Last Week's Bull Market Behavior Could Wilt As Macro Concerns Dominate

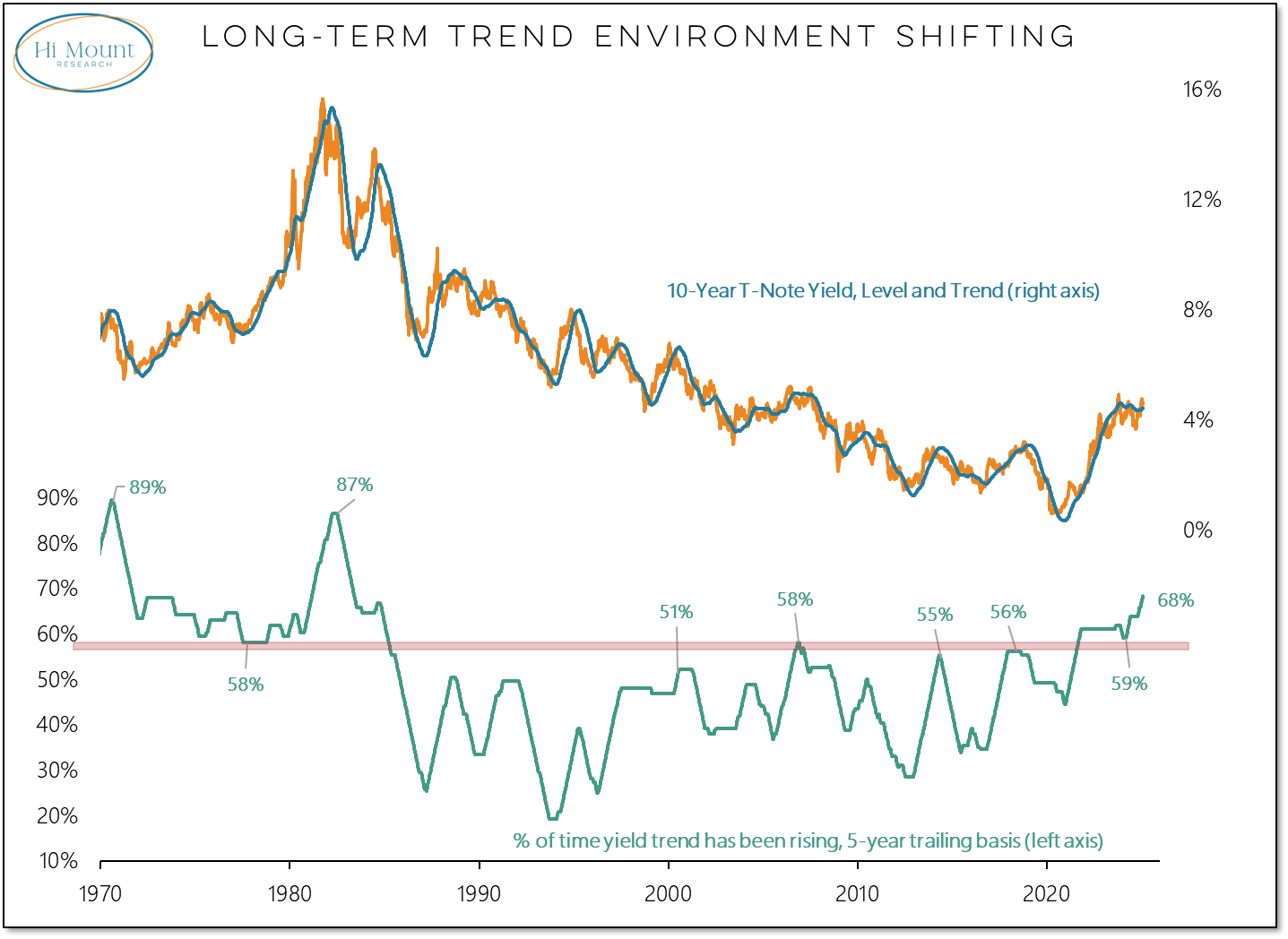

Long-term trends moving away from stocks as Gold climbs to new highs

Portfolio Applications update: The monthly update to our Systematic Portfolios is now available. Notably, our composite asset allocation model reflects the shift in leadership from Stocks to Commodities. Scroll through to the bottom of this note to see a summary of the model's current positioning.

