More of a Bounce than a New Beginning

Price trends haven't broken, but the bulls need to prove they deserve the benefit of the doubt

Key Takeaway: Last week’s rally had a feel-good quality, but lacked evidence that sustainable strength is emerging.

Subscribers can scroll down to see the latest update to our Bull Market Behavior Checklist, the Fear or Strength Model and an important shift in relative strength from an asset allocation perspective.

New starts tend to be noisy but noise alone does not signal a new start. The financial markets have experienced plenty of noise in recent weeks in anticipation of a new (or returning) Presidential Administration.

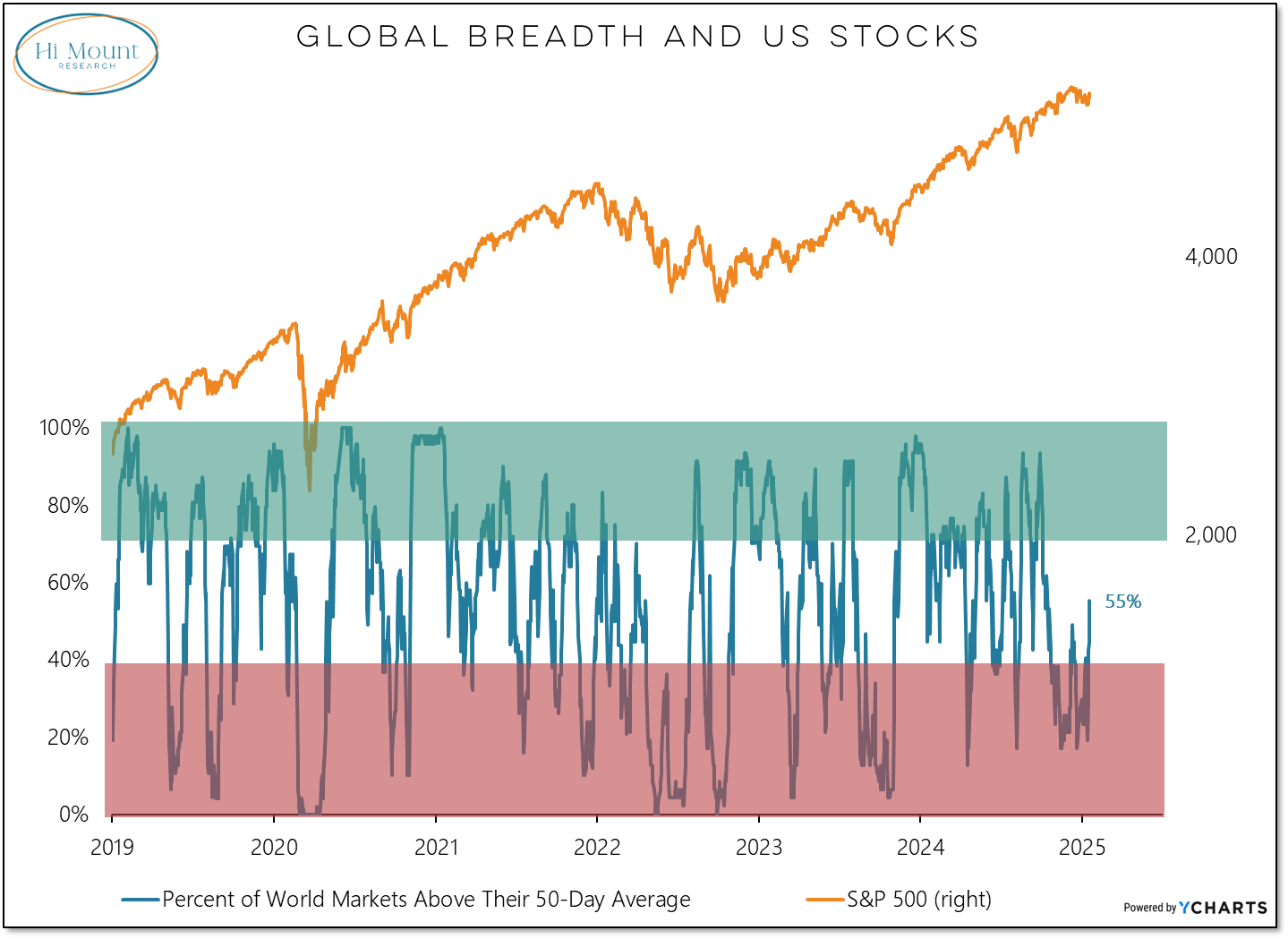

Equities rallied last week and bond yields retreated from their recent highs, but on neither front was the improvement sufficient to argue that a new beginning (from an equity market perspective) is at hand. More than half of the markets in the MSCI All-Country World Index are now above their 50-day averages, but to greenlight a sustainable rally, we need to see this climb above 70%.

