Key Takeaway: Rally attempts don’t merit the benefit of the doubt. A year after the “low” it’s up to the bulls to prove that it’s a bull market.

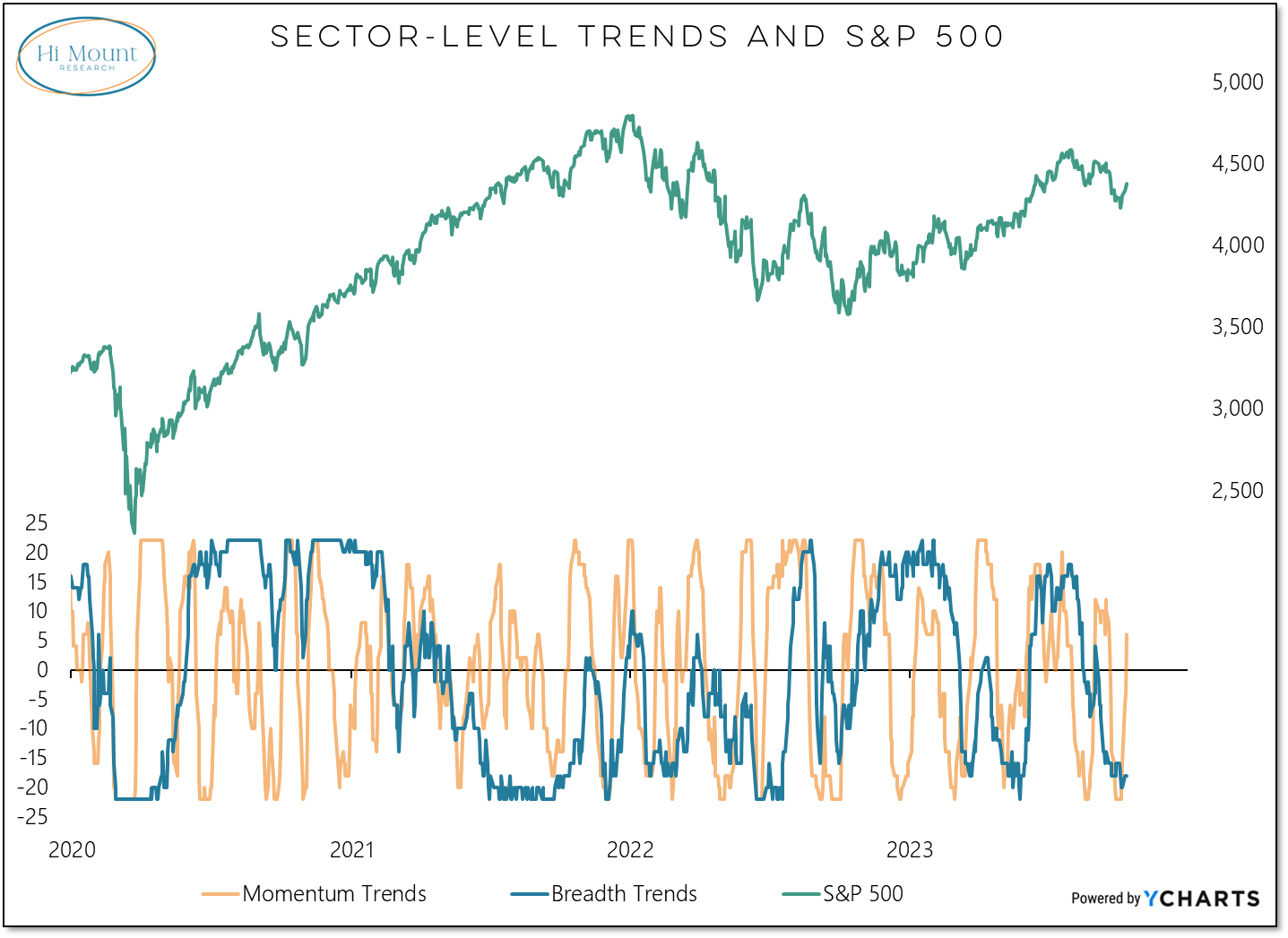

Sector-level momentum has picked itself up off the mat, but if breadth cannot get in gear, this is more likely to be a head-fake than the beginning of a widely anticipated Q4 rally.