Key Takeaway: Macro news will likely dominate the week (and months ahead). While stocks continue to behave as if they are in a bull market, fissures beneath the surface have yet to be fully repaired.

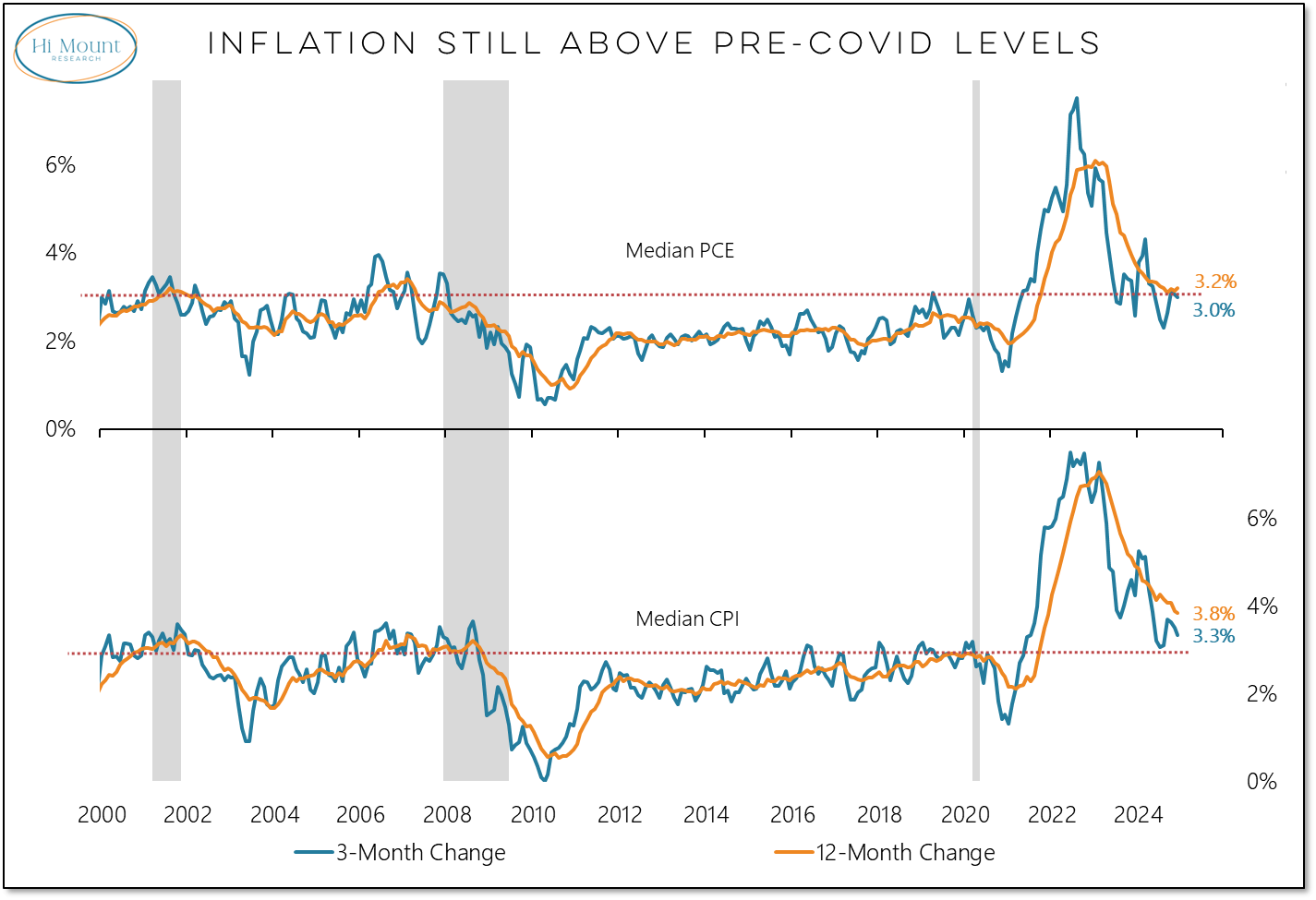

News of inflationary tariffs comes at a time when inflation remains stubbornly high and the path of least resistance for bond yields is higher.

