Note: This monthly review of the weight of the evidence was originally published last week. Charts have been updated, but comments are un-amended.

March 7, 2023 - Key Takeaway: As good as the market looked in January, it looked that bad in February. The month began with the technical conditions for the re-birth of a bull market being met, but by the end of the month there was still little evidence of bull market behavior. If the Q4 turn is going to prove resilient, it’s time for the bulls to step up and show that the path of least resistance is indeed higher. That means firmly embracing a rally that has faltered under the ongoing weight of macro concerns and is on the cusp of breaking down.

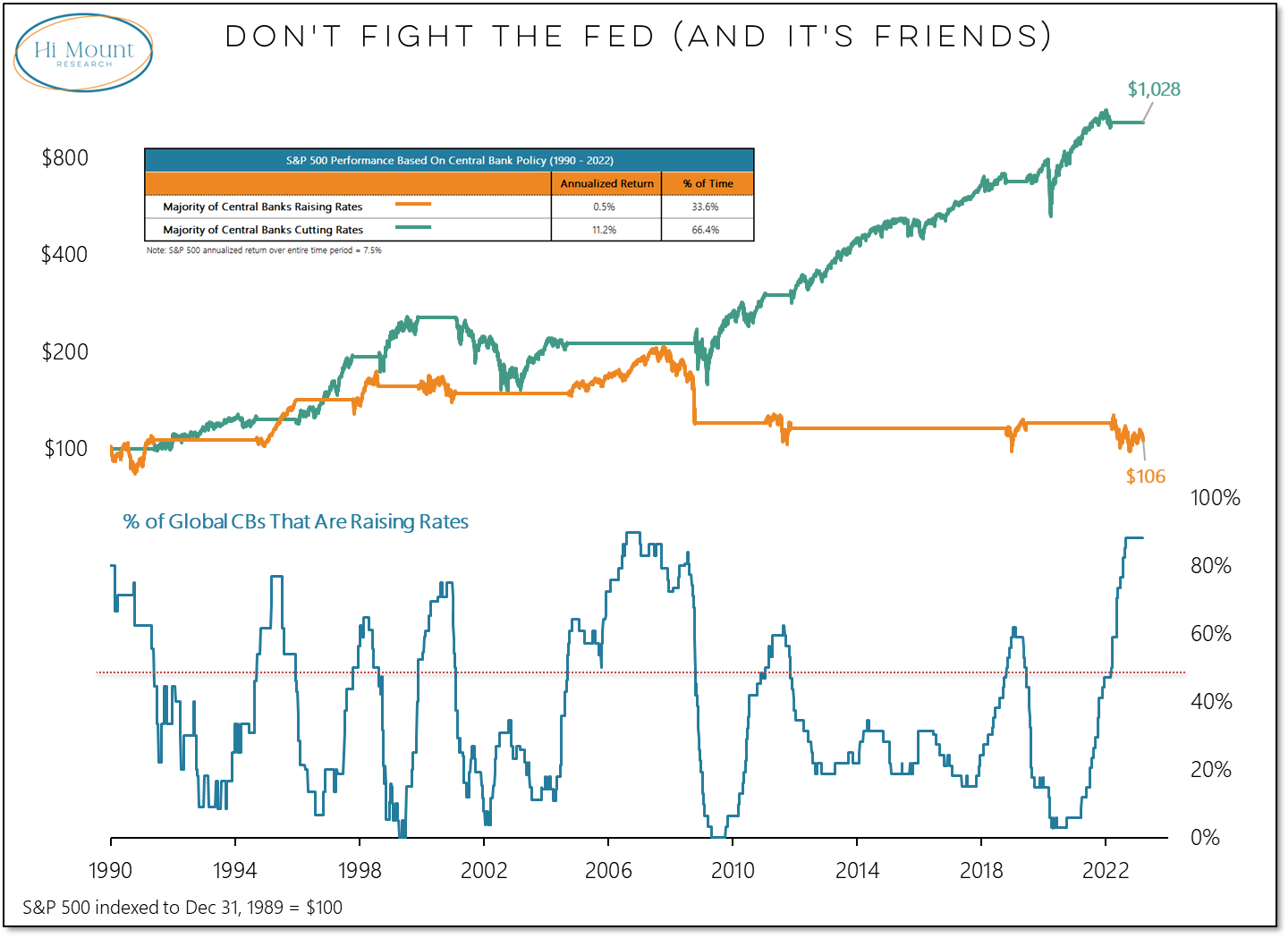

Financial Liquidity: A majority of global central banks have been raising rates for the past year. Investors who stepped aside and didn’t fight the Fed missed a roller coaster of a ride in equities that would have left them worse off than when it began.

