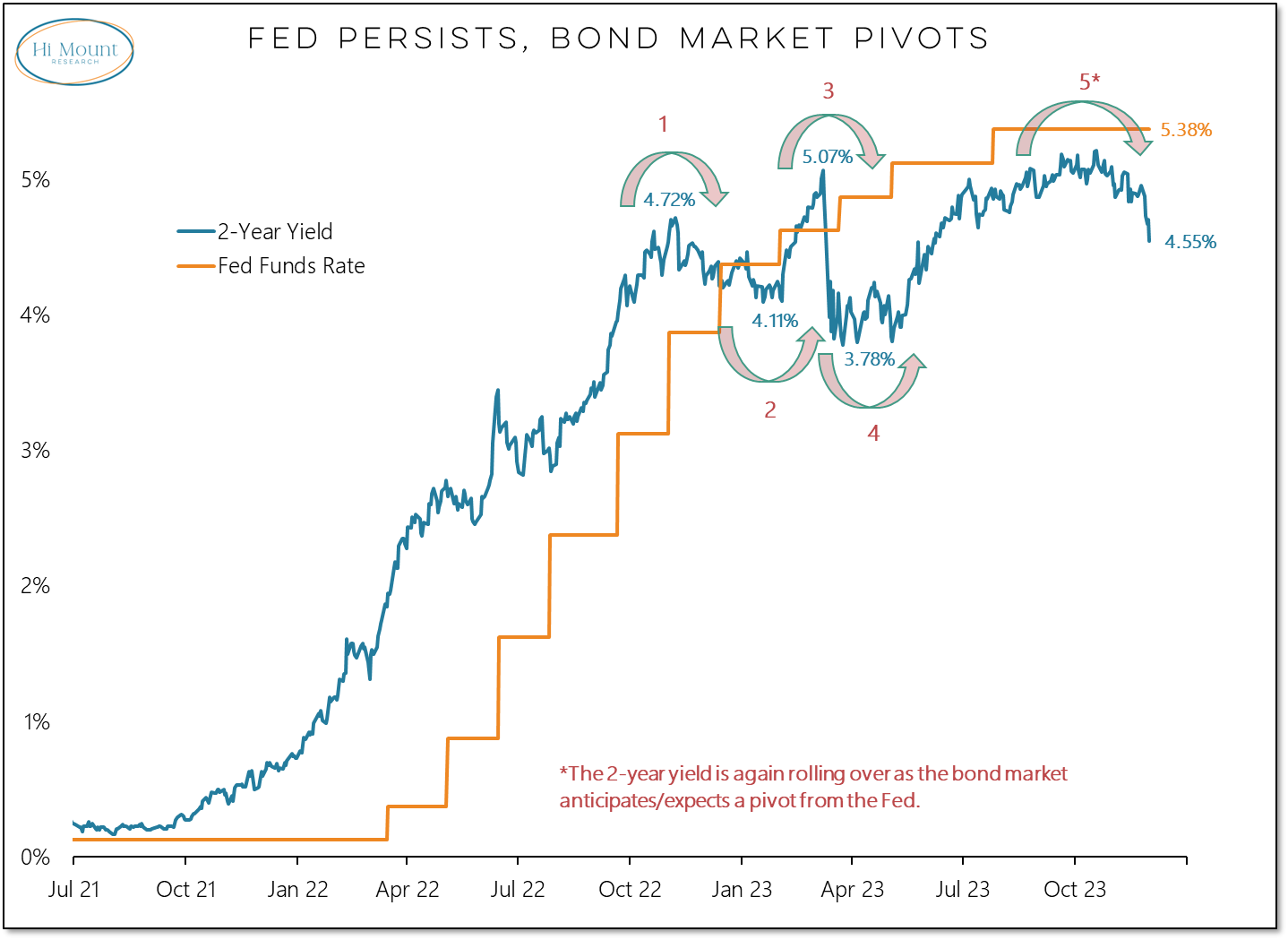

Market Betting On A Fed Pivot

Quiet strength in equities is building on hopes that yields will make a sustained turn lower.

Key Takeaway: Expectations of Fed rate cuts next year have fueled equity market strength in recent weeks. The bond market has tried to sniff out a pivot from the Fed other times this cycle, only to get its nose bruised as the upward trend in yields persisted.

I had a chance to check in with Oliver Renick on the Schwab Network earlier this week to discuss recent bond market developments, elevated equity market valuations and the substantial improvement that we have seen in market technicals over the past month.

You can see the whole interview below and subscribers can download the annotated chart pack that I sent over in advance of the conversation (as well as a bonus chart that came up in the conversation). While Oliver and I covered plenty, there were still some topics that we just didn’t have time to get into.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.