Move Lacks Margin

The US is going it alone but is seeing new leadership that needs to be sustained.

Key Takeaway: They’re not winning on style points, but US stocks continue to exhibit bull market behavior. Rising bond yields are the primary risk for a rally that is seeing increasing leadership small-caps.

Note: Margin is not how much we are making, but how much space we are leaving. For more on this, read Margin by Richard Swanson. I have read a lot of books and this is one of the most impactful of them all.

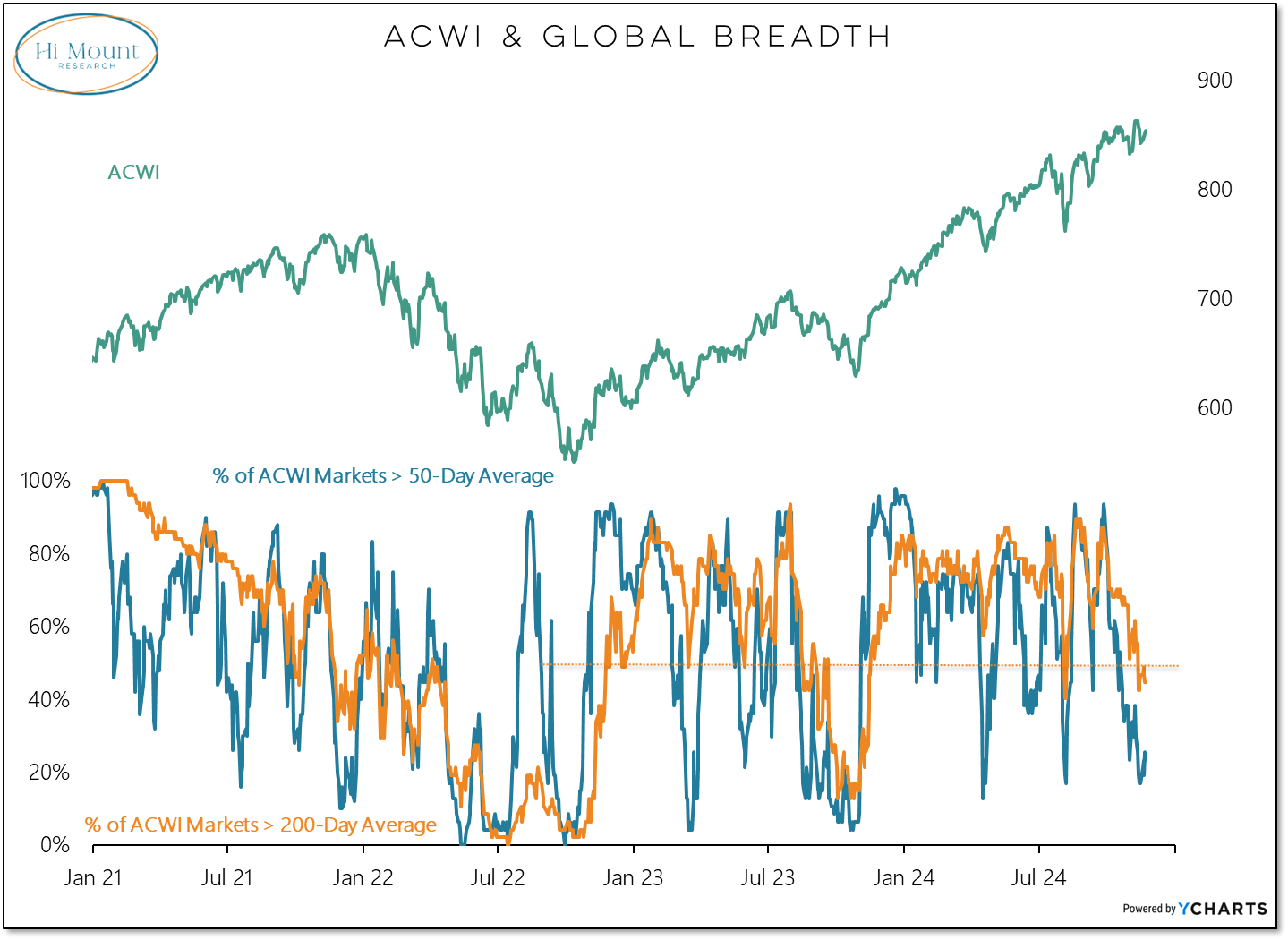

The global equity backdrop remains challenging. Our global trend indicator has broken down (after failing to confirm ACWI strength earlier this year) and now fewer than half of ACWI markets are even above their 200-day averages. The last two times this happened the ACWI experienced an 8% pullback (Jul 2024) and an 11% correction (Jul – Oct 2023).

The global challenges seem to confirm the less-than-enthusiastic bounce in our risk appetite indicator. While the data suggests it is a Risk On Environment, there is a case to be made that without substantial further improvement, the clock is ticking.

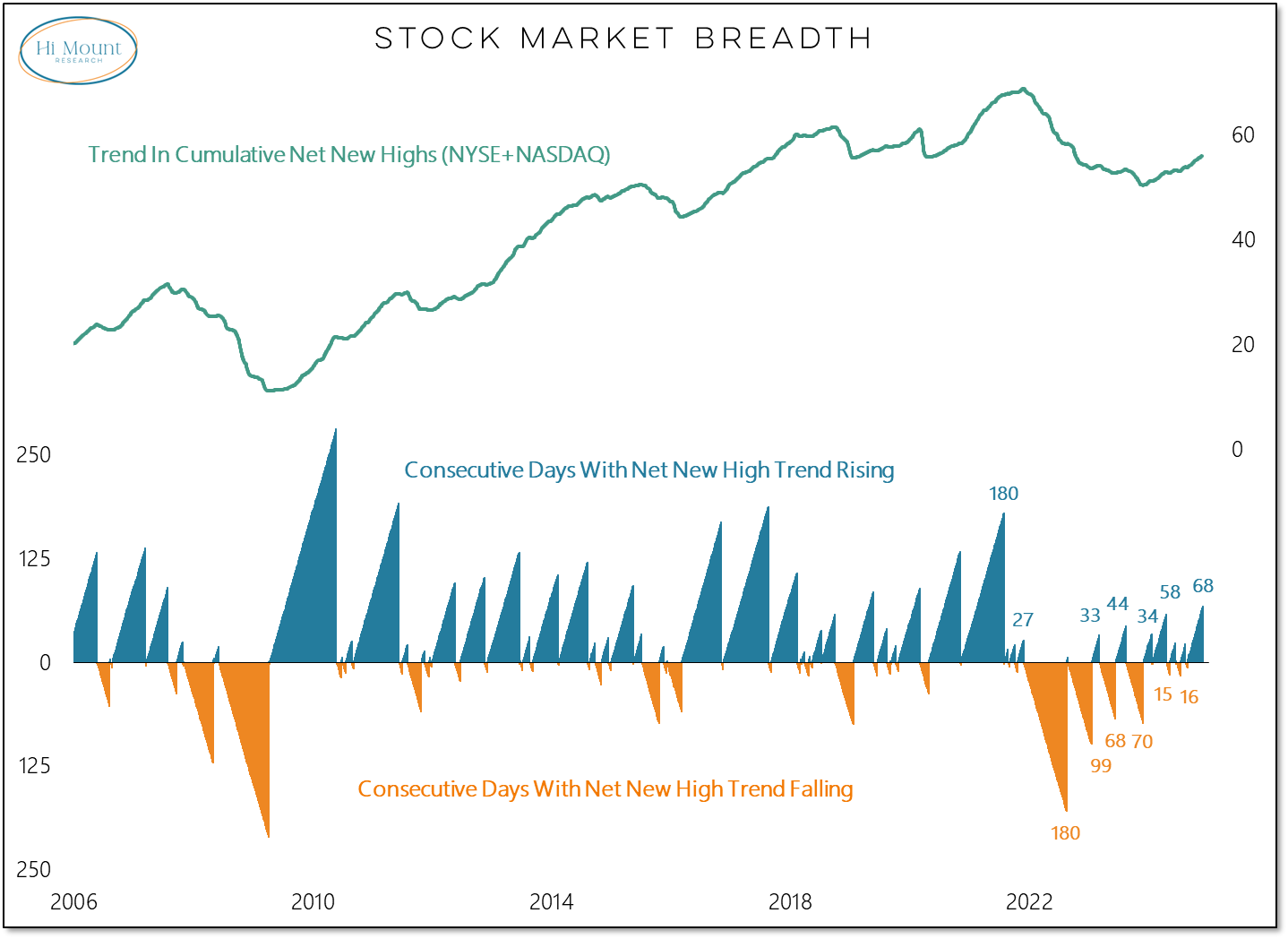

We could extend this view as we see the recent rise in the number of stocks making new 52-week lows. While they are rising, new lows remain below new highs.

The trend in net new highs is experiencing its longest sustained advance since 2021. As long as this is moving higher, the bulls get the benefit of the doubt.

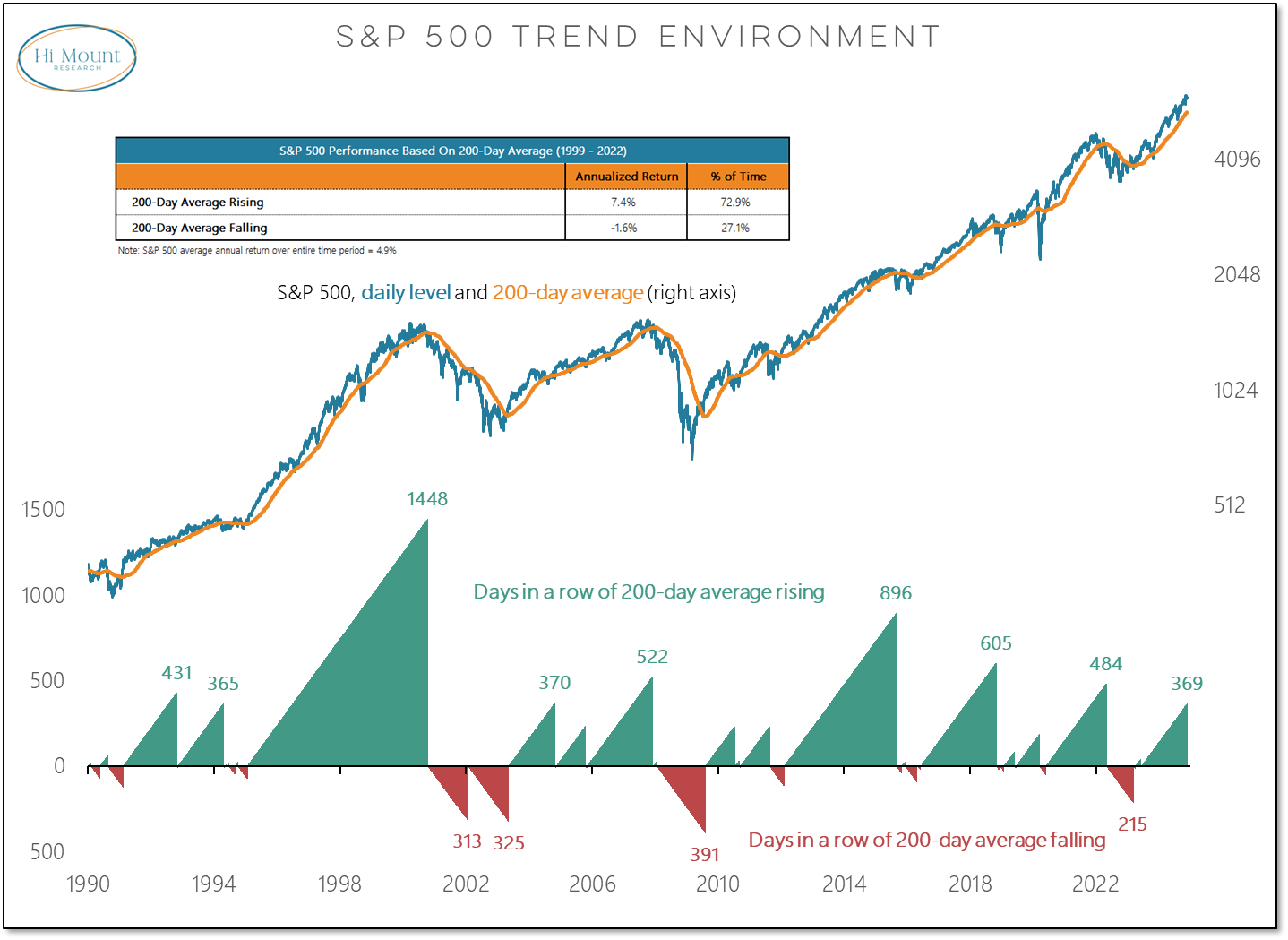

Going back to 1990, this is now the 8th longest sustained increase in the 200-day average. This week it should move into the number 7 spot.

The greatest challenge to continued technical strength and fundamental improvement is the changing trend backdrop when it comes to interest rates. If inflation is not as dormant as many hope than the bias for yields is higher, not lower. That means a new paradigm for investing, or at least one that has been experienced in recent decades.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.