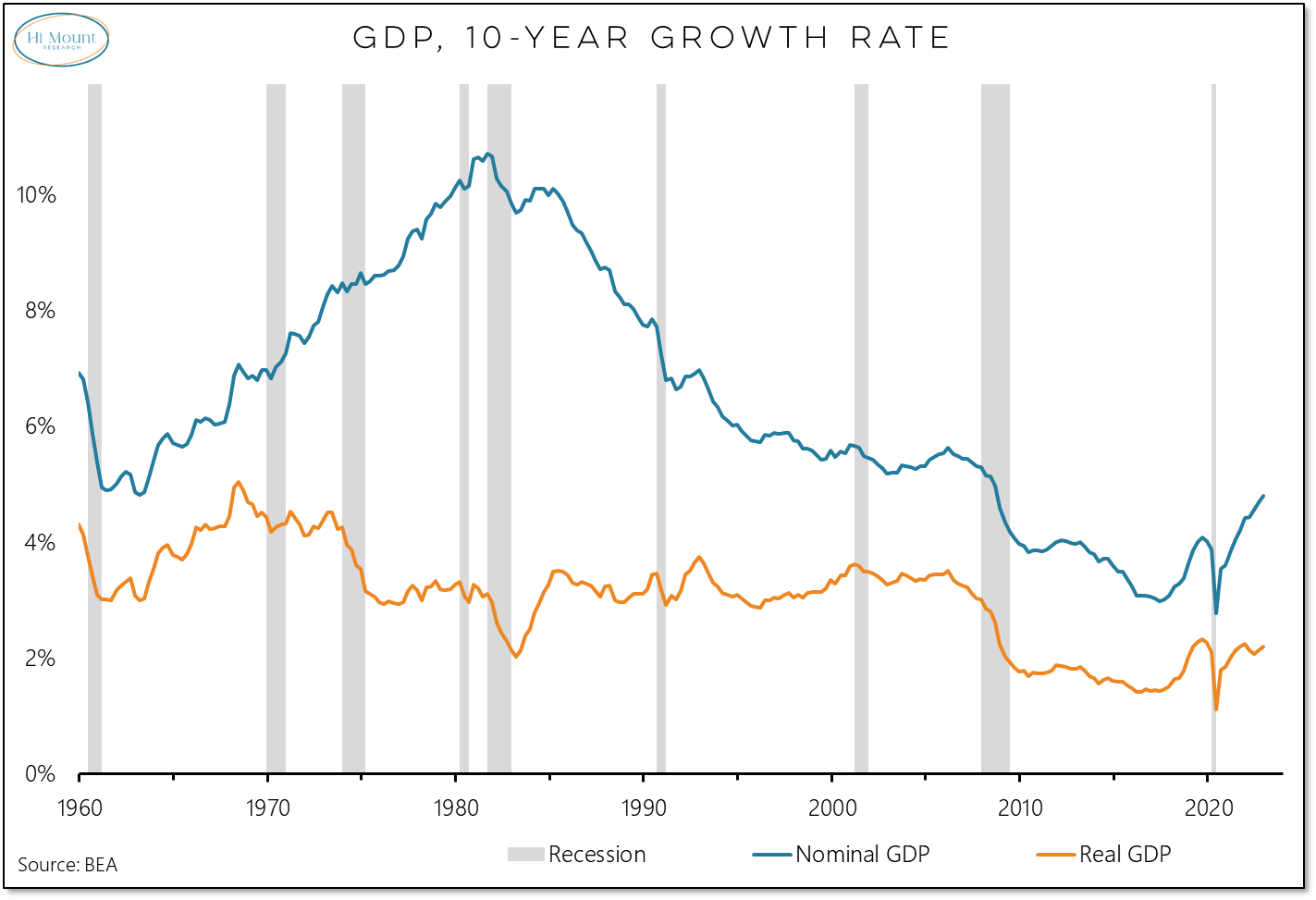

Economic Fundamentals: Nominal retail sales continue to soar, while real spending has gone sideways for two years. This echoes the divergence in long-term growth trends between real and nominal GDP that are a headwind for the economy and a challenge for the Fed.

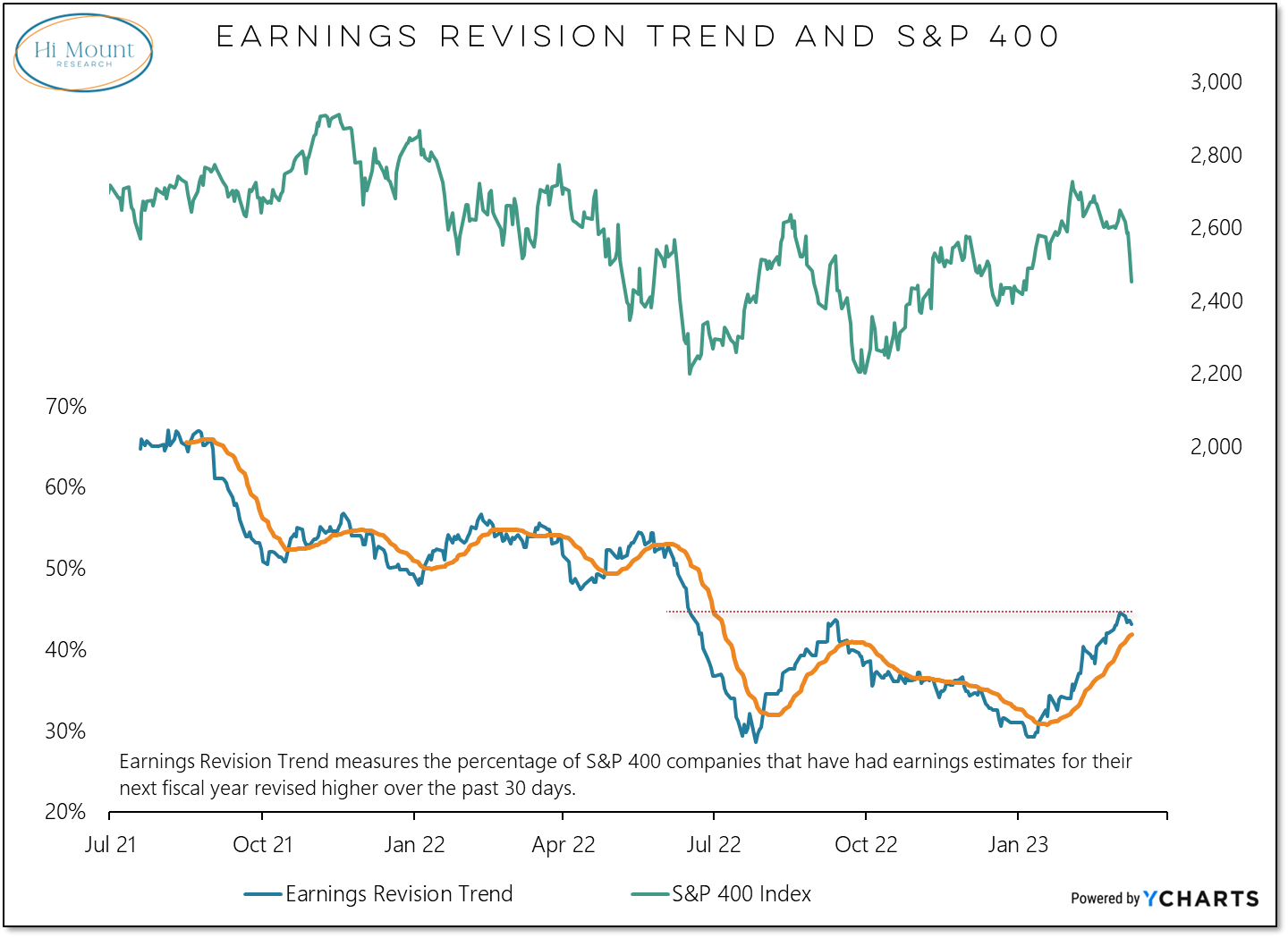

Valuations: Relative to each other, stocks are expensive and bonds are cheap. But at the margin, still rising yields makes bonds seem less attractive while sell-side analysts having to raise earnings estimates makes stocks (especially mid-caps) appear more attractive.

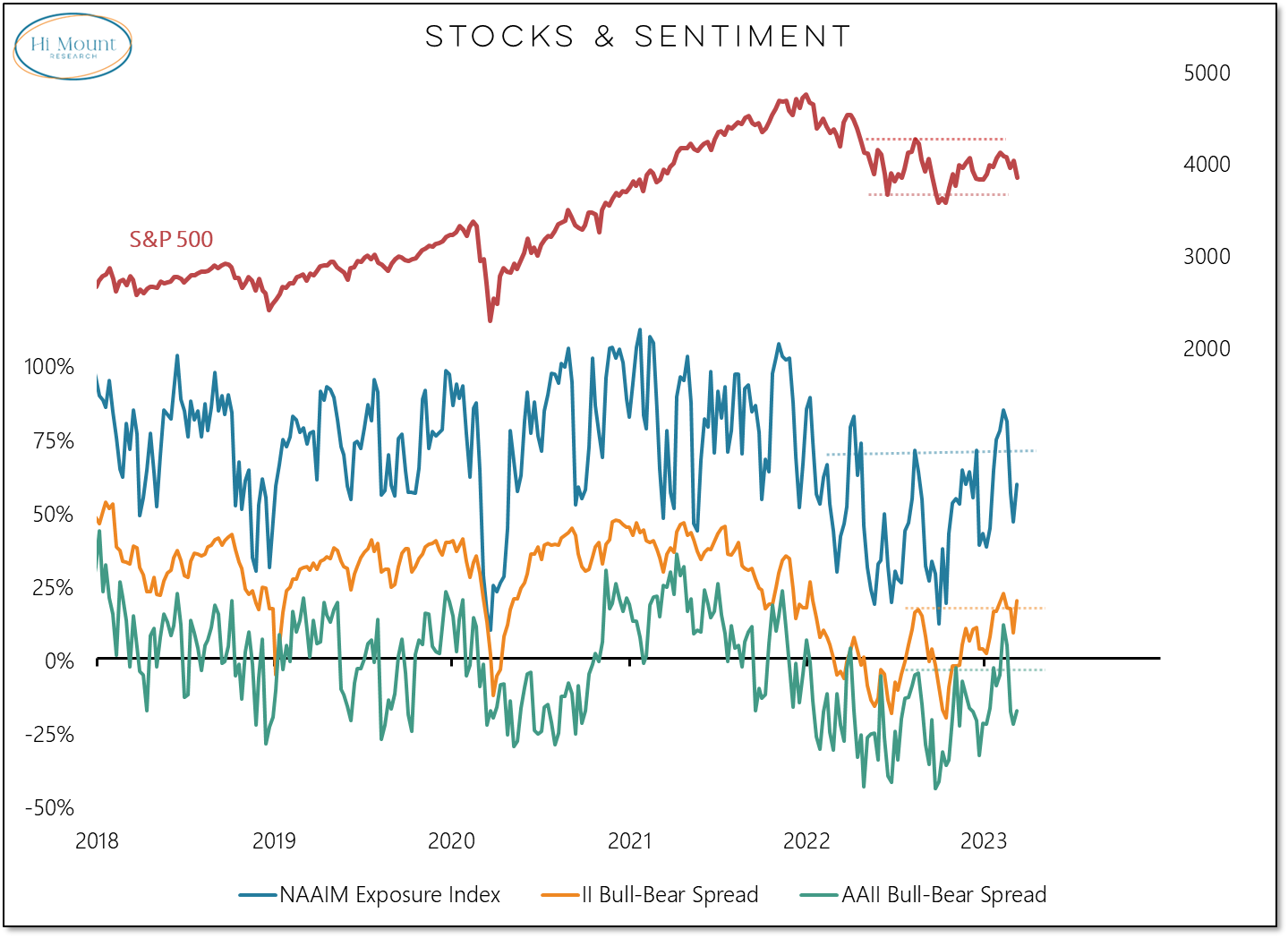

Sentiment: Investors were slow to embrace stocks and are having second thoughts about that optimism after a challenging February. As long as these sentiment indicators remain above their early year lows, seeing this as a healthy consolidation is probably the right construction.

