Futures have almost fully discounted a 25-basis point rate hike by the Fed today, though the 2-year T-Note yield dropping below the fed funds rate suggests the bond market doesn’t see additional tightening is a good idea.

If the Fed passes on a rate hike today, safe havens could rally but risk assets could come under pressures as the market asks, “what does the Fed know that we don’t know?”

The best case for the bulls would probably be a 25-basis point rate hike accompanied by hints from Powell that they are prepared to pause and a dot plot that has a consensus year-end fed funds rate lower than what was released in December.

A more likely outcome is that a 25-basis point rate hike today is accompanied by a dot plot that is at least as hawkish as the one released in December and Powell’s comments are peppered with references to “finishing the job” on inflation.

Key Takeaway: If the FOMC is not prepared to pivot, Powell’s job is to as calmly as possible to tell the bond market that it is wrong to fight the Fed.

It is historically rare for the Fed to continue to raise rates after the yield on the 2-year T-Note has dropped below the fed funds rate. The caveat is that the 2-year yield was below fed funds at the first FOMC meeting of 2023 and the Fed still tightened. Prior to the February 1 rate hike, the spread between the 2-year and the fed funds rate was less than 25 basis points, now it is nearly 50.

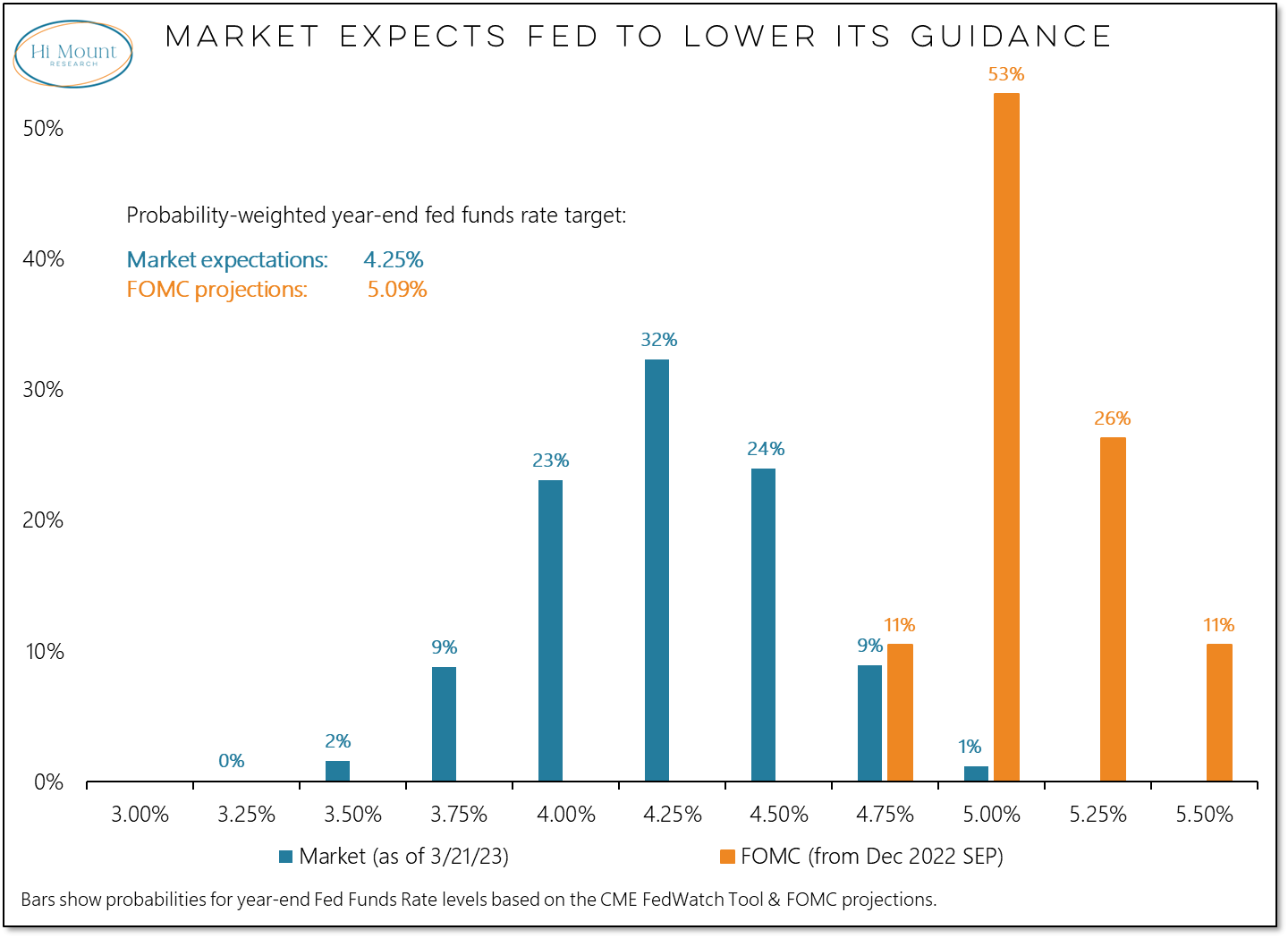

At least as important as today’s decision on rates is the guidance the Fed gives about the remainder of the year. The December economic projections released by the FOMC had the fed funds rate above 5.0% by the end of the year (on a probability-weighted basis). Through yesterday, the market was pricing in a 4.25% year-end fed funds rate. If the Fed doesn’t see rate cuts in the cards this year, Powell will need to re-iterate that message to the market.