Less Strength Brings More Struggles

The bull market is absorbing blows, but hasn't yet been knocked out

Portfolio Applications update: With our Fear or Strength model turning negative (read the un-locked update here) we are raising cash and taking a more defensive equity position in our Tactical Opportunity Portfolio.

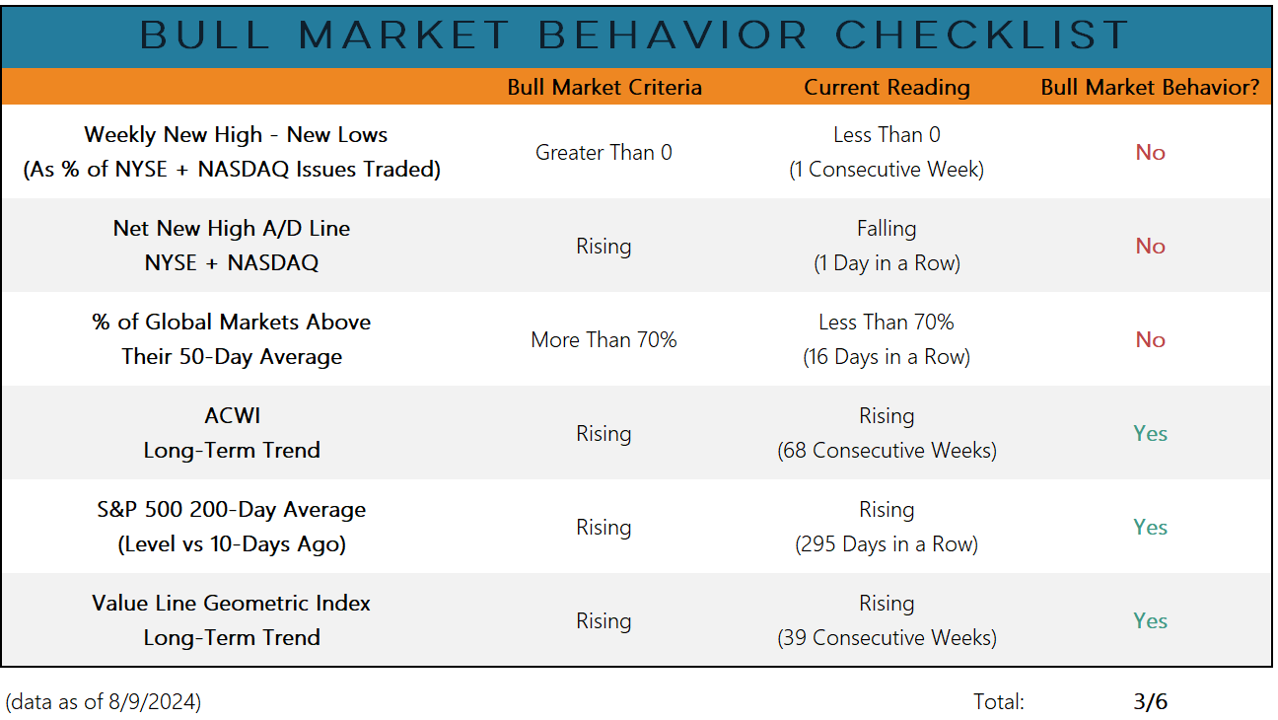

Key takeaway: The market is behaving less like a bull market is still intact, but a broad breakdown has not occurred.

Last week began with a spike in the VIX. All of the market’s net upside over the past three years has come with the VIX above 28.5.

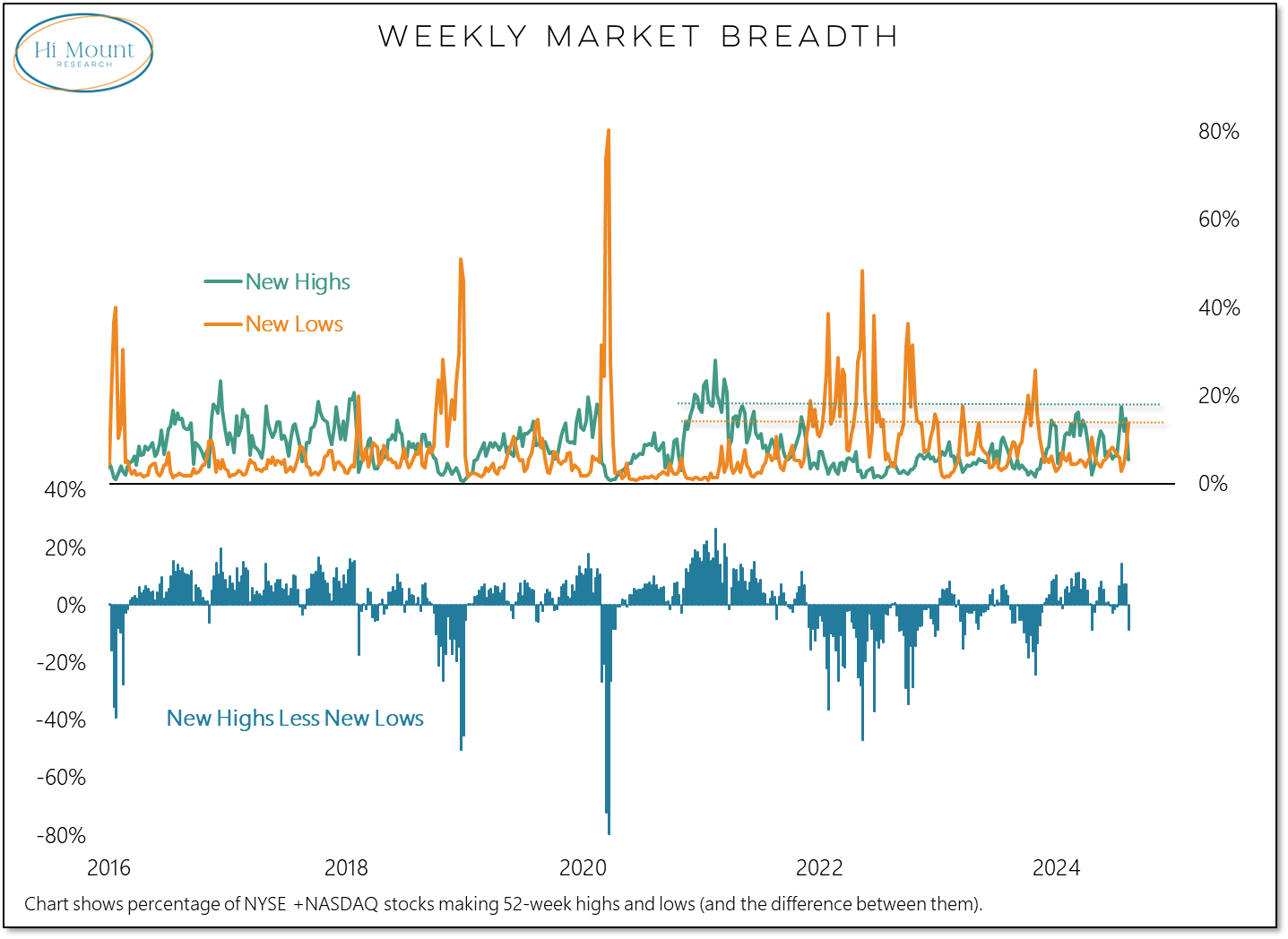

That surge in fear did not persist and by the end of the week broad market strength had been exhausted. In the space of just a few weeks, the market moved from a new cycle high in New Highs to a new year-to-date high in New Lows on a weekly basis and on a daily basis new lows have outnumbered new highs for six consecutive days and counting.

