Rally Loses A Tailwind

Breadth Is Fine, But A Breadth Thrust Regime Has Ended + Global Trends Are Breaking Down

Portfolio Applications subscriber note: Updates to the Blue Heron models are included below. Formal portfolio updates (to both the dynamic and systematic portfolios) will be provided later this week.

In case you missed it: I checked in on Schwab Network last Wednesday for a little pre-Thanksgiving market chat with Caroline Woods.

Key Takeaway: The US is seeing an important and encouraging leadership rotation, but the current rally lacks global sponsorship and no longer enjoys the tailwind provided by last year’s breadth thrust.

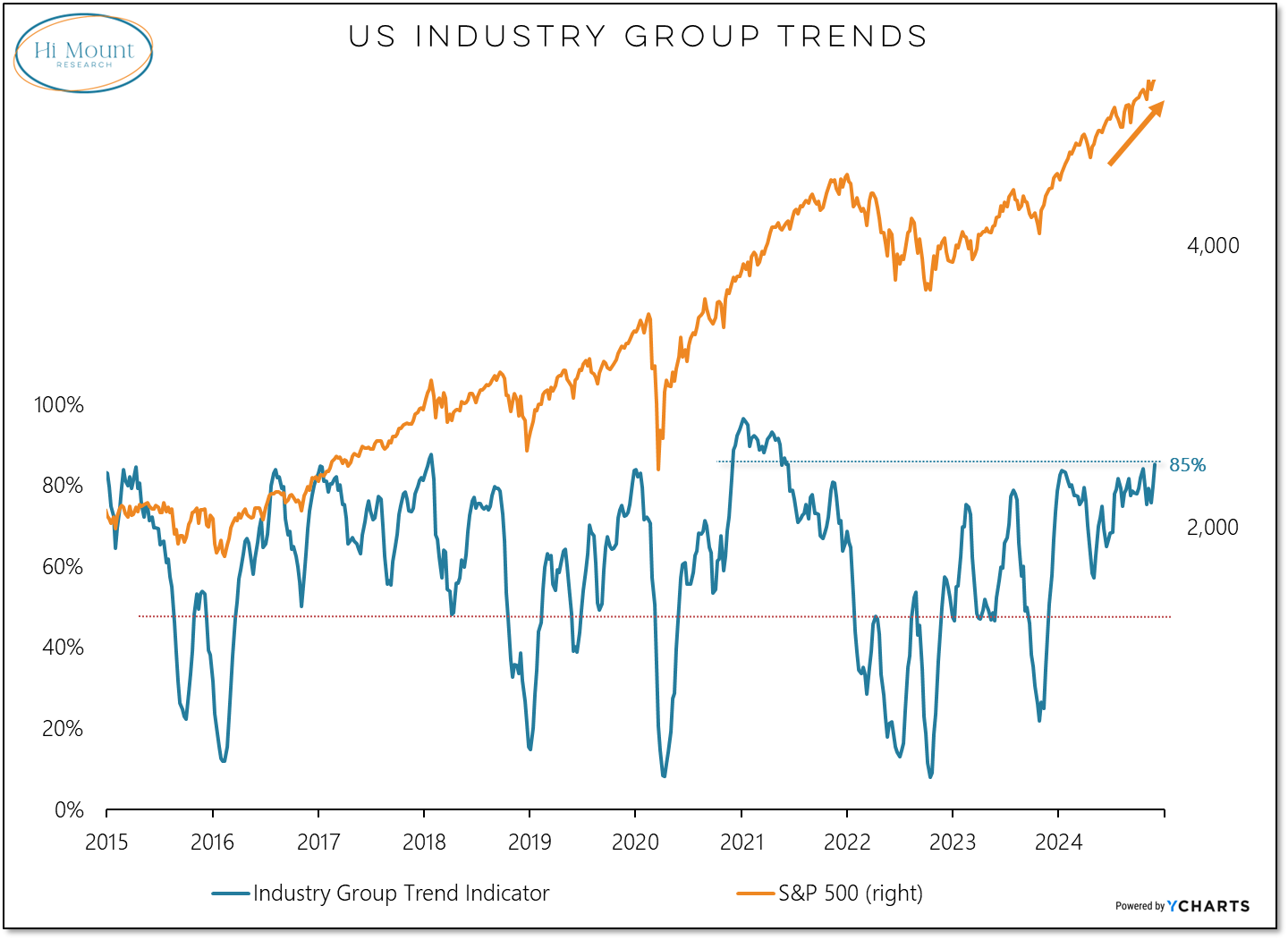

As the S&P 500 has set new records (Friday was an all-time high on a monthly, weekly and daily basis), our industry group trend indicator has climbed to new recovery highs. No evidence of divergence here.

For the first time since early 2021, more than half of the industry groups in the S&P 1500 made new highs last week. Strength was evenly distributed across all three cap-levels (small, mid & large).

