Quiet July Brings Strength For Stocks & Struggle For Economy

The fundamental vs technical imbalance persists, but bulls can quietly grind the market higher longer than bears can remain solvent

Market Insights subscribers can access this report online to get a link to the video update and download the chart pack. If you are ready to become a subscriber, register for a free Hi Mount Research account and then let’s talk.

Key Takeaway: Quiet strength has emerged in the stock market while it is a quiet struggle in the real economy. Investors continue to pivot in response to the latest data and are losing sight of shifts in longer-term trends.

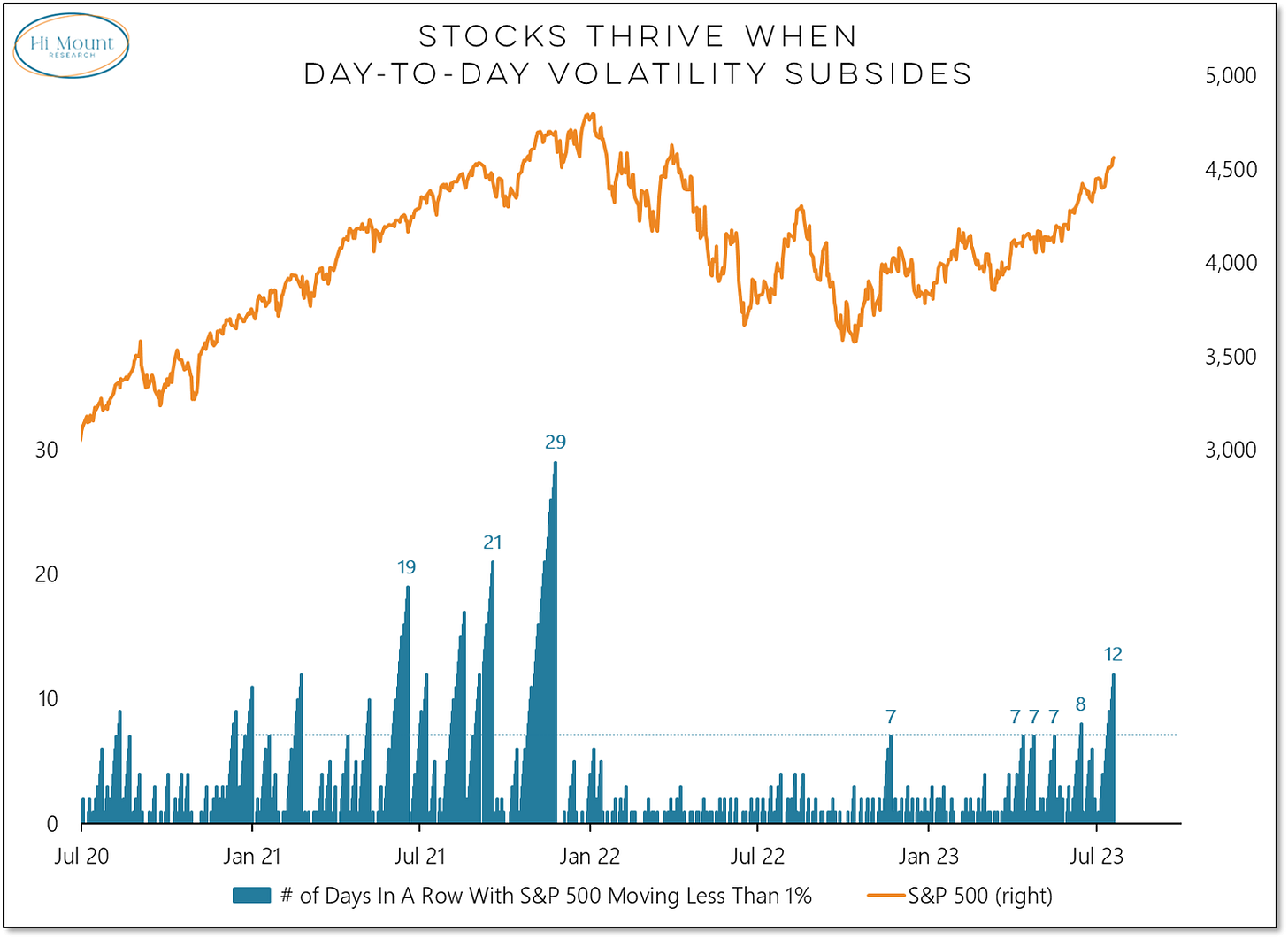

More Context: The S&P 500 has not moved up or down 1% on a daily closing-basis yet this month. Big moves in either direction are usually associated with periods of market weakness and volatility. It's not without risks, but usually bulls can quietly grind the market higher longer than bears can remain solvent.

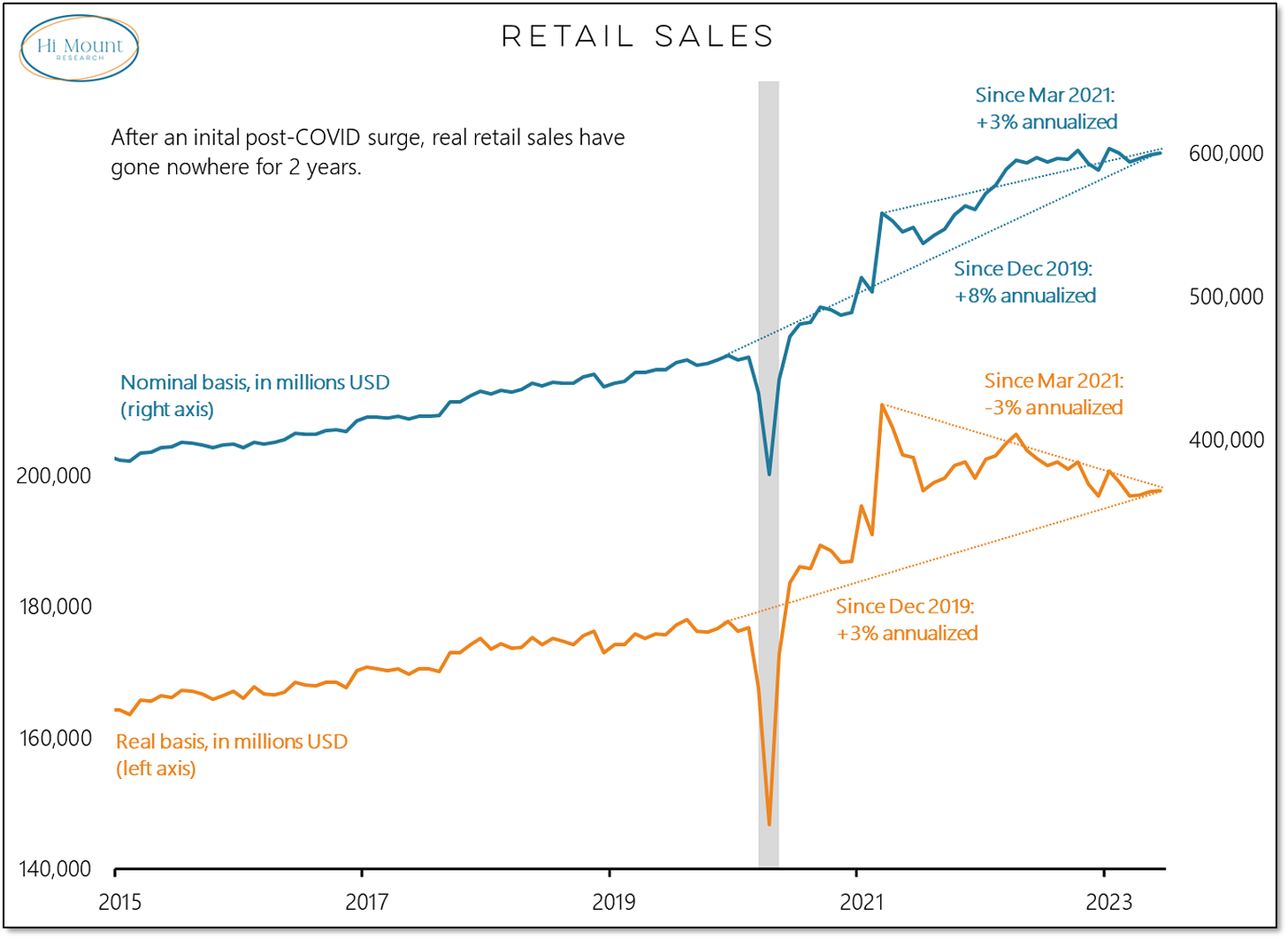

While market conditions have been strong in July, the economic picture remains a struggle. Inflation is masking weakness beneath the surface. Since March 2021, nominal retail sales have risen at a 3% annualized pace while adjusted for inflation they have fallen at a 3% annualized pace. Cash registers are ringing up receipts, but consumers are buying less. Existing home sales have dropped to their 5th lowest level in the past decade while the Conference Board's Leading Economic Index and the Philly Fed Manufacturing Survey are sending signals consistent with recession.

