Latin America At Confluence Of Global Equity Strength

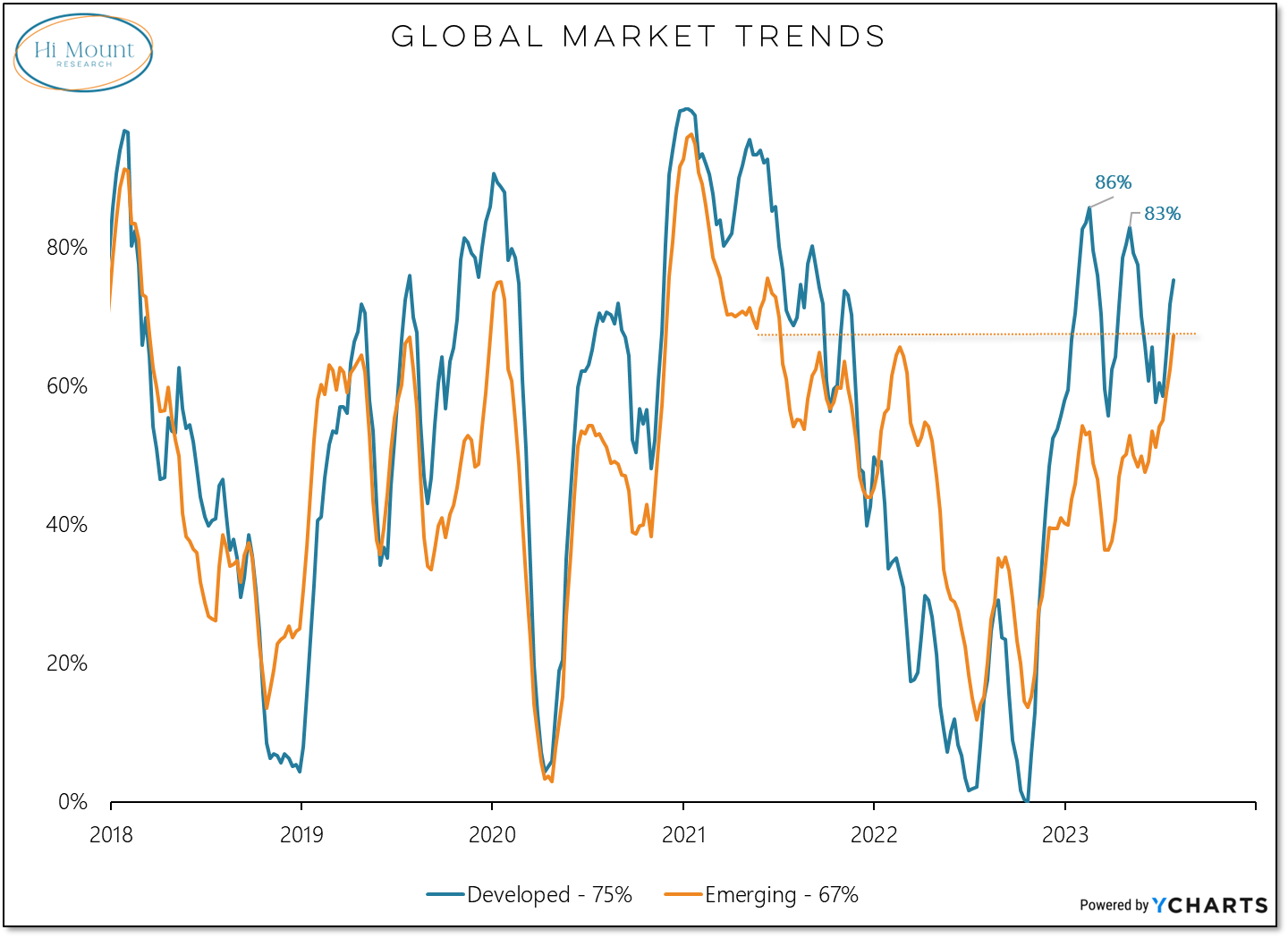

Emerging Markets are getting in gear, but the best opportunities may be relatively close to home.