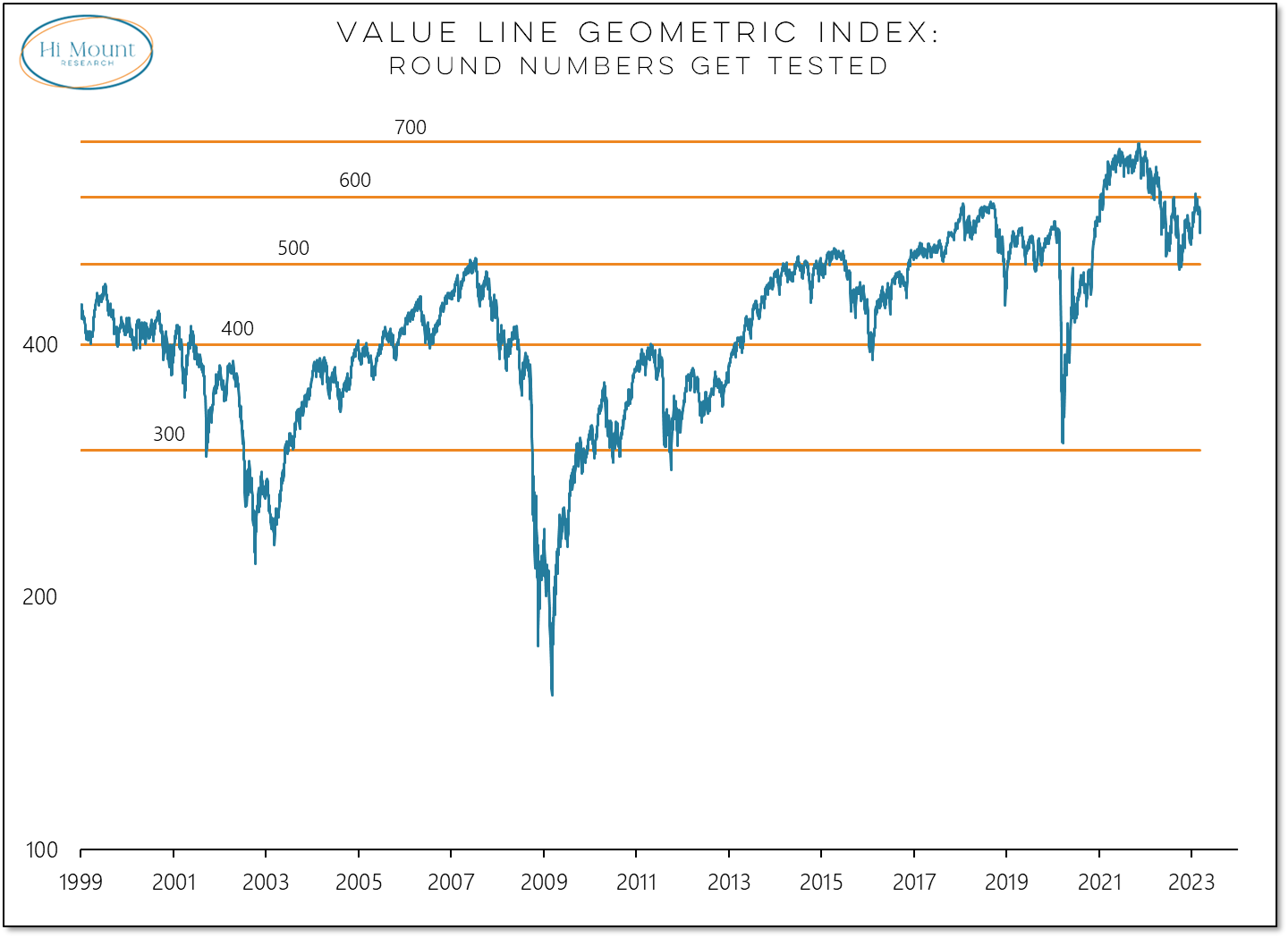

Market Trends & Momentum: The S&P 500 remains in a downtrend and the Value Line Geometric Index (our proxy for the median stock) continues to move between well-tested levels (and the longer it remains below 600, the more likely it is to re-test 500 before moving toward 700). Beyond the headlines, there are areas where uptrends are starting to be more widespread. But this new environment requires a new playbook.

