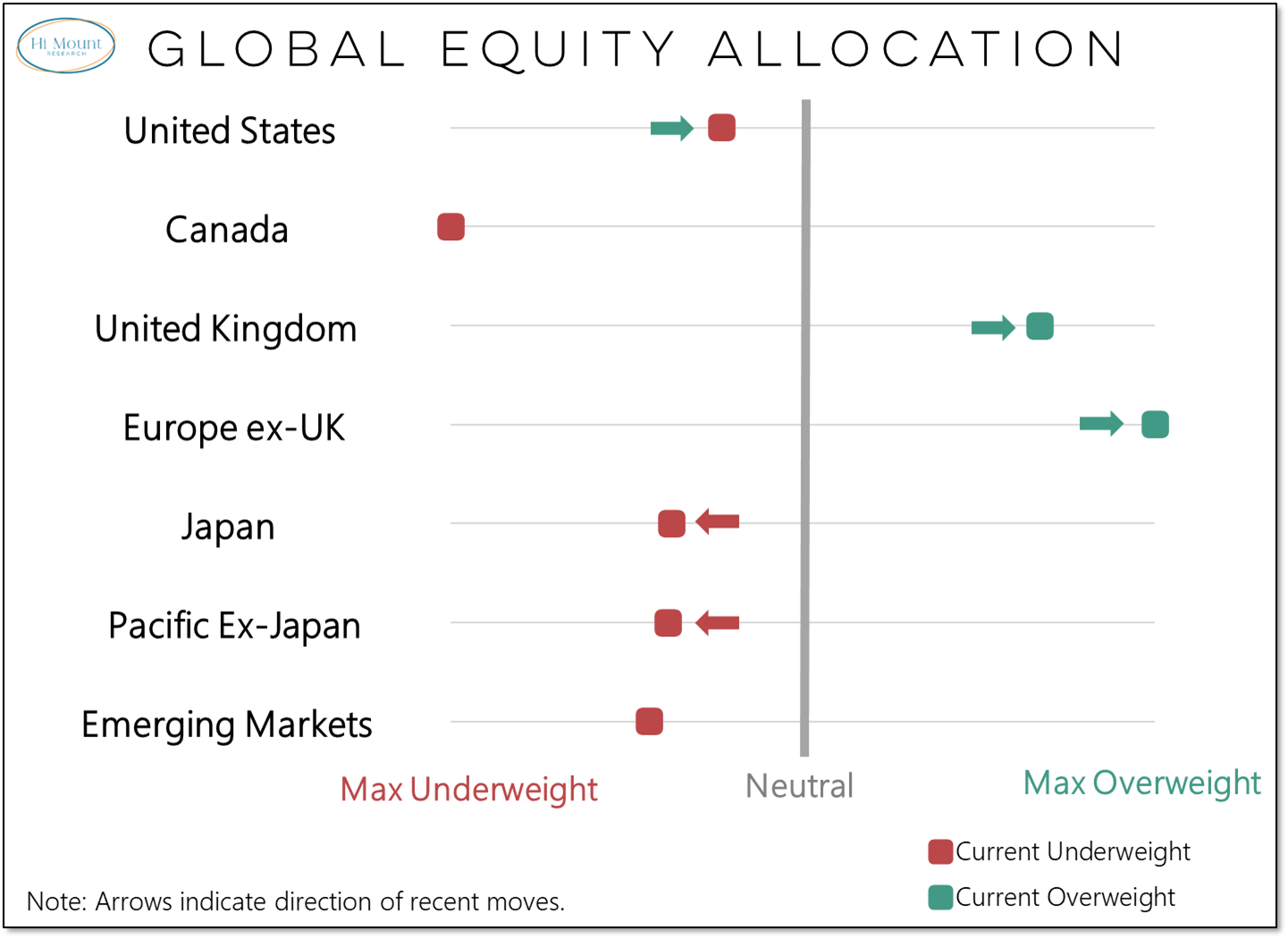

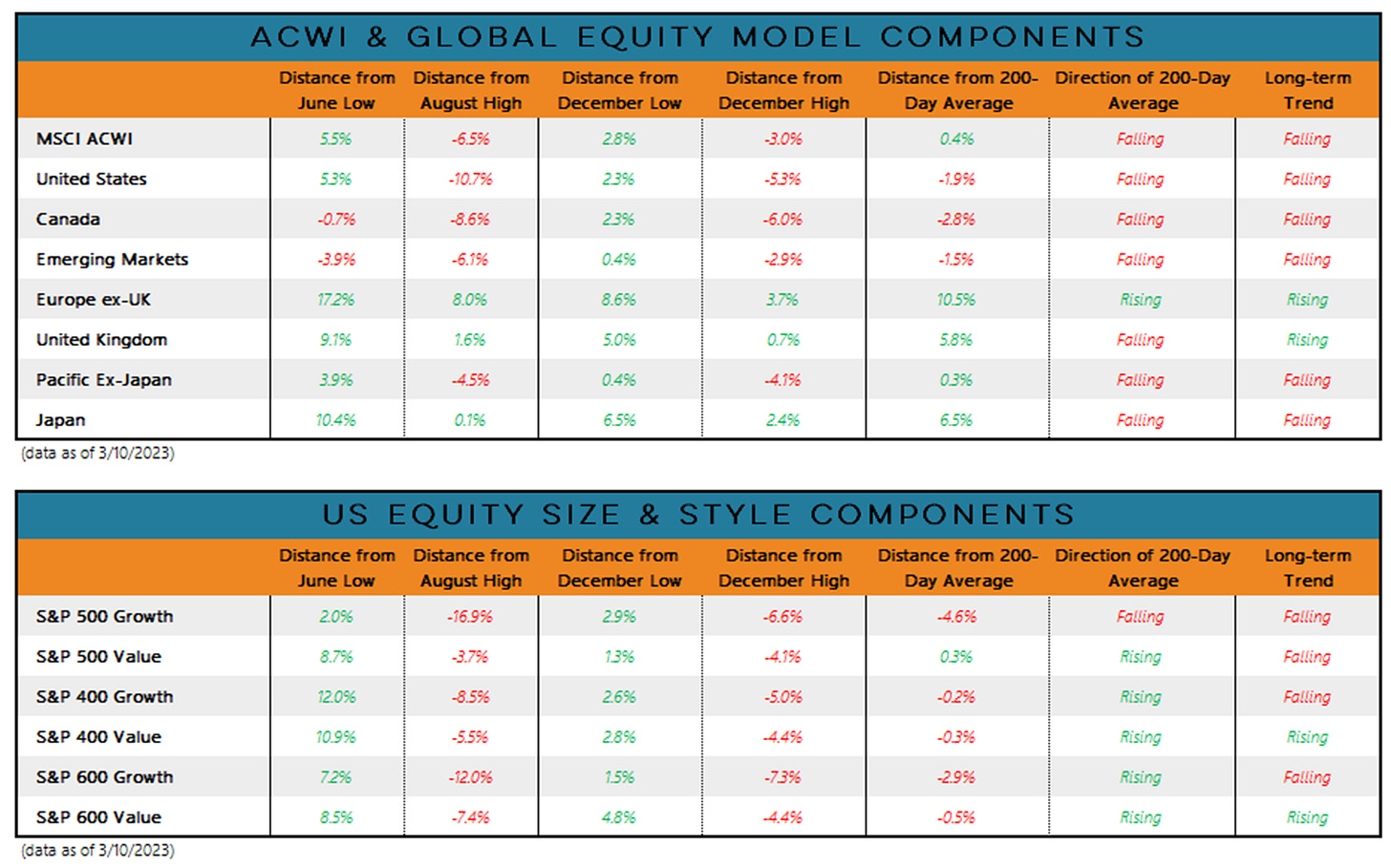

From a global perspective, the US is still a relative underweight (though less so than a few weeks ago). Absolute strength and relative leadership is coming from Europe and the UK.

