Investors Can't Quit

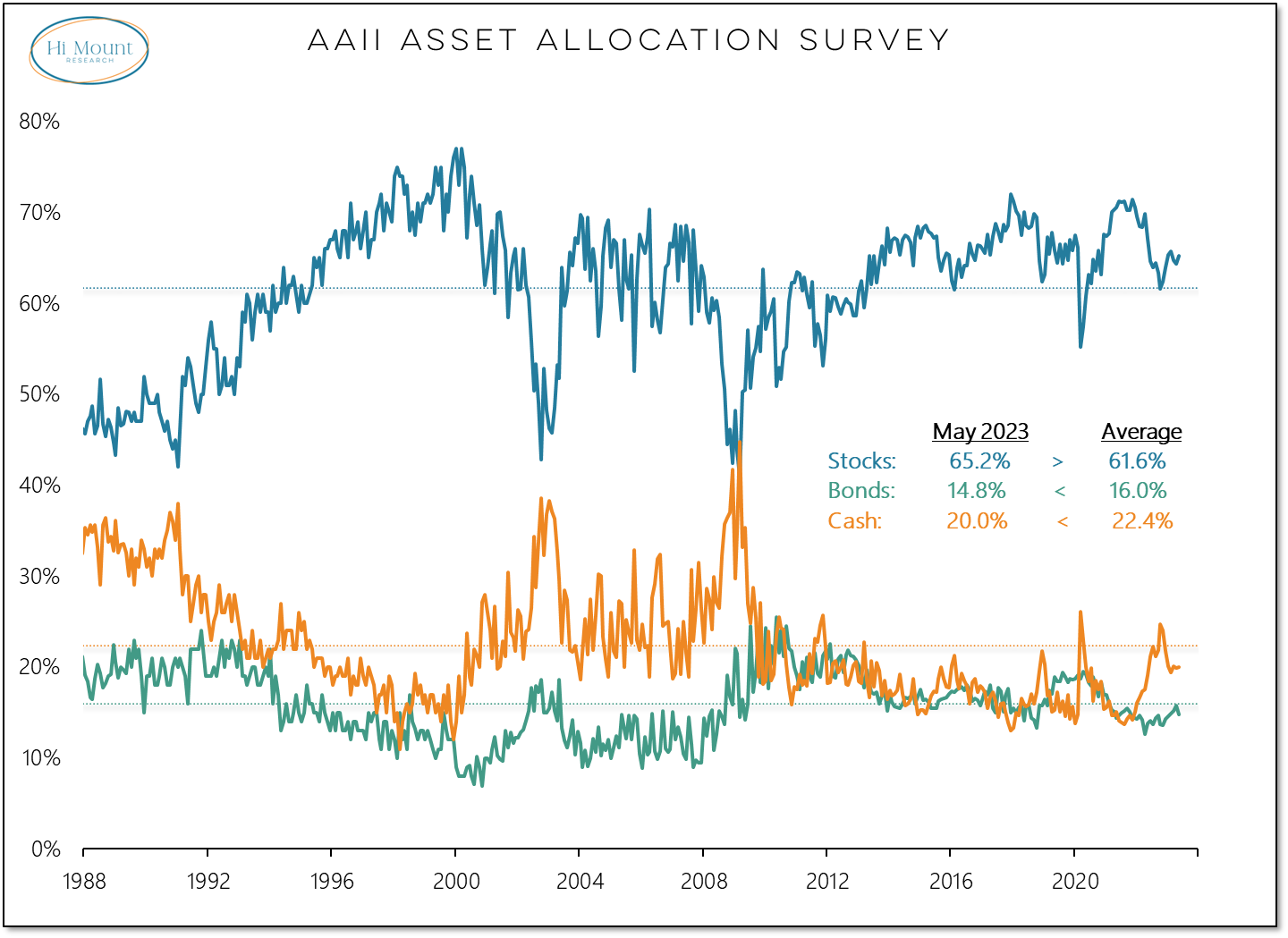

Pessimism, volatility, and reasonable alternatives all notwithstanding, investors continue to hold above average exposure to equities

Key Takeaway: Sentiment surveys point to pessimism, but positioning data from the AAII reveals that equity exposure is historically high and ticking higher.

More Context: From valuation perspective, bonds are their most attractive relative to stocks in more than 20 years. That hasn't kept investors from keeping their stock exposure above average and thumbing their collective nose at bonds. For all the persistent pessimism that is so widely reported, cash exposure is below average. Moving from TINA (There Is No Alternative) to TARA (There Are Reasonable Alternatives) has not meaningfully impacted how investors are positioned. Investors not abandoning equities has helped stock prices in the here and now, but the heavy tilt toward stocks and away from bonds suggests the path forward for equity market returns could be rocky.

Note: The Hi Mount Research website is now live. Check out what we have to offer and while there register for access to our free content.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.