Market Back In Gear But Powell Misses The Mark

The Fed is accommodating the market's hopes for lower rates. That's bullish for stocks now but allows secular inflation pressure to persist.

Portfolio Applications subscriber note: New highs eclipsing new lows has returned our Fear or Strength model to positive territory. We are increasing equity exposure in our Tactical Opportunity Portfolio as well as adding to our position in Gold.

Key Takeaway: Stocks are making new highs as bullish behavior is widespread. A Fed pivot is a near-term tailwind for stocks but benchmarking off of 2019 opens the door for more inflation (and higher rates) down the road.

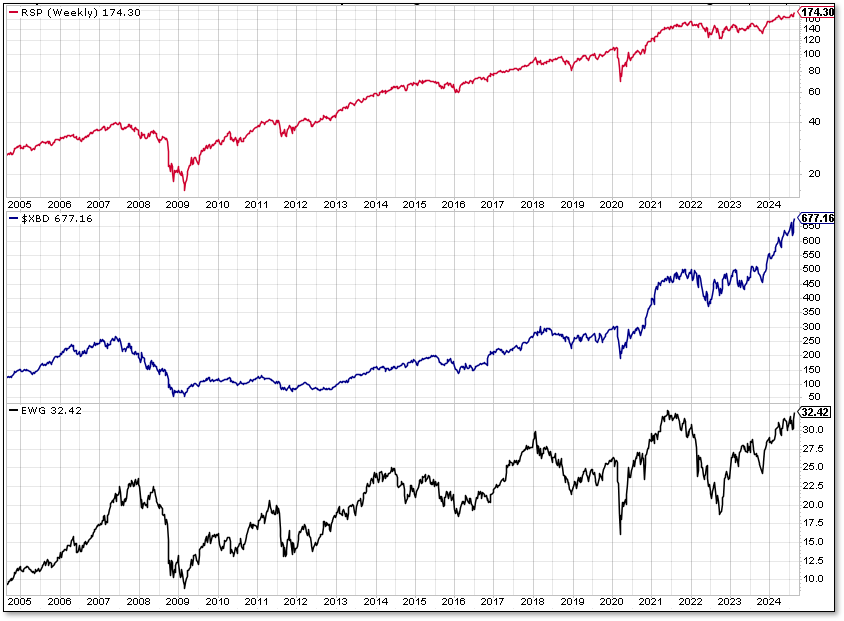

Last week finished with a surge in upside volume that carried the Equal-Weight S&P 500 (RSP) and the Broker/Dealer Index (XBD) at new highs and Germany (EWG) just off the pace. When this trifecta is strong, stocks overall tend do well. Concerns about narrow rally participation should be fading.

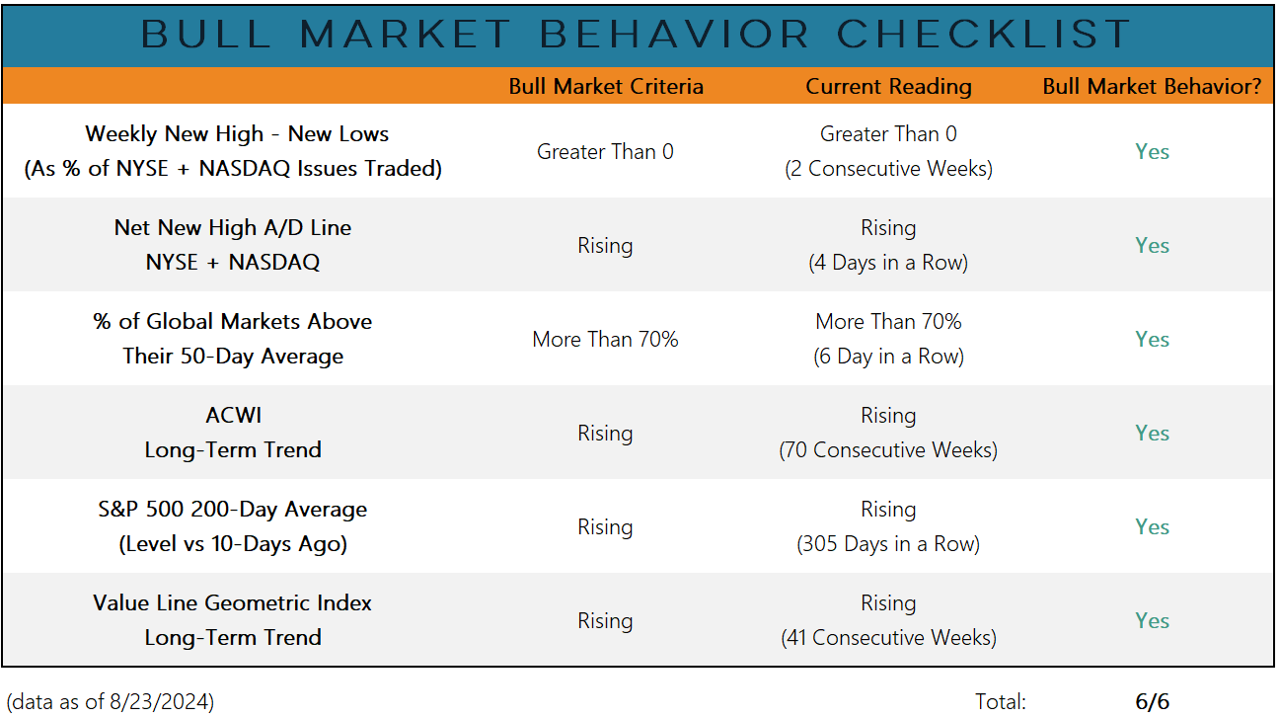

This is consistent with our Bull Market Behavior Checklist which is back to showing bullish behavior across the board.

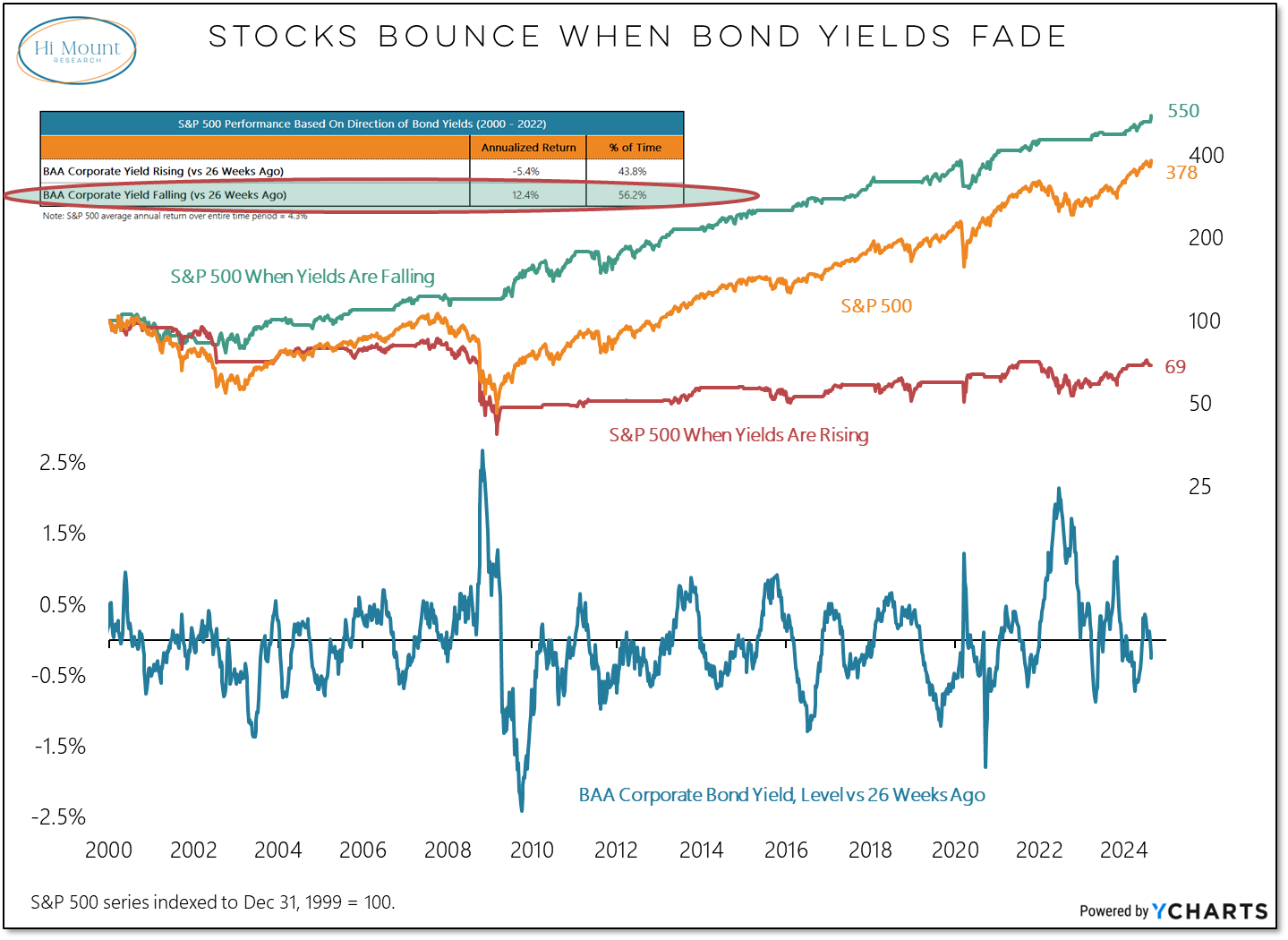

Adding to the bullish market message is an improving liquidity environment as the Fed prepares to cut rates at its September FOMC meeting. Corporate bond yield momentum has already rolled over as yields pull back from their peaks. When bond yield momentum is negative, stock market returns are usually positive.