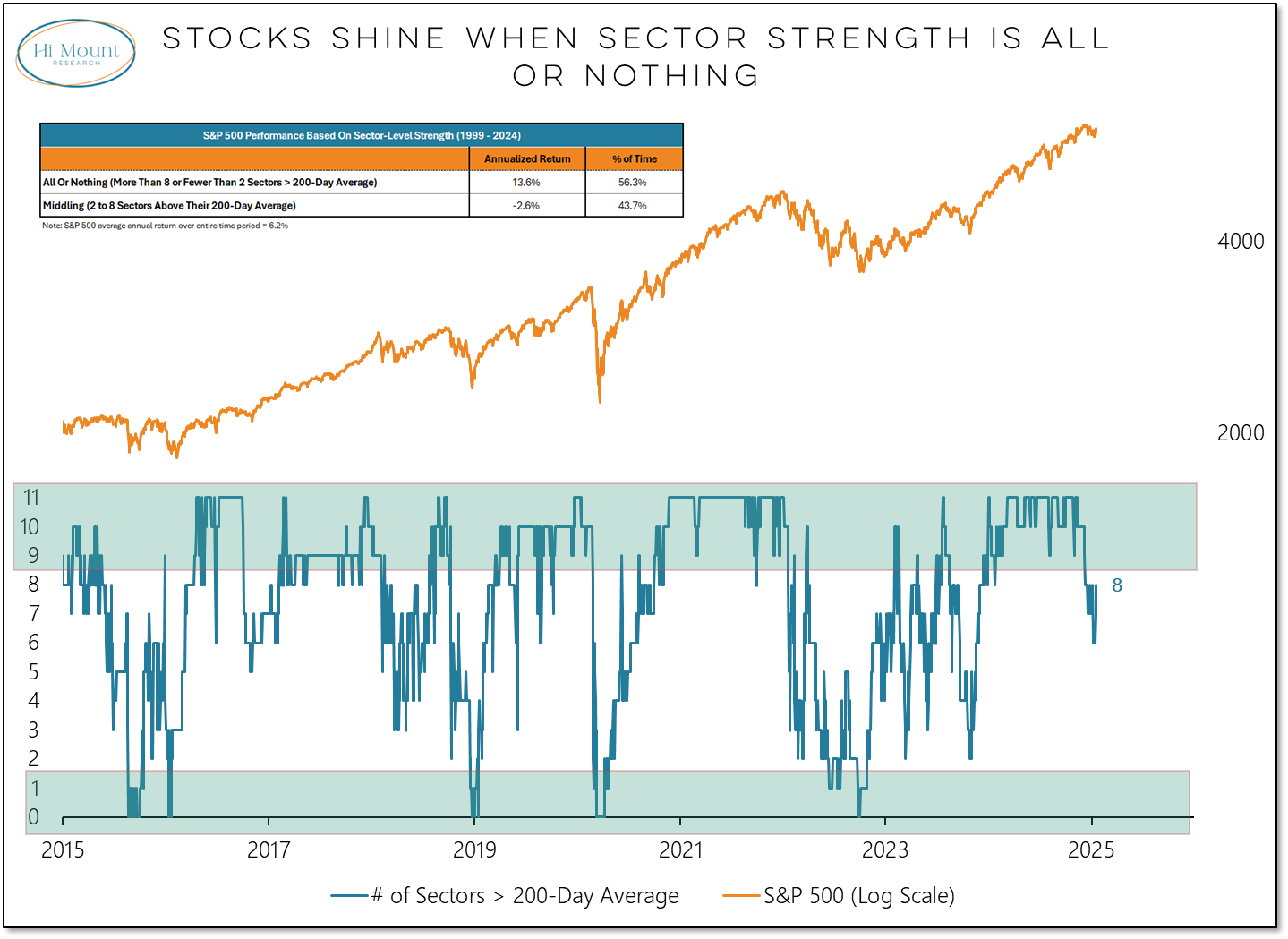

This is especially the case when we are outside of a breadth thrust regime (which has been the case since early December). The inability of the post-election rally to produce a Breadth Thrust remains one of the most important market developments of the past 2+ months. Similarly, the number of sectors (out of 11) that are above their 200-day average expanded last week from 6 to 8, but this is not enough to return our sector breadth model to its bullish mode.

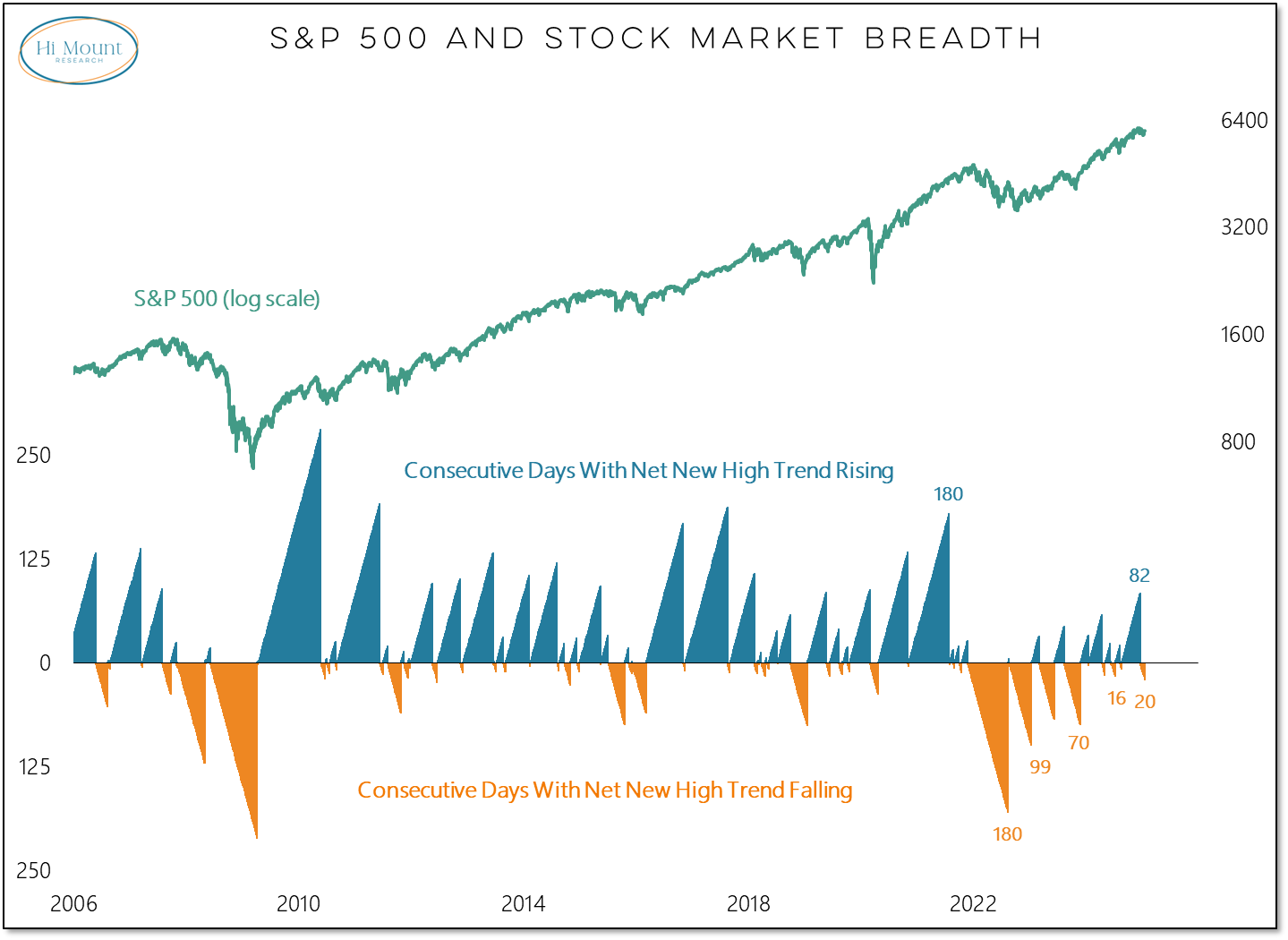

On a daily basis, new highs exceeded new lows to close out last week, but on a weekly basis, new lows exceeded new highs for the fifth week in a row.

Our daily net new high trend indicator continues to fall, marking its longest sustained decline since 2023.

If last week’s rally was the beginning of a sustained move, this week will bring follow-through from a breadth perspective. But for now, liquidity conditions (measured by the 26-week change in corporate bond yields) are still a challenge for stocks and the Bull Market Behavior Checklist has yet to improve:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.