A replay of my recent conversation with Michael Gayed of the Lead-Lag Report is now available .

This week’s Relative Strength Rankings and Asset Allocation Model updates are available for Portfolio Applications subscribers. Not yet a subscriber? Let’s talk about your options.

Key Takeaway: Improving Emerging Market trends and continued strength from the Americas puts Latin America in the crosshairs of opportunity.

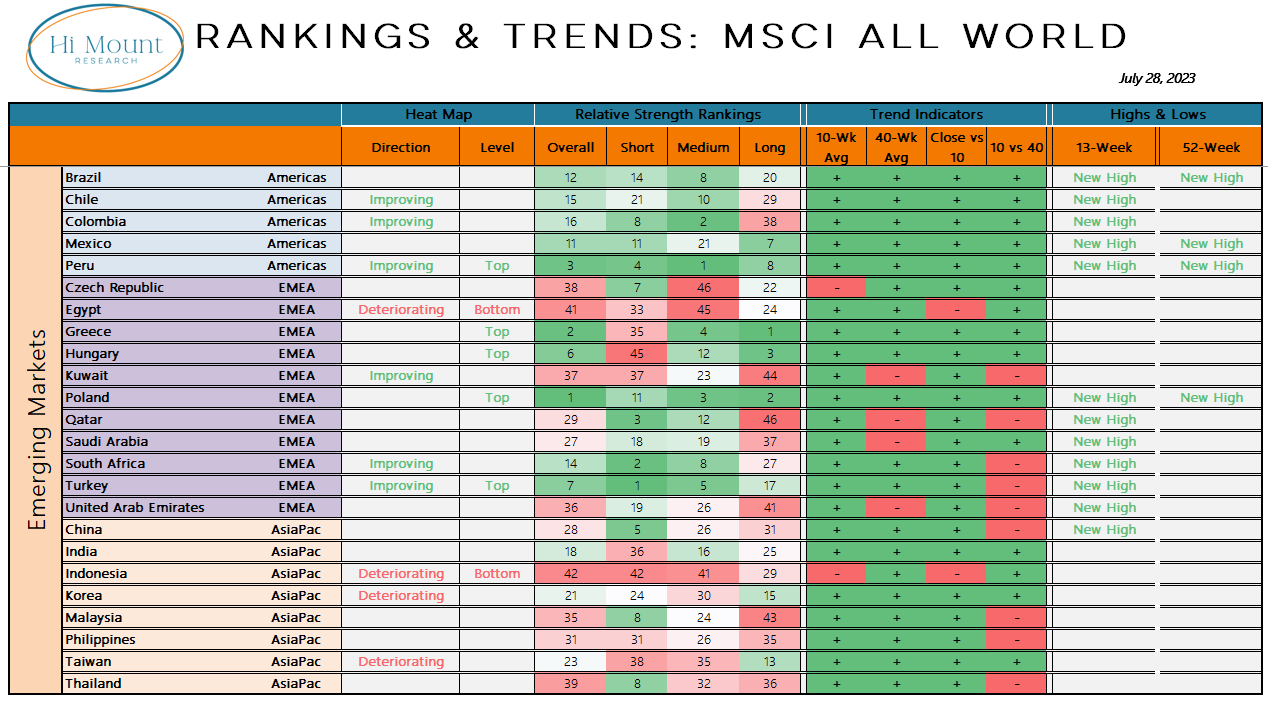

More Context: The Emerging Market half of our MSCI All World relative strength rankings (Developed Market rankings are on page 8 of our weekly Relative Strength Rankings report) shows clear strength out of the Latin American markets. While only one (Peru) makes it into the top 10 overall (DM + EM) rankings, three of the five have improving trends and all five made new 13 week highs last week. No other region is experiencing across the board relative and absolute trend strength. Mexico made a new 52-week high last week (as did Brazil and Peru) and continues to trend higher relative to the US.