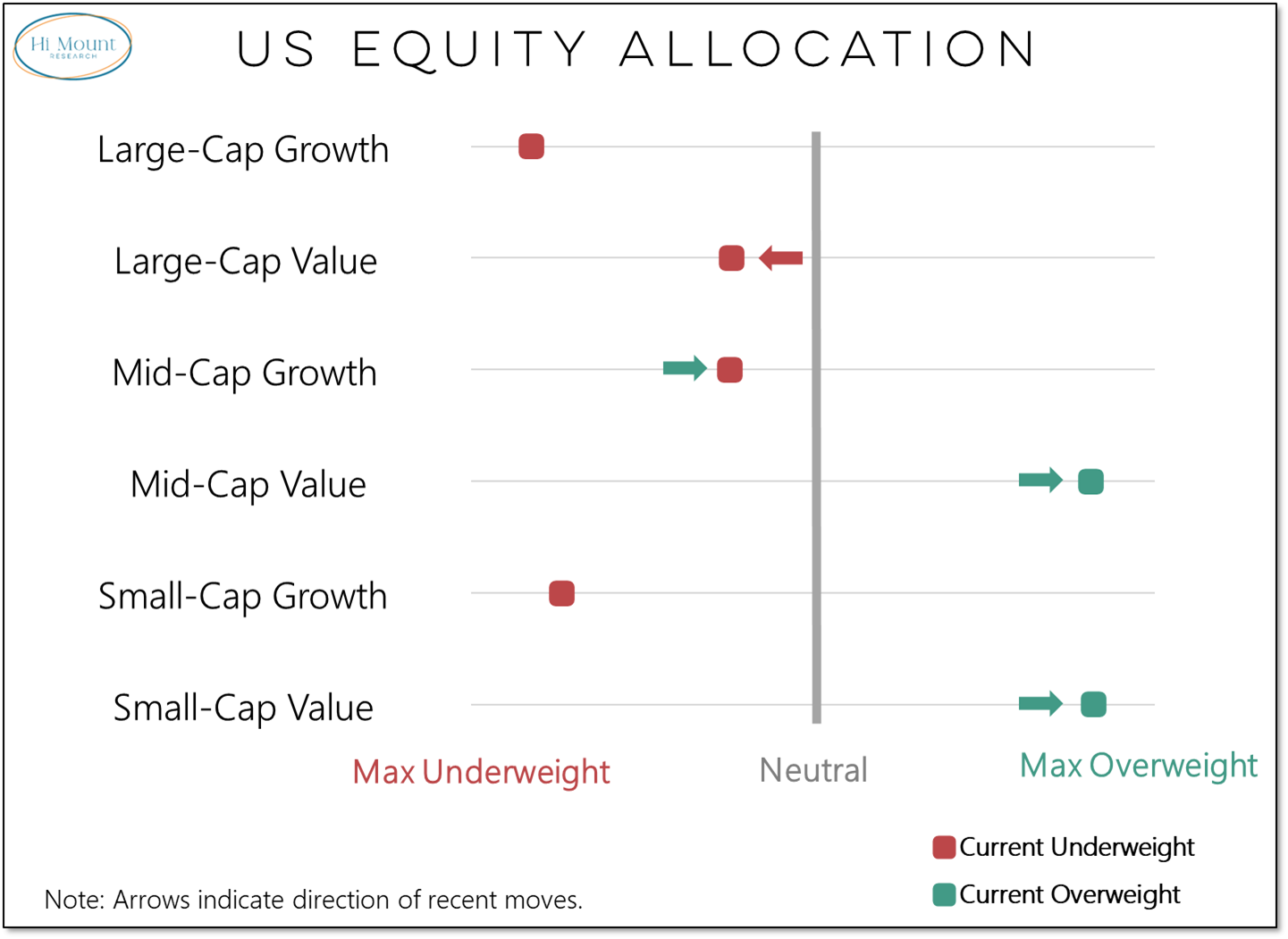

Within the US, small and mid-cap value are still showing strength and leadership. Large-cap value is back to being an underweight, while mid-cap growth is gaining strength.

In terms of maintaining exposure in an overall challenging trend environment our focus has been on areas with up-trends that are able to hold above their August and December highs. There is little that fits that bill in the US (small & mid-cap value are in up-trends, but have failed to maintain their breakouts). Globally, Europe and the UK pass the test. Japan is above its August high, but the trends have not yet turned higher.

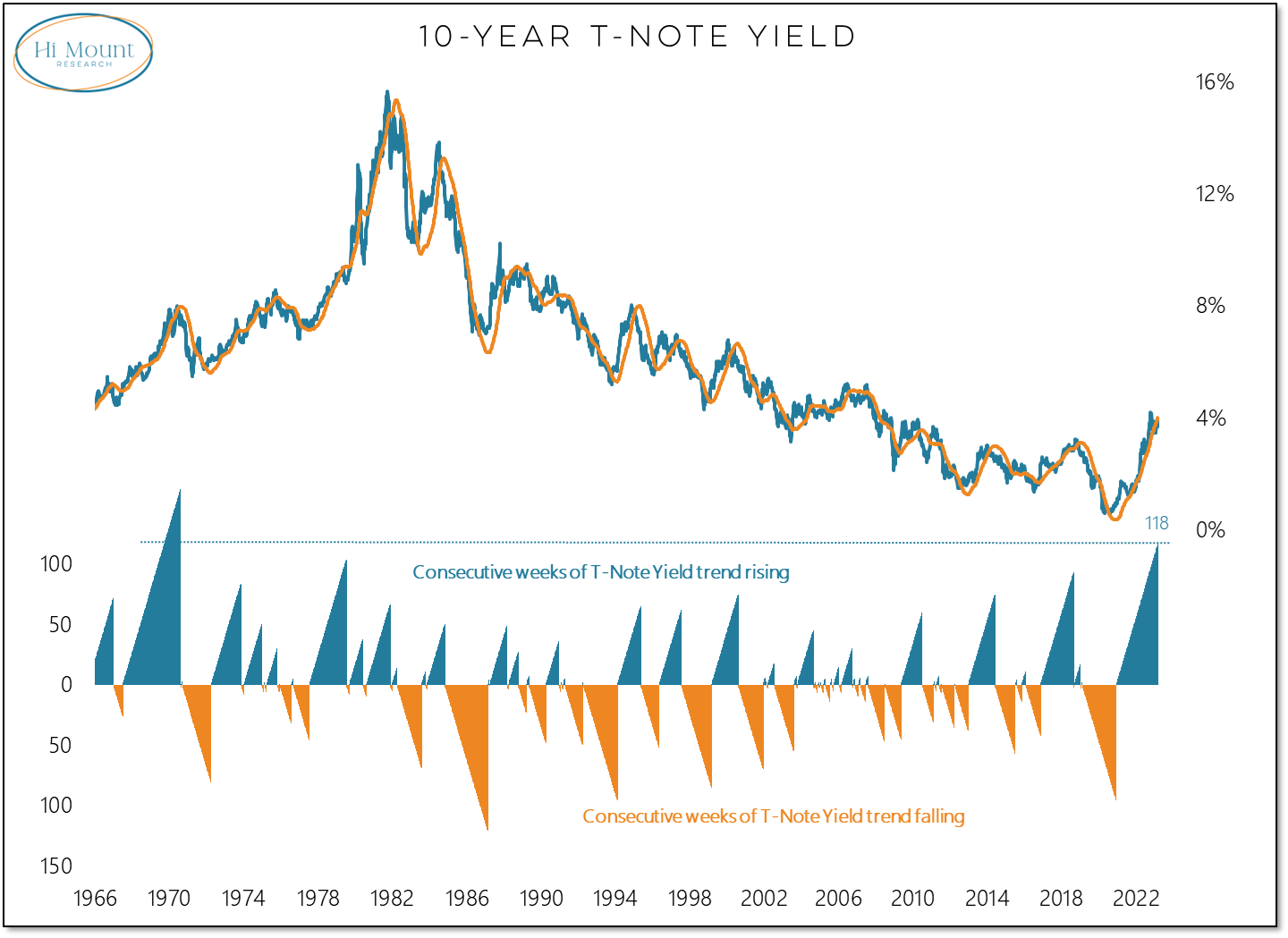

Speaking of trends turning, there have been plenty of premature attempts call a peak in yields over the past year. But I’ll wait for the trend to turn lower before reaching that conclusion. For now, it’s 118 weeks in a row of rising, the longest sustained advance since the late 1960s.

