Risk On At Risk Of Waning?

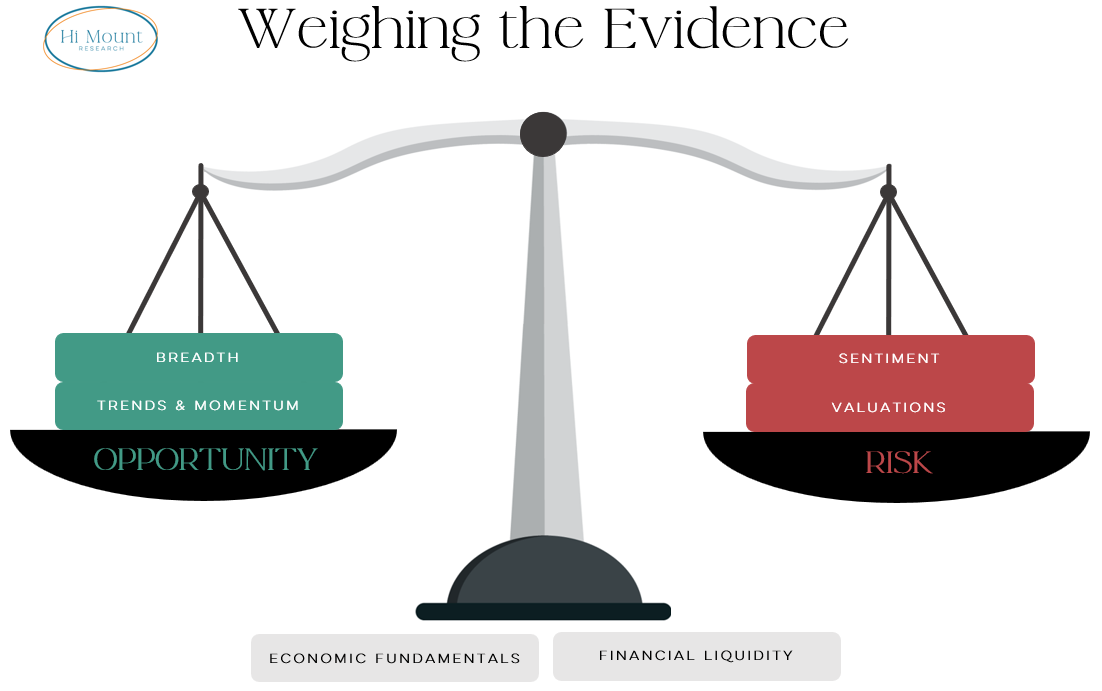

Divergence, like valuations, don't matter until they did matter. For now we are seeing Bull Market Behavior and the cyclical Weight of the Evidence remains balanced between risk and opportunity.