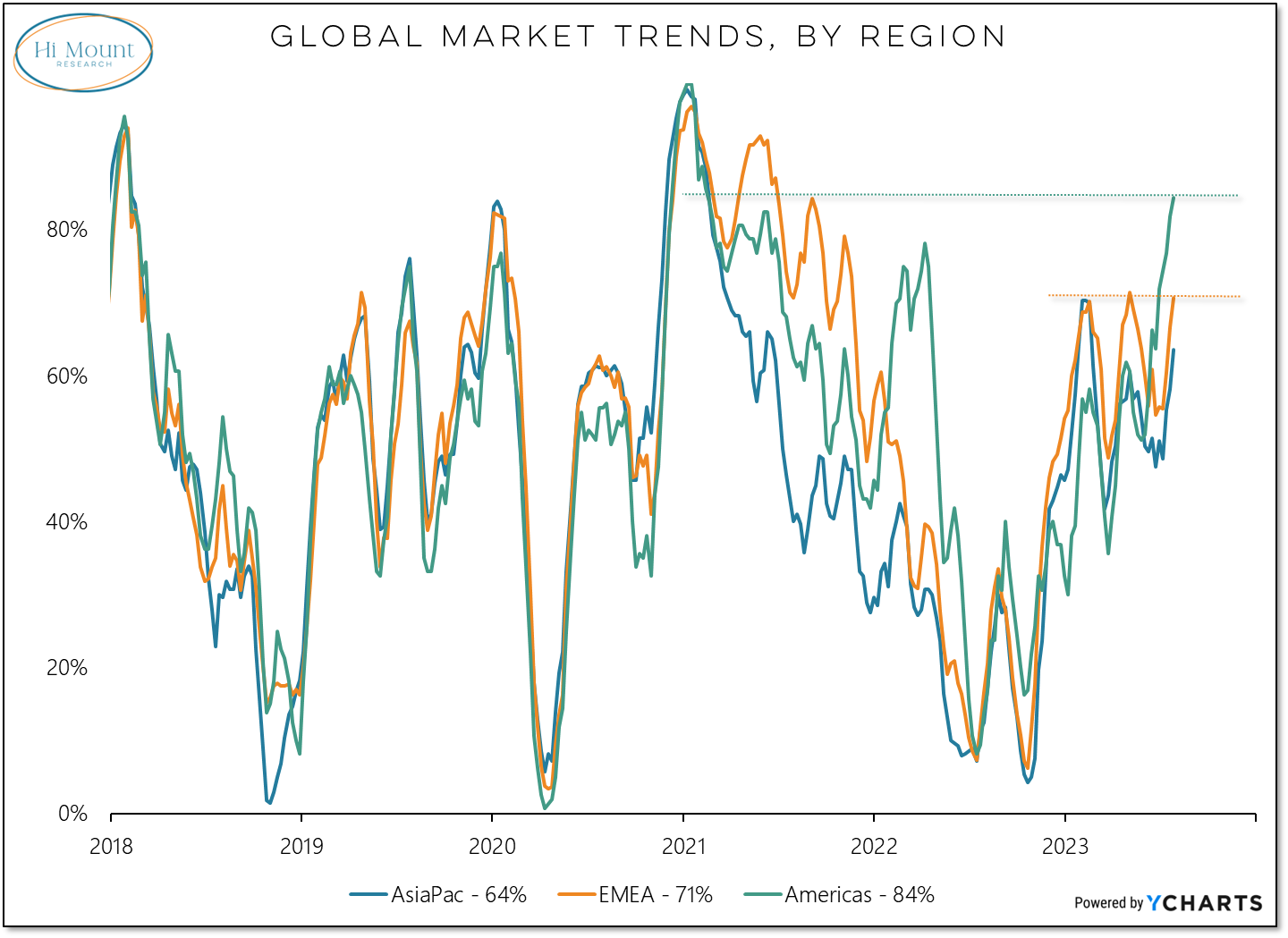

Trends is the Asia-Pacific region remain relatively weak and EMEA (Europe, Middle East & Africa) are back to where they peaked in late 2022 and early 2023. Trends for the Americas (which includes the US and Canada in addition to Latin America) are the strongest since early 2021 and still improving. Overall trends in Emerging Markets trail Developed Market trends, but EM trends have broken out while DM trends remain below their recent peaks.