Inflation Fight Far From Over

Transitory disinflation is a headache for the Fed (and anyone banking on lower interest rates)

Note for subscribers: We have published updates to our Systematic ETF Portfolios (Blue Heron Sticks With Commodities, Adds Energy) and Sentiment Scorecard (Bulls Bring A Bull Market But Add To Secular Risks). Follow the links above to skip directly to those reports or check out the summaries after the break below. If you are ready to upgrade your access, let’s talk.

Today’s main event in the market was the release of the March Consumer Price Index data. . .

Key Takeaway: Inflation not doing what the Fed wanted it to do, so the Fed is not likely to do what the market wants it to do.

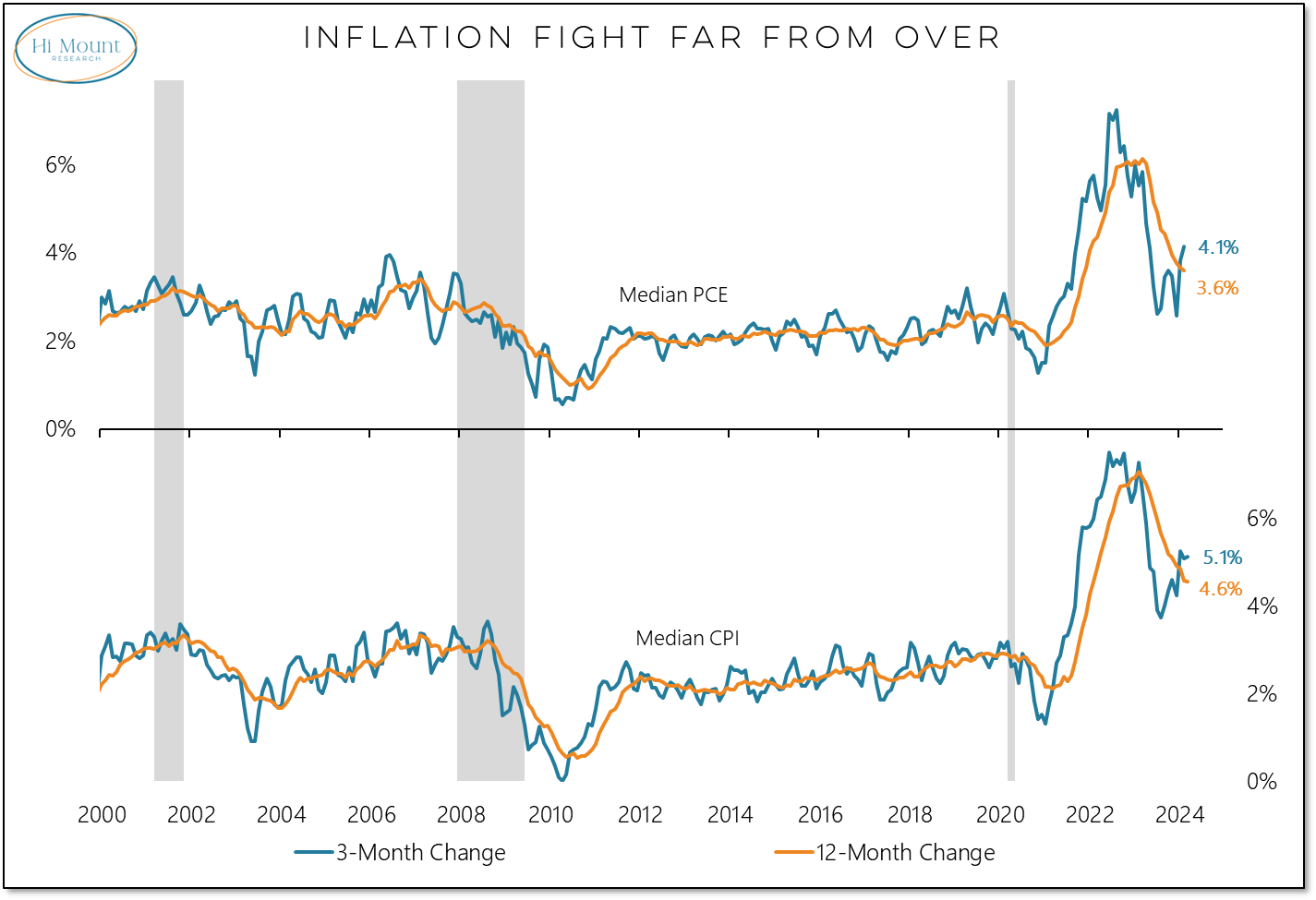

Taking apart and then re-constituting the CPI into a series of your liking is a parlor game among strategists and economists. Rather than adding this and subtracting that, I like to lean on the work done by researchers at the Cleveland Fed. Median inflation measures have been shown, over multiple cycles to do an exemplary job of tuning out the noise when it comes to inflation. The message from this data (through March for CPI, through February for PCE) is that dis-inflation was transitory. Even at its recent lows, inflation was still hotter than the peak from the previous decade.

