Investors Remain Bullish

Optimism fuels strength and strength fuels optimism - that cycle is still intact

Portfolio Applications subscriber note: The December updates to the systematic Blue Heron portfolios are available. Key changes: Global equity trends are struggling while in the US, Technology continues to fade and small-caps are ascendent.

Key Takeaway: Last week’s dip in bulls on the AAII survey appears to be an outlier. A broader look at sentiment (and asset allocation data) shows that investors remain optimistic. Sentiment is elevated, but risks increase after bulls head for the exits in a meaningful way.

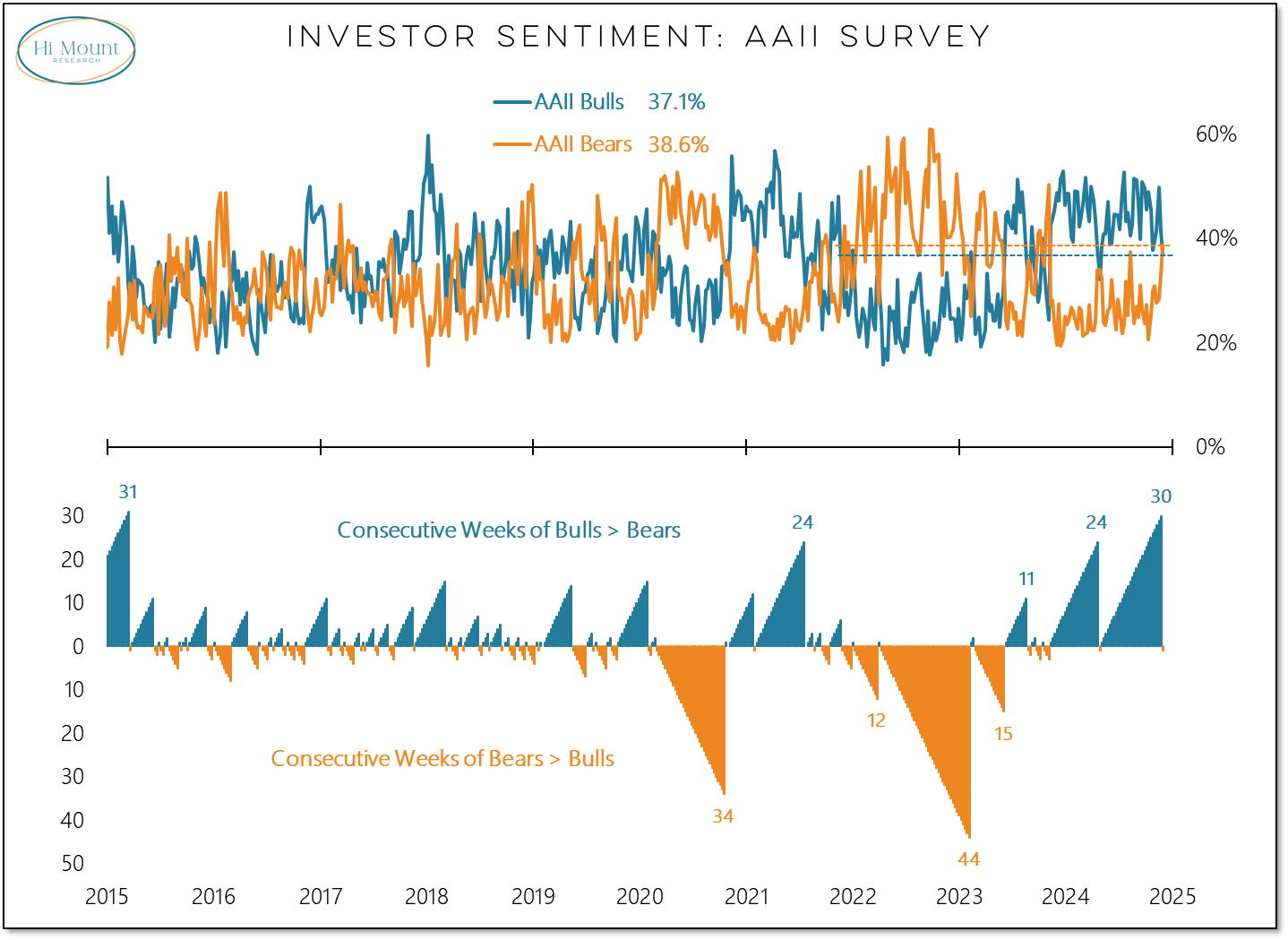

After 30 consecutive weeks of Bulls > Bears (the longest stretch in nearly a decade), Bears eclipsed Bulls on the AAII survey last week.

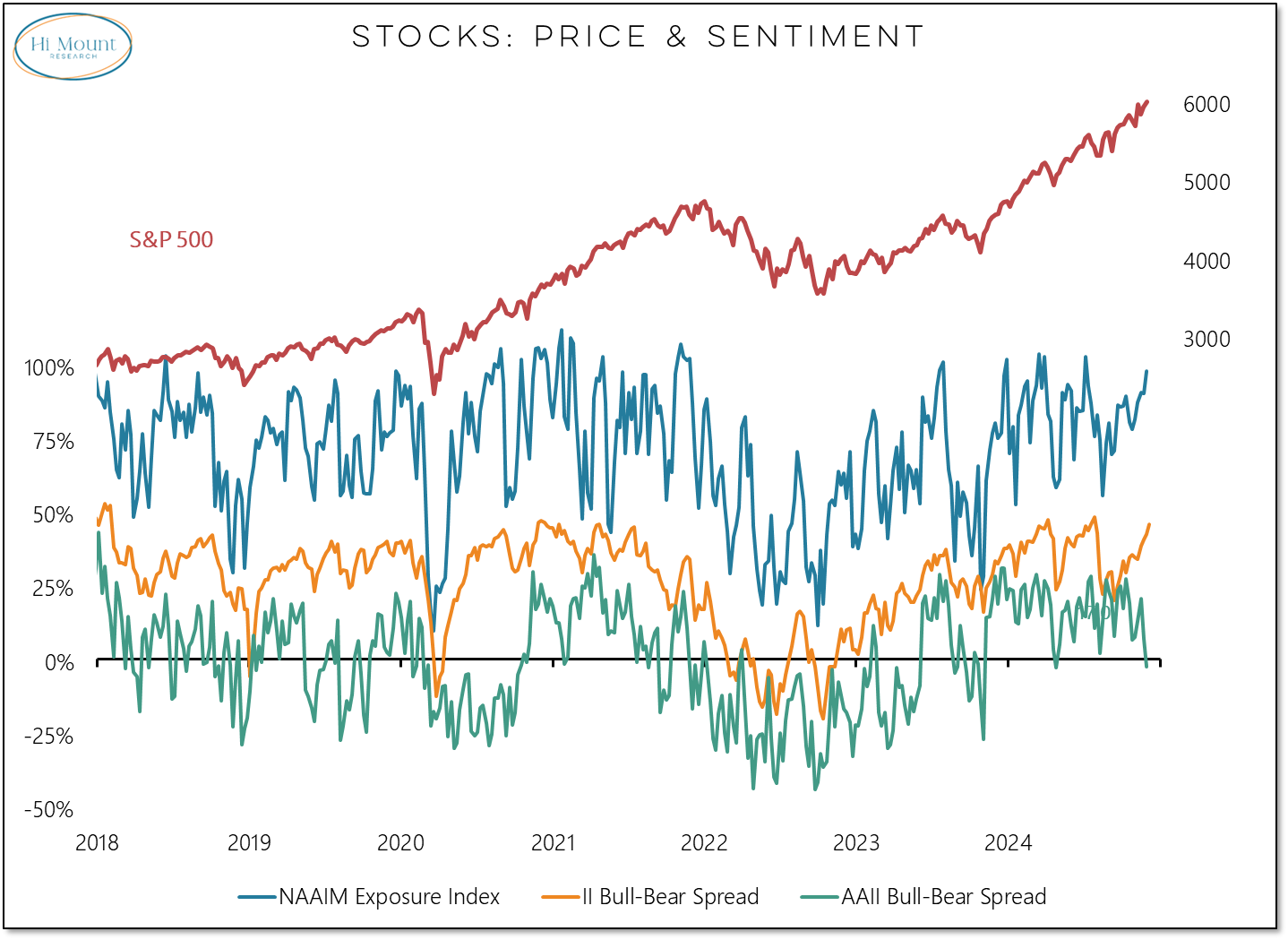

While the AAII survey hinted at a shift in tone among investors, other data (from Investors Intelligence and NAAIM) showed that optimism remained elevated.

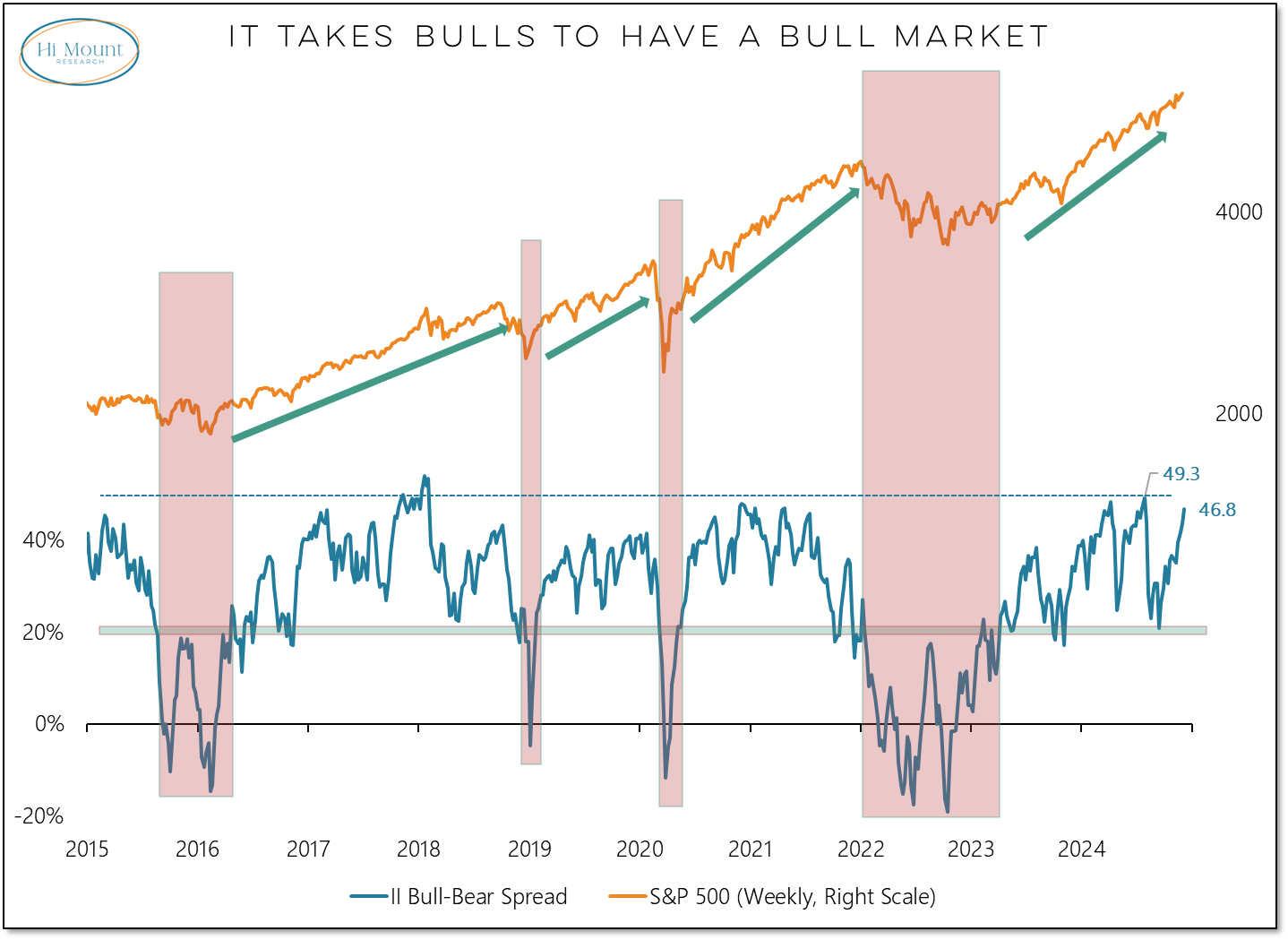

That was confirmed this week with the latest II data showing a continued expansion in optimism (bulls rose to 62.9%, bears dropped to 16.1% and the bull-bear spread is approaching its early 2024 peak). While excessive optimism gets presented as a risk, we actually need bulls to have a bull market. All the net gains for the S&P 500 over the past decade have been accompanied by a bull-bear spread of 20% or higher. Cyclical risks rise when optimism sours.

