Looking for opportunities while waiting for sustained strength

Townhall Takeaways for November 10

Moving beyond big day-to-day price swings & seeing sustained strength. Big up days feel great but over time elevated day-to-day volatility tends to be inversely correlated with sustained strength. 2022 has plenty of the former and not much of the later.

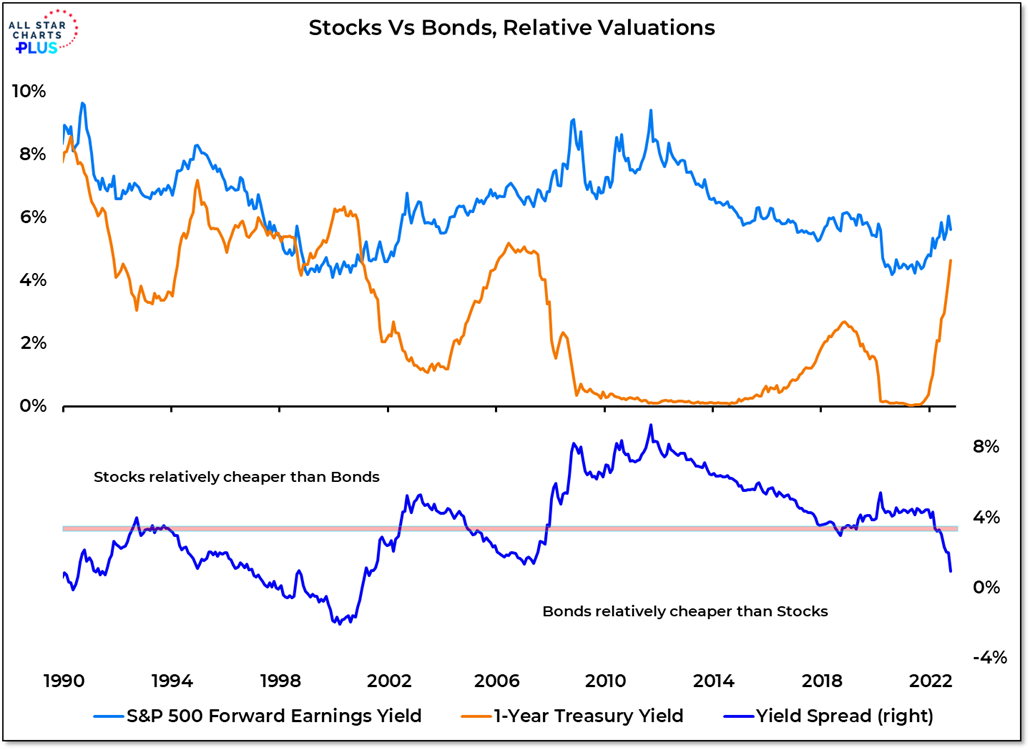

Relative to bonds, stocks have been getting more expensive. Since the beginning of the year, the P/E ratio for the S&P 500 has been falling (meaning the earnings yield is rising). The spread between the forward earnings yield and 1-year Treasury yields is the lowest in more than 20 years.

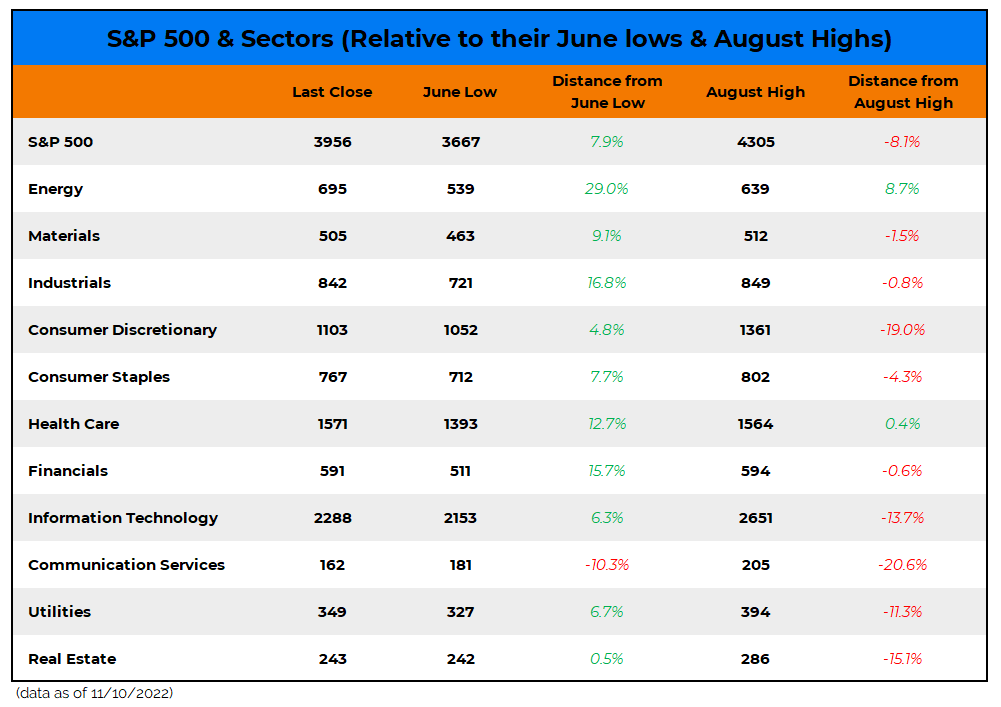

Watch the August highs for evidence of strength. Relative leadership is great, but getting above the August highs is evidence that we are seeing absolute strength that we can lean into at the sector-level.

My weekly Townhall Takeaways are also available wherever you listen to podcasts (https://www.buzzsprout.com/2078368/11672828) and on YouTube: