Market Notes: US Weighs On The World

Global trends get tested as the largest market in the world struggles to get in gear

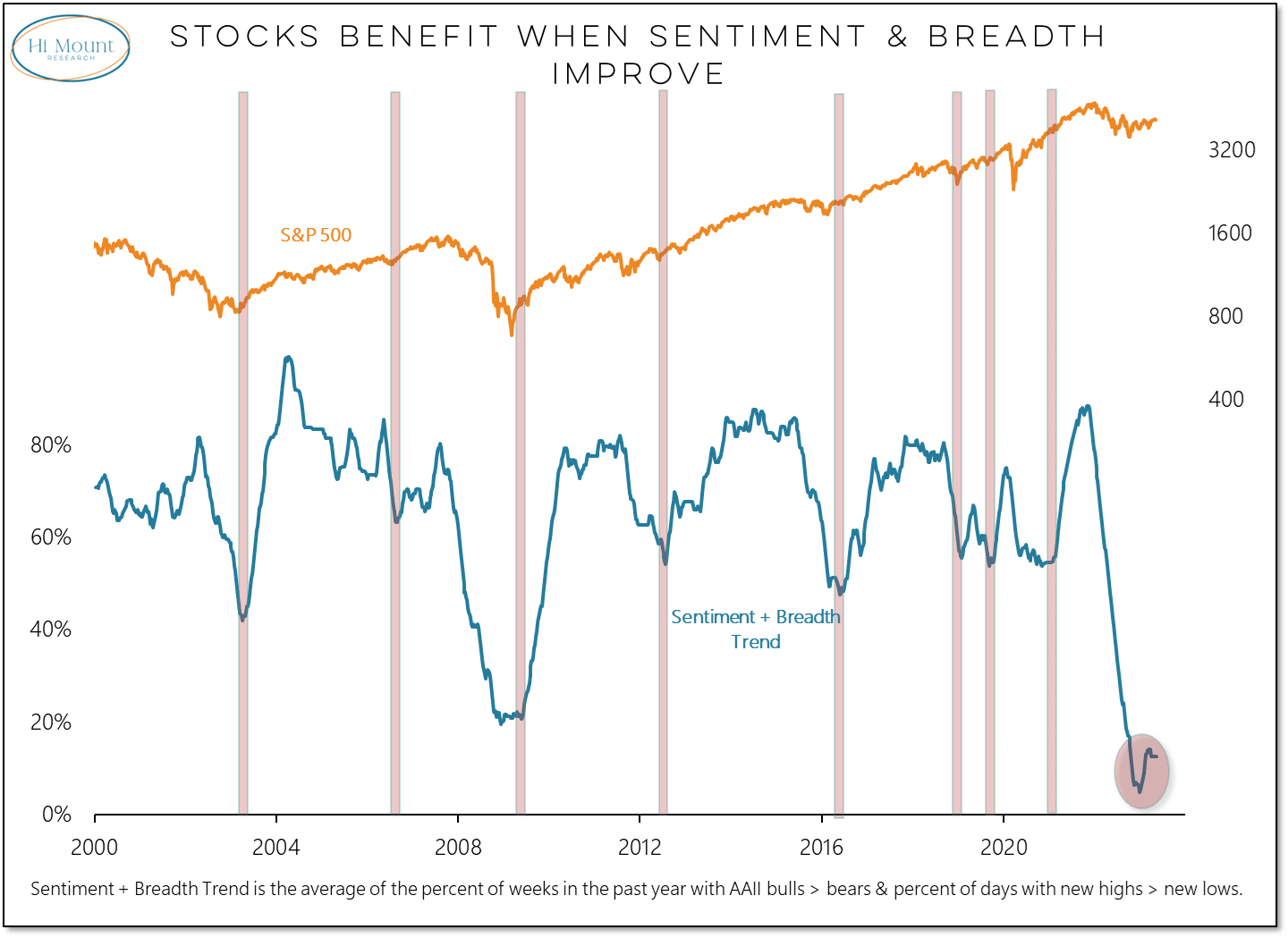

We know that it takes bulls to have a bull market. We also know that sustained strength in the S&P 500 is unlikely when more stocks are making new lows than new highs. Over the past year, bulls have outnumbered bears on the AAII survey less than 5% of the time and new highs have outnumbered new lows only 20% of the time.

More Context: The cyclical Sentiment + Breadth trend is off its lows, but we have yet to see the sustained rise that has proven to be beneficial to the S&P 500 in the past. The promise of improvement that emerged in Q1 has been unfulfilled in Q2. A handful of stocks are helping keep the indexes buoyant in this risk-off environment.

This week’s Market Notes Takeaway: Global strength has been unable to pull the US higher and now our weakness is testing the resiliency of overseas gains.

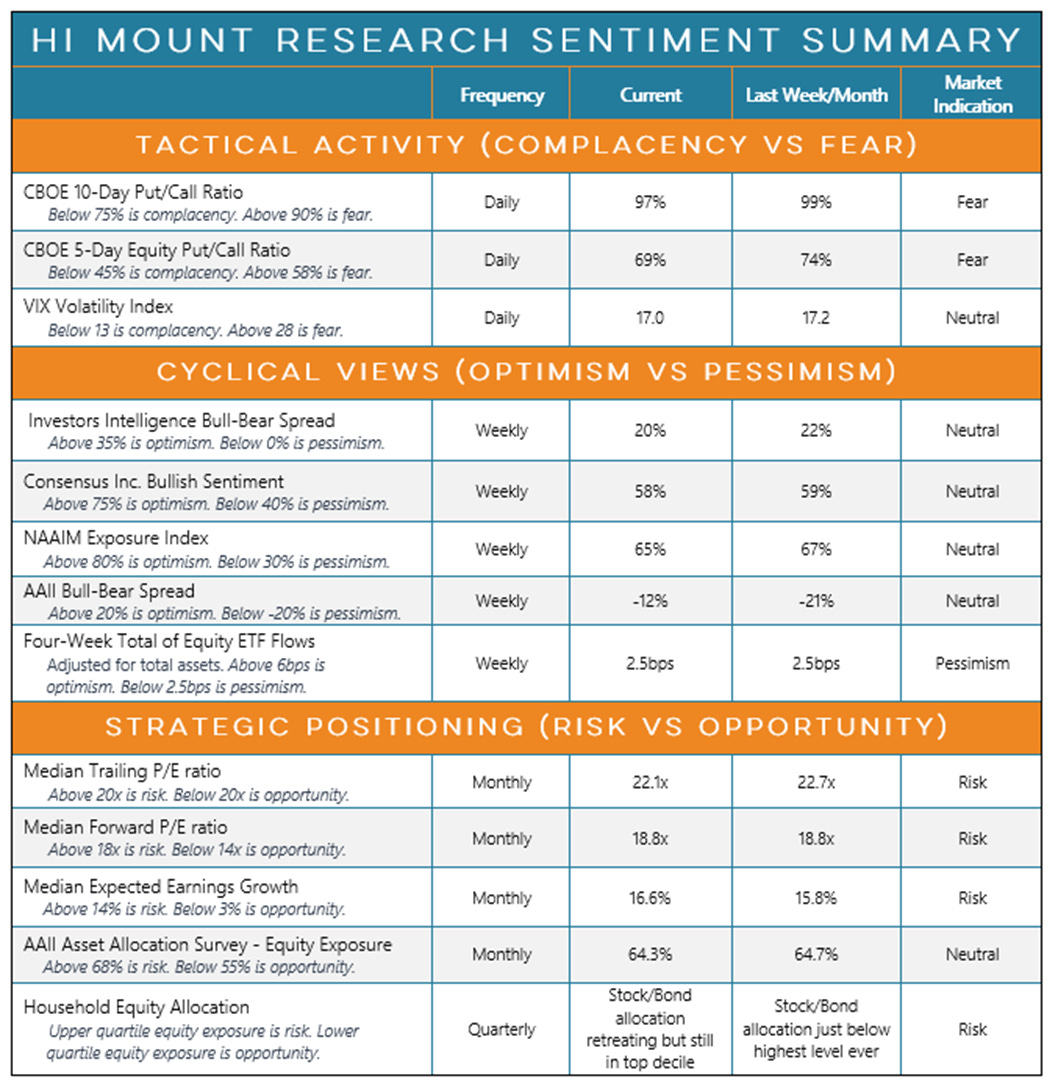

While fear (VIX > 28.5) can help fuel a bounce we typically need bulls to have a bull market and our cyclical sentiment indicators show that investors have not embraced the market’s attempts to rally.