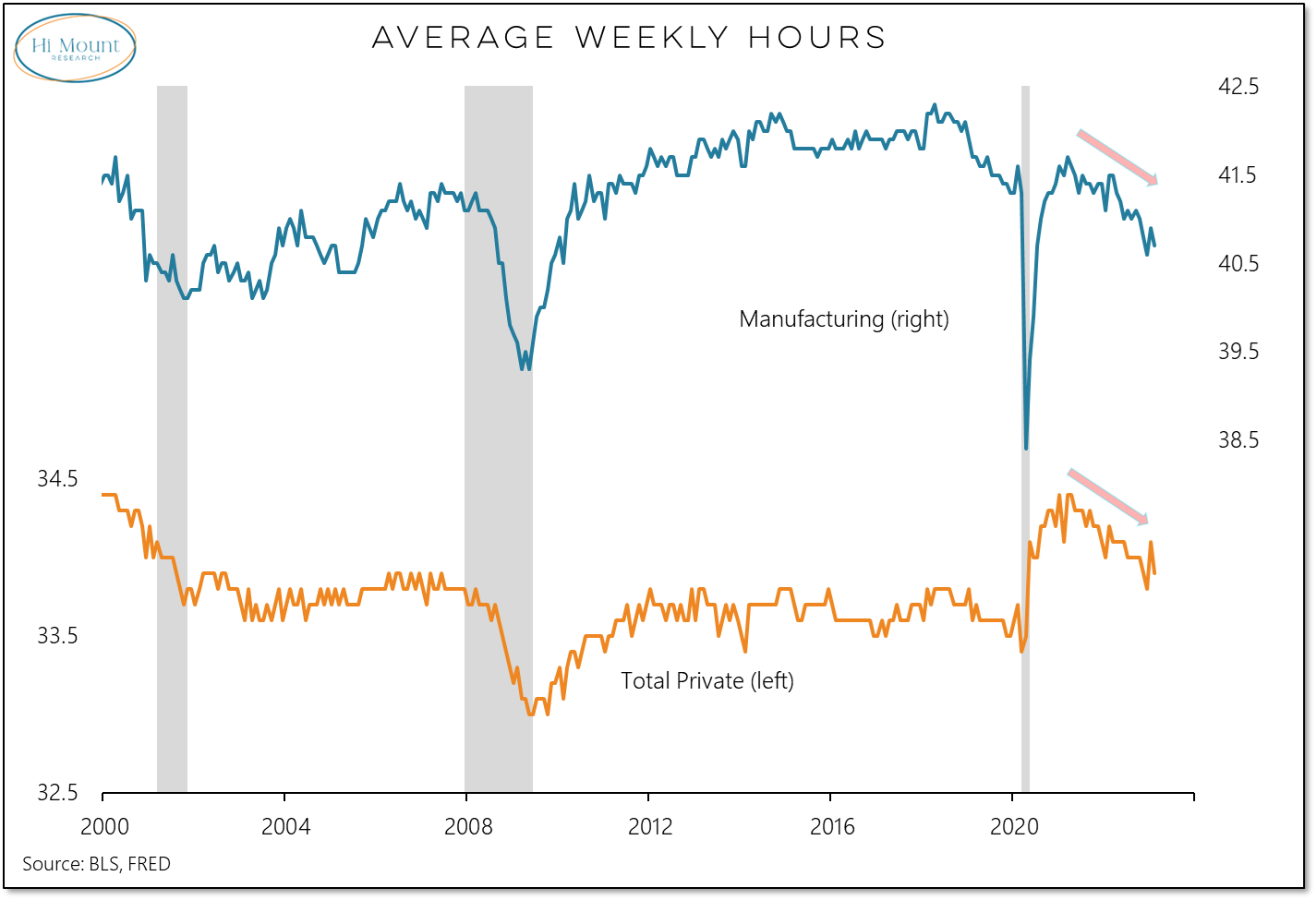

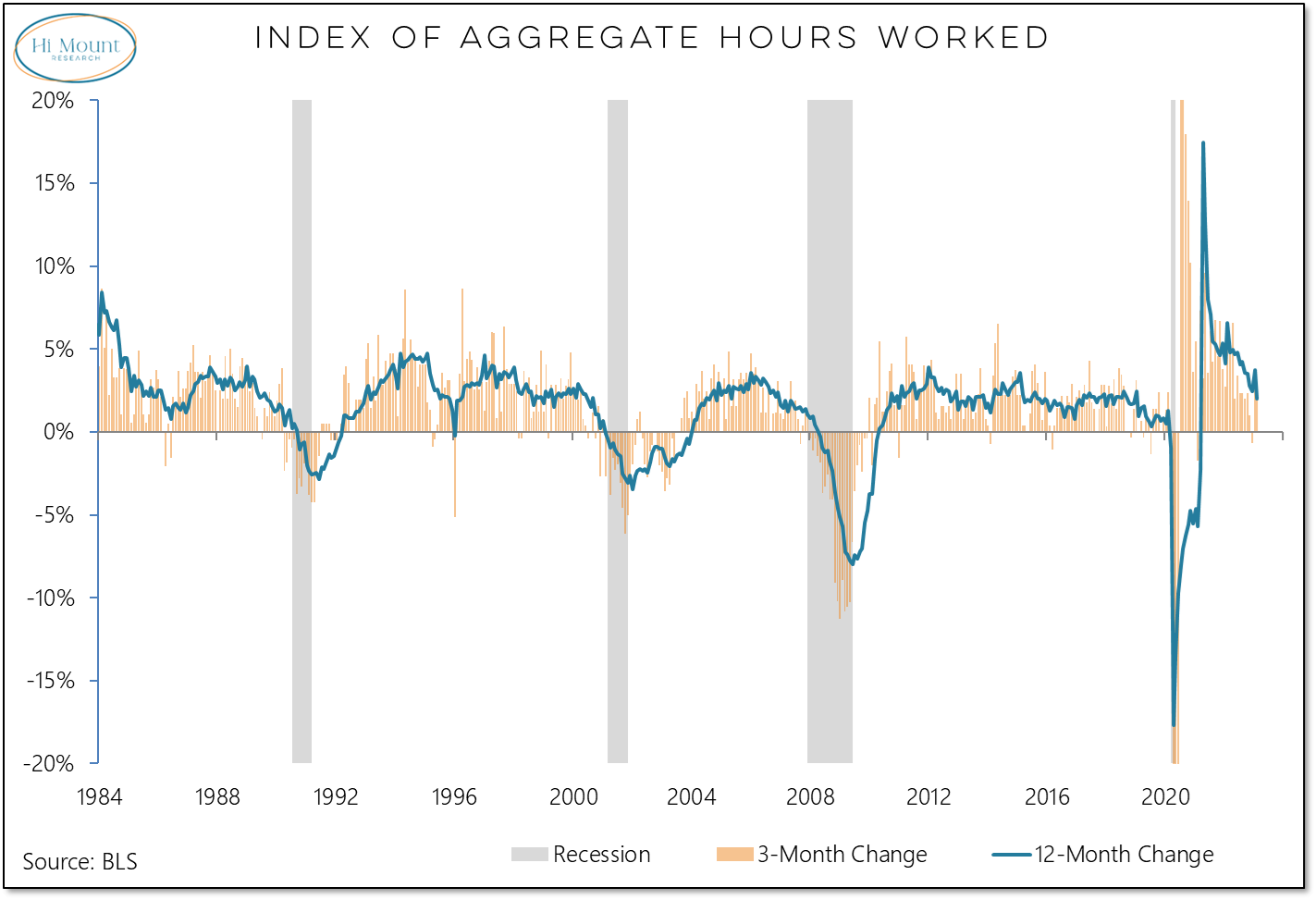

The Fed’s focus remains on inflation – and that puts plenty of attention on this week’s CPI report. If that comes in stronger than expected, I expect the Fed to go with a 50 basis point rate hike at next week’s FOMC meeting. But there were details last week’s employment report that point to a less-than-robust situation in the labor market. Despite still strong hiring, average weekly hours turned lower in February and the growth in aggregate hours worked continues to cool.