Townhall Takeaways podcast:

Asset allocation doesn't reflect record-setting persistent pessimism. Household equity exposure remains above its long-term average despite 35 weeks in a row of more bears than bulls on the AAII sentiment survey. Being quick to abandon equities was painful for investors in 2020, being slow to do so has been painful in 2022. Bonds (and commodities) remain the unloved asset classes.

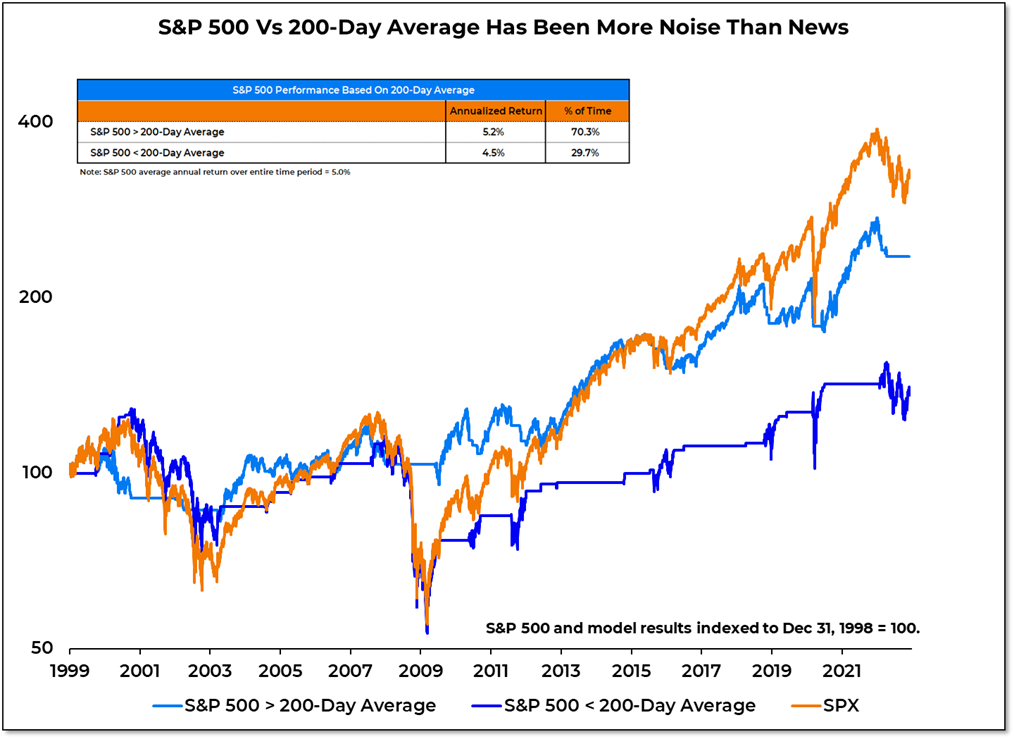

S&P 500 is back above its 200-day average. Or at least it was for a day or two. Either way, whether it is above or below the 200-day average doesn’t seem to matter that much from a performance perspective. Crossing that threshold is usually more noise than news. The direction of the 200-day average, however, is a different story (for a different post on a different day).

Sector-level breadth is in the messy middle that sees more consolidation than consistent strength. The number of sectors above their 200-day averages has climbed up to 7. While an expanding number of sectors above their 200-day averages seems like a good thing, the S&P 500 is at its best when sector strength is all or none. When it has been more than eight or fewer than two, the index has produced double-digit returns. It has tended to actually lose ground when between 2 and 8 sectors are above their 200-day averages.