Investors Find Reasons To Celebrate

Excessive optimism increases risks of disappointment and return of noisy markets

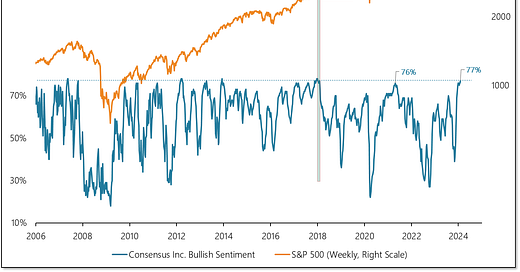

What: Optimism has surged to new cycle highs. The Investors Intelligence bull-bear spread has risen to its highest level since the summer of 2021 while Consensus Bulls* this week reached a new 6-year high.

So what: Whether its hopes of a dovish pivot from the Fed or surging trend strength around the world, investors have found reasons to celebrate. While rising optimism can be a tailwind for stocks, the path higher becomes more challenging once investors are all in. The last time Consensus Bulls were as high as they are now, the S&P 500 proceeded to churn sideways for 18 months.

Now what: When optimism is this extreme, it doesn’t take much by way of bad news to rattle investors nerves. For now, strong breadth and improving momentum at the sector level provide a bulwark against these extreme sentiment readings. If those trends roll-over or we see significant deterioration in our Bull Market Behavior Checklist, a noisy market and a disappointment fueled sell-off could move from risk to reality.

*I find value in the Consensus data for two main reasons: it is less widely followed and is more stable on a week to week basis than other more popular sentiment surveys (e.g. NAAIM, II, AAII).