Keeping It Simple: Follow the Trend & Don't Fight The Tape

Noise and distractions are the enemy for investors

Key Takeaway: Price and breadth trends remain bullish, especially for US equities. By focusing on what matters and ignoring the rest, investors can manage both risk and their peace of mind.

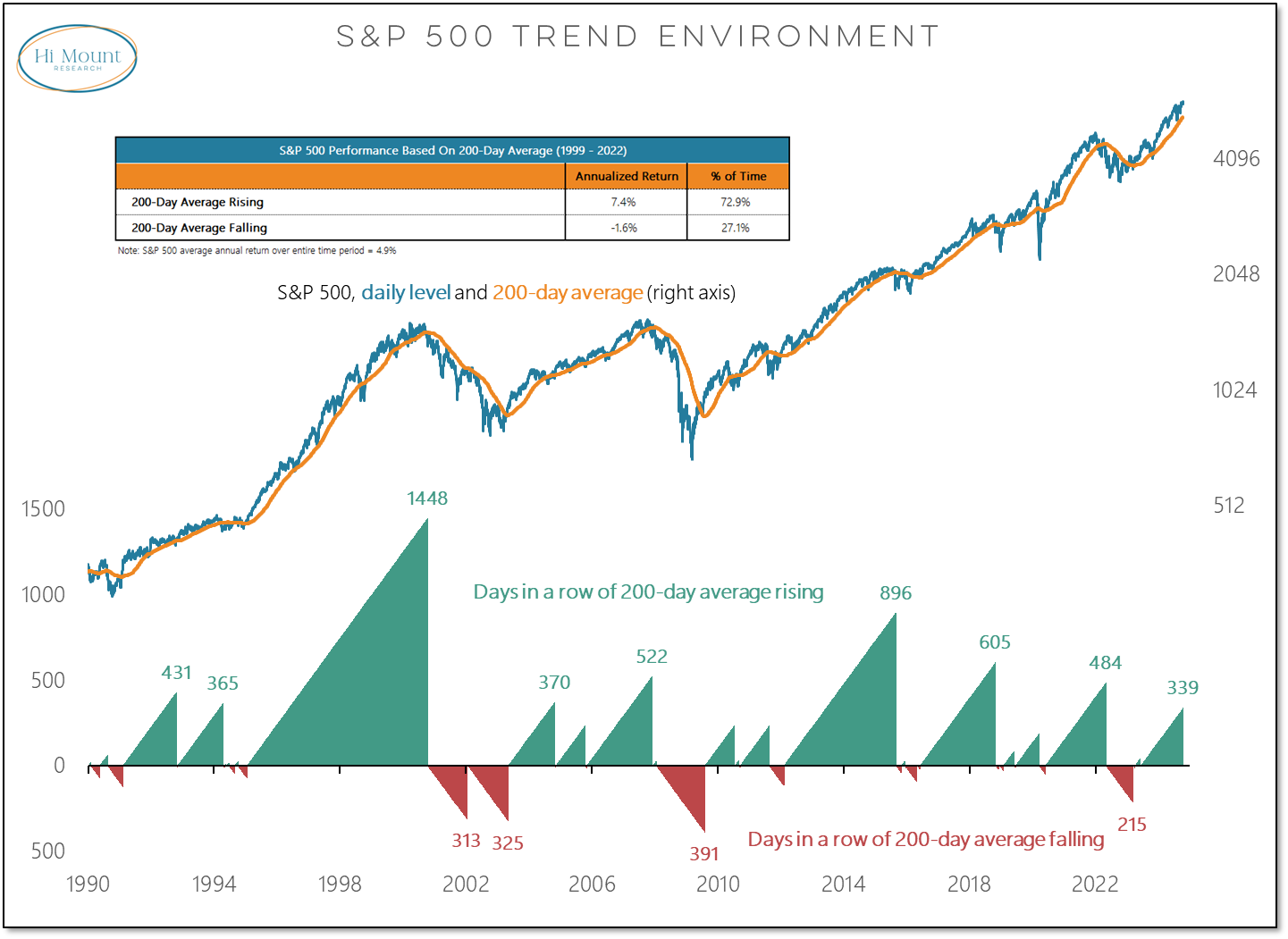

The trend in the S&P 500 (measured by whether the 200-day average is rising or falling) continues to be positive. When that is the case, investors get rewarded for owning stocks.

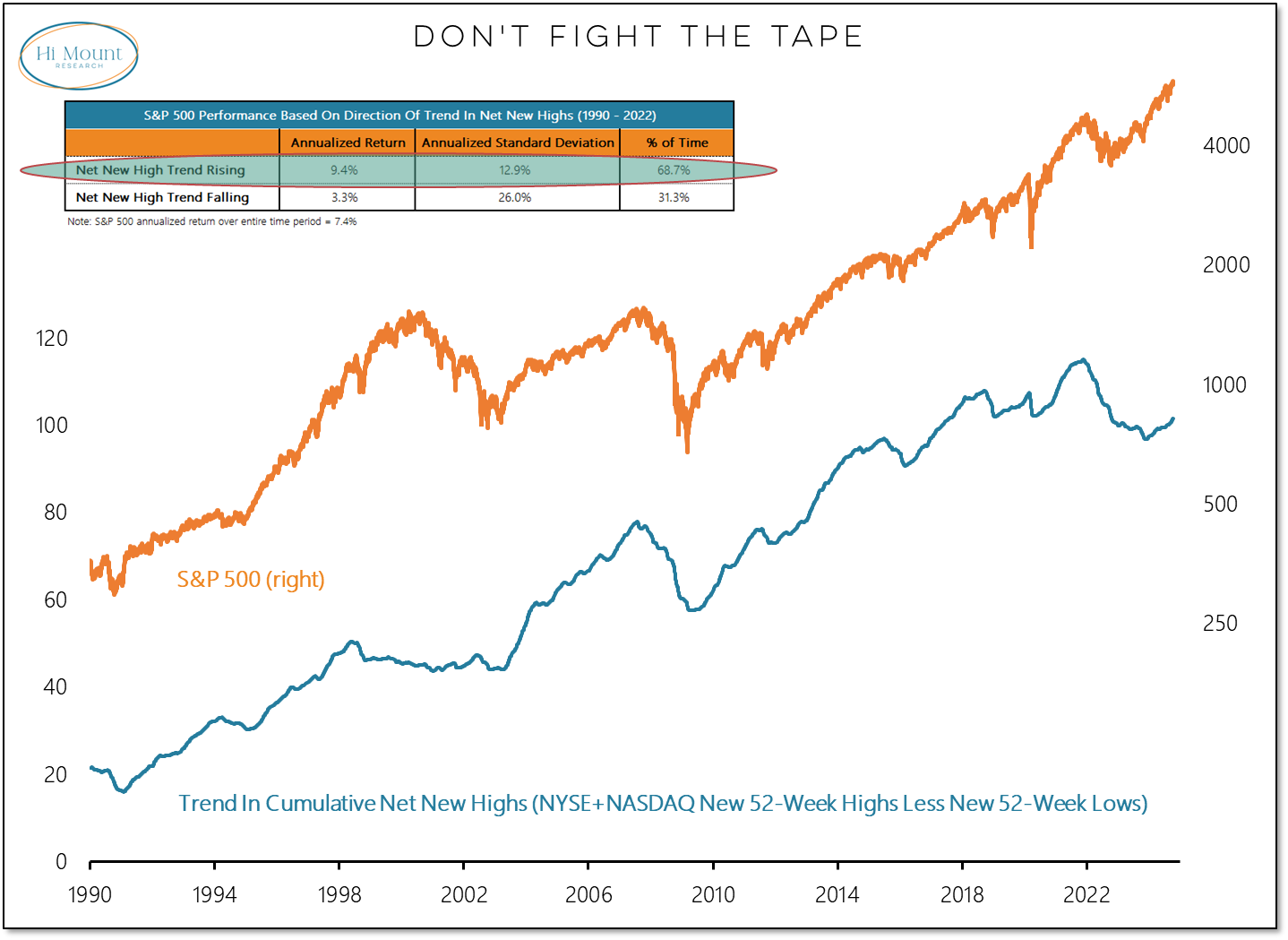

Even for investors who aren’t looking for a tactical timing mechanism, staying in harmony with the tape is prudent risk management strategy. When net new highs are trending higher, the S&P 500 produces higher annualized returns and lower volatility than when the trend in net new highs is falling.

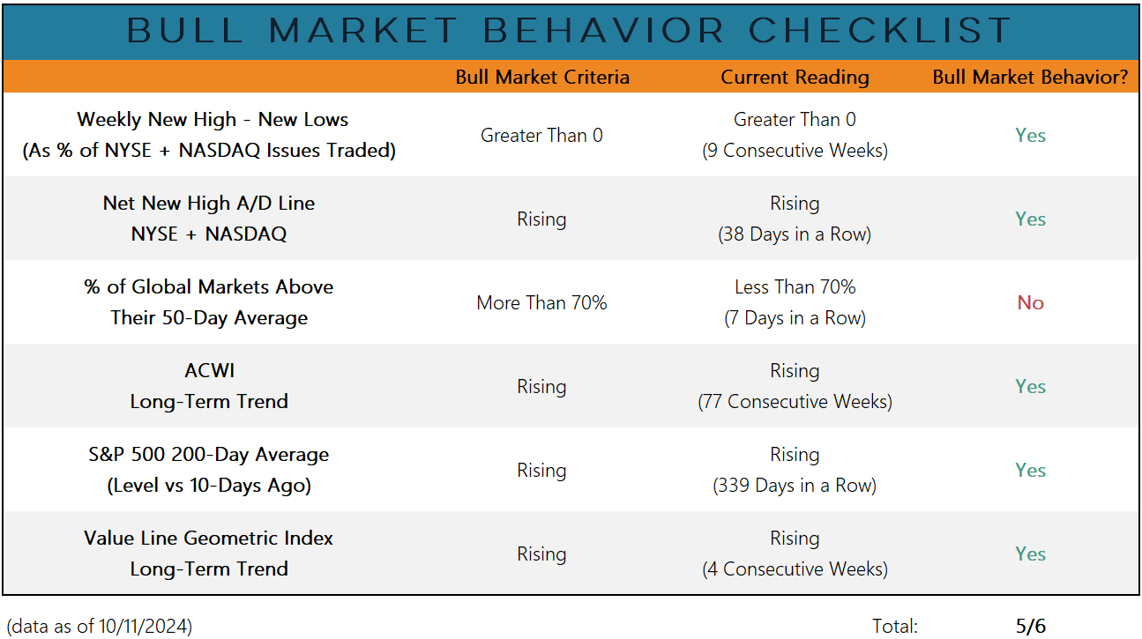

Recent price and breadth behavior is consistent with an ongoing bull market. The one exception from our checklist is the percentage of global markets above their 50-day average.

New highs from Industrials & Financials, at both the large-cap & mid-cap level, is not on my “signs of a market top” bingo card.

To be clear, not all macro-related signals are noise. There are two in particular to pay attention to right now (plus one breadth indicator that is less than robust).

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.