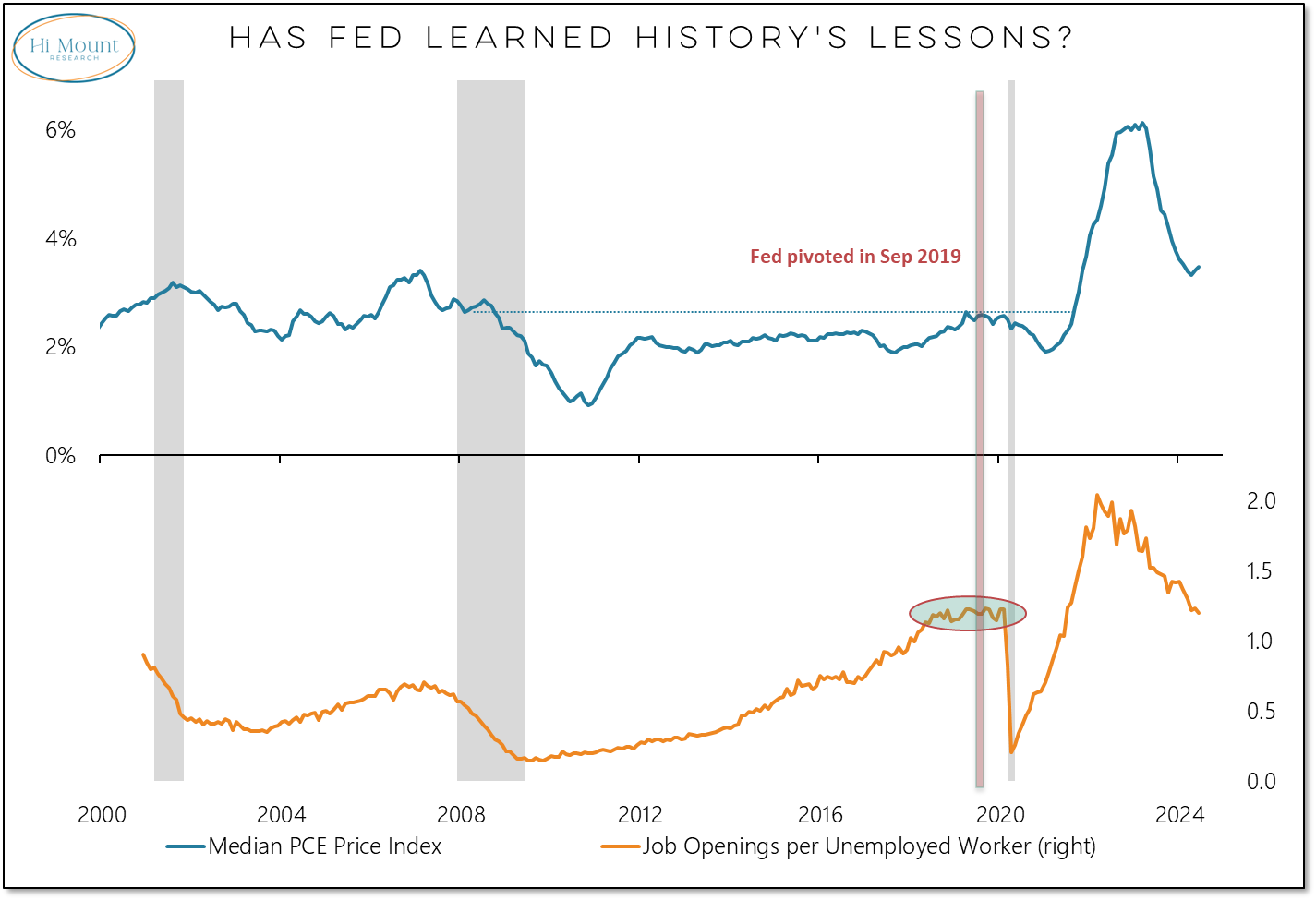

In his Jackson Hole remarks last week, Fed Chair Powell noted that labor market conditions were returning to their 2019 levels. It is revisionist history to not see that conditions in 2019 helped fuel the imbalances that emerged post-COVID. Job openings per unemployed worker were at all-time highs then and median inflation had risen to its highest level in a decade. The risk of policy error from the Fed grows as it forgets history’s lessons and benchmarks off of outliers. Cyclical employment conditions are weakening and price pressures have moderated, but a return to the previous inflation paradigm is unlikely.

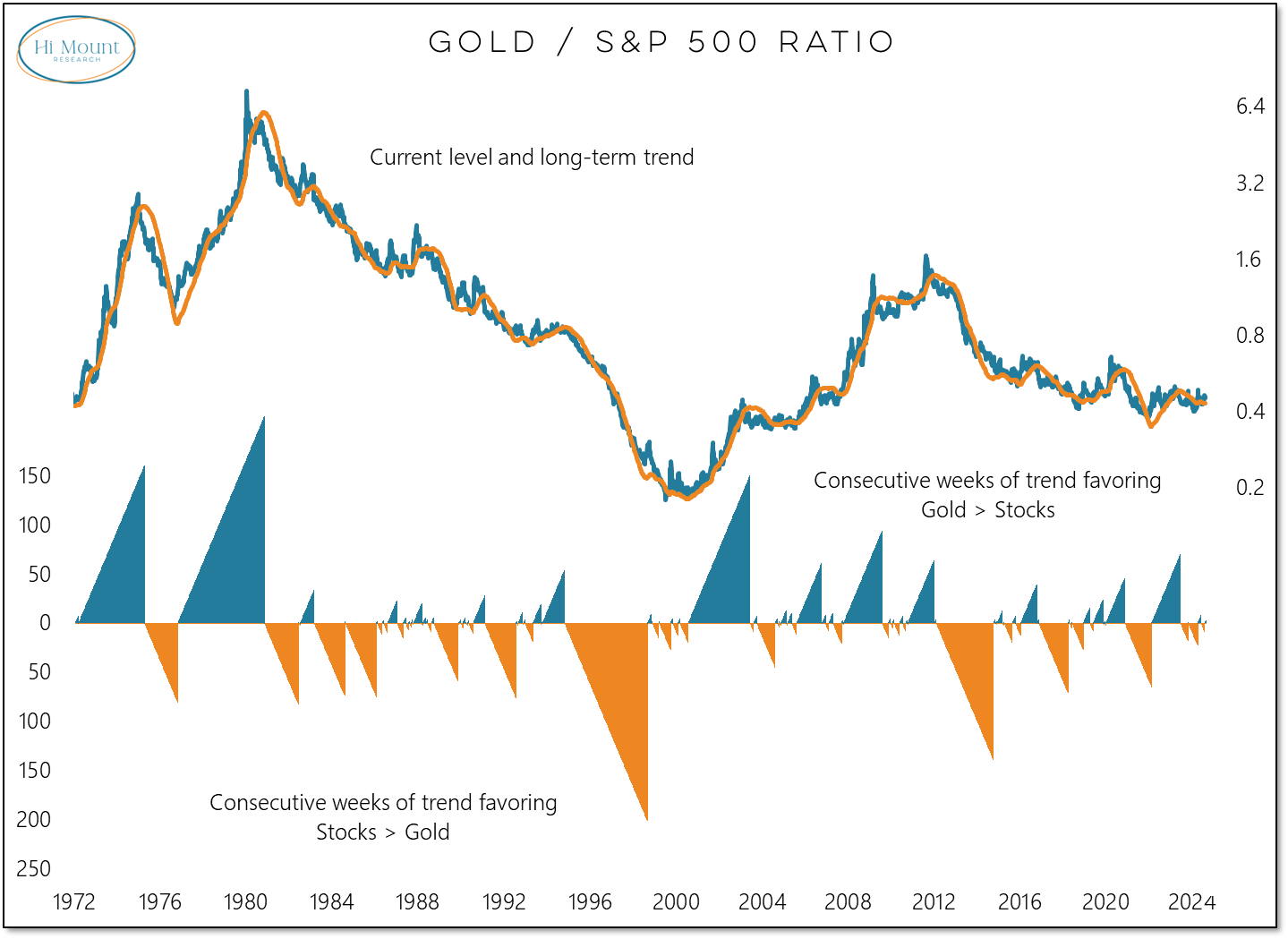

While improved liquidity, strong momentum and broad participation is bullish for stocks, the long-term trend in the ratio between gold and stocks has turned in favor of Gold. The appropriate asset allocation question is not “Gold or Stocks” but “When Gold and when stocks”. Right now the trend in the market has moved to Gold and we like to keep the trend our friend.

Strength in Gold is showing up in our Macro relative strength rankings, while at the sector-level, leadership is coming from Utilities and Real Estate:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.