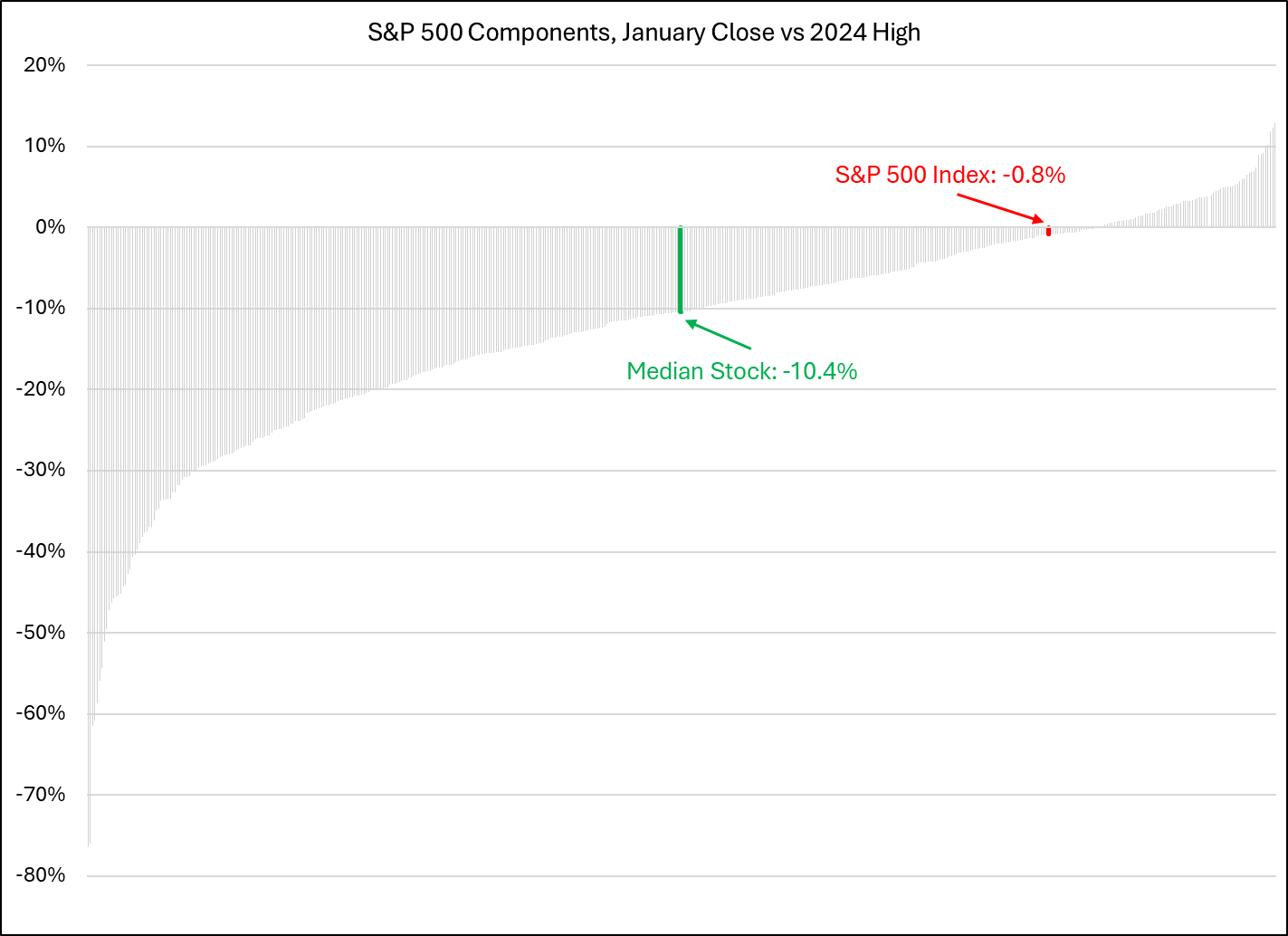

The S&P 500 finished January less than 1% below its high from 2024, while the median stock in the index is more than 10% below its 2024 peak (the silver lining is that 15% of the index finished the first month of 2025 higher than it closed at any point in 2024).

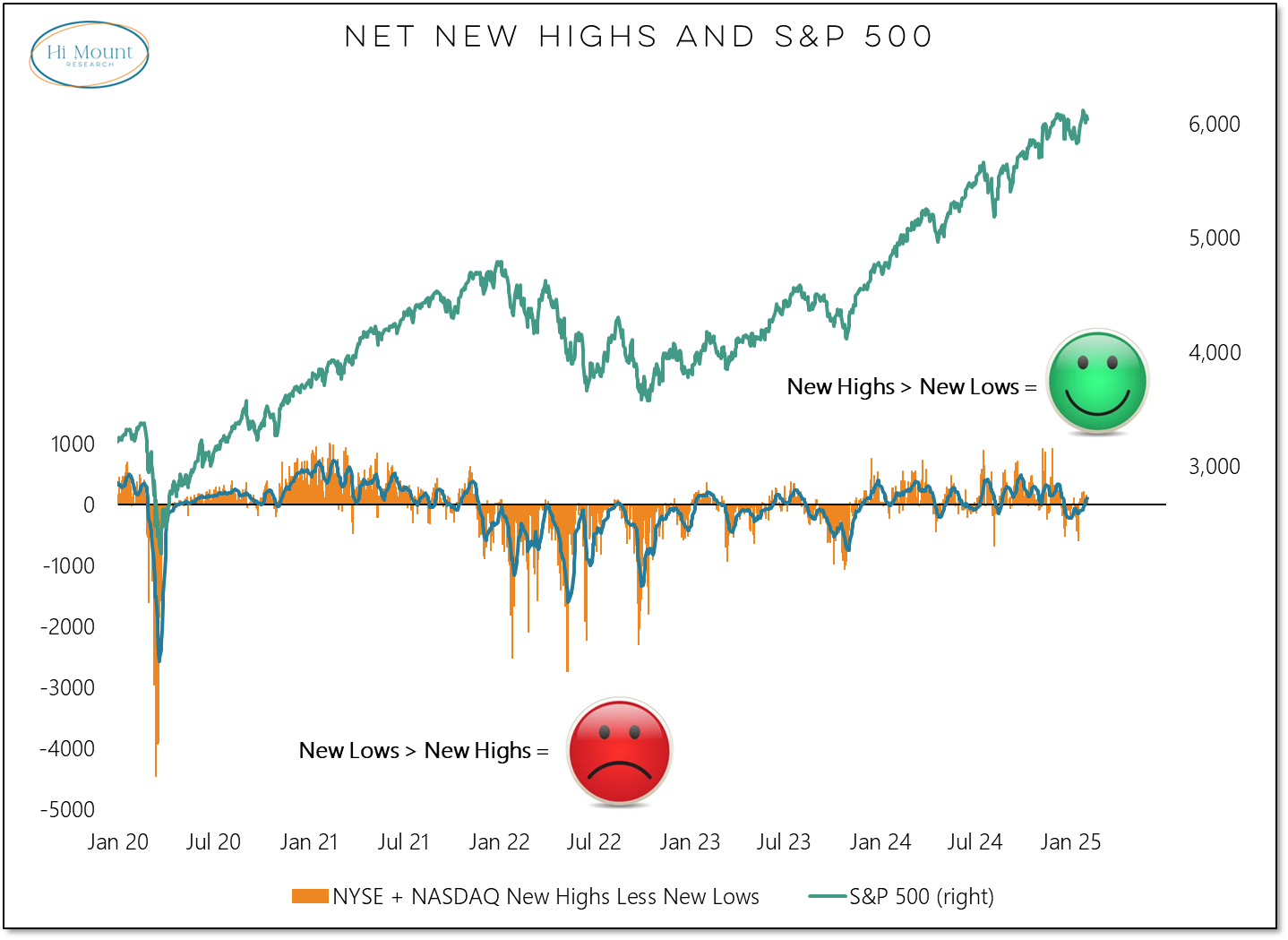

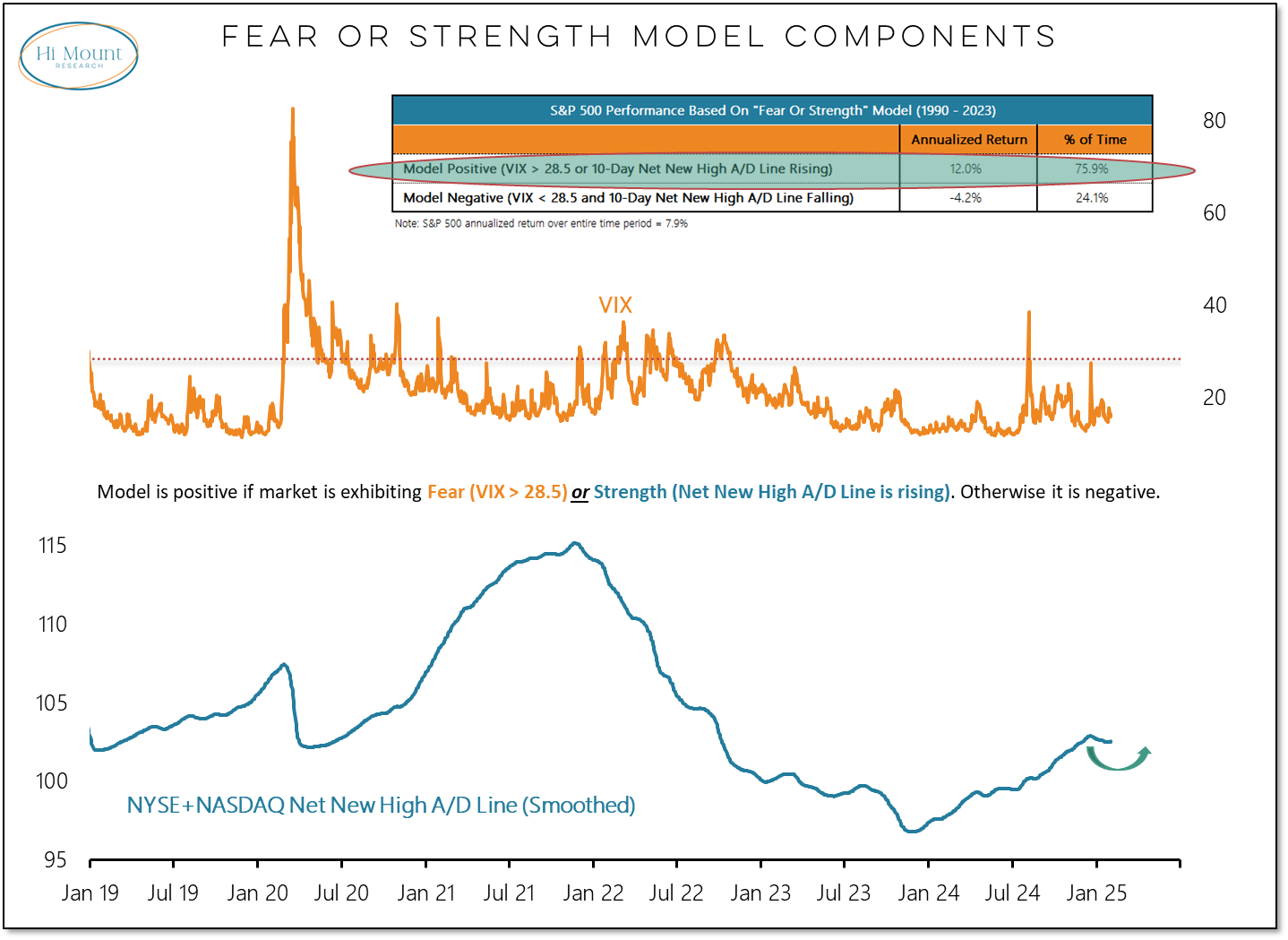

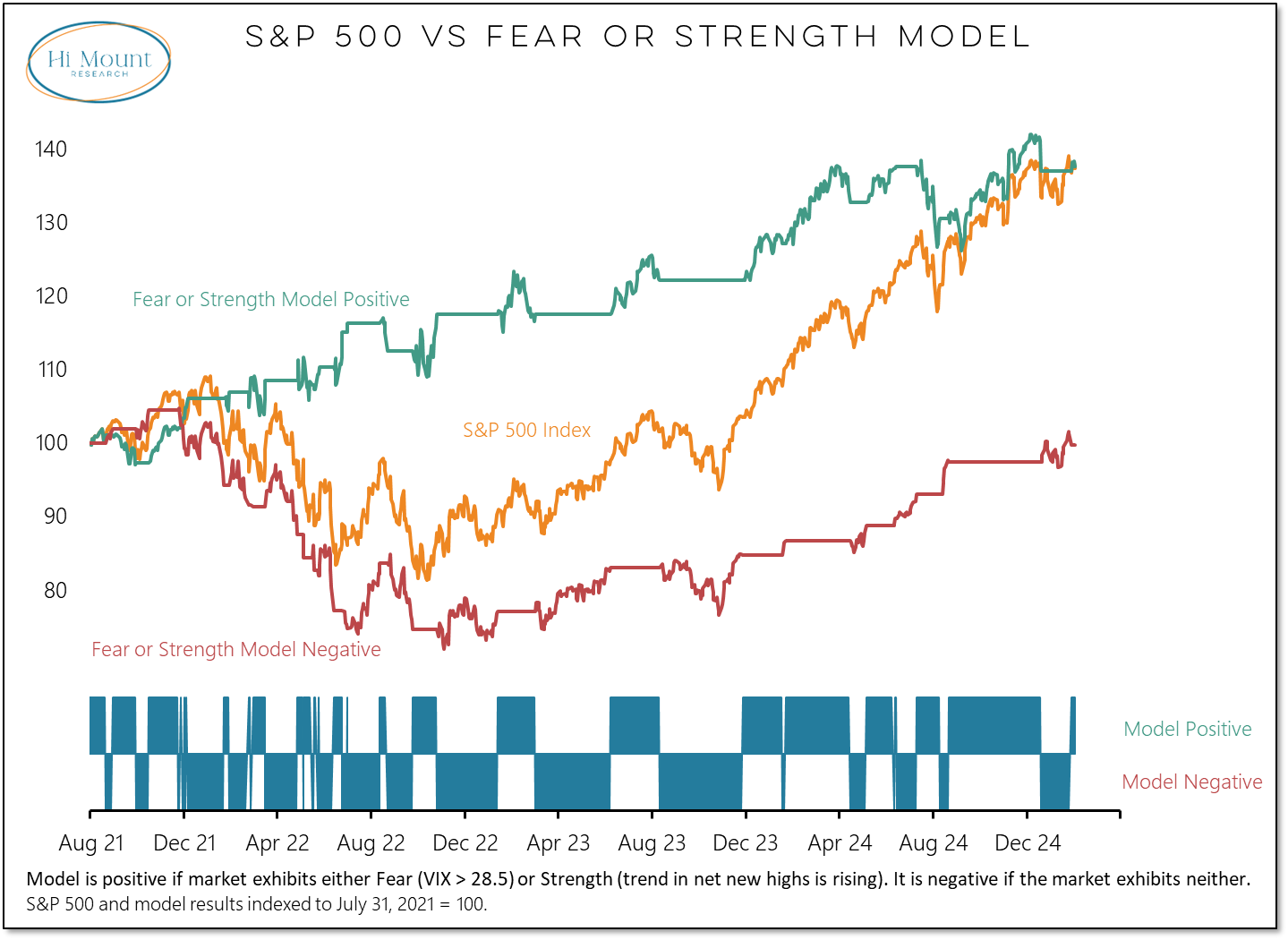

While the new high list remains relatively narrow, it has eclipsed the new low list and the trend in net new highs is now rising.

The pushes our Fear or Strength model back into positive territory (at least for now).

The signals from this model have not been perfect, but overall it has continued to do a great job of keeping investors out of trouble over the past few years.

Our Bull Market Behavior Checklist is back to 6 out of 6 (for the first time since September) though our market indicators are not providing an all-clear at this point.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.