Tactical Opportunity Portfolio Update: Based on the bull market behavior and recent breadth thrust discussed below, we have increased equity exposure in our Tactical Opportunity Portfolio

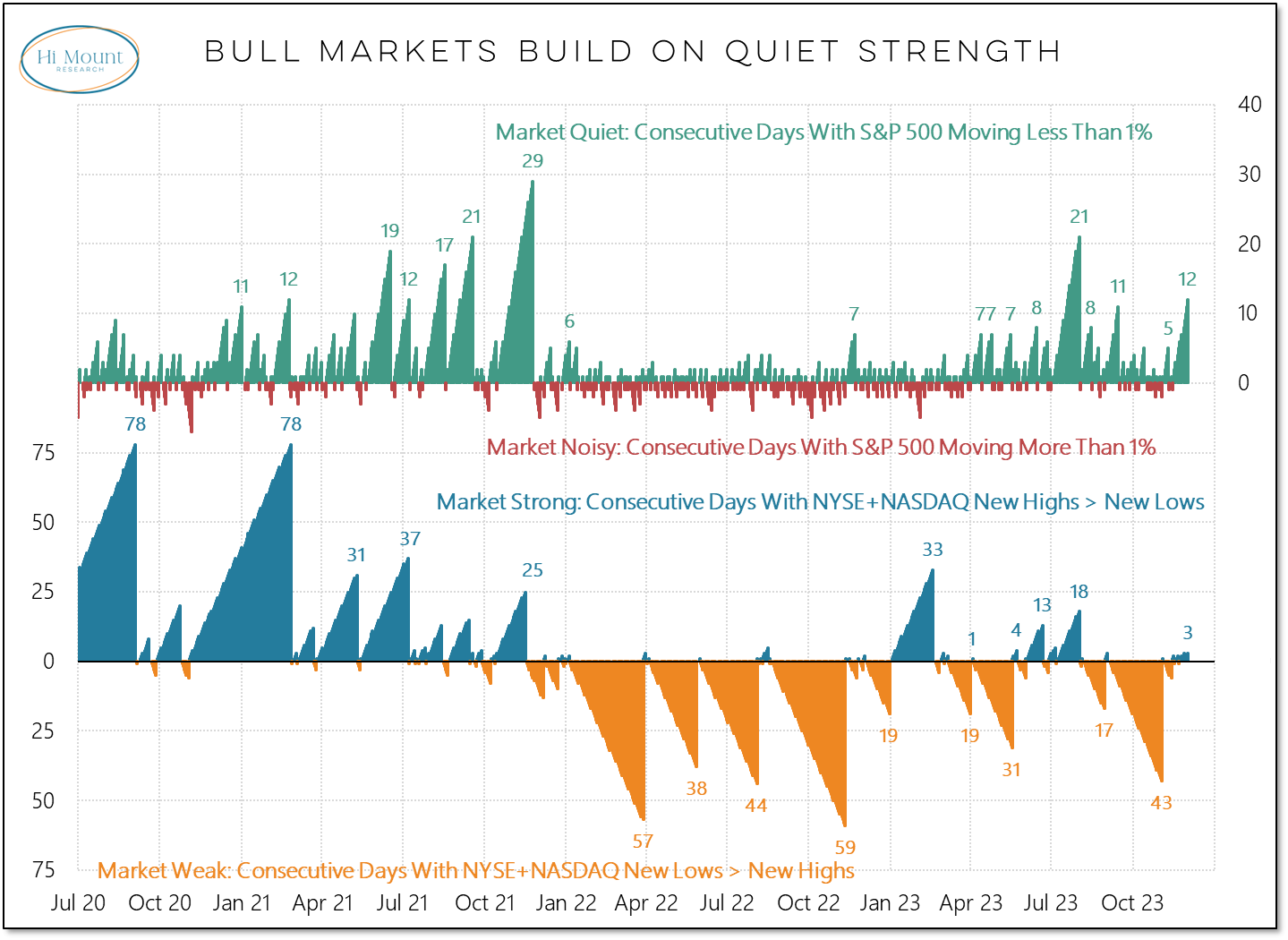

Key Takeaway: It has been 12 days (and counting) without a 1% swing in the S&P 500 is the longest stretch since August. When the market goes quiet, it’s usually a sign that strength is building.

A cautious case for stocks had been supported by the market technicals. But that is not the case now.

We are seeing that in our Bull Market Behavior Checklist (now 6 out of 6) and our tactical Fear or Strength Model. Friday also brought a new Breadth Thrust.

Breadth thrusts have become a dime a dozen of late, but this is one that I continue to pay attention to:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.