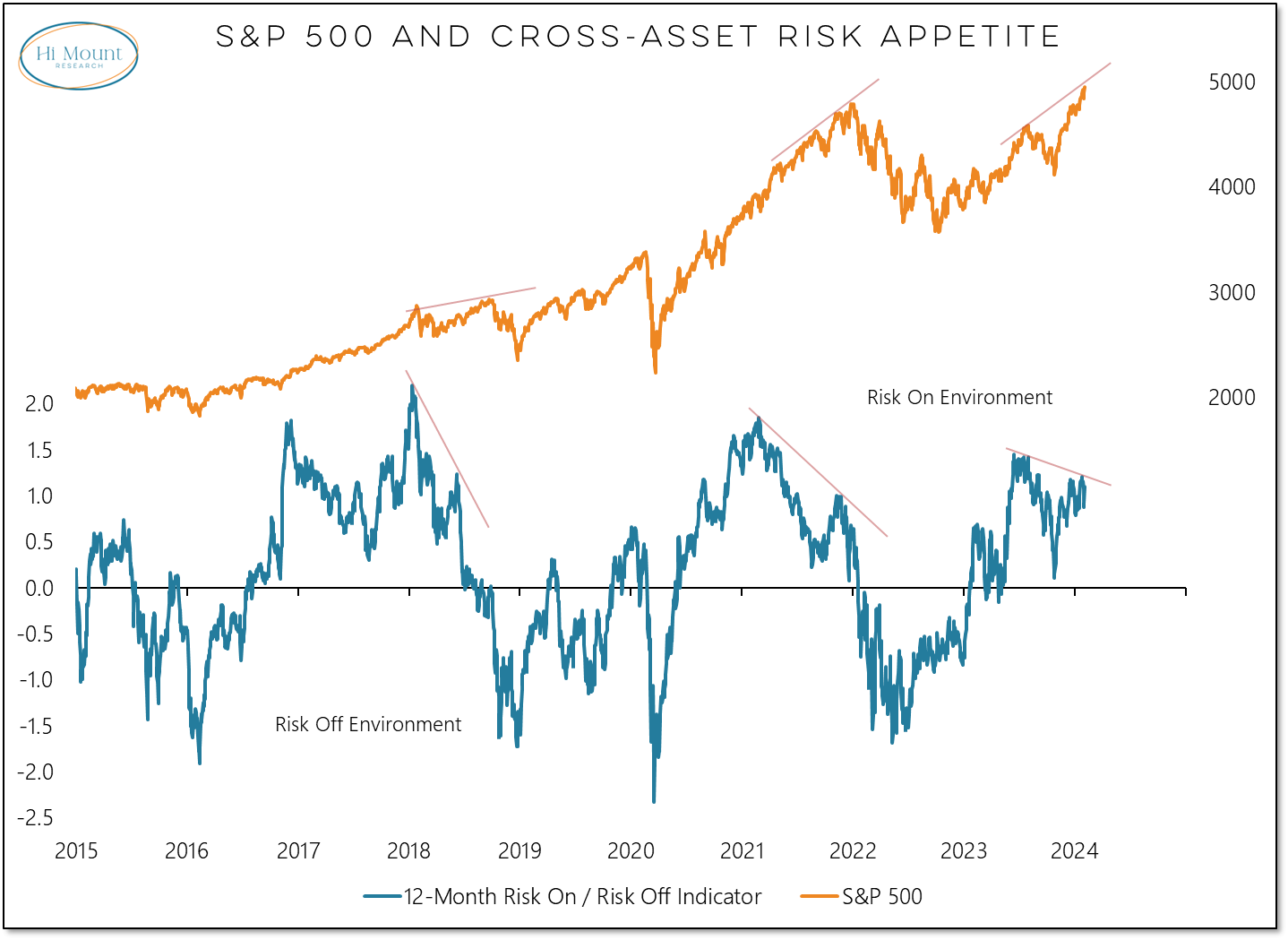

Our Cross-Asset Risk Appetite Indicator is still firmly ensconced in Risk On Territory. BUT. . . It has made a lower higher while the S&P 500 has made a higher high. If divergences matter, this would be one to make bulls feel a bit uncomfortable. Not all divergences, however, lead to downturns.

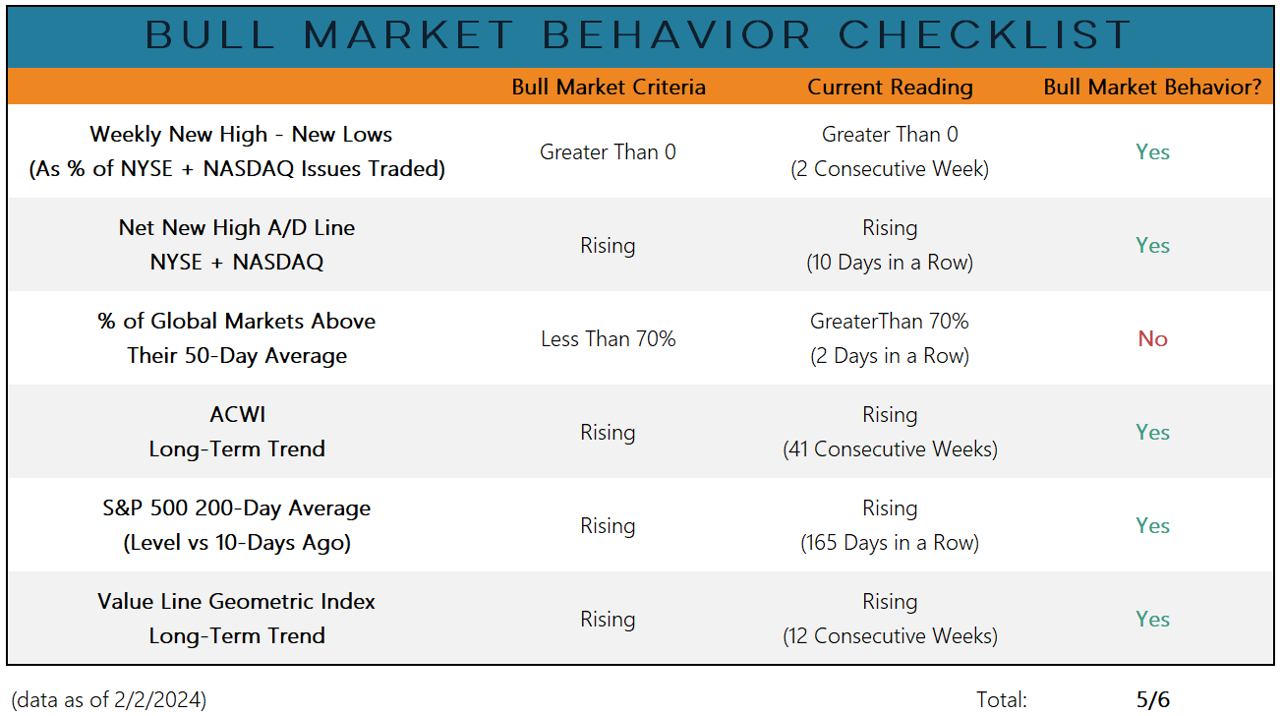

We are not seeing meaningful risk of weakness emerging on our Bull Market Behavior Checklist. The percentage of global markets above their 50-day average has been crossing back-and-forth over the 70% threshold in recent weeks but otherwise conditions remain healthy:

Our Weight of the Evidence scales remain in balance, with bullish Breadth and strong Trends & Momentum offsetting the risks posed by Sentiment and Valuations.

Subscribers can keep reading for the key takeaways from our February Weight of the Evidence update:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.