It's not the Label, It's the Behavior

With the S&P 500 nearly 20% above its October low, the "bull market" label is being slapped on this rally. But should it?

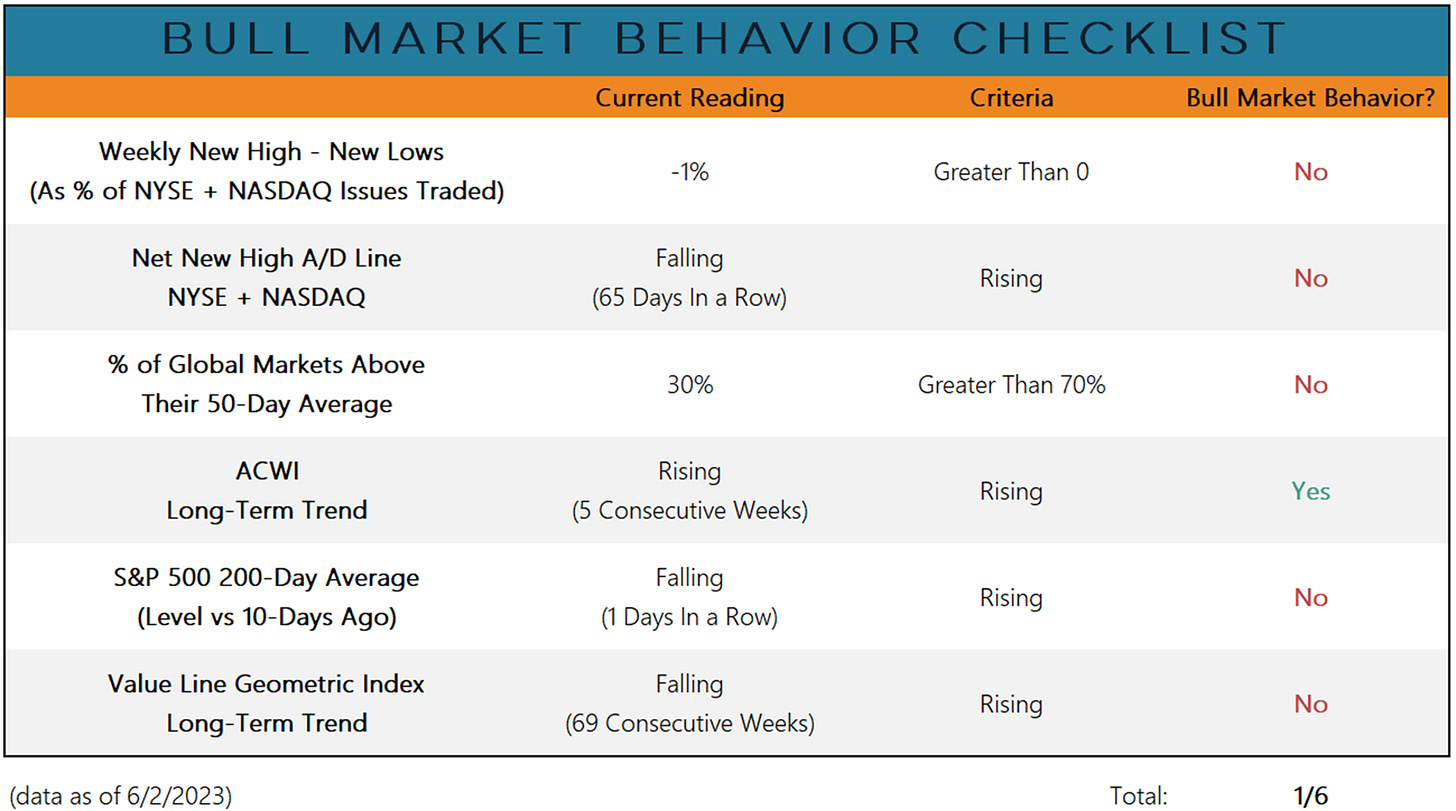

Key Takeaway: Price trends are improving and the cap-weighted indexes are moving toward bull market territory, but a broader look at current conditions suggests we are not seeing bull market behavior.

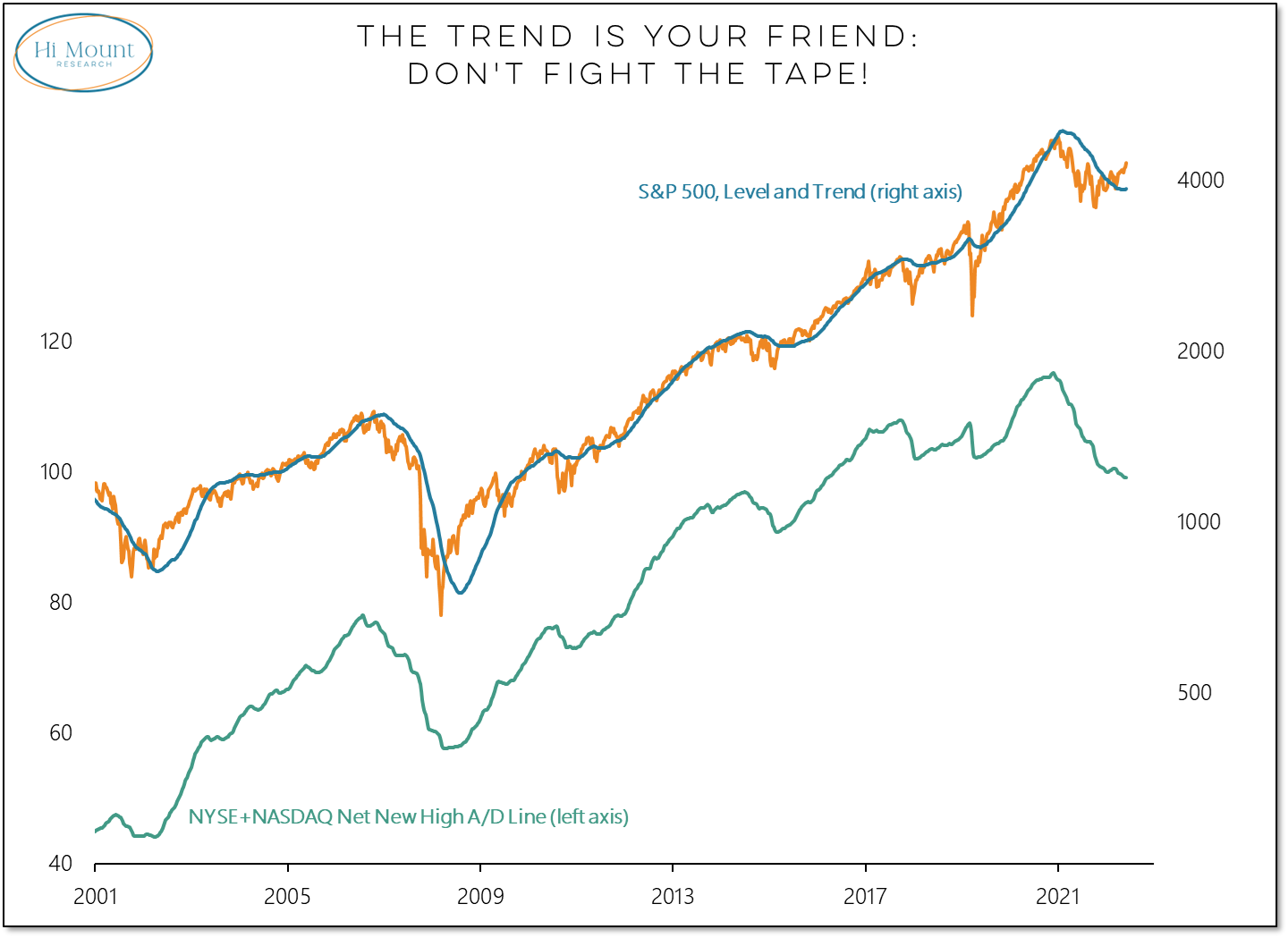

More Context: Our bull market behavior checklist actually deteriorated last week as the 200-day average for the S&P 500 turned lower. While this may be an arithmetic blip (last August's highs have dropped out of the 200-day average calculations), it's consistent with the weight of the evidence. Bull markets tend to see persistent strength and the accumulation of more new highs than new lows, neither of which have been hallmarks of the rally off of the October S&P 500 lows.

