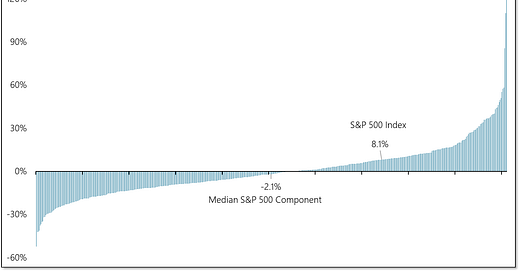

Most Stocks Are Moving Lower

Mega-caps fuel index-level gains, but a majority of the stocks in the S&P 500 are in the red for 2023.

As we approach the Memorial Day weekend, the S&P 500 is up a solid 8% on a year-to-date basis. The median stock in the index, however, is down 2% so far this year.

More Context: The year-to-date gain in the S&P 500 is little changed from where it was at the beginning of the month, but that gain is increasingly dependent on a handful of mega-cap high flyers. Since the end of April, the year-to-date return for the median stock in the index has fallen form +3% to -2%, while the median return among the 10 largest stocks in the index has soared from +27% to + 37% (led by the 160% YTD gain from NVIDIA). So while the S&P 500 remains largely range-bound, most stocks are losing ground and the breadth bias is lower. That is not usually the recipe for an upside breakout.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.