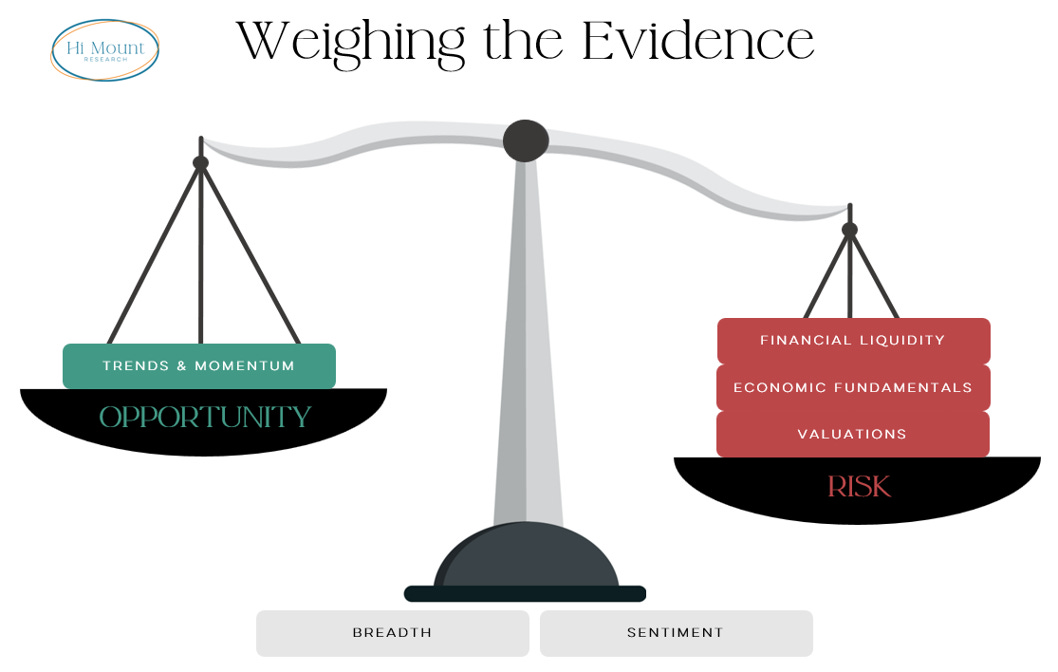

Scale tips further away from Opportunity in June as Financial Liquidity moves to the Risk side (from Neutral).

Key Takeaway: Index-level gains provide the veneer of a robust rally. Weighing the evidence, however, suggests more risk than opportunity in the market right now. Macro conditions remain a challenge even if widespread deterioration is not being observed. Bonds are beginning to realize that the Fed is serious about its intention to keep rates higher for longer (and show that it learned its lesson from the premature pivot in 2019). From a market perspective the absence of strength beneath the surface leaves index-level gains sitting on a shaky foundation.

Don’t forget to go to our website and register for your free Observations account.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.