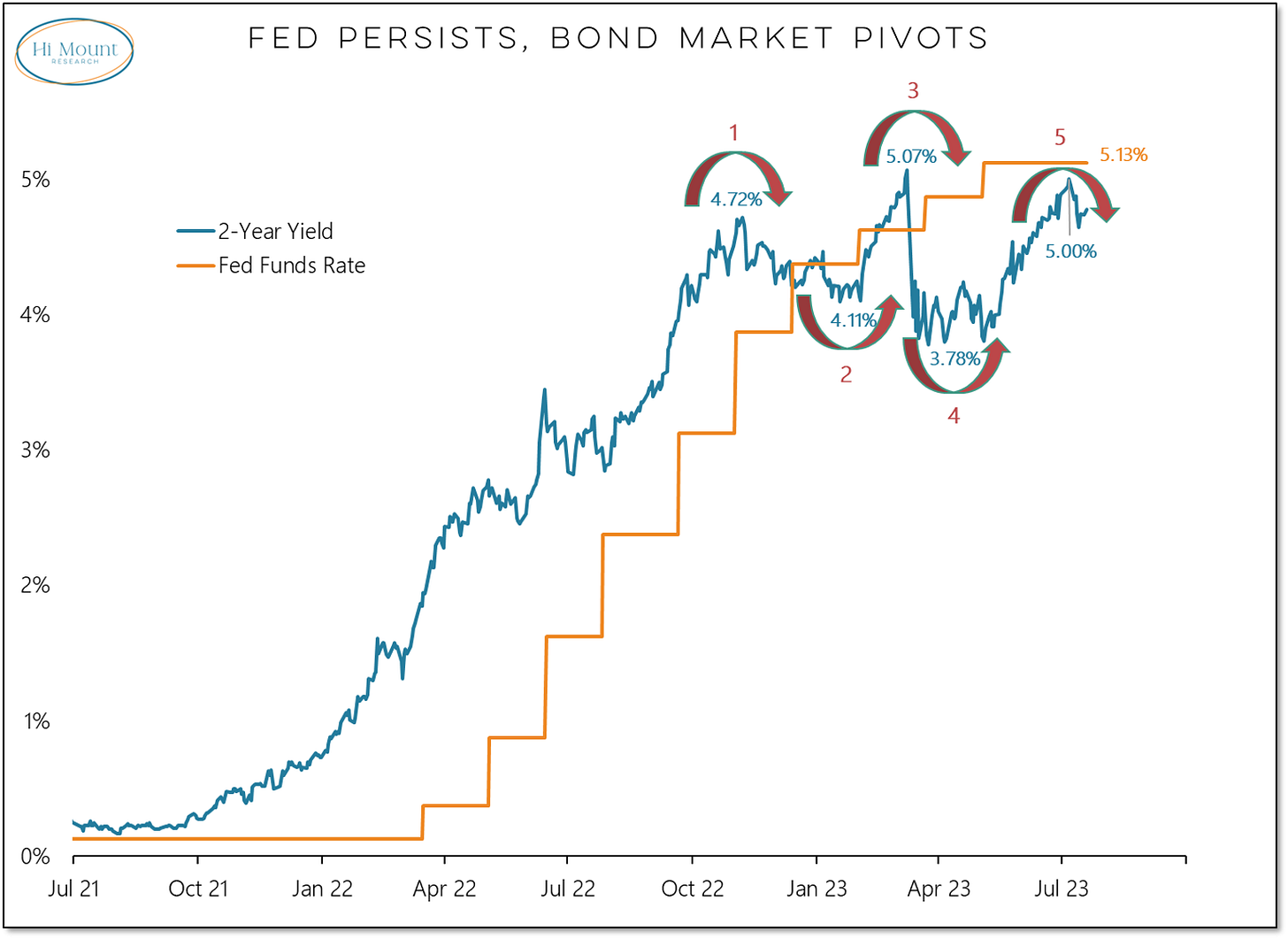

Bond investors are struggling to make sense of the situation. The 2-year T-Note yield has pivoted for the fifth time since October. But the Fed is likely to raise rates by another 25 basis points next week and again later this year. Even after the tightening cycle has completed, rates are not likely to move as low are stay low for as long as they have in the past. The long-term trend in bond yields has already shifted.

Go Deeper: We discuss these topics and the latest message from our systematic asset allocation models in our latest Three For Thursday video. The accompanying chart pack includes a few bonus slides to help round out the discussion.