From a sector perspective, Technology relative strength is waning, as is the strength of its trend. Rotation is the lifeblood of bull markets, and so far new leadership is emerging (5 of 11 large-cap sectors made new highs last week, while 8 of 11 small-cap sectors did so).

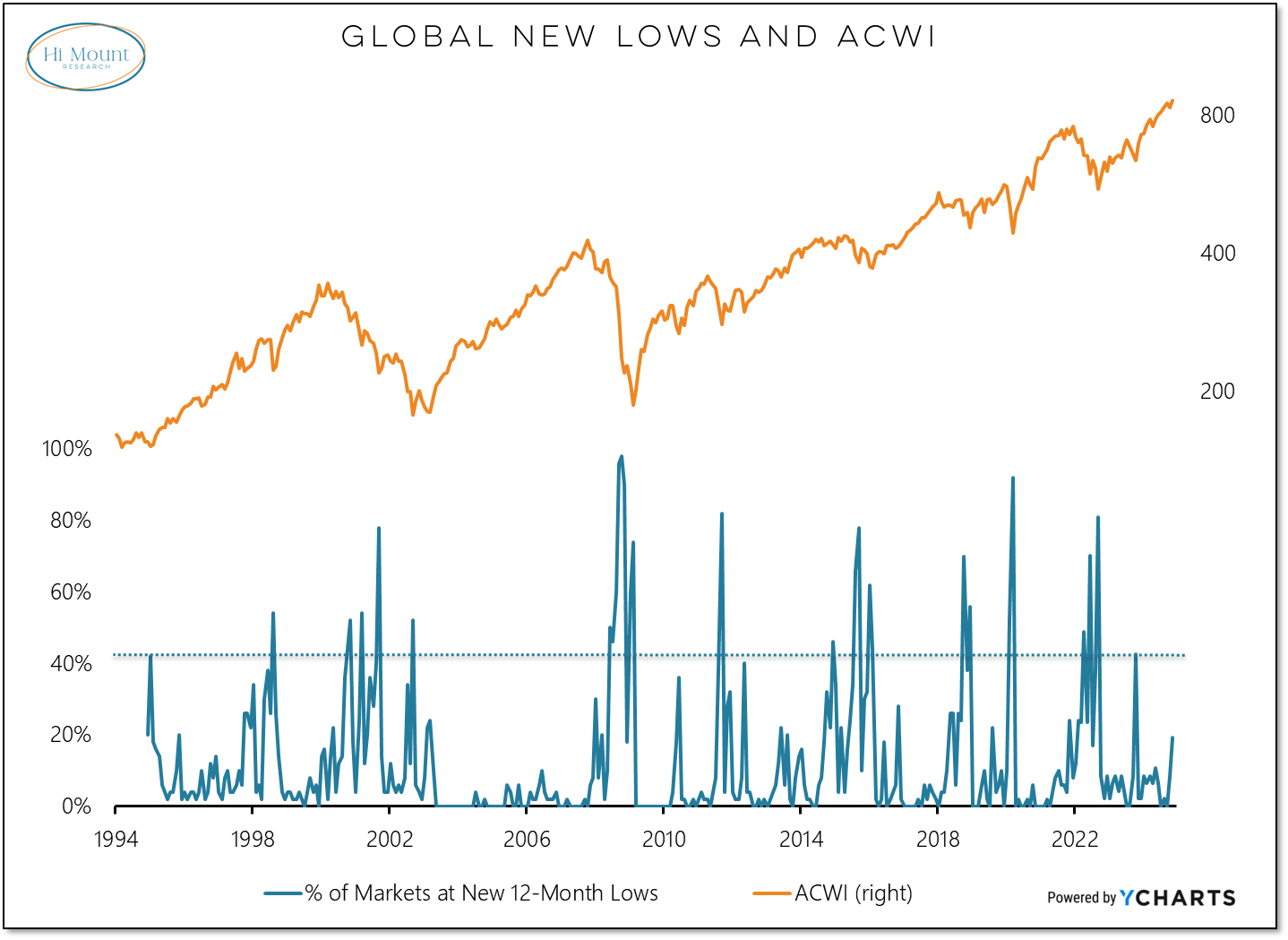

Global trends, however, are more suspect. Not only is our global trend indicator not making new highs, it has dropped into a critical support zone. US-based equity market strength is not getting support around the world.

On a weekly basis, more ACWI markets made new highs than new lows last week. On a monthly basis, new lows outnumbered new highs as the new low list rose to its highest level in over a year.

The breadth thrust that fired on Dec 1, 2023 is expiring, but only after delivering an annual return that is more than twice the long-term average. There have been 30 spikes in 20-day new highs since 1979 and only 4 of them have produced a better 12-month return than what we just witnessed.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.