Optimism Abounds As Investors Are All-In For Equities

Economic challenges are not enough to dissuade stock market bulls

Subscribers can skip ahead and download the Sentiment Report directly from HiMountResearch.com.

We’ll get to sentiment in a moment, but first some thoughts on the macro situation: The housing market is a mess and this appears appears to be a symptom of broader challenges in the economy.

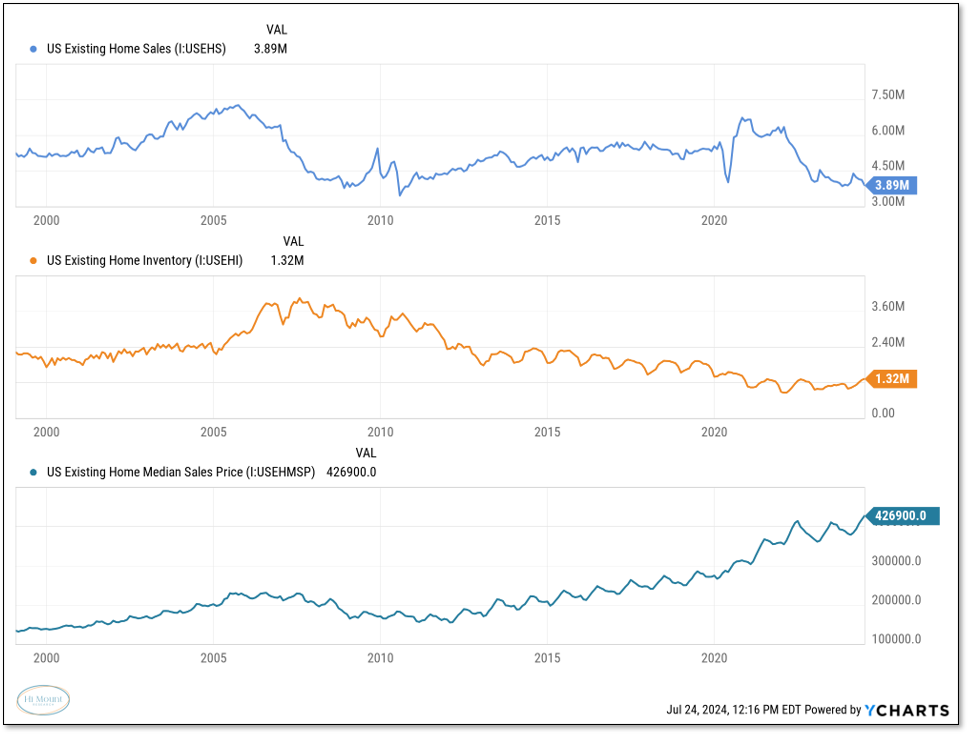

Existing home sales fell in June for the 4th month in a row and are on the cusp of a new cycle low. While inventories are still historically low, they are rising.

Inventories have expanded on a year-over-year basis for eight months in a row and were 23% higher in June 2024 than in June 2023.

While sales are down and inventories are rising, prices continue to climb. This not only defies Economics 101 (less demand and/or more supply usually results in lower prices), it puts further pressure on new homebuyers.

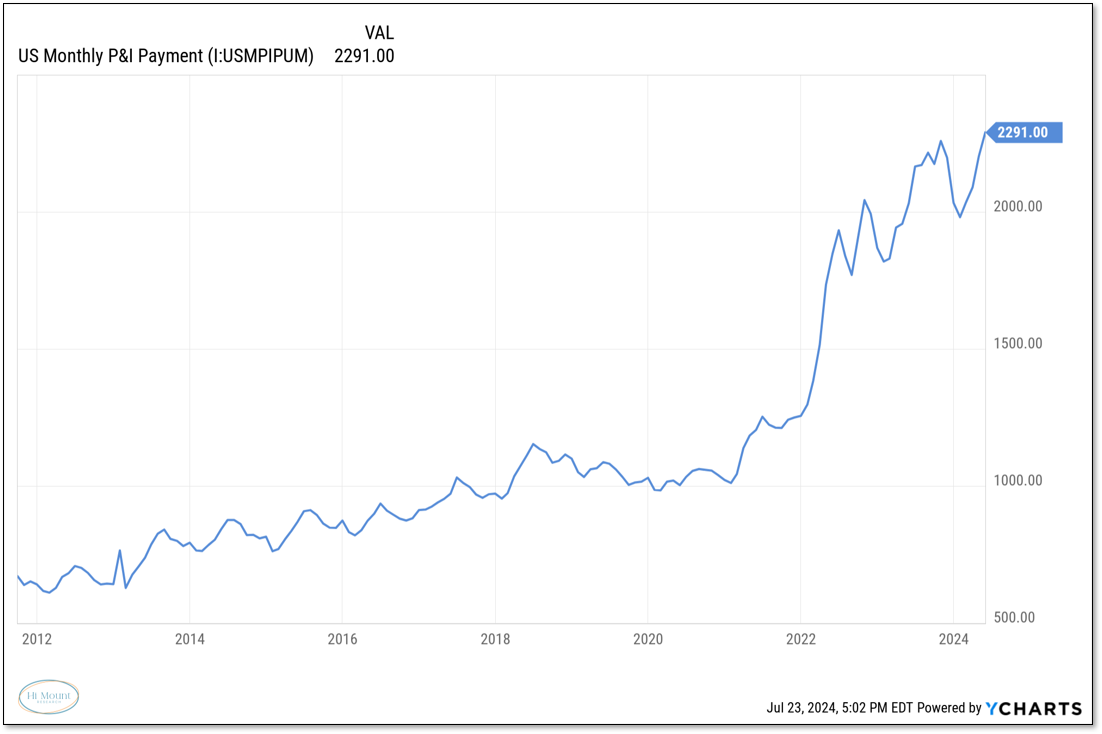

Monthly mortgage payments have skyrocketed and are more than double pre-COVID levels. The ability to accumulate wealth in the years ahead may depend heavily on whether you bought your first home before or after 2020. When housing costs double, there is less money for other spending and long-term savings.

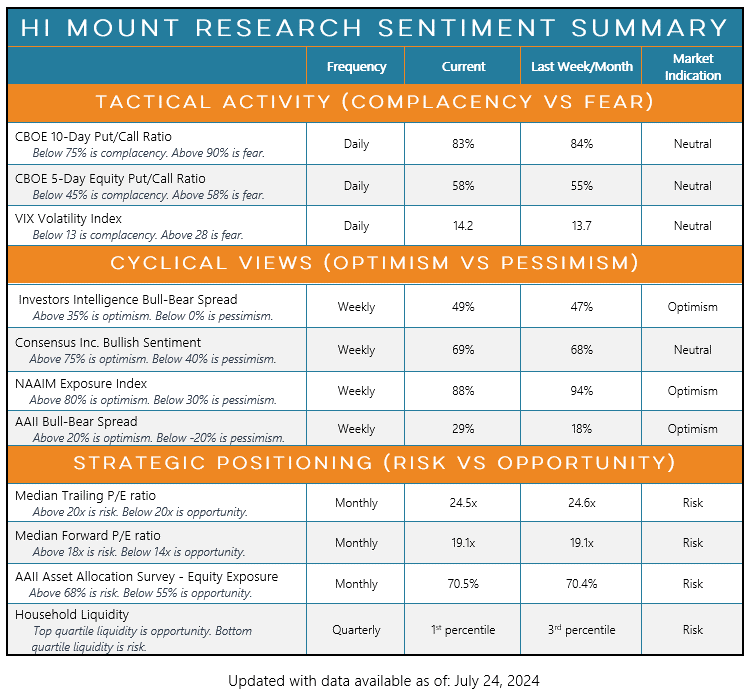

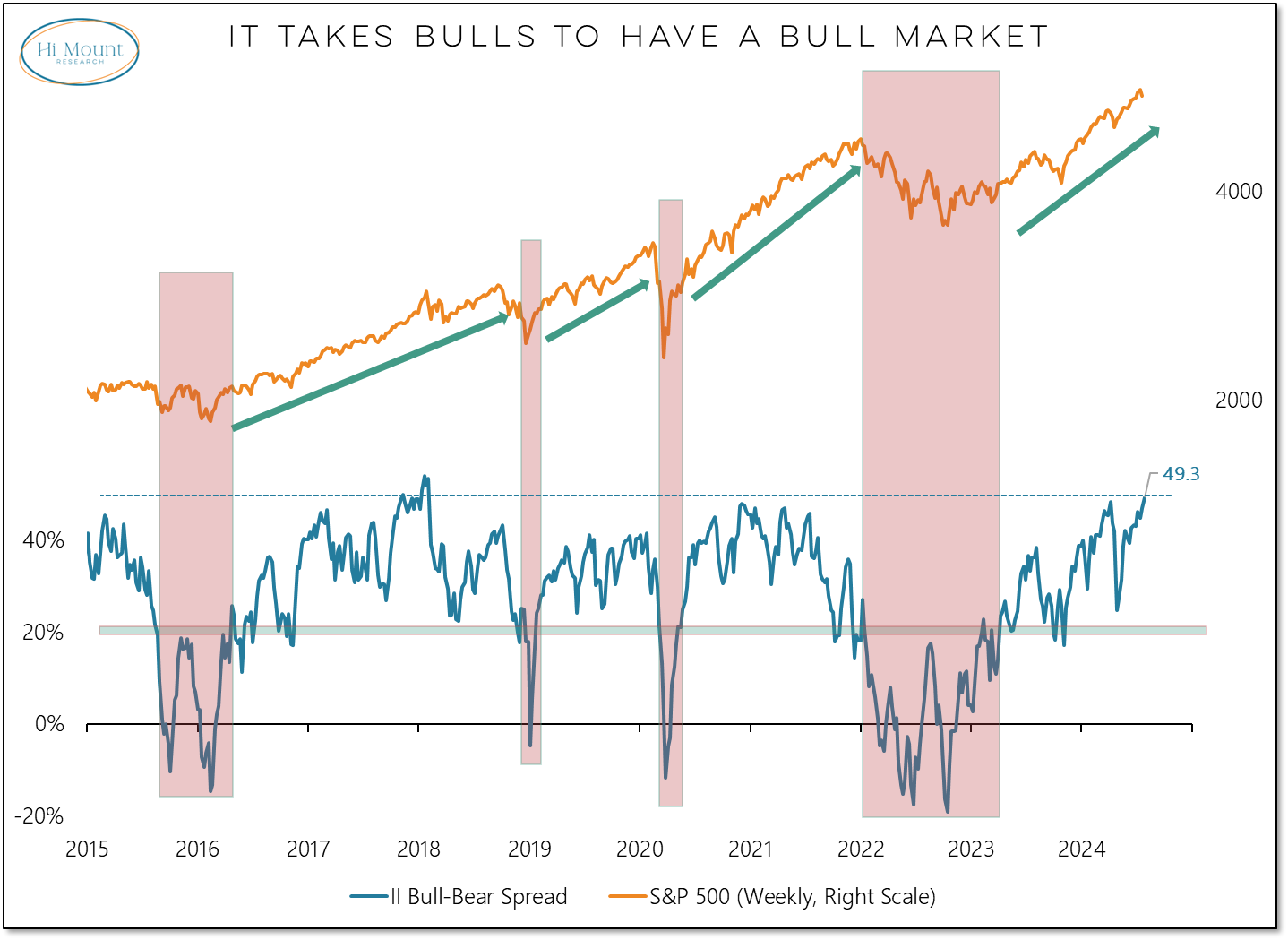

Don’t tell investors any of this. They remain bullish on stocks and committed to equities. That is good for now, as cyclical optimism is a key ingredient for sustained market strength. But in the longer term, overexposed investors are a secular headwind, especially at a time when stocks lack a valuation advantage over bonds.

When using sentiment as a risk management tool from a cyclical perspective, we want to go with the crowd until it reverses at an extreme. While extreme optimism is present, it has yet to reverse. The II bull-bear spread reached its current level in November 2017. The S&P 500 peaked in September 2018 (at a lower level of optimism) and selling intensified after the bull-bear spread dropped below 20%.

