In our final Takeaways of this unprecedented year, we look through a few charts that have us full of wonder about what might be in store for 2023 and beyond.

As we wind down for the year, I want to take just a moment to express my appreciation to all those who have engaged with or responded to my work over the past year. I am honored that you allow me to be a part of your daily or weekly routine. Merry Christmas and God's Blessings on a joy-filled and prosperous New Year.

Townhall Takeaways podcast:

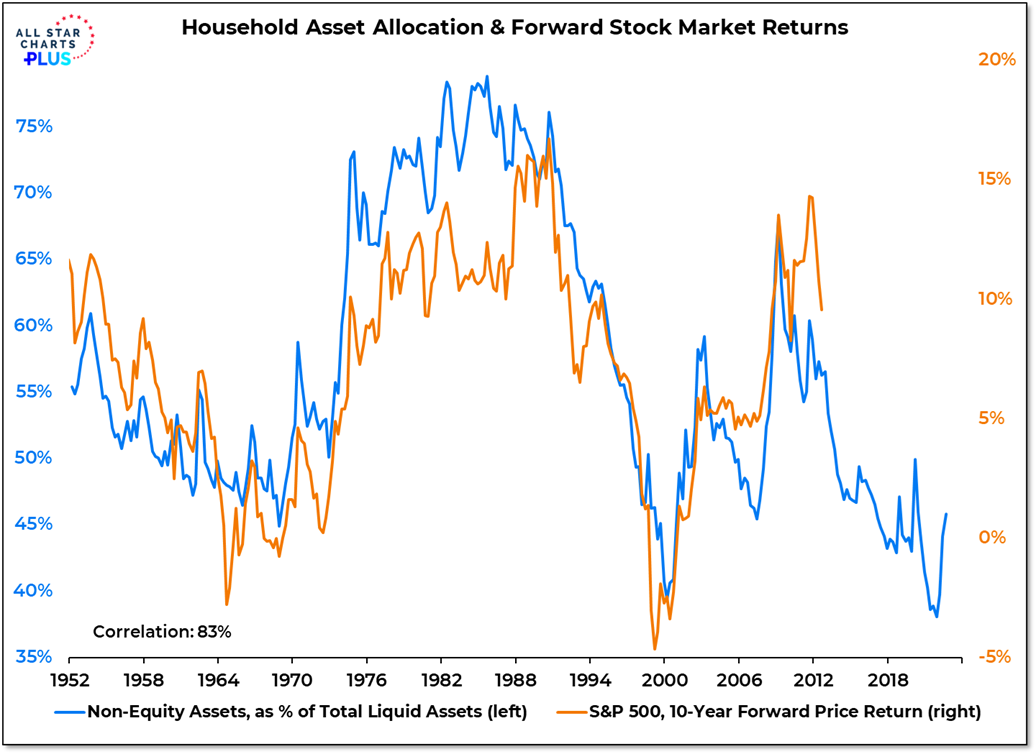

Poor liquidity leads to low returns. The high correlation between non-equity liquid assets and forward stock market returns suggests investors should be preparing an environment with persistently low equity market returns.

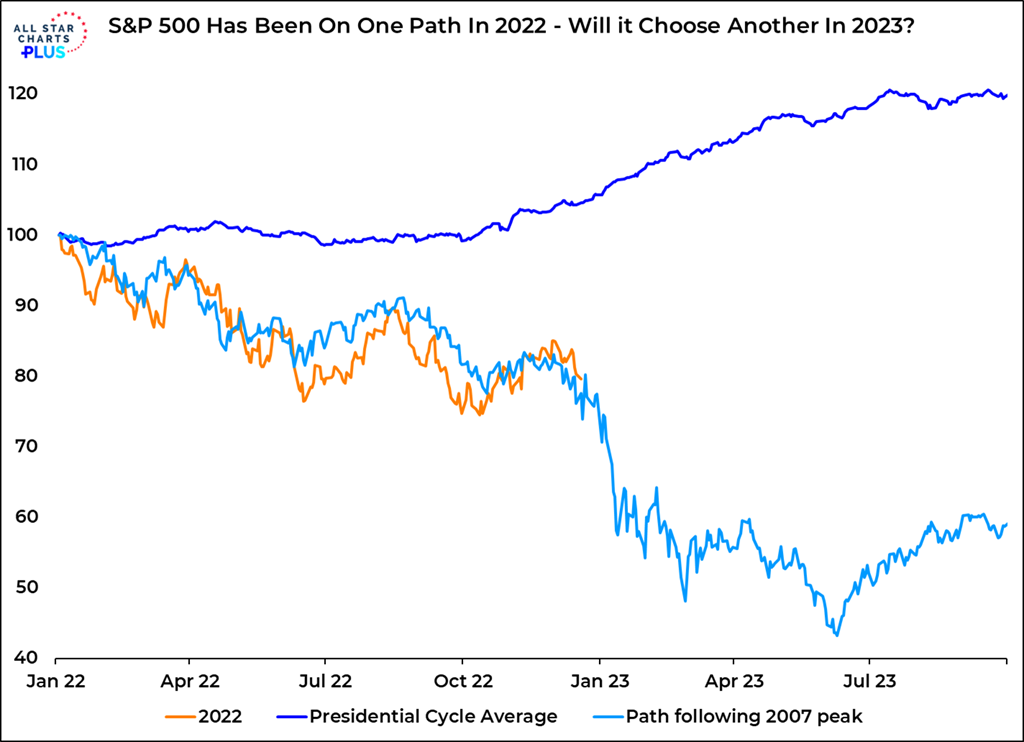

2022 has followed the path off of 2007 highs - will it change course in 2023? Following the financial crisis path would send stocks sharply lower in 2023. Election cycle patterns show a path that is up & to the right. The S&P 500 is looking at two paths that diverge and can only choose one.

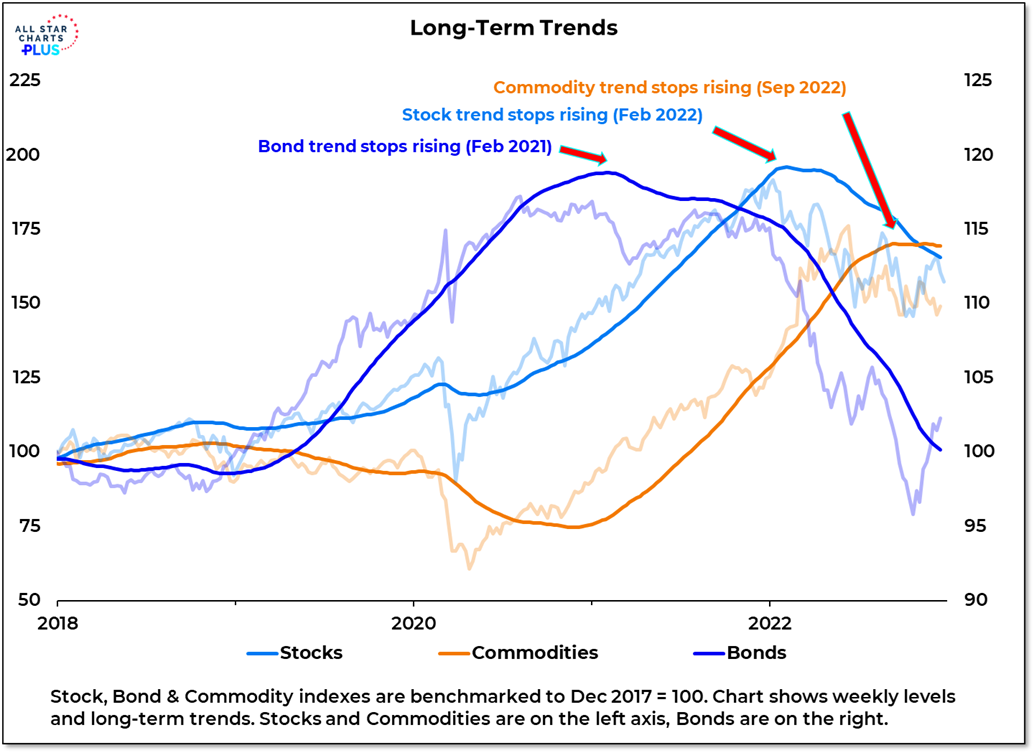

The year ends with stocks, bonds and commodities all under pressure. 2023 is set to begin with investors facing an asset allocation opportunity set full of downtrends. If history holds, it should be bonds that turn higher first.

The Takeaways are also available on YouTube: