One Year Later . . .

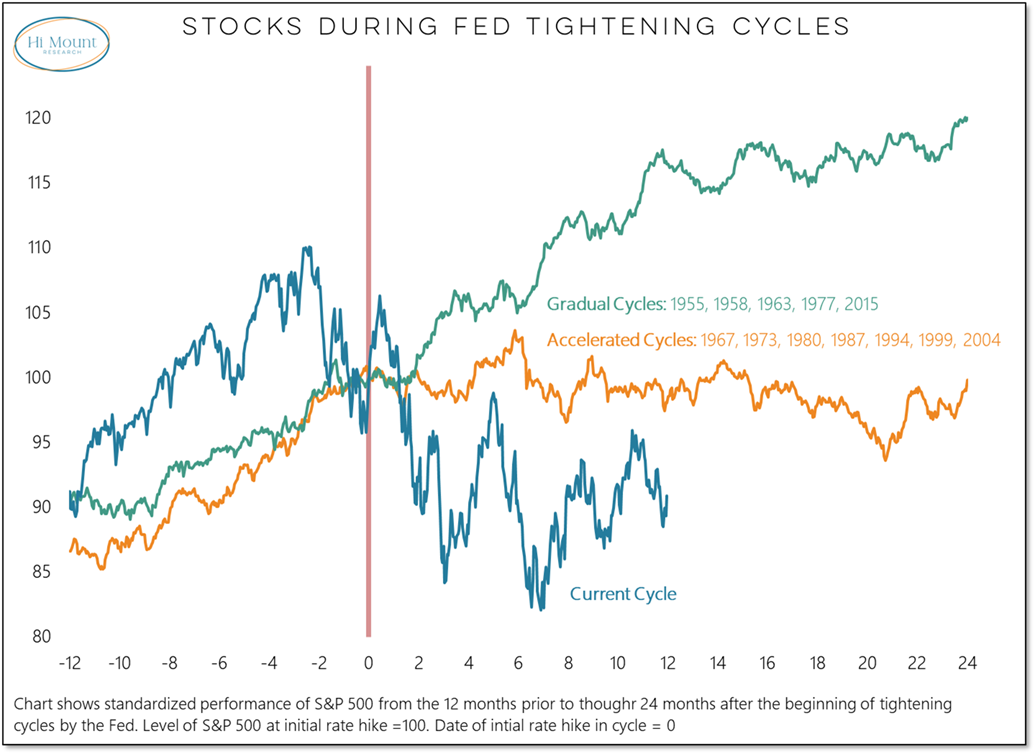

Stocks struggling in the face of an accelerated Fed tightening cycle is not an exception

The Federal Reserve raised rates by 25 basis points on March 16, 2022. The overdue tightening cycle that emerged over the ensuing year has been the most accelerated in over a generation. The failure to distinguish between typical market behavior in accelerated cycles versus gradual cycles has been an expensive lesson for investors.

More Context: The immediate bounce in the wake of last March’s initial rate hike reflects the widespread belief at that the time that “stocks typically do well when the Fed is raising rates.” That over-simplified conclusion glossed over the distinction in market performance during gradual and accelerated tightening cycles. The S&P 500 has averaged a 16% return in the year following the initial hike in a gradual cycle, but has tended to be down slightly in the year after the beginning of an accelerated cycle.

Further, a majority of central banks were already raising rates by the time the Fed was spurred to action. Over the past 30 years, the S&P 500 has struggled to make any upside progress when most central banks are in tightening mode.

Weekly Observations:

Financial Liquidity

After the volatility of the past week, fed funds futures are pricing in one final rate hike (next week) and rate cuts in the second half of the year. Futures were pricing in a year-end fed funds rate well above 5% early last week - today, a sub-4% year-end fed funds rate is priced in.

Lost in the discussion of maximum employment and stable prices is the Fed’s role as lender of last resort. In fulfilling that obligation, it has seen its balance sheet expand over the past week. I don’t believe this is the beginning of a new round of quantitative easing. I do believe it says bad things about liquidity when the lender of last resort needs to do some unexpected lending.

Despite the issues in the banking sector (and perhaps a preview of next week’s FOMC meeting), the ECB this week raised rates by 50 basis points, versus the 25-basis point hike that had been expected.

Economic Fundamentals

After an initial post-COVID surge, real retail sales have been flat over the past two years. Consumers are spending more, but they are not getting more.

On a nominal basis, average weekly earnings are 20% higher than they were pre-COVID. Adjust for inflation and that entire increase disappears. Real weekly earnings are no higher now than in mid-2019.

The Fed still has an inflation problem – the yearly change in the median CPI rose to its highest level ever in February. This isn’t just big increases from last year that will soon drop out of the calculation.

Valuations/Earnings

Earnings revisions continue to defy the expectations of many and are still trending higher.

Stocks are not just over-priced (in terms of valuation) but are over-owned (in terms of household equity exposure). Data from the Fed shows that household equity exposure (as a % of total liquid assets) ticked higher in Q4 2022 and is above the 90th percentile in terms of historical levels.

Sentiment

Investor sentiment soured this week. Consensus bulls dropped below their December level and both the AAII bull-bear spread and NAAIM exposure index are just above their December lows. Waning optimism at this point in the cycle is not contrarian bullish, as we remain quite a distance from the excessive pessimism of last year.

Despite the uptick in volatility, the fear response has been relatively muted. The VIX has traded above, but not closed above 28.5.

Market Trends & Momentum

The 200-day average for the S&P 500 managed to be rising for just 3 days before turning lower again. That leaves our Bull Market Behavior checklist at 0/6.

The S&P 500 remains above its December low after testing it earlier this week. More than half of the sectors, however, are below their December lows.

Breadth

Global breadth is deteriorating. Only half of ACWI markets are above their 200-day averages and fewer than 10% are above their 50-day averages.

Early-year rallies failed to bring an expansion of new highs, but recent weakness has brought an expansion in new lows. New lows have exceeded new highs on the NYSE + NASDAQ for 11 days in a row and the Net New High A/D line is moving lower.

Short-term sector-level breadth trends are as bad now as they were in October.

Portfolio Management

With weakness replacing strength and yet little evidence of widespread fear, we raised cash in our Cyclical and Tactical Portfolios this week.

During last year’s volatility, up-trends in Energy and commodities provided agile investors with some safe harbor. Commodities are no-longer in an up-trend and the Energy sector is coming under pressure. While there is talk about bond yields peaking, the trend evidence does not point in that direction at this point. If anything, bond yields look oversold within an ongoing up-trend.

Behavioral

Don't over-react to noise. Don't under-react to news. Good luck.

Expressing outrage can feel good but we learn more when we understand motivation. "Why did they" is generally a better question than "how could they?"