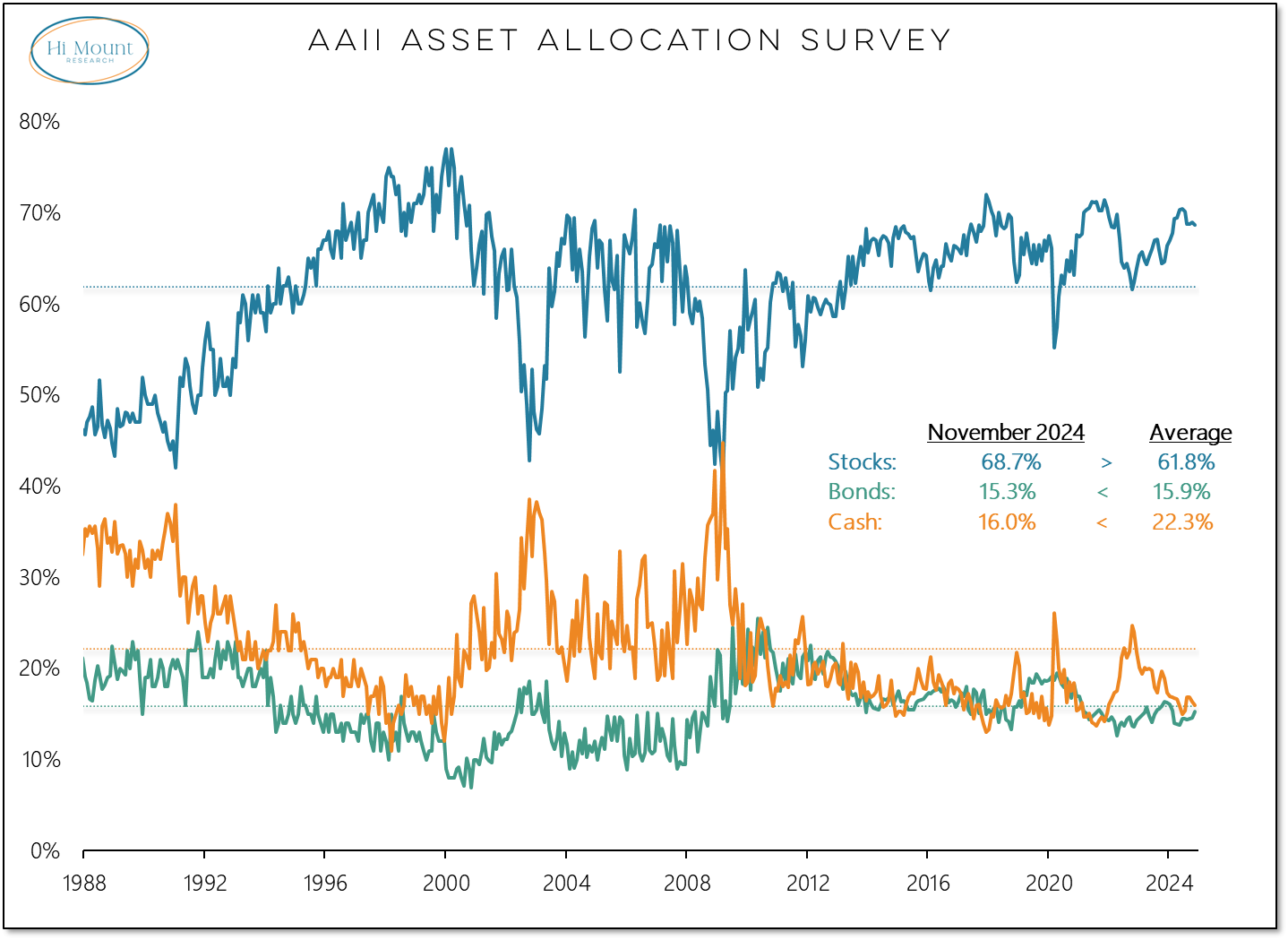

The November AAII Asset Allocation data shows that individual investors remain engaged with equities. While this is supportive of continued cyclical strength, elevated equity exposure now suggests longer-term equity market returns are likely to be muted.