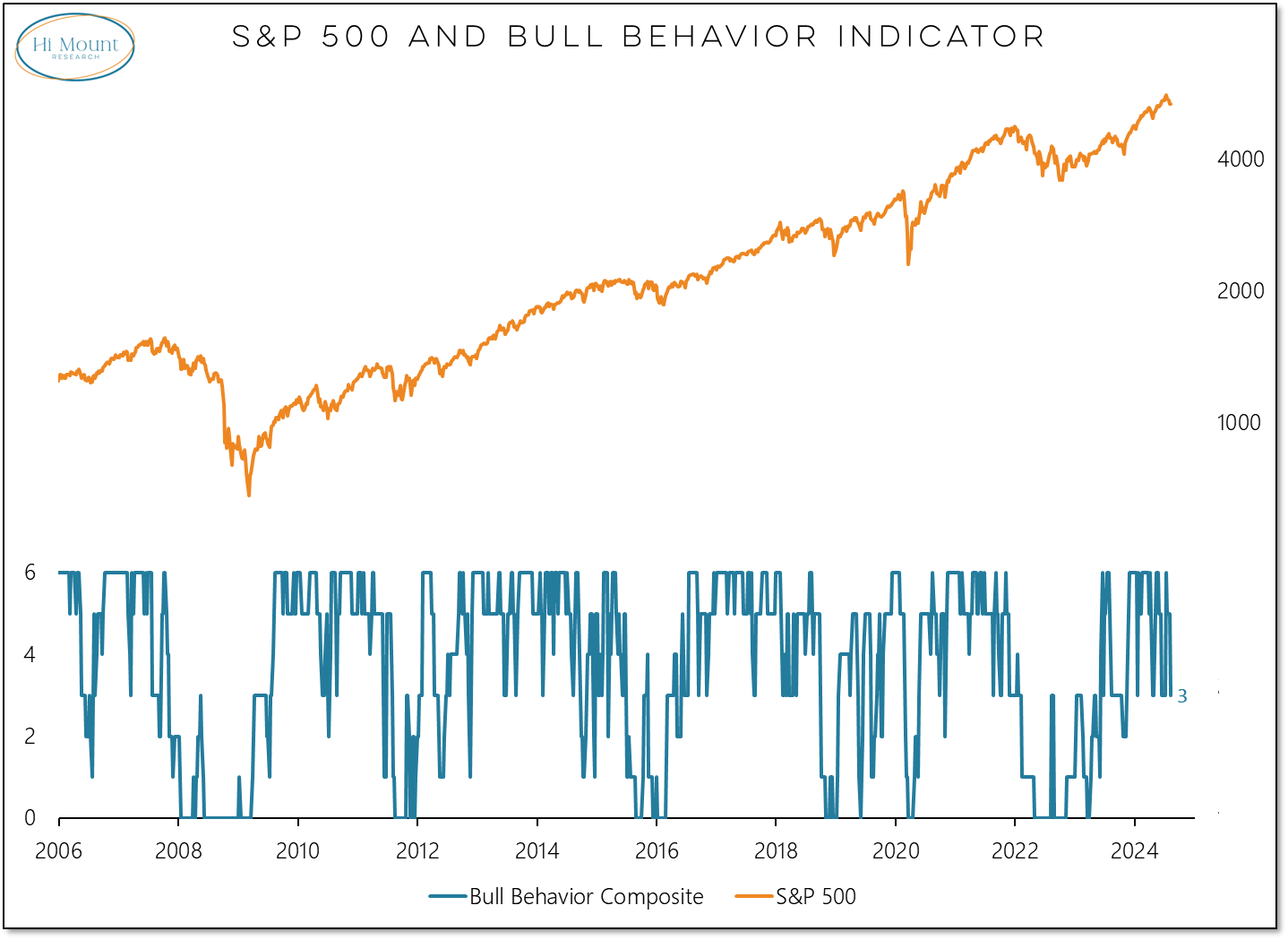

Broad market weakness has pushed our Bull Market Behavior Checklist down to just 3 out of 6 indicators still in positive territory.

If price trends deteriorate from here, our Bull Behavior Composite would drop below 3 and claiming that the bull market is intact would be a dubious proposition.

While the higher price trends remain intact, we have already seen strength evaporate and noise overwhelm the quiet environment of the first half.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.