Macro Machinations Mar an Otherwise Marvelous Month

July's Quiet Strength Shines Despite A Late-Month Fade

Portfolio Applications update: The August update to our Systematic Asset Allocation Portfolios has been published (subscribers can click the link for the full report or scroll to the bottom of this email to see a summary of the composite model). Equities (in the US and around the world) have climbed to new highs and reinforced their leadership position. Our asset allocation models are little changed this month.

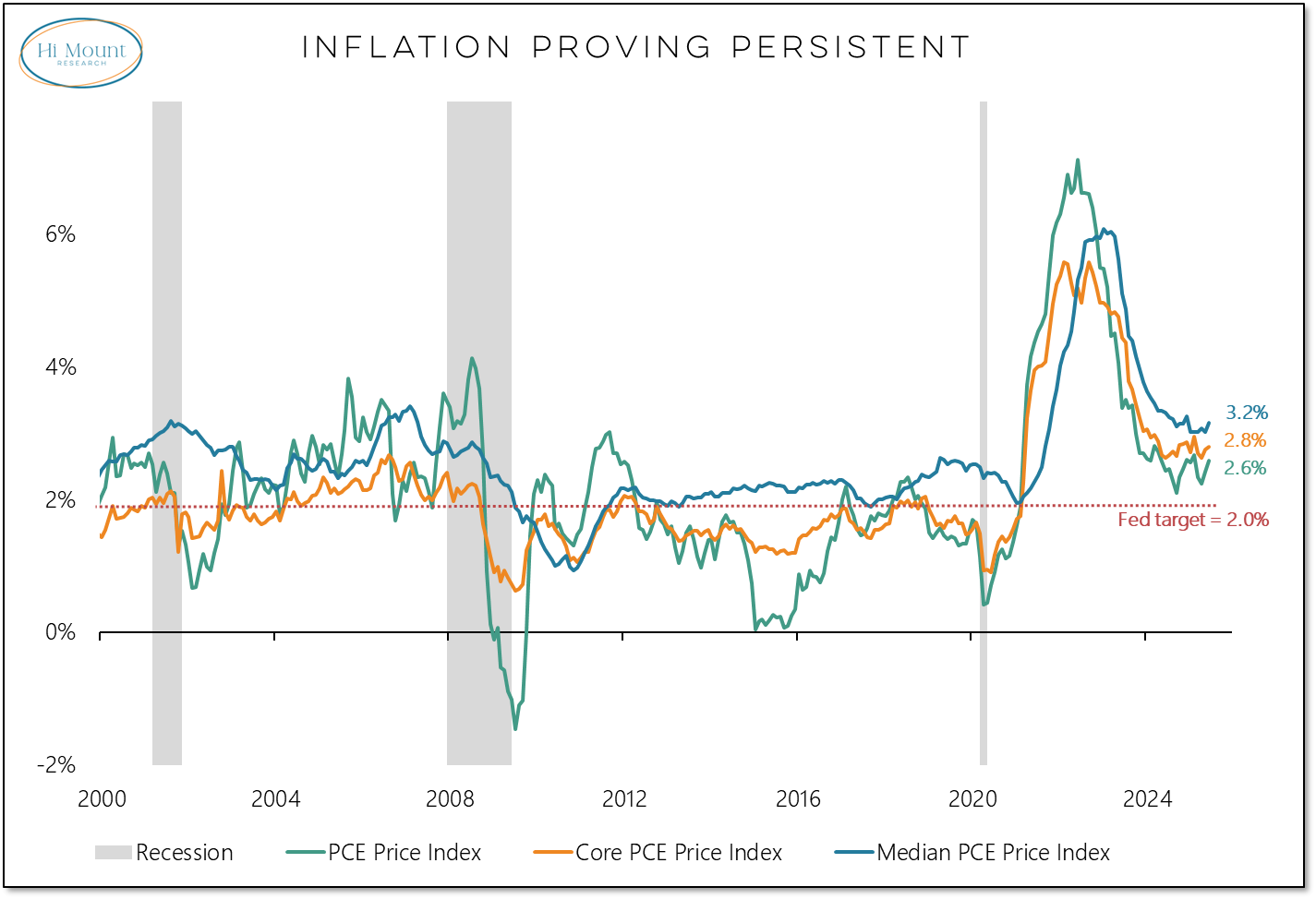

Even without the political pressures, the Fed is in a box. The FOMC remained on pause last week, although two Fed Governors dissented from the consensus in favor of a rate cut. At the post-meeting press conference, Fed Chair Powell pushed back on the consensus view that a cut at the September FOMC meeting was a done deal. Under Powell, the Fed will seek to be efficient in its conduct of monetary policy, rather than acting and reacting to short-term economic developments. The challenge for the Fed is that the incoming data is moving away from stable growth with moderating inflation and toward persistent inflation and deteriorating growth.

The latest inflation figures (PCE price index data for June) show that elevated inflation is persisting and moving away from the Fed’s 2% target. A Fed that is focused on fighting inflation in this environment is not a Fed that is cutting interest rates.

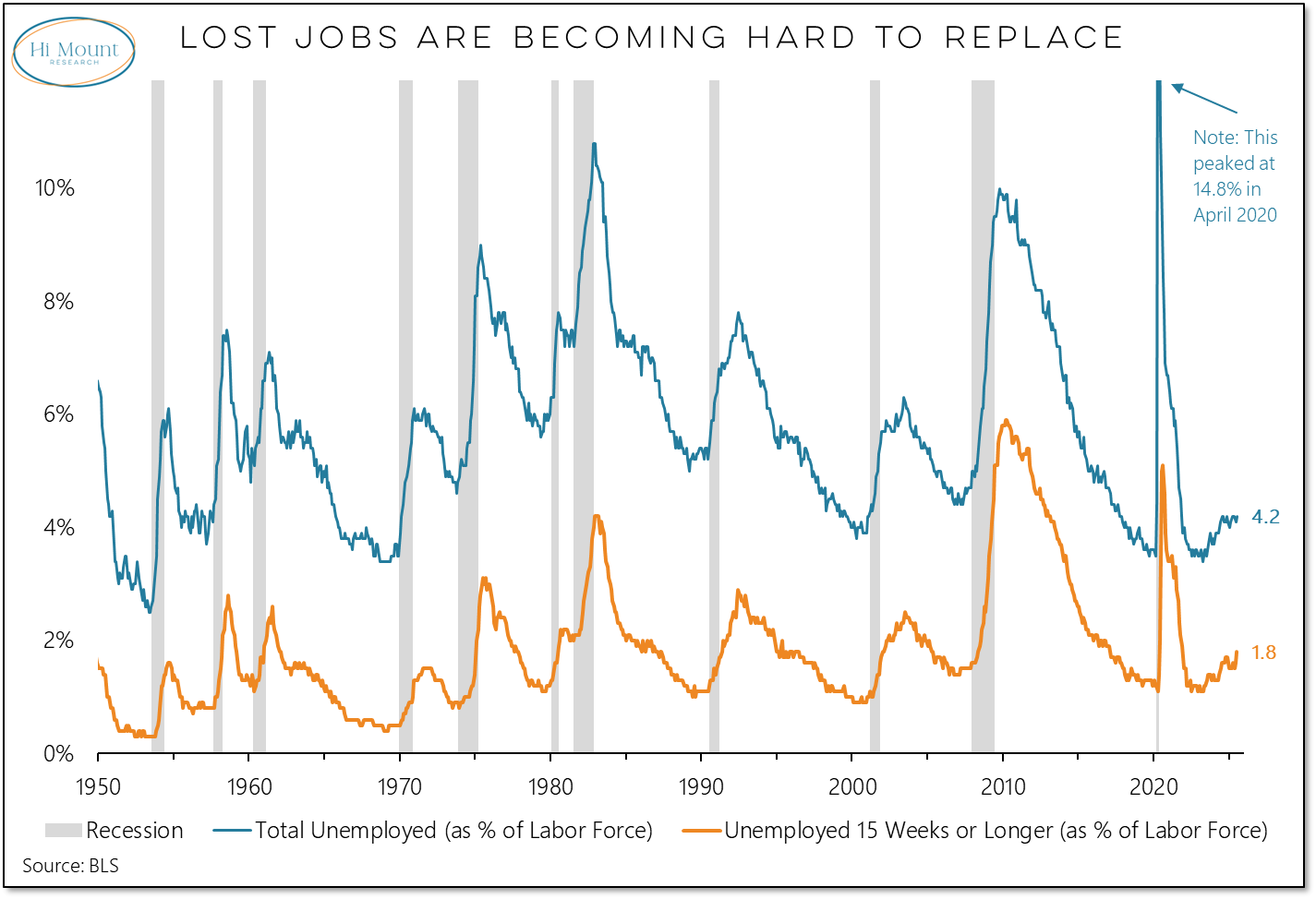

As my econ and finance students at Wisconsin Lutheran College are well aware, the Fed has a dual mandate. It is not only interested in price stability (usually interpreted as low and stable inflation) but maximum employment. Friday’s employment report (and the associated downward revisions to data for previous months) reflects a labor market that has been soft and is getting softer. There are a thousand or more ways to slice and dice the employment data. The unemployment rate for teenagers continues to push higher – it was less than 10% in 2023 and is now above 15%, outside of COVID this is the highest level in nearly a decade. The overall unemployment rate is off its lows but has been stable in recent months and is still below its long-term median level. The unemployment rate for those out of work 15 weeks or longer has continued to push higher and is above its long-term median level. Job losses overall are still relatively rare, but the inability to replace a lost job (or even get a first job) is becoming more of a challenge. When lost jobs are hard to replace, it is usually a sign that a recession is just around the corner. Ceteris paribus (all else equal), the Fed should be cutting rates.

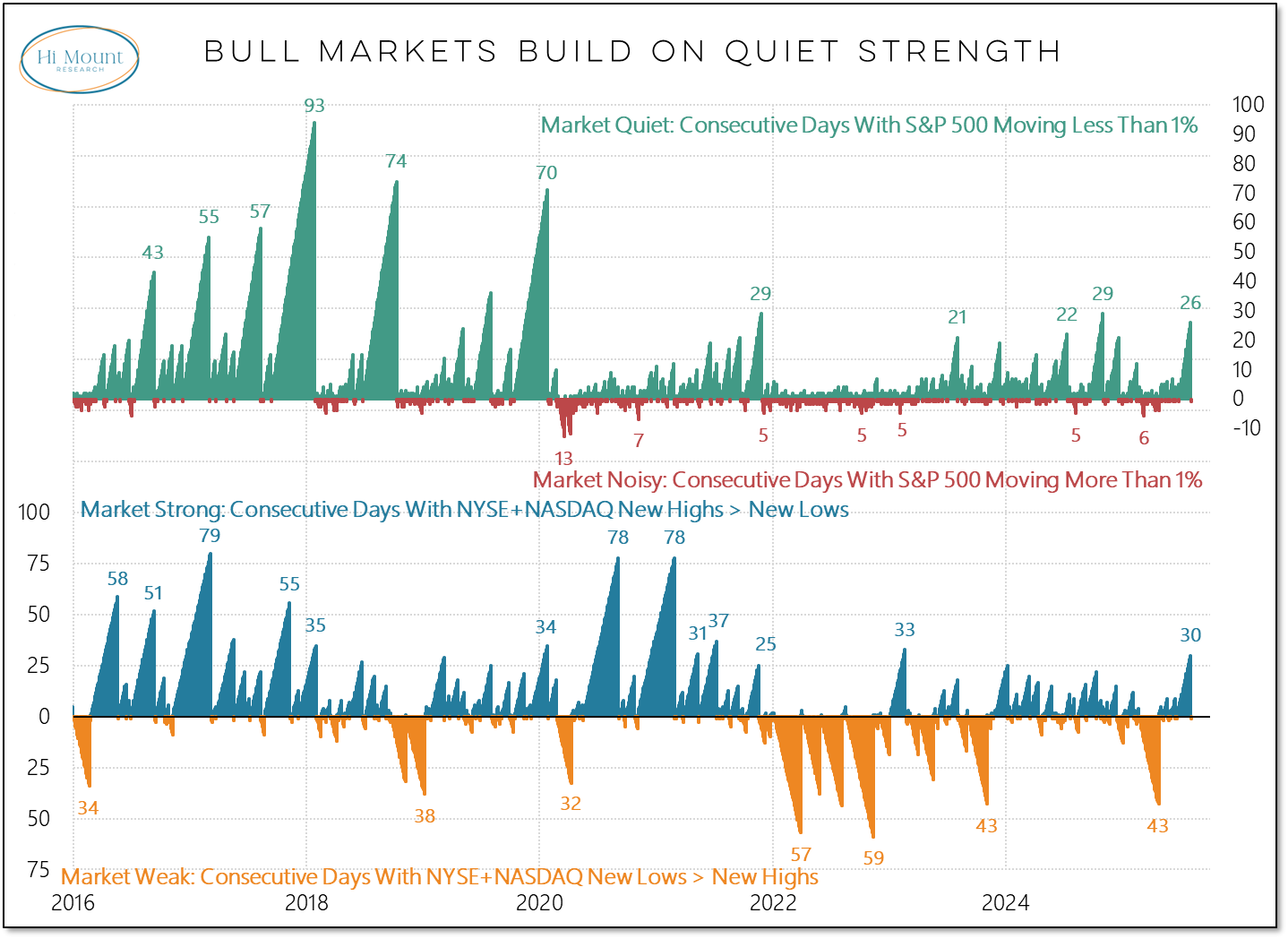

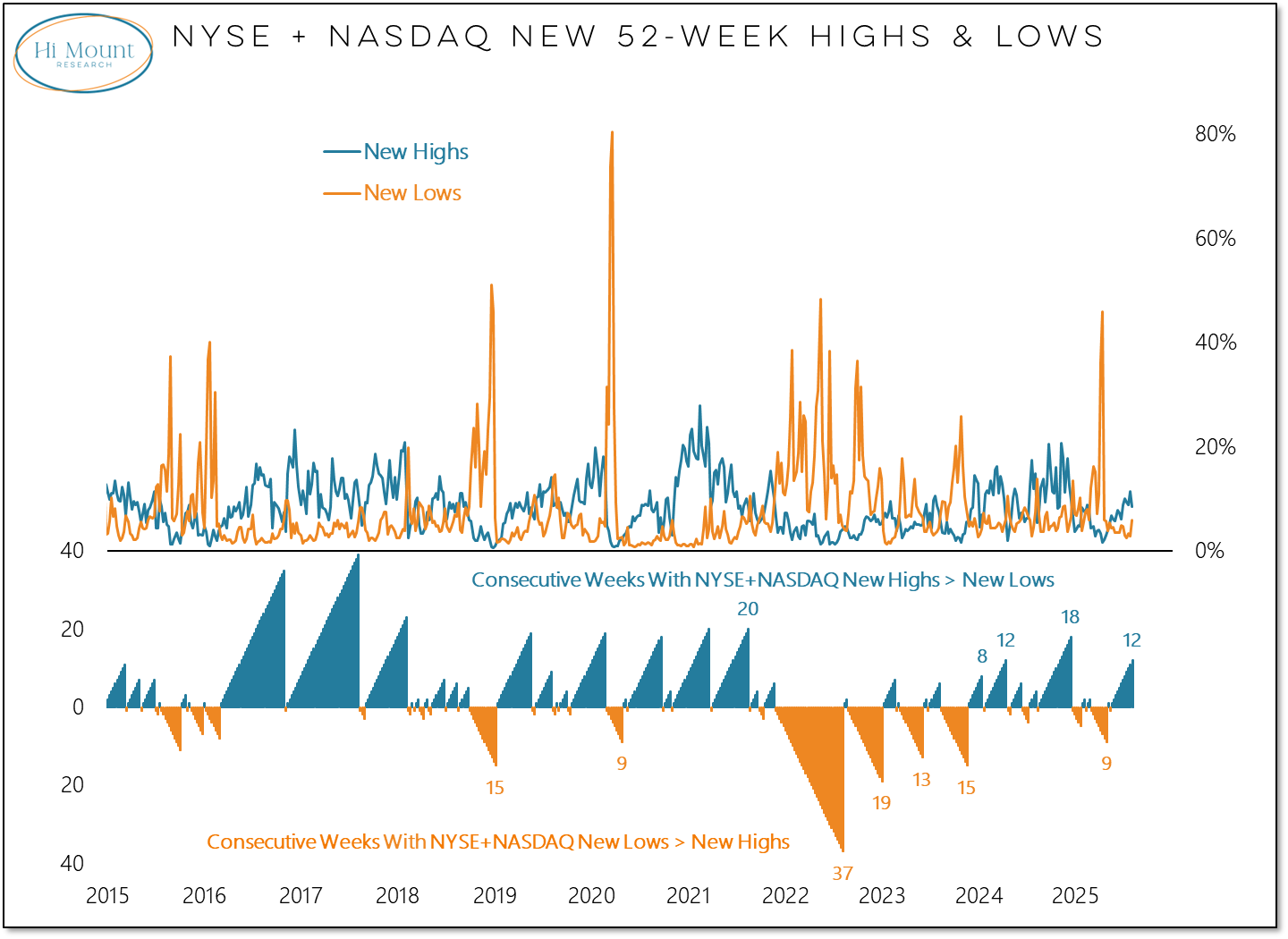

All that being said, our primary intent is not to analyze the health of the economy or the decisions of the Federal Reserve (though both are important factors as we consider the weight of the evidence). Our main focus is on the financial markets and how they are absorbing the macro-related noise. In other words, our primary question is whether last week’s volatility meaningfully disrupted the bull market behavior that was on display for much of July. It seems like a long time ago, but last week actually began with a 6th consecutive all-time high for the S&P 500. By the end of the week, both the consecutive days of strength (new highs > new lows) and the run of quiet (a daily move of less than 1% for the S&P 500) had ended. Nonetheless, the month-plus of quiet strength was clear evidence of bull market behavior.

At this point, last week appears to have been a hiccup and bull market behavior remains largely intact.

The question for this week is whether the bullish market forces that prevailed for much of July can re-assert themselves. Seeing a continuation of more new highs than new lows on a weekly basis would be supportive in that regard.

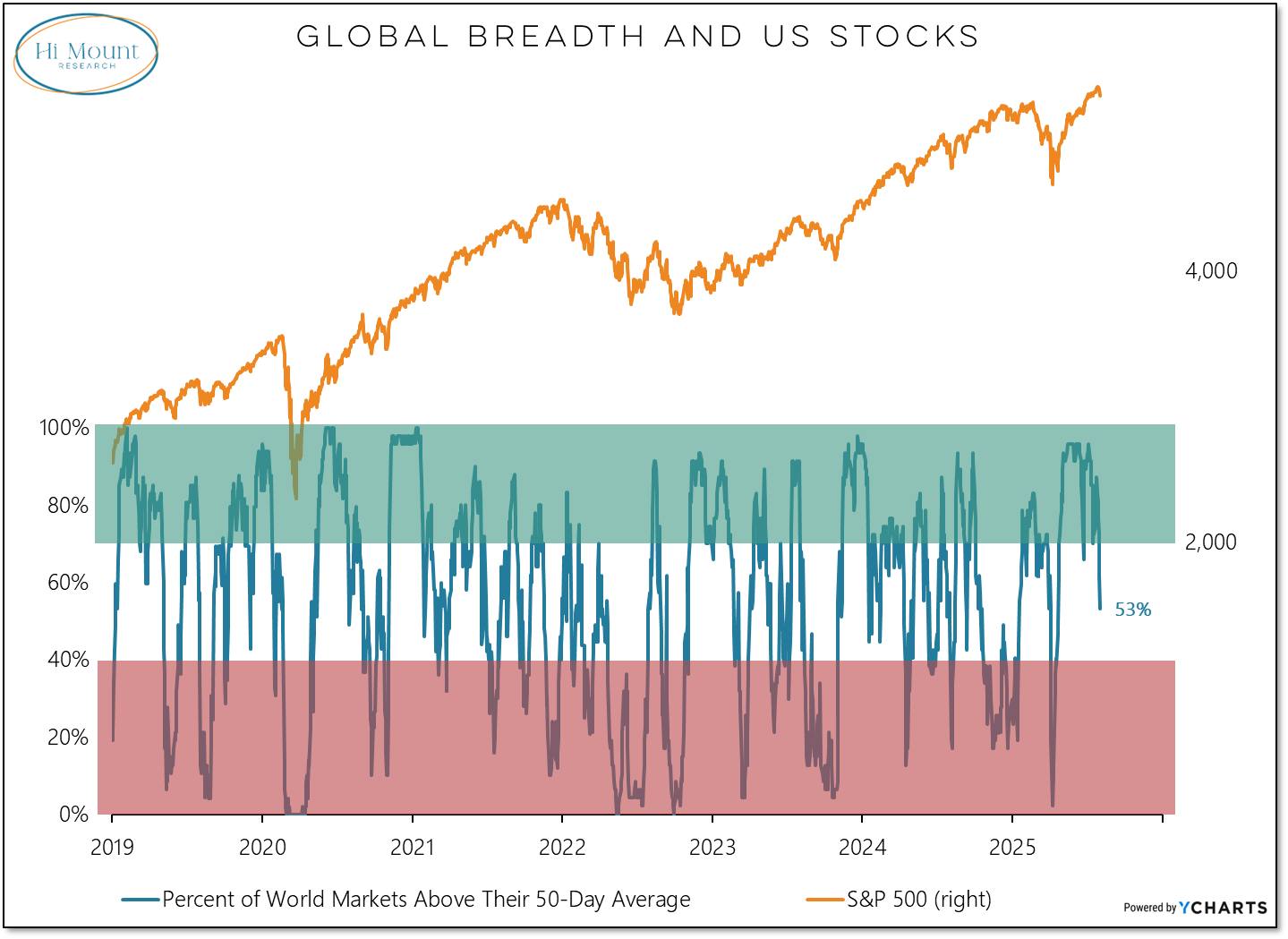

So too would be seeing the percentage of global markets above their 50-day averages climb back above 70%.

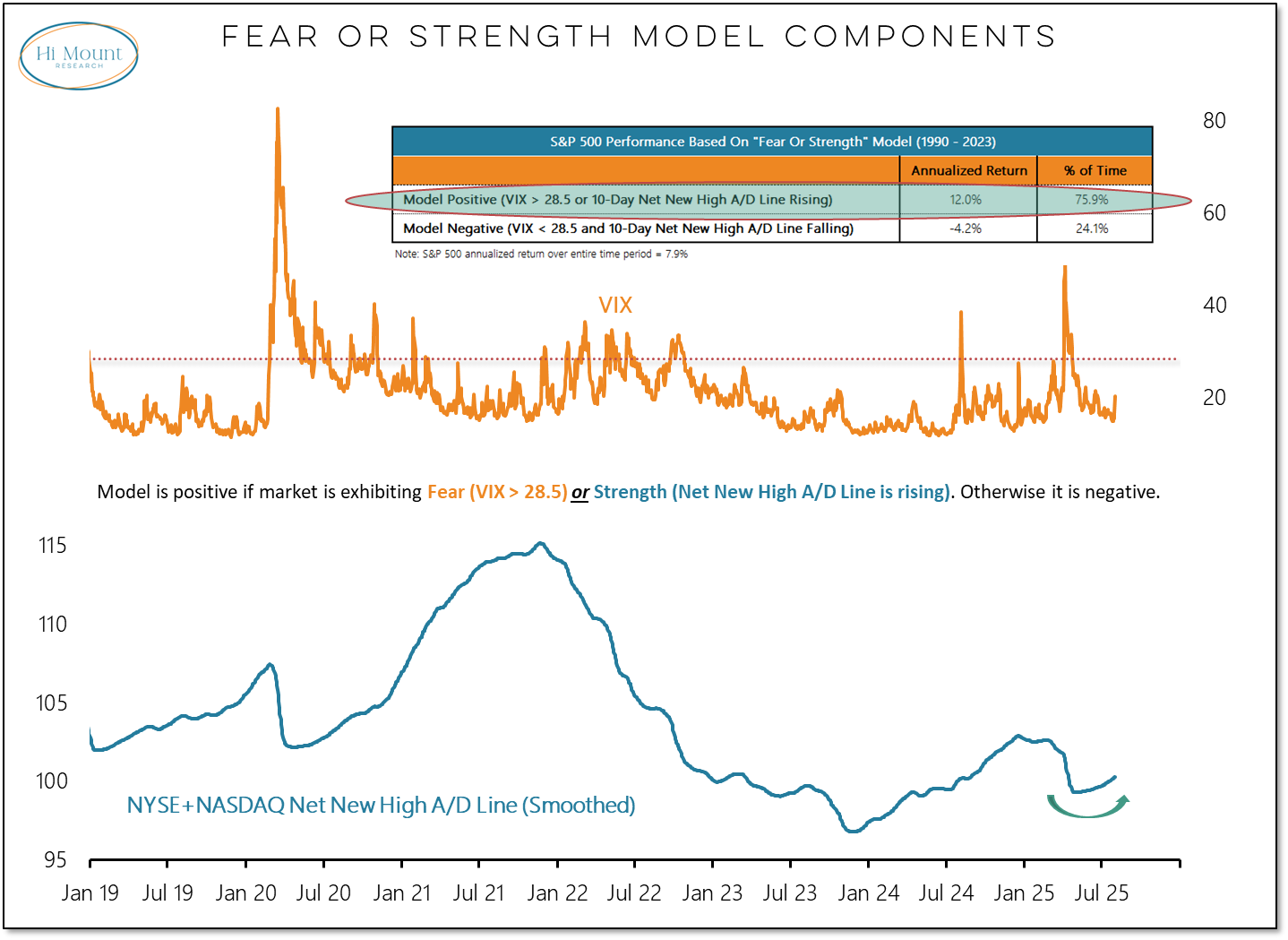

If new highs are outnumbering new lows, our tactical Fear or Strength model is going to stay positive despite the noise associated with macro-related headlines.

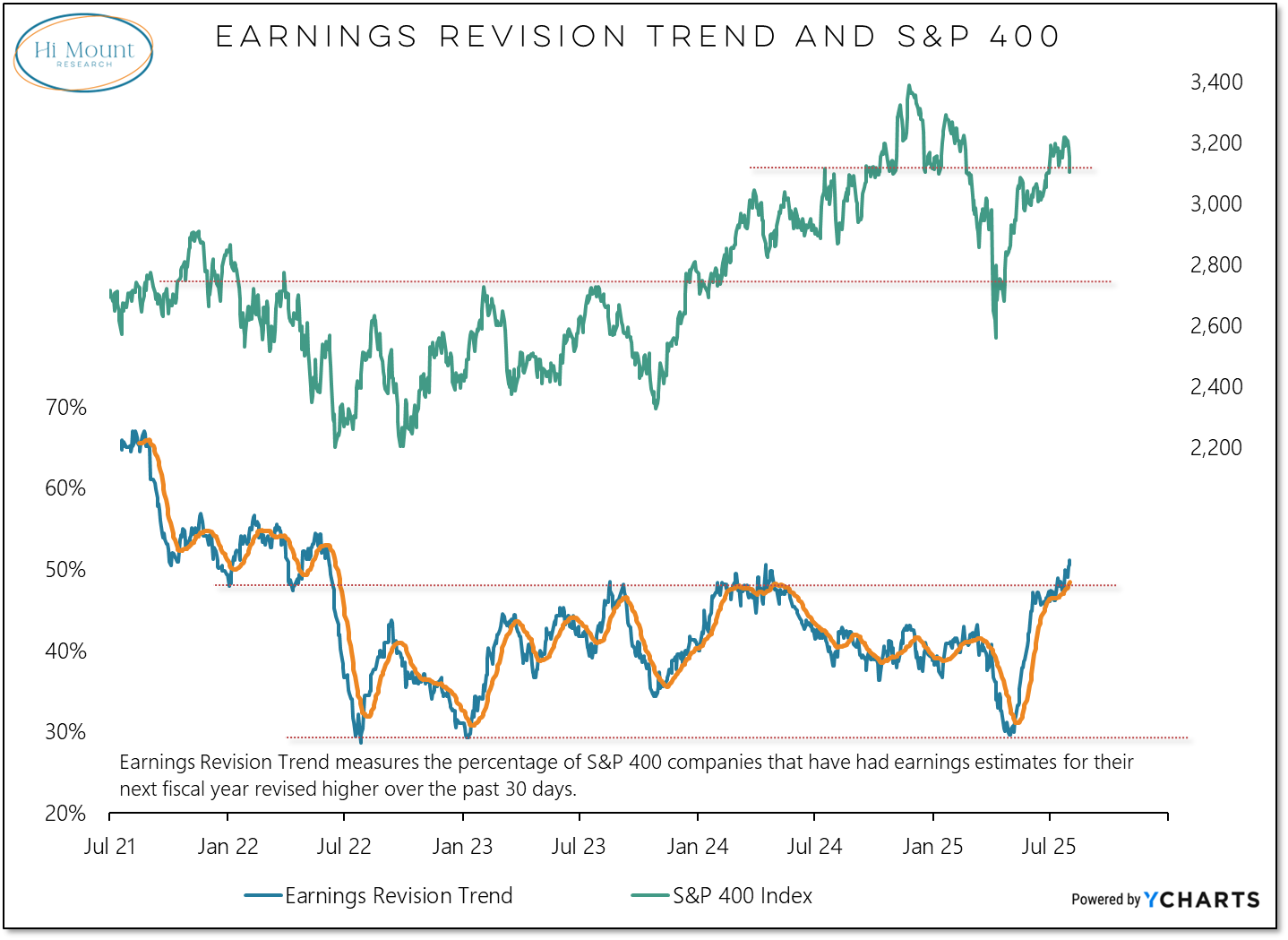

Further, the market right now is benefitting from the tailwind coming from upward revisions in earnings estimates, which are breaking out to new multi-year highs for mid-caps and large-caps.

In summary: last week may have alerted bulls to macro-related risks, but there is little evidence that risk appetite and bull market behavior have headed for the exits.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.