On The Cusp Of New All-Time Highs

Relative to bonds, our equity market benchmark is just shy of its 2022 peak

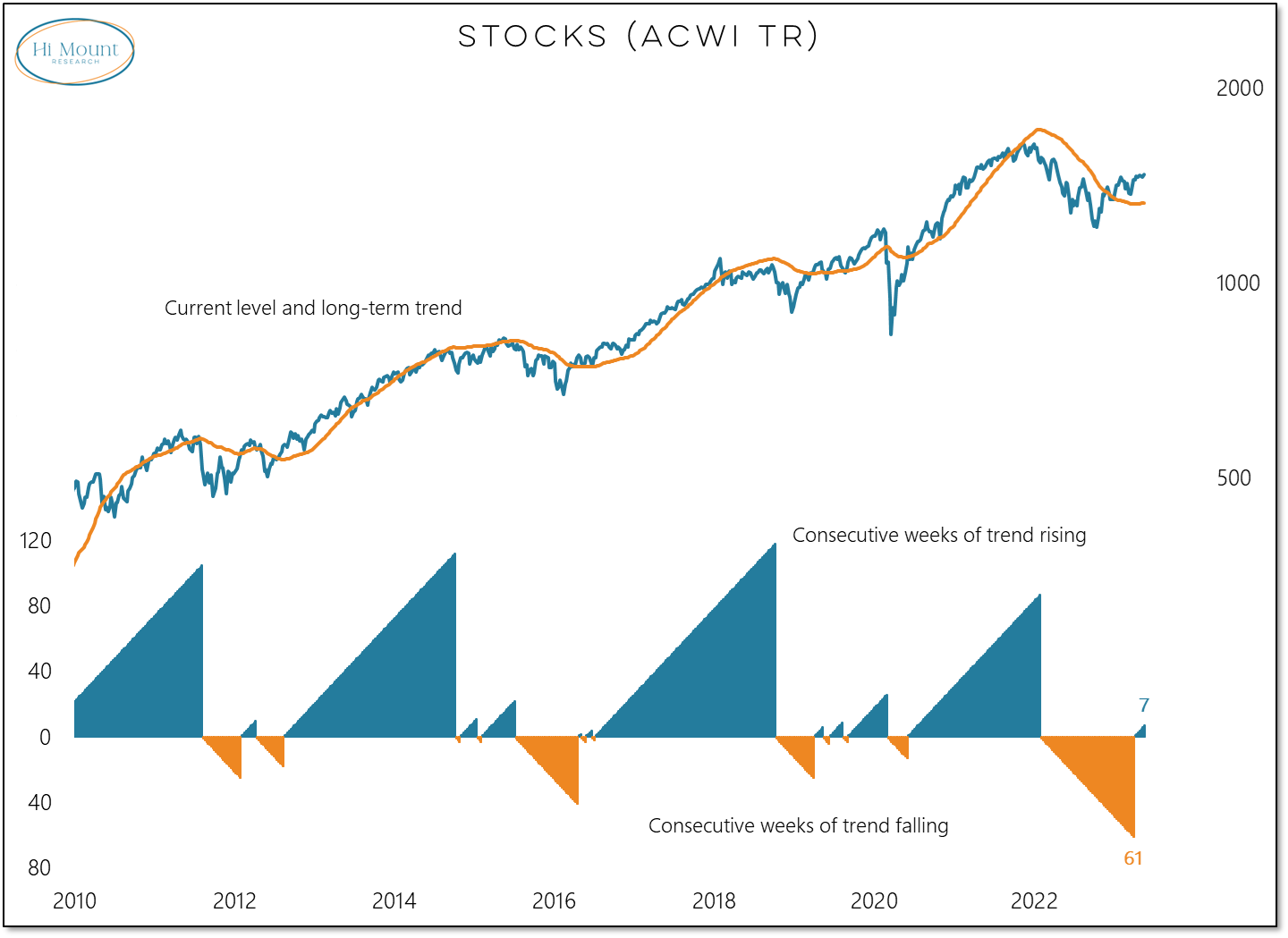

Key Takeaway: With the All-Country World Index trending higher on an absolute basis and approaching a new all-time high relative to bonds, our dynamic asset allocation has equity exposure at a maximum overweight.

More Context: The stock/bond ratio bottomed in September but it took some time for the trend to turn higher. Now the trend is up 7 weeks in a row and the ratio itself is just of its April 2022 peak. The trend for the ACWI itself is also rising and while the index is less than 1% from a new 52-week high, it remains 13% below its 2022 peak.

The Details: Our “Let Price Speak” approach to Asset Allocation reflects the long-term uptrend in stocks (and their relative leadership versus bonds and commodities). Bonds were unable to build on last week’s trend improvement and while commodities continue to trend lower on both an absolute basis and relative to other asset classes.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.