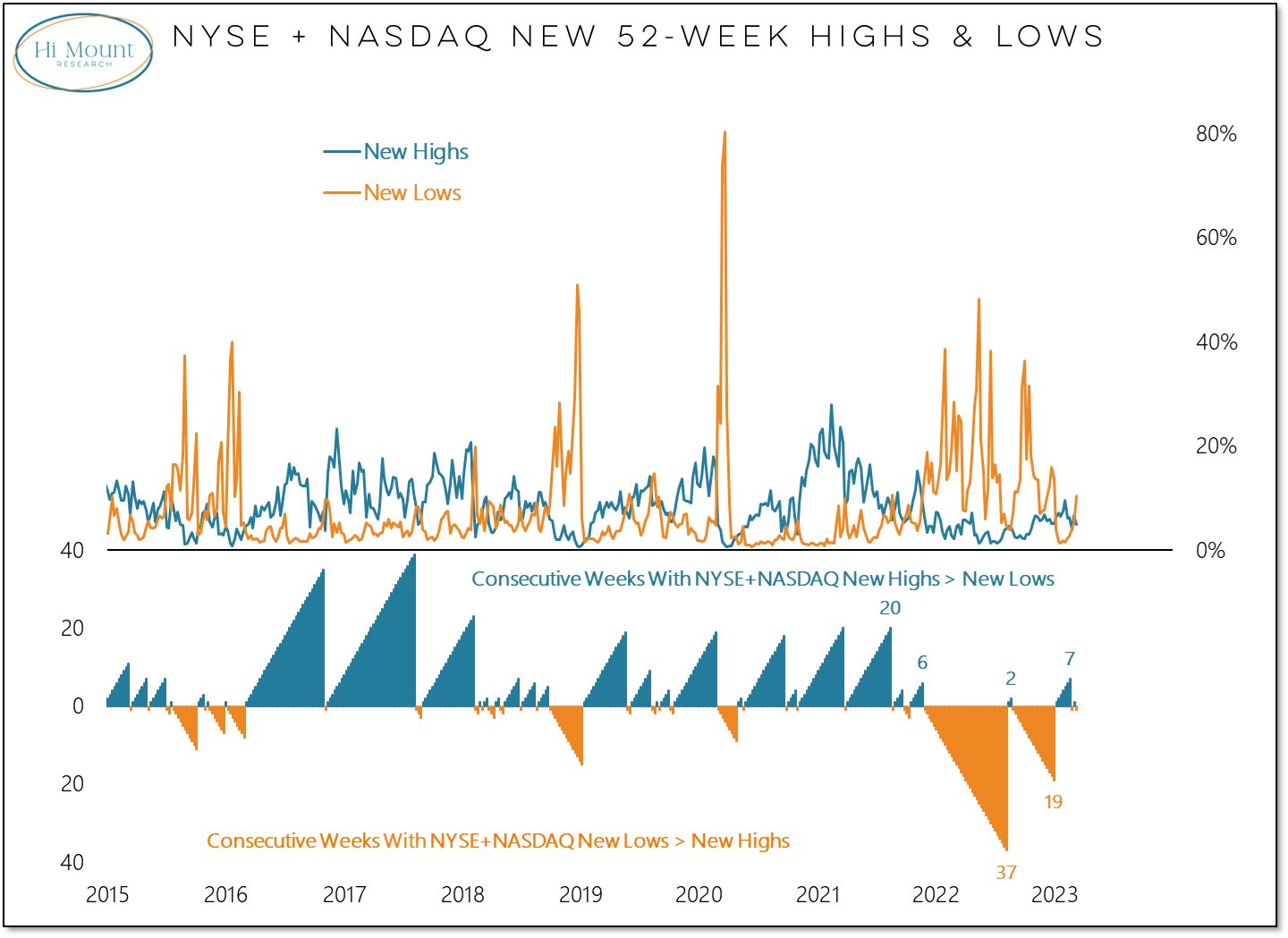

Breadth: More stocks making new highs than new lows is bull market behavior. But as bull markets persist, the new high list typically climbs. That isn’t happening in the US and adds some fragility beneath the surface of the market.