This week I discussed how continued volatility is making it hard for investors to embrace stocks and turn more optimistic. Previewing next week's FOMC meeting, it looks like an expensive game of chicken being played between the Fed and the market right now. Finally, while new highs > new lows is an important improvement over 2022, without higher highs it's hard to make a robust case for a new bull market.

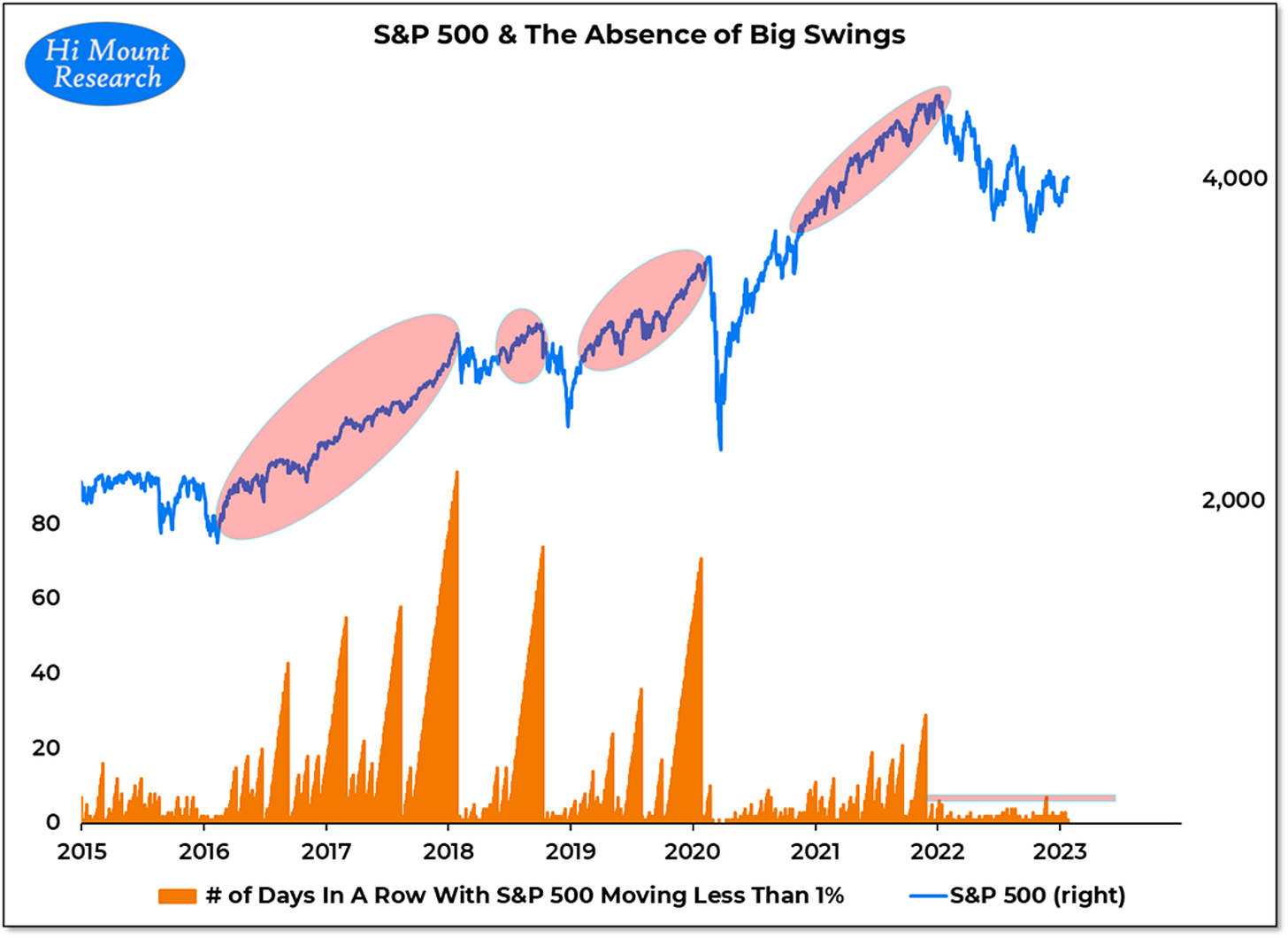

Big daily swings weigh on optimism. 2022 was characterized by a lack of new highs and near record levels of day-to-day and week-to-week volatility. Even though stocks have moved higher so far in 2023, that day-to-day volatility has remained elevated. We haven’t gone more than 3 days in a row without a 1% swing in over two months. History shows that the market does best when bulls embrace strength and when that strength is slow and steady. Fewer big moves in the market could help bulls get on board.

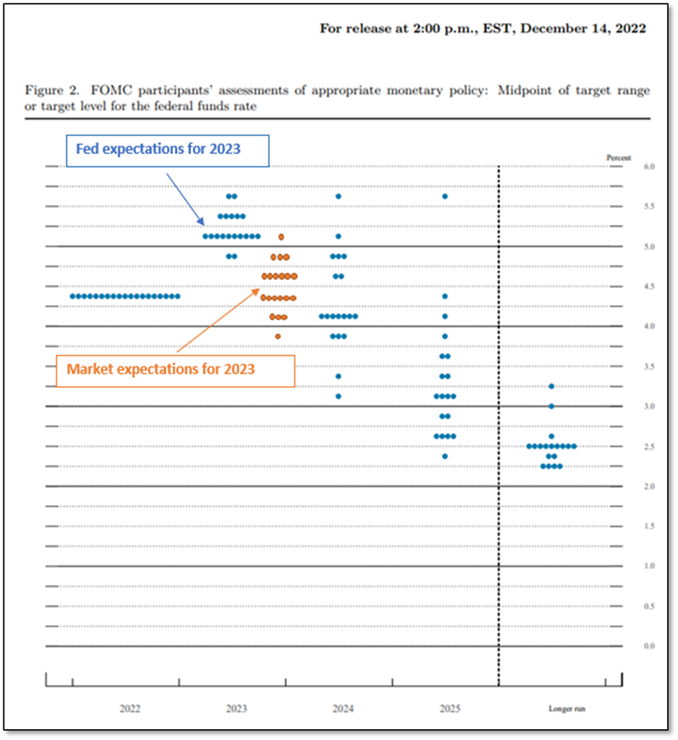

The Fed and the market disagree about where rates are going. Most members of the FOMC (voters and non-voters alike) expect the fed funds rate to finish 2023 above 5%. The market not only doesn’t see rates get that high, it is pricing in cuts by the end of the year. Given the recent inflation data, the Fed will likely meet the market’s expectations for next week’s FOMC meeting and go with a 25 basis point hike. But if the Fed is still serious about the prospect of rates getting above 5% and then staying there, Powell’s post-meeting comments could work against a less volatile environment emerging in 2023.

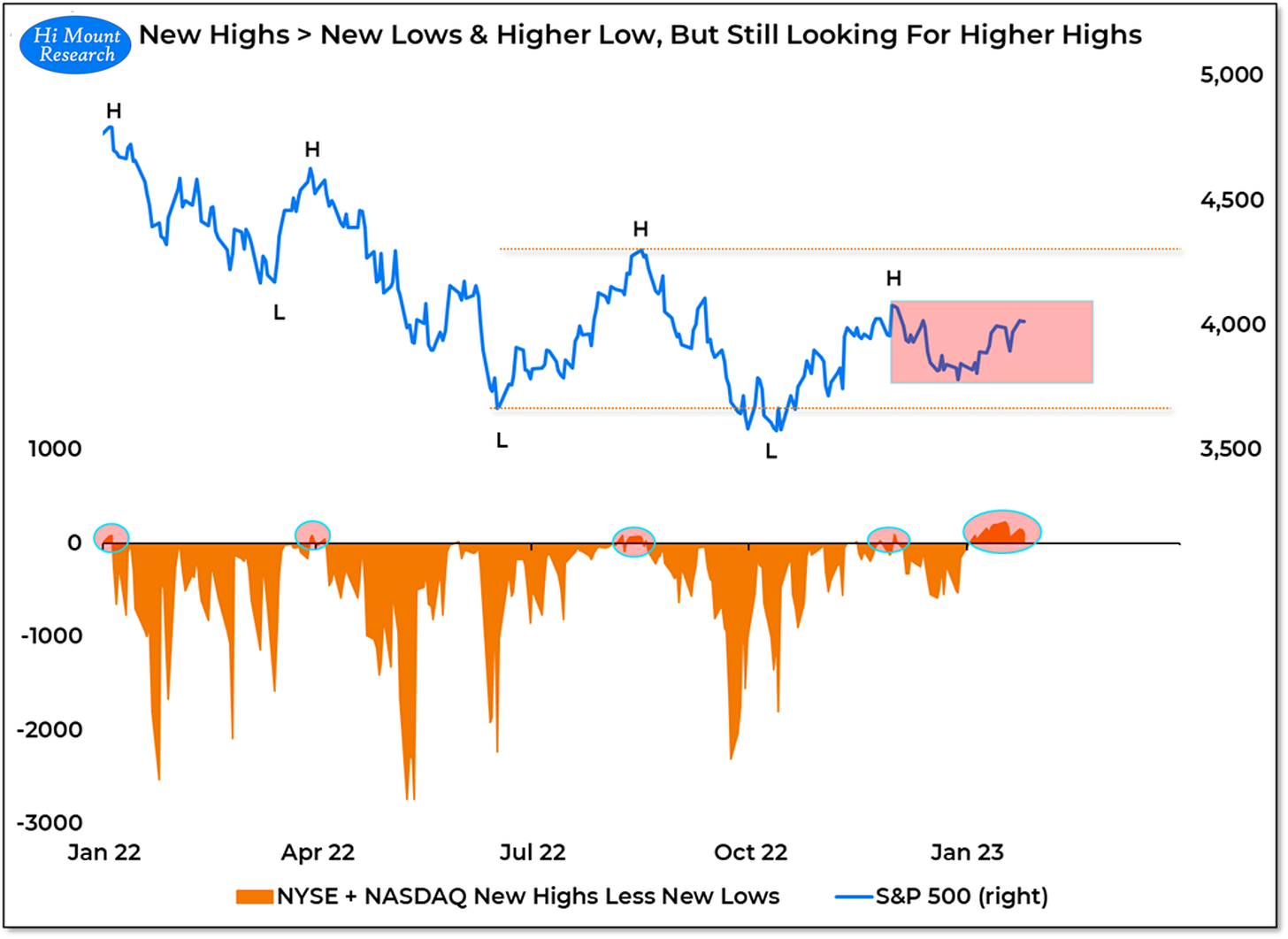

Bull markets bring higher highs. More stocks making new highs than new lows is bull market behavior. So too is indexes (or stocks) making higher lows and higher highs. The S&P 500 in December appears to have made a higher low. Despite the strength seen so far in January, a higher high has proven elusive. On a short-term basis, , movement within the December range is likely noise. On a longer-term basis, the August highs look like an important threshold.

The Takeaways are also available on YouTube: