Optimism Following Strength As Investors Look Overseas

Townhall Takeaways for the week ending January 20

In this week’s podcast, we look at how investors have greeted recent strength with a healthy dose of optimism and how that strength has been enough to turn our tactical model bullish. Finally, we zoom out and see that a decade and a half of strength in the US versus EAFE is coming to an end. Trends around the world are turning higher.

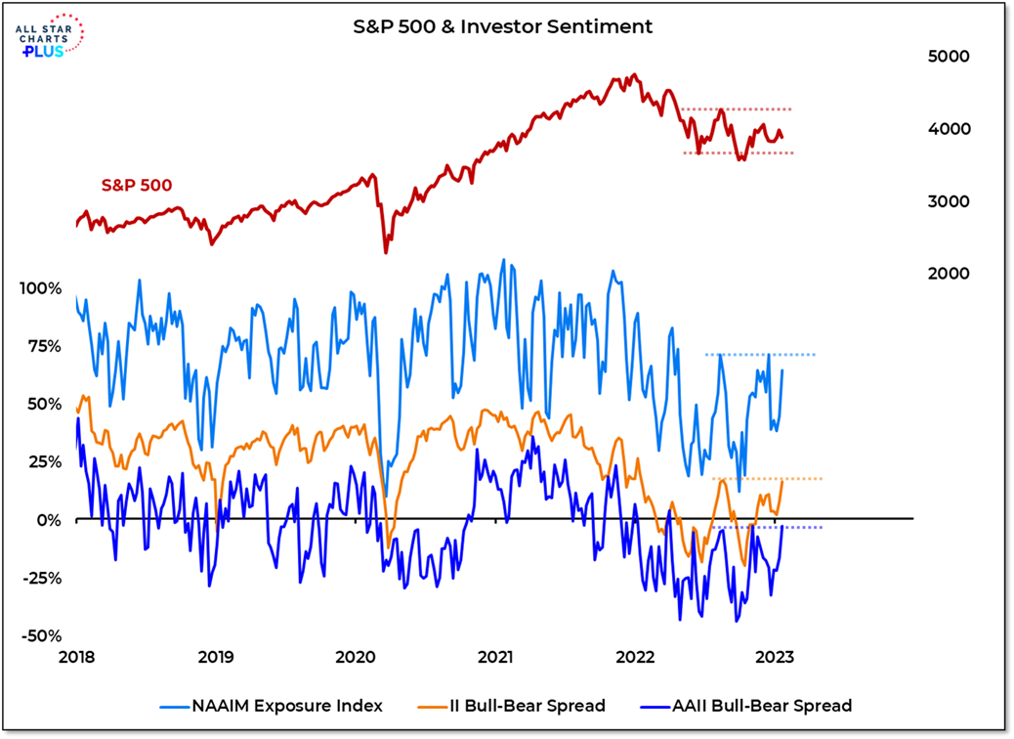

1. Rising optimism would be fuel for a further rally. The move by stocks off of their October & December lows has investor optimism on the rise. The Bull-Bear spreads for the AAII & II surveys, as well as the NAAIM Exposure Index, are at their August highs. Getting those levels will be important if the move higher for stocks is just getting started. We still need more bulls if we are going to have a bull market.

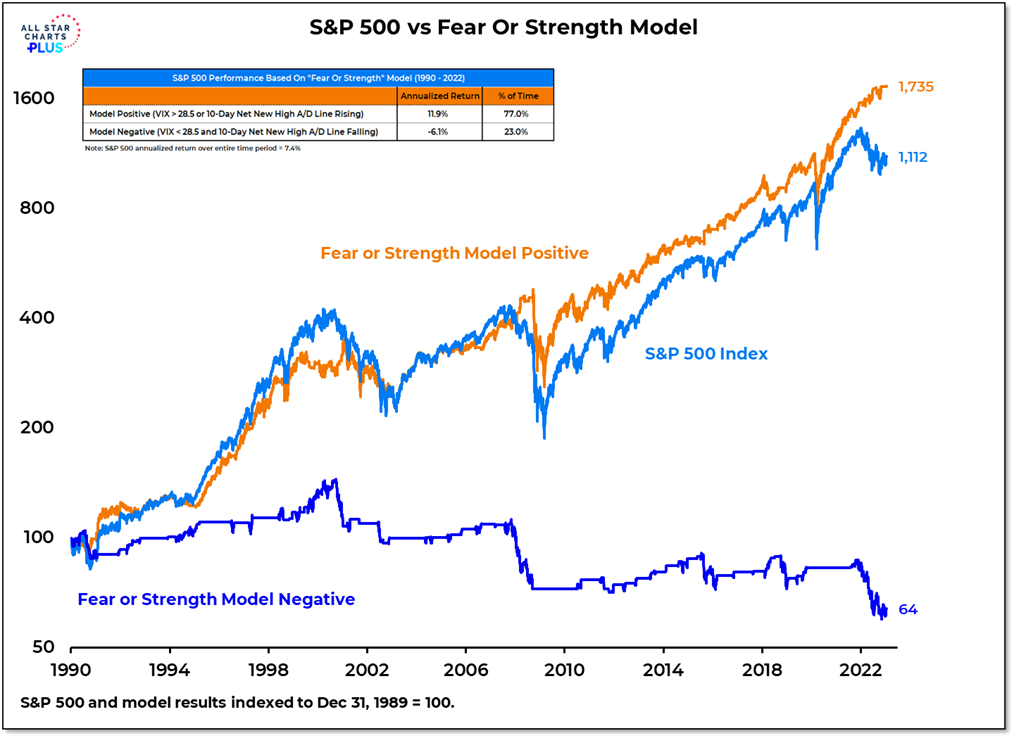

2. New highs > new lows turns our "fear or strength" model positive. Whatever your time frame, our goal is to identify environments that favor sustained moves higher versus those that do not. Our tactical “fear or strength” model shows that over the past 30+ years, the S&P 500 has moved higher when we have seen either fear (VIX > 28.5) or strength (more stocks making new highs than new lows) and it moved lower when neither was present. Last year was no different and so it is encouraging now to see the model turn positive as we have strength emerge in 2023.

3. After 15 years of US relative strength the trend now favors the rest of the world. The US has just experienced its longest sustained period of leadership versus other Developed Markets in more than half a century. Now, however, the trend is shifting. Investors whose perspective doesn’t stretch beyond the past decade-and-a-half are in for a new experience. The market is already showing it’s hand. Over the past six months, the US has gone sideways, while the UK and Pacific ex Japan are up double digits and the Eurozone has gained nearly 20%.

Townhall Takeaways on YouTube: