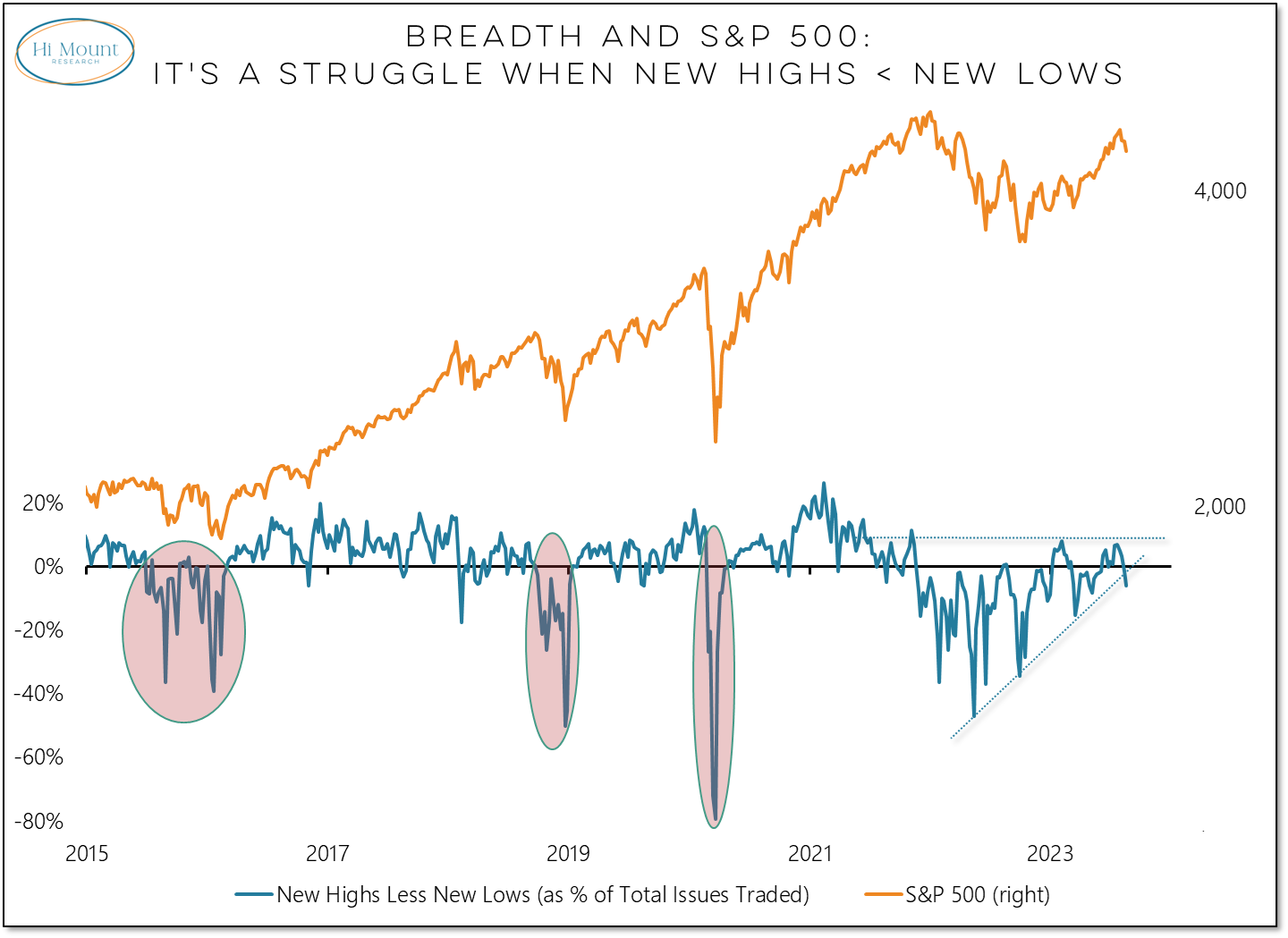

New Highs Break Lower

If the market is just experiencing seasonal weakness, than breadth should stabilize soon and experience a healthy rebound later this year.

Key Takeaway: If new highs have peaked but bond yields haven't, the S&P 500's roller coaster ride may have only just begun.

More Context: Not only have new lows exceeded new highs over the past two weeks, but the rising trendline in net new highs has been broken. Moreover, the July peak in net new highs failed to exceed the February peak. The strength that fueled recent equity market gains has evaporated at a time when bond yields are breaking out to new highs and the S&P 500 is stuck in the mud.

For more detail on the S&P 500's lack of progress and the push in bond yields to new highs, subscribers can check out this week's Market Notes and Chart Pack.

I talked about all that and more with JC and Steve this morning on Stock Market TV.