Is "Getting There" Good Enough

Data moves in increments, while commentary tends toward absolutes. Our challenge is to acknowledge (and adapt to) improvement without overstating strength.

If you have not done so already, please create your Hi Mount Research account to access content on our website.

Market Insights and Portfolio Applications subscribers can access the online version of this report (which includes a link to the chart pack).

Key Takeaway: Breadth improvement over the past week supports a more tactically bullish posture but not enough to overwhelm the persistent cyclical challenges.

More context: Our price-based asset allocation model favors stocks over bonds or commodities. This week's relative strength rankings show increasing leadership from US equities, which now trail only Japan in the global macro rankings.

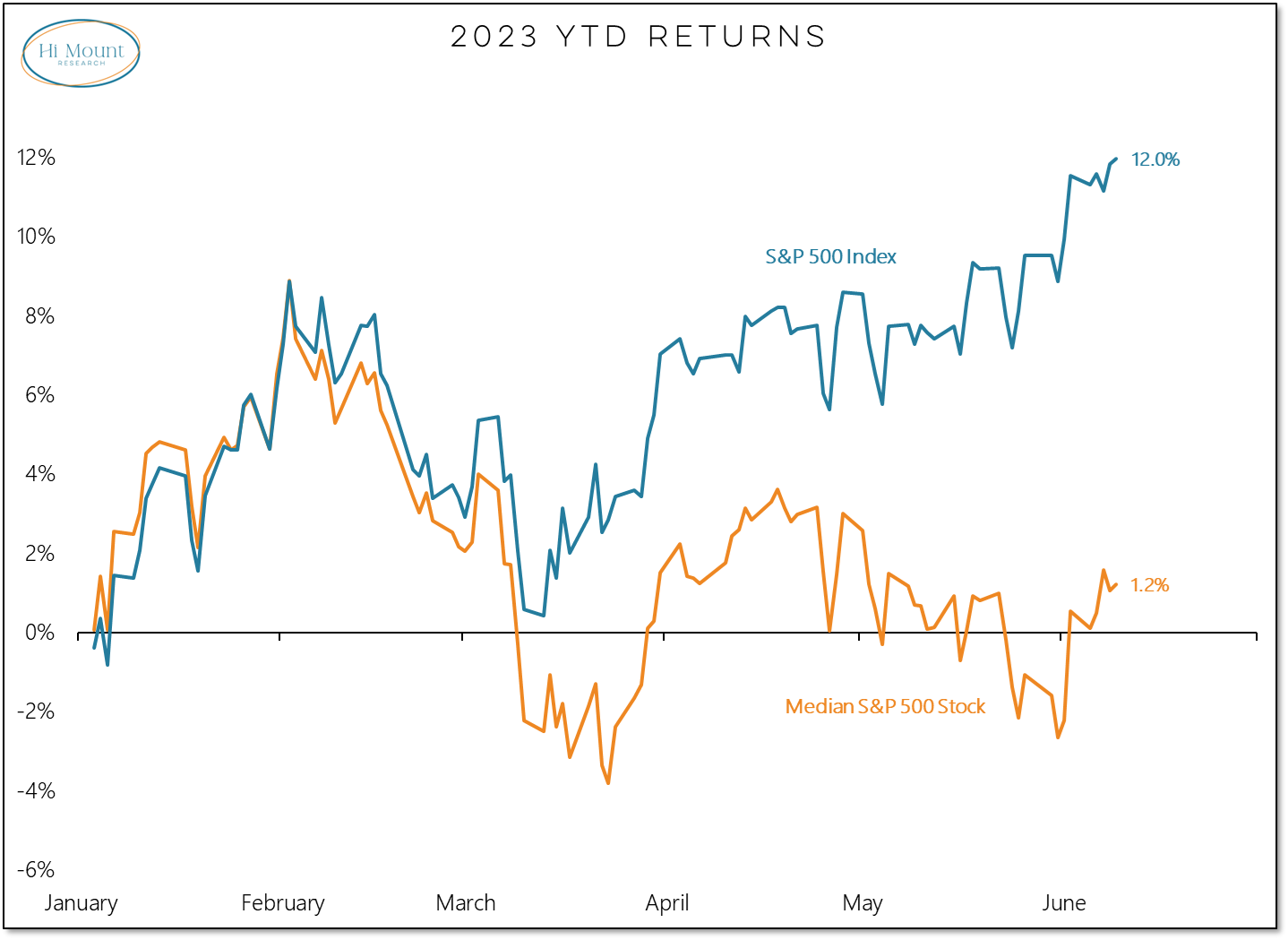

Beneath the surface, new highs exceeded new lows by a wide enough margin last week that the trend in net new highs has turned higher and the median stock in the S&P 500 is now back in positive territory on a year-to-date basis. There still, though, is a gap of more than 10 percentage points between the YTD performance of the index and the median stock (after moving in lock-step over the first two months of the year).

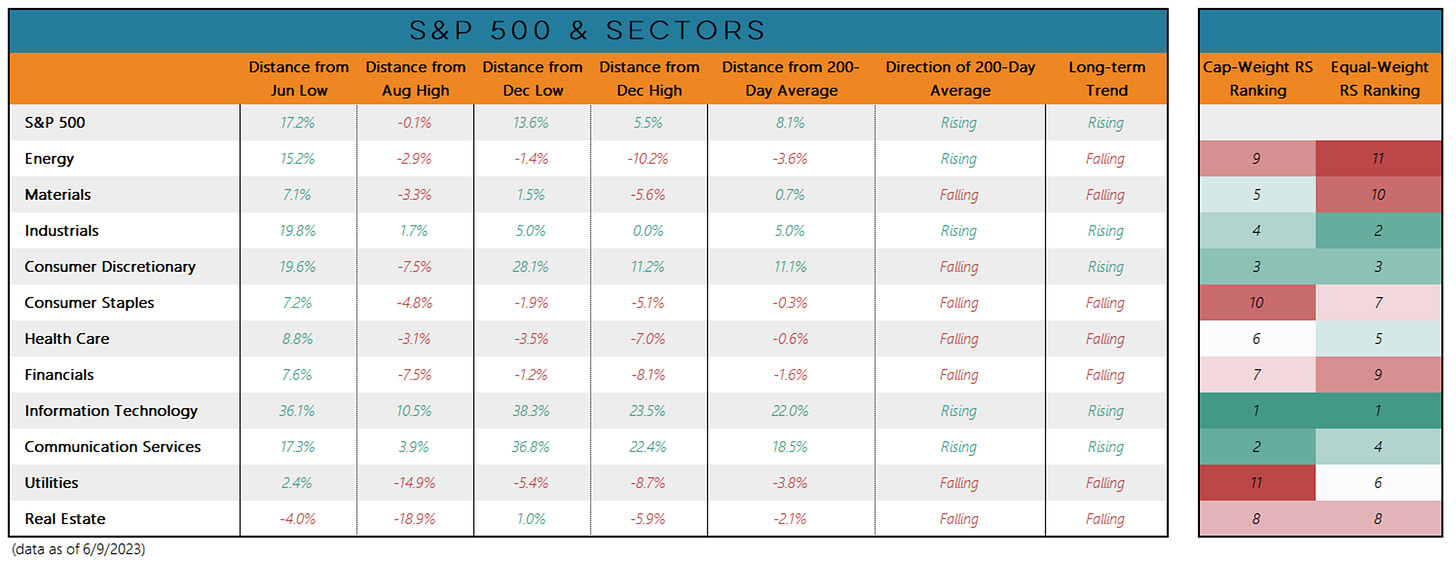

Gains at the index level (the S&P 500 is more than 8% above a now rising 200-day average and is on the cusp of breaking above its August high) have not been confirmed with sustained strength at the sector level. Only three sectors are above their August highs and fewer sectors are above their 200-day averages now than a month ago. Going back to 1999, when 200-day average for the S&P 500 has been rising, 9 of 11 sectors on average have been above their own 200-day averages. Currently, it's just 5.

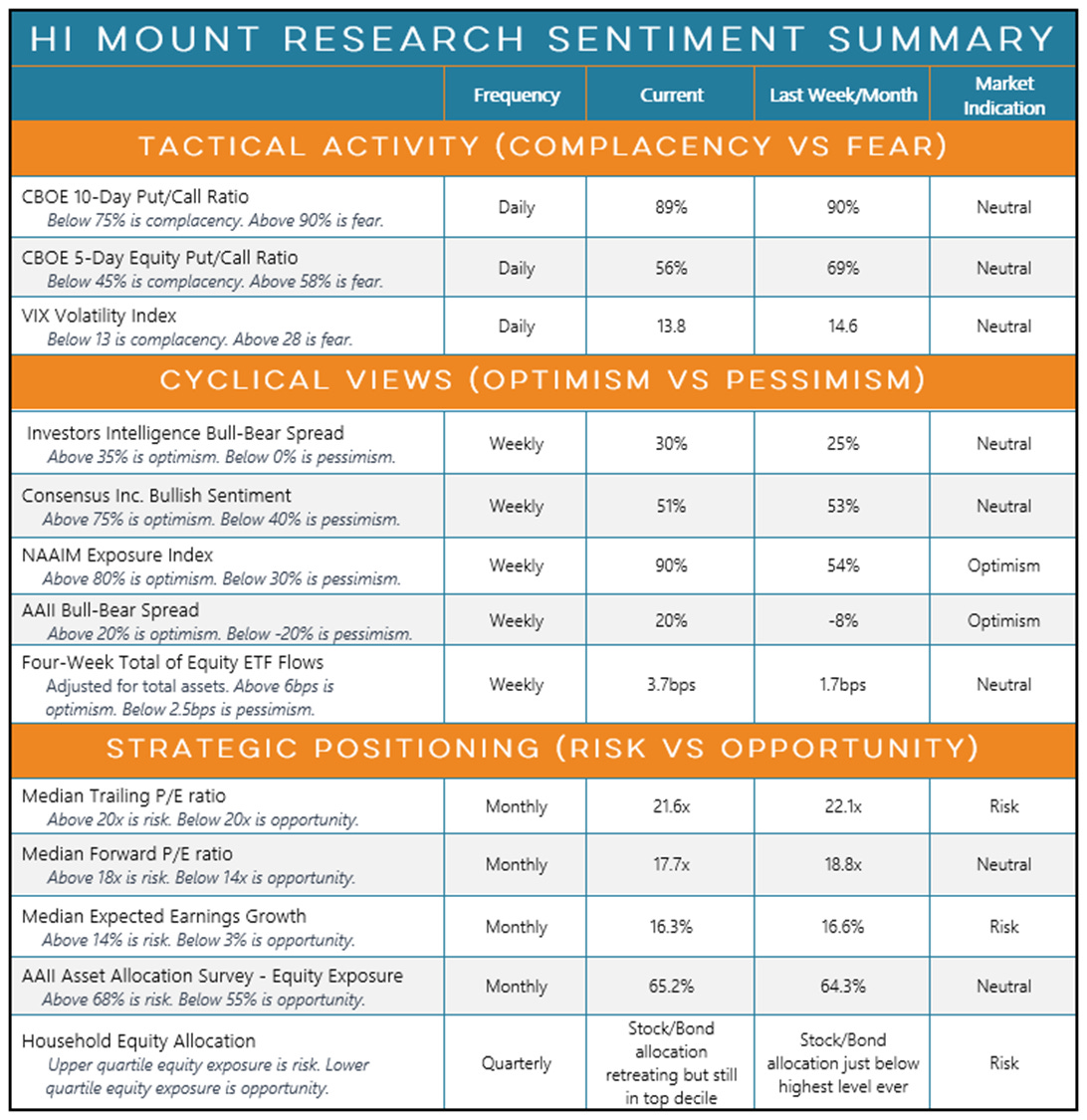

Investors have finally embraced the rally and after a period of persistent pessimism look like they are ready to dance with the bulls. So far, we don't see dangerous levels of complacency from either a tactical or cyclical perspective. With the secular positioning indicators continuing to show that stocks are neither cheap nor underowned, equity market upside from this bloom in optimism could be limited.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.