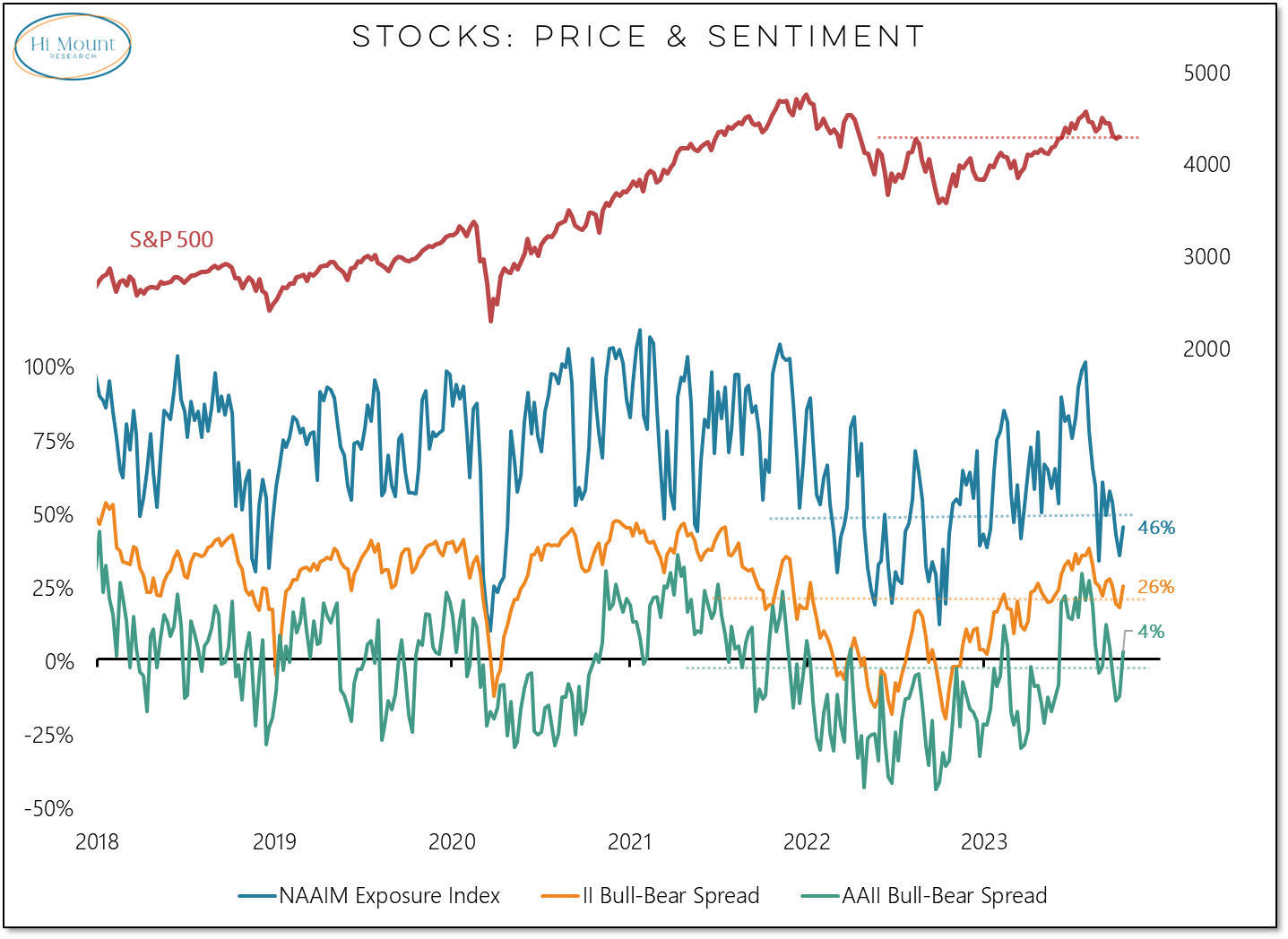

On a hopeful front, AAII bulls exceeded bears this week for the first time in a month. Too often, sentiment is looked at from a strictly contrarian perspective. The reality is that it takes bulls to have a bull market. The bull-bear spreads for both the AAII and II surveys moved in a positive direction this week.