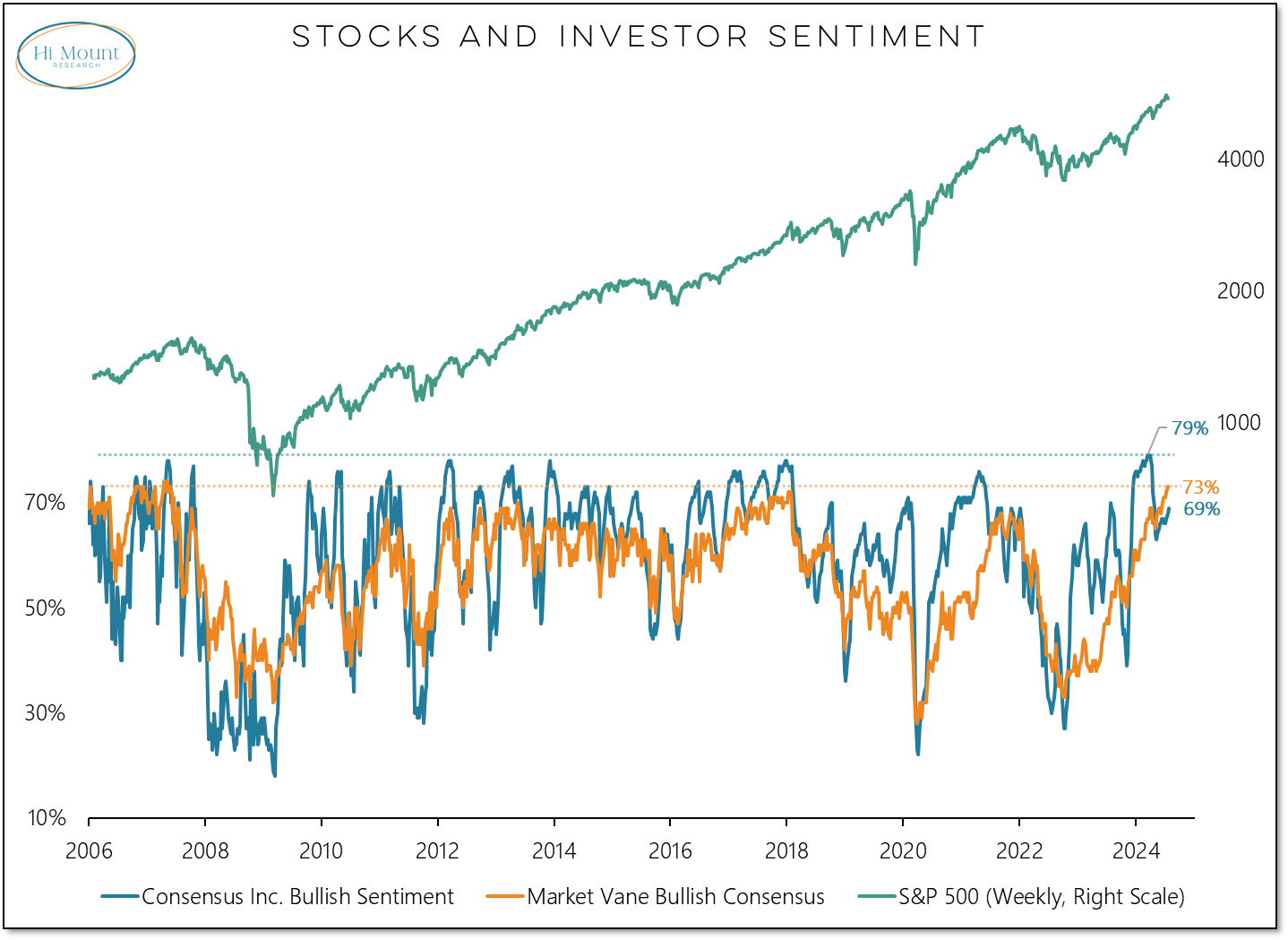

Similarly in 2007, Consensus Inc and Market Vane sentiment peaked in the spring while the S&P 500 peaked in October. This week Market Vane bullish consensus reached its highest level since that May 2007 peak. Consensus Inc bullish sentiment is expanding but remains below the all-time high reached in March of this year.

Cyclical optimism can help keep stocks buoyant, but elevated equity exposure tends to be a secular headwind.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.