More Higher Highs

Q1 began with a flourish but finished with plenty of unresolved questions about the durability of the rally

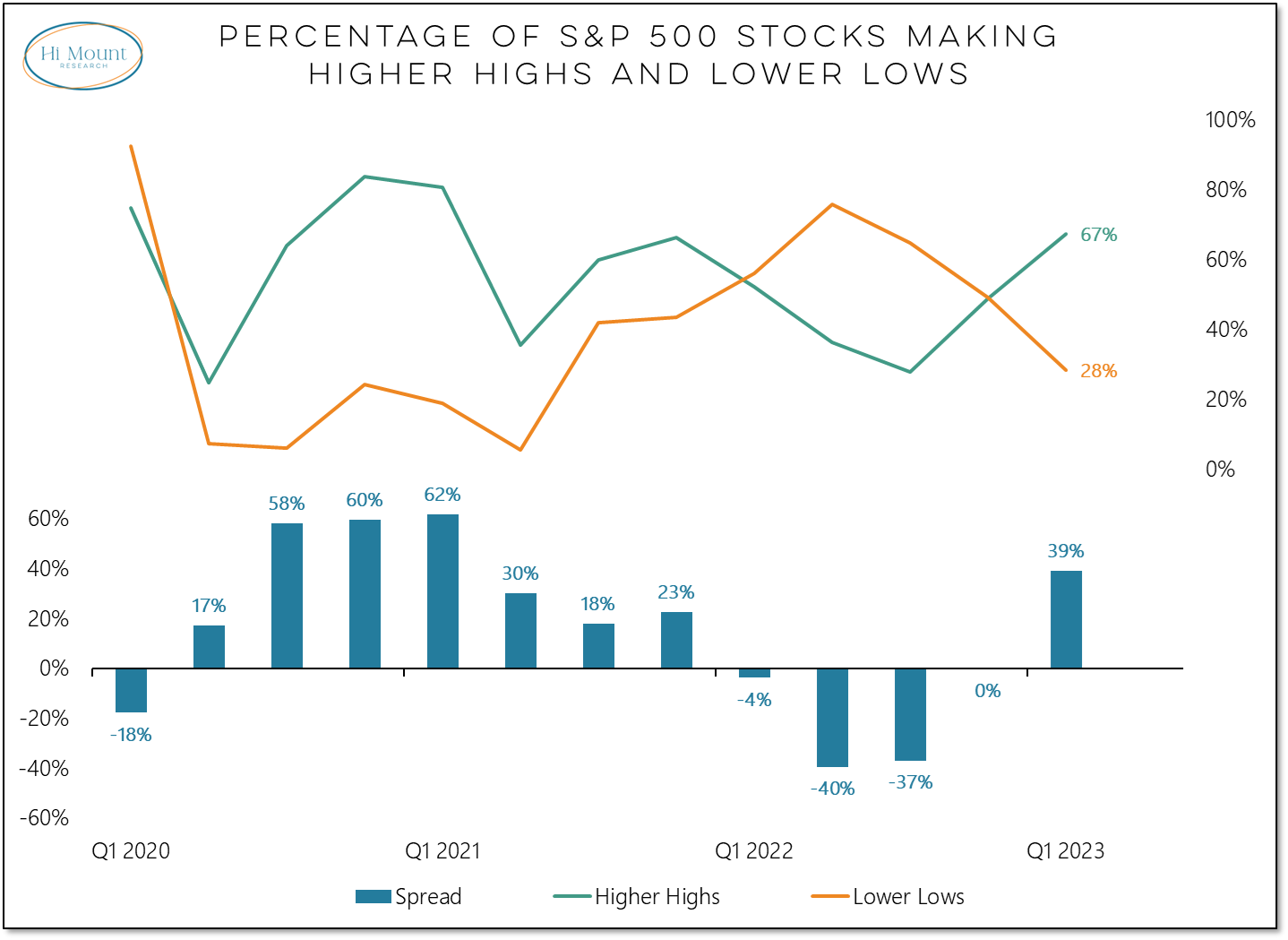

The percentage of S&P 500 stocks making lower lows (versus the preceding quarter) in Q1 fell for the third quarter in a row and the percentage of stocks making higher highs rose for the second quarter in a row. For the first time since Q4 2021, more stocks made higher highs than lower lows.

More Context: Q1 saw the fewest stocks making lower lows and the most stocks making higher highs since Q2 2021. That seems to be an important change in character beneath the market’s surface. Over the course of the quarter, however, the issues that plagued the market in 2022 seemed to re-emerge. As Q2 begins, interrupting the recent pattern of more new lows than new highs would be an important display of bull market behavior. That would indicate broad strength expanding beyond the current pockets of opportunity. The complicating factor in the current environment is that as financial stress fades, the Fed has more room to focus on persistent inflation. A renewed surge in energy prices will add to those pressures.

In this week’s Market Notes we look at how breadth evolved over the course of the quarter and where we see opportunity within a long-term trend environment that is offering investors an opportunity to embrace a new paradigm.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.