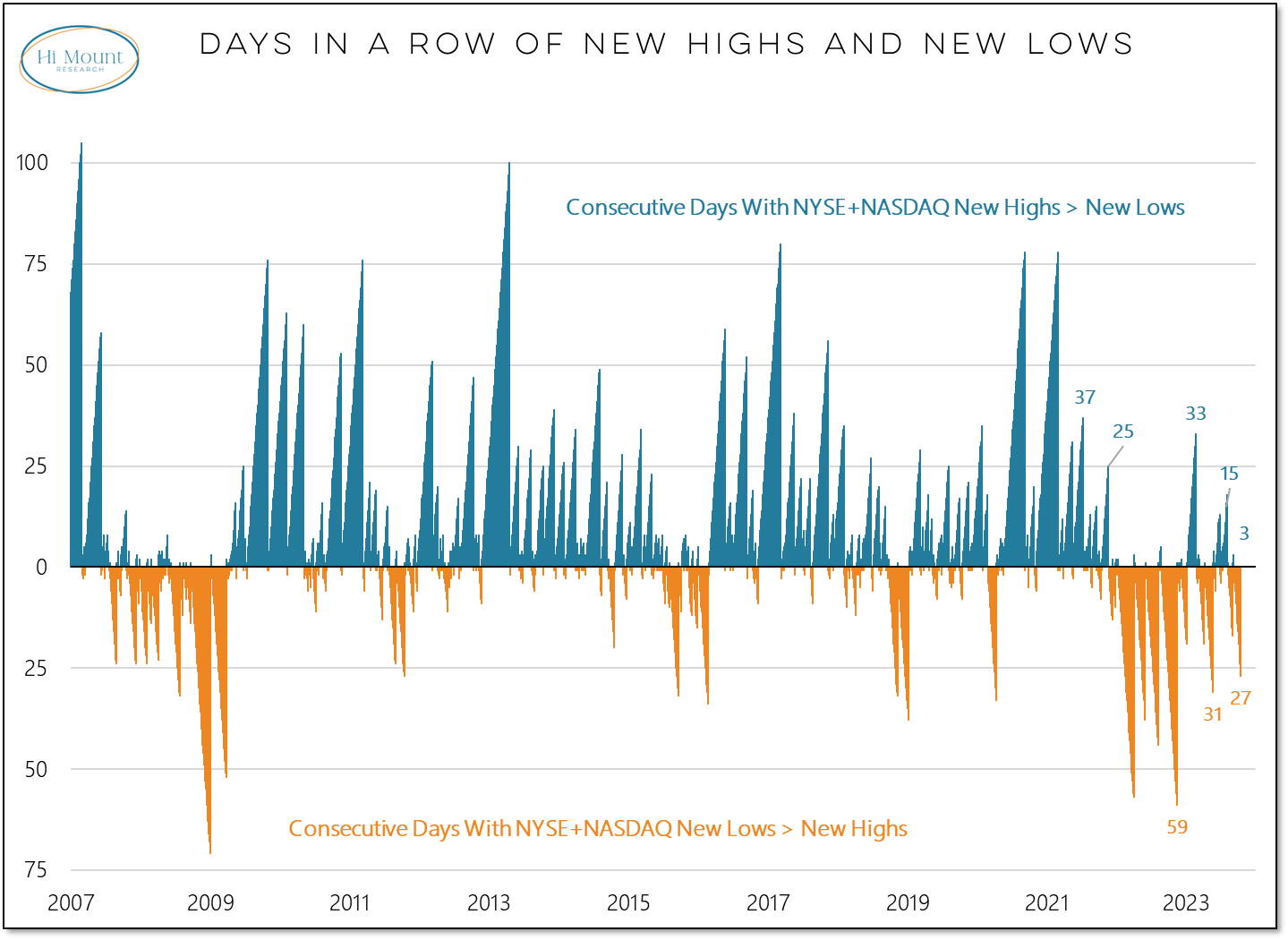

Momentum and sentiment shifts aside, unless and until new highs persistently exceed new lows on both a daily and weekly basis, bullish arguments for stocks are built on sand.

The continued prevalence of new lows > new highs suggests that either this is a bull market unlike any we have seen (and I’ve been doing this half my life at this point) or there is still a bear market dynamic that is intact

Given the current market environment, we’ve made generally risk off adjustments to our suite of Dynamic Portfolios.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.