Rally Burnishes Bull Market Credentials

Broad strength stocks comes as macro headwinds ease

Key Takeaway: The headlines remain noisy, but rally participation continues to broaden as one of our key macro indicators has flipped from bearish to bullish.

The rebound off the April lows was initially led by the rest of the world, and our long-term trend indicator continues to favor the ACWI ex-US over the US. More recently, the US has rallied to new highs, fueled by a familiar cohort of large-cap growth stocks. While those have been the leaders, they have not been the only source of strength.

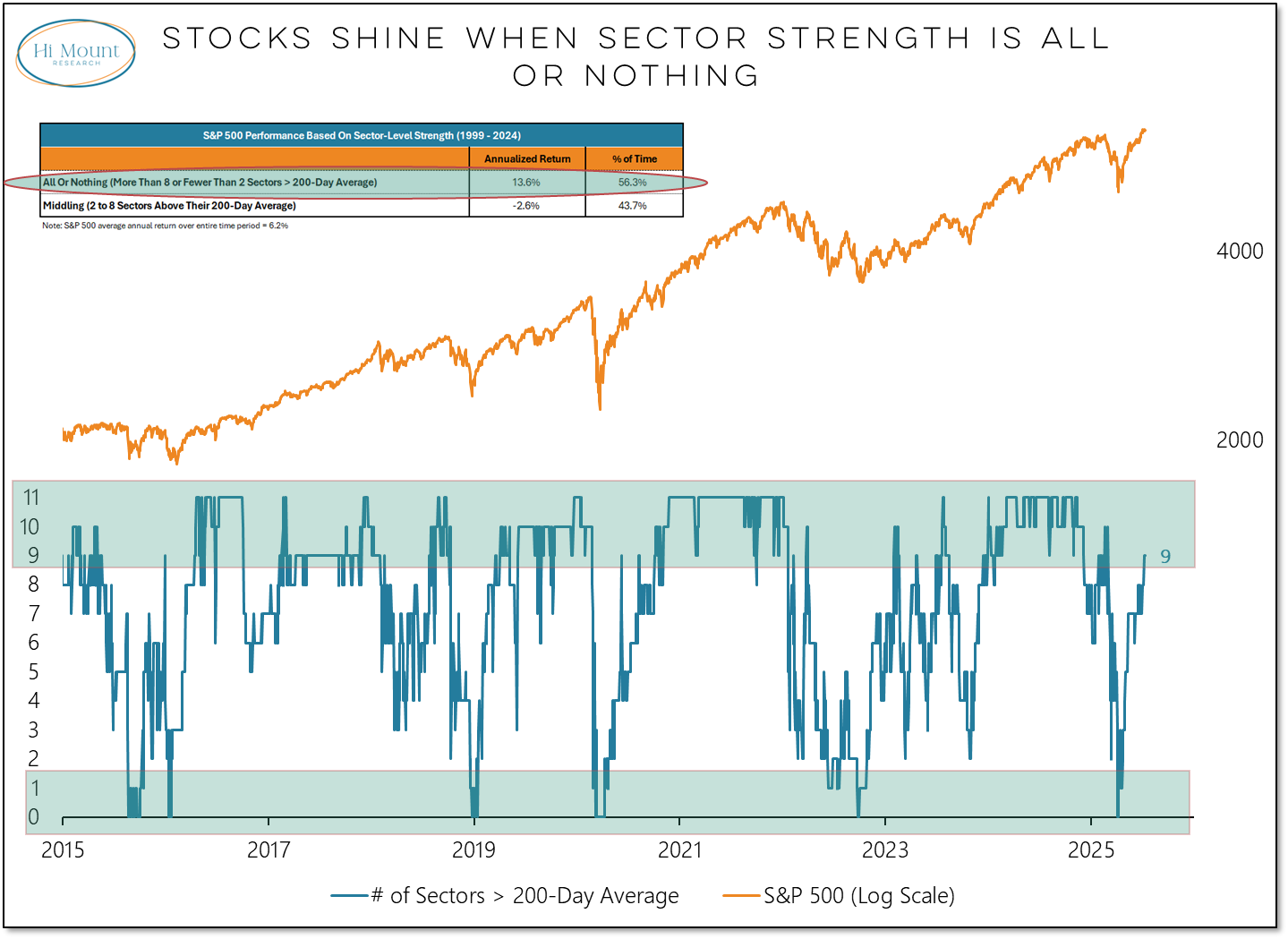

The latest evidence of this is the continued expansion in the number of S&P 500 sectors above their 200-day averages, which climbed to nine last week. The only sectors not above their 200-day average at this point are Health Care and Real Estate. The collapse in the number of sectors above their 200-day averages in early April was fuel for an oversold bounce, while the expansion now provides broad support for recent strength. All of the net gains for the S&P 500 over the past quarter century have come under these conditions (when more than 8 or less than 2 sectors were above their 200-day average).

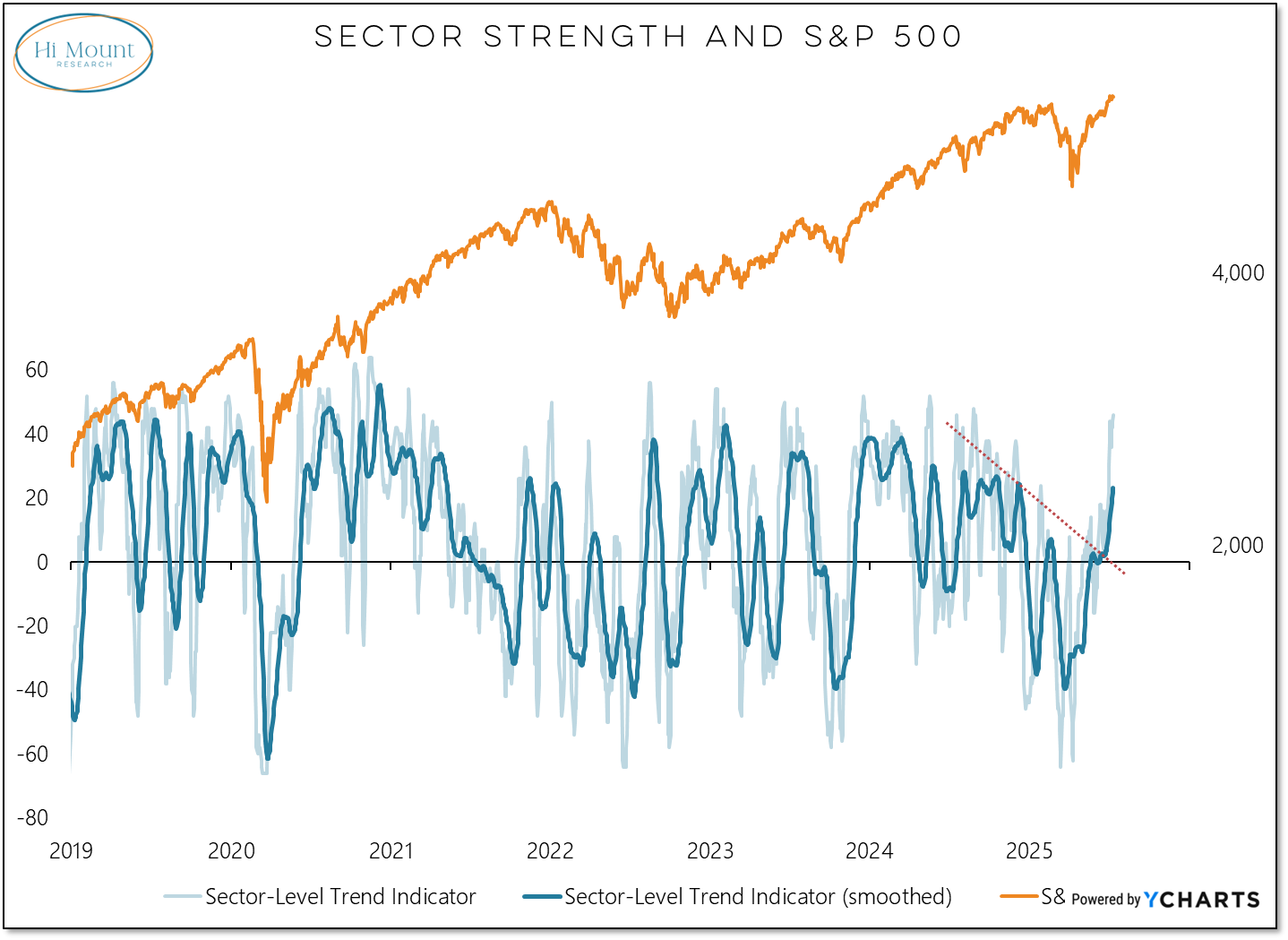

Shorter-term sector trends based on momentum, price and breadth have also improved.

Sector-level trend strength was deteriorating over the course of 2024 but has turned dramatically higher in recent weeks.

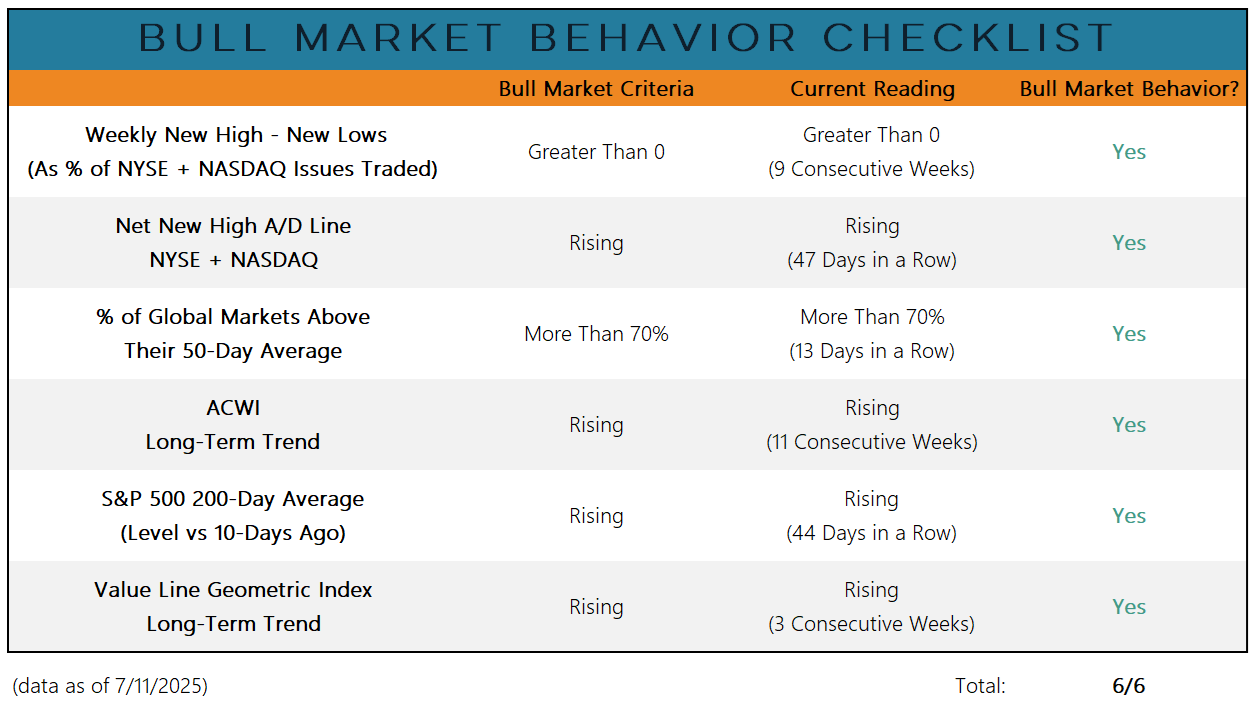

Simply put, bull market behavior is widespread, both in the US and around the world, on a breadth and trend perspective.

A market that is firing on all cylinders can make some folks nervous. Rather than worrying about conditions eventually deteriorating, a better approach is look for evidence that such deterioration is actually occurring.

In the current environment, there are two technical measures that I am keeping a close eye on in this regard. There are also two macro measures that have improved recently and are providing additional tailwinds to the rally.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.