Key takeaway: The Fed was late to the inflation fight - it cannot afford for it to bow out early. I expect a 25 basis point rate hike this week and an updated dot plot that disappoints those looking for rate cuts in the second half.

Fed officials begin another FOMC meeting today, internally debating the merits of further rate hikes amidst emerging strains in the banking sector.

With the 12-month change in the median CPI at its highest level ever and the 3-month change re-accelerating, the Fed is not well-positioned to declare victory on inflation.

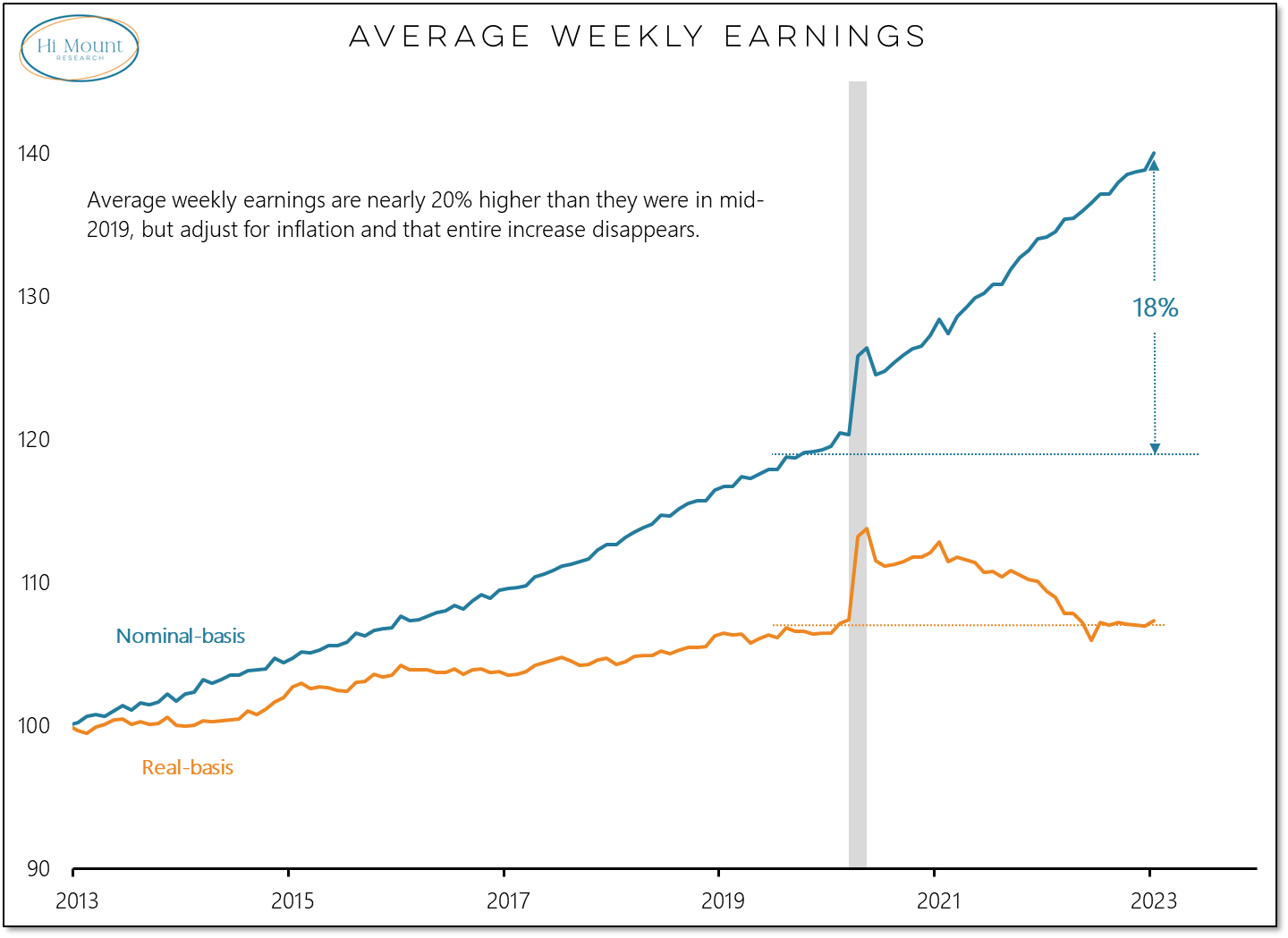

Adding to the Fed’s challenge is that the persistence of inflation obscures the lack of real economic progress in recent years. This is the insidious nature of inflation, and it is on full display when we compare headlines numbers versus measures of actual activity. Allowing this to become embedded in expectations makes the fight against inflation even more difficult.