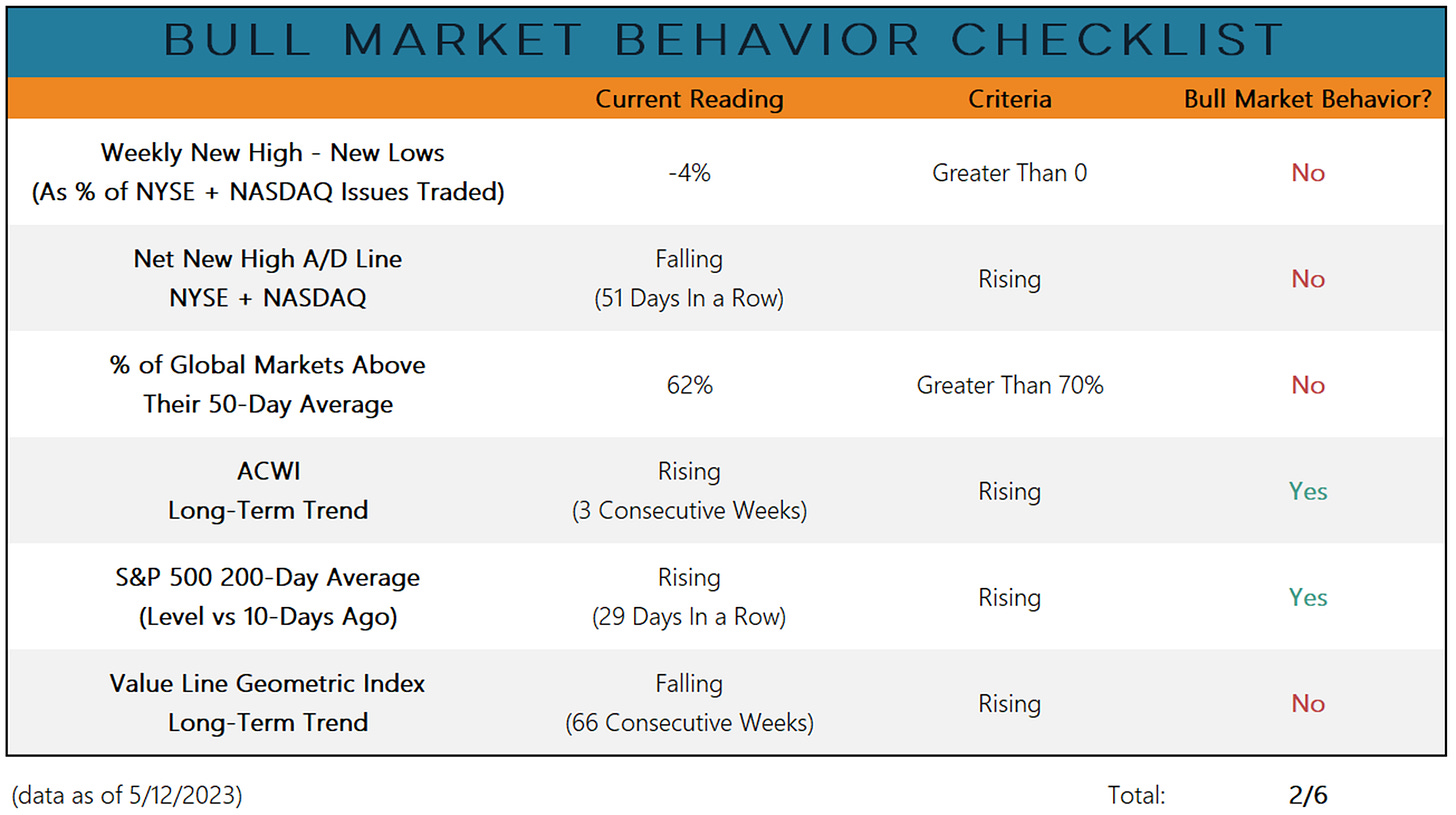

Improving trends in the market-cap weighted indexes is not supported by strength beneath the surface. With the % of global markets above their 50-day average dropping below 70%, our bull market behavior checklist lost a “Yes” last week.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.