Looking Backward

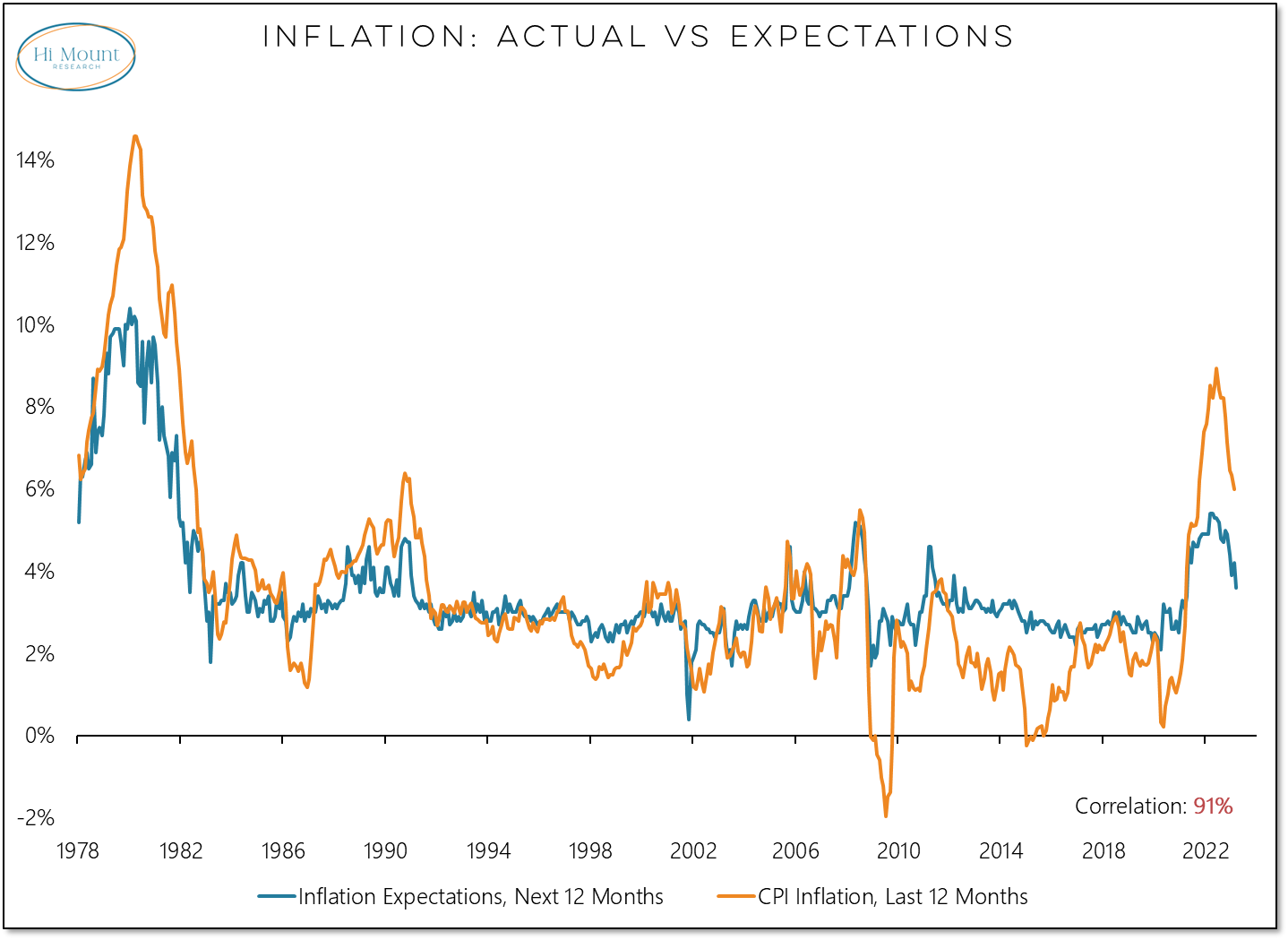

Inflation expectations are more correlated with where inflation has been than where it is going

The March Consumer Sentiment data from the University of Michigan shows inflation expectations for the next 12-months dropping to 3.6%, the lowest level since early-2021.

More Context: The decline this survey data suggests that a win for the Fed, as inflation expectations seem to remain well anchored. However, inflation expectations are more a reflection of where inflation has been than where it may be going. There is a higher correlation between expectations and CPI inflation over the past 12 months than expectations and CPI inflation over the coming 12 months. Inflation expectations are reflective, not predictive.

Beyond the noise of backward looking expectations, we see that the underlying trend in inflation remains uncomfortable high and that is likely to keep more pressure on the Fed than the market is currently pricing in.

We take a closer look at at inflation trends, financial stresses, and the message of the market as Q1 comes to a close in our weekly wrap up.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.