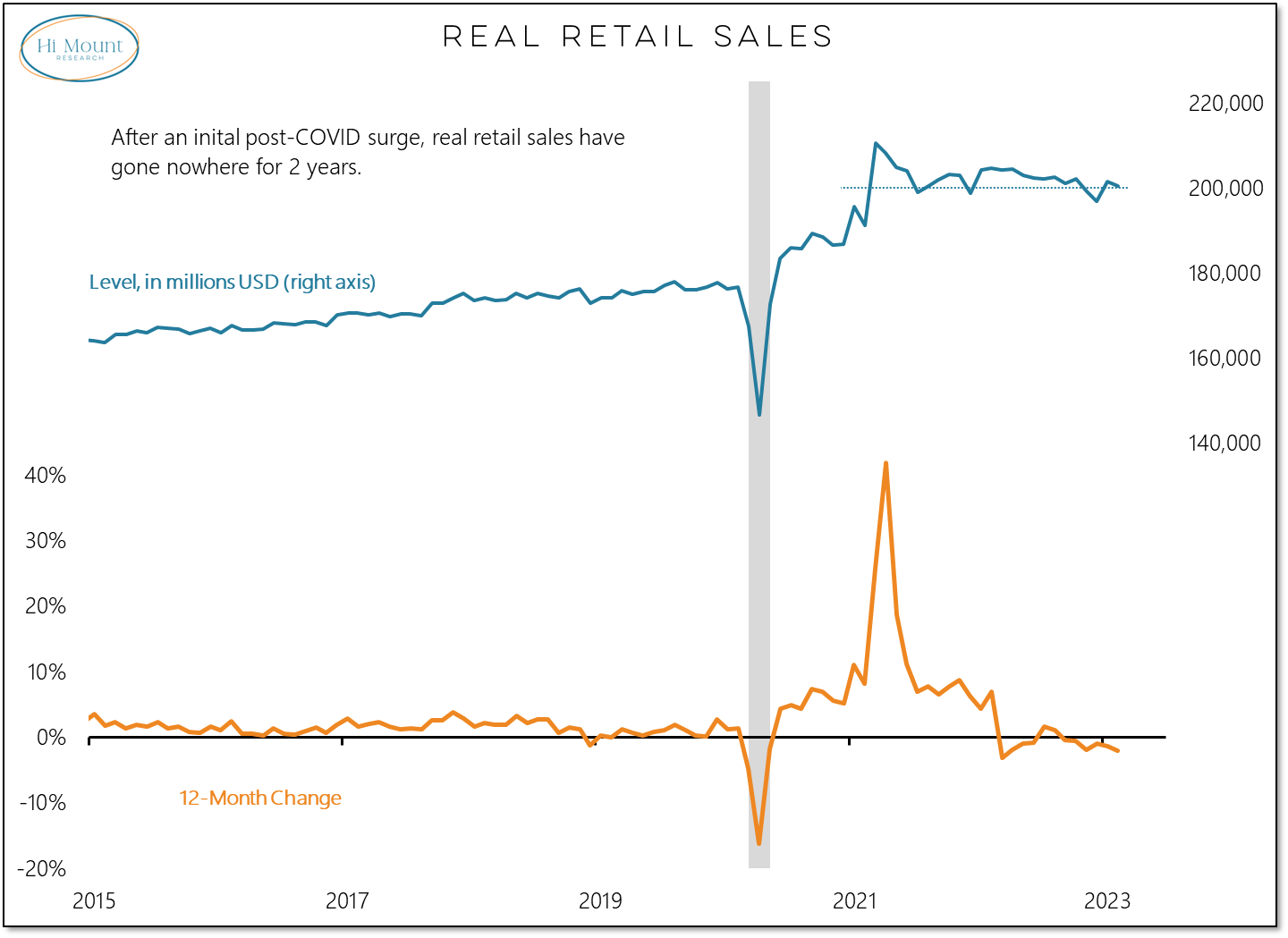

Recent retail sales and weekly earnings data demonstrate this gulf between nominal improvement and stagnating real activity.

Retail sales have risen nearly 10% over the past two years, but adjusted for inflation they are flat. Consumers are spending more, but not getting more.

The average weekly paycheck is nearly 20% higher than it was pre-COVID. But adjusted for inflation, real weekly earnings have been decline since their COVID-related peak and are no higher now than in mid-2019.