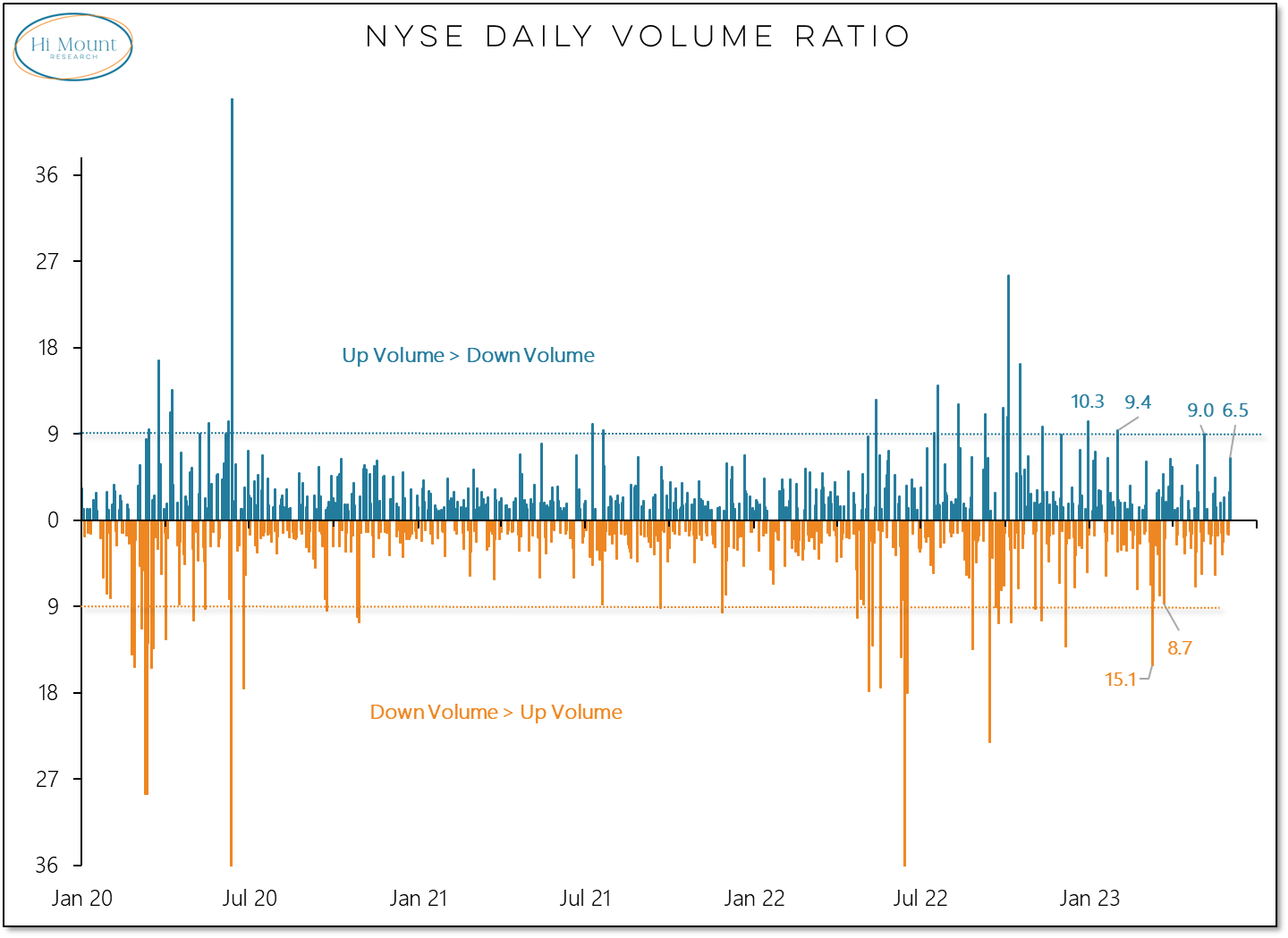

This lack of robustness is was on display last week. More stocks made new lows than new highs for the 13th week in a row and even with Friday's big bounce in small-caps, upside volume was relatively pedestrian and the Value Line Geometric index couldn't even get above 550 (a level it has crossed 65 times in the past 5+ years). Strong moves surge and don't look back. The last year has been all about stopping and starting.

Going Forward: Mega-cap strength has helped equity market indexes turn higher. But breadth has not followed and the tape remains challenging. Our systematic, trend-based asset allocation models have added equity market exposure in recent weeks. The cyclical weight of the evidence has not improved and we continue to hold elevated levels of cash in our discretionary dynamic portfolios.

Dive into the details by downloading our weekly chart pack.

Don’t forget to go to Hi Mount Research and register for your free account.