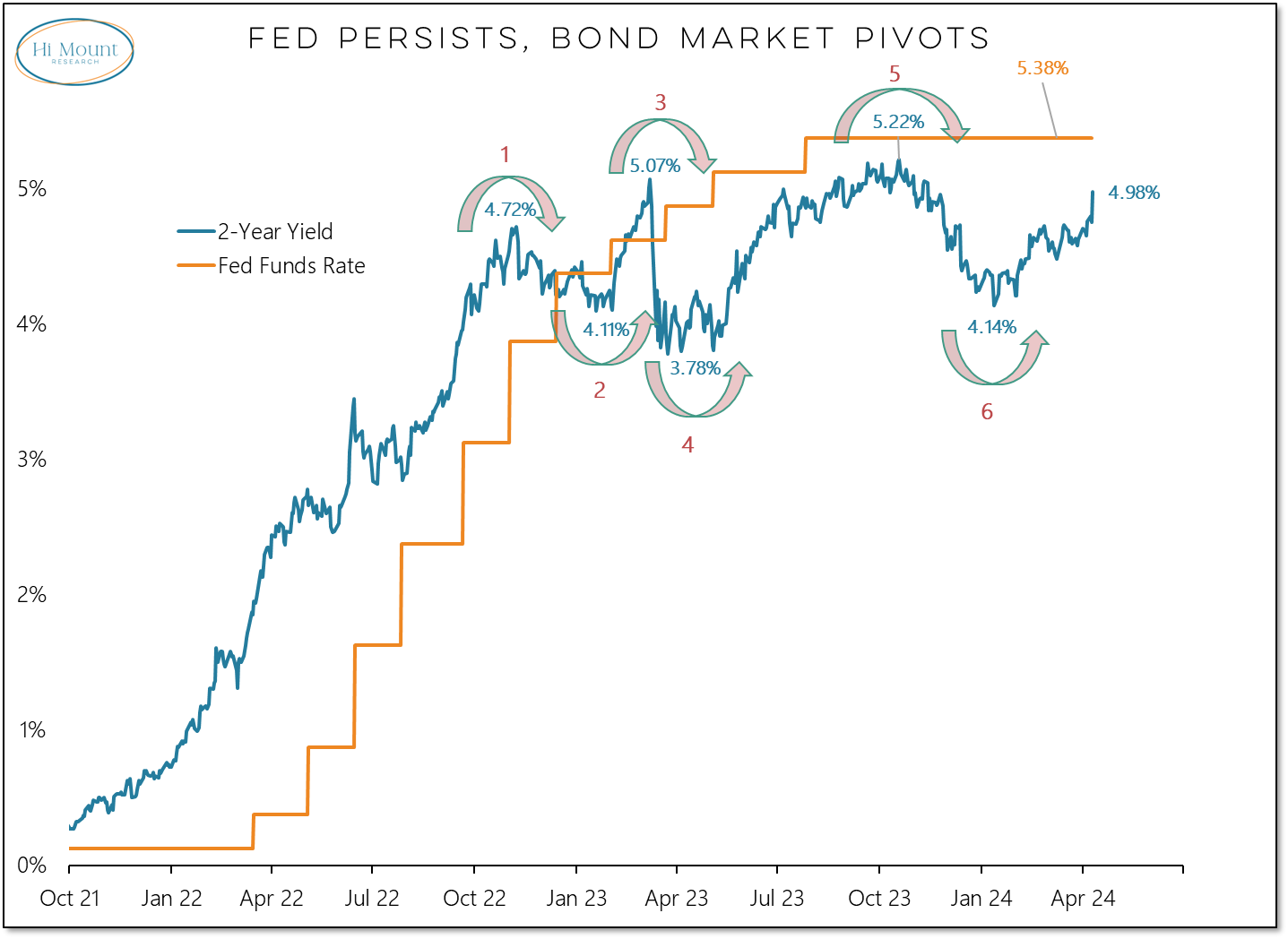

Inflation that won’t die complicates the Fed’s job. It has signaled that it expects to to cut rates at some point this year. The market has been looking for the Fed to pivot on rates for over a year now. The inflation data received so far in 2024 almost certainly delays the timing and reduces the scale of any such easing. So while the Fed persists (the “average time between the final hike and first cut” calculations may not carry much water this cycle), the market is pivoting again.

For those of us of a certain generation, the comparison between the market and Ross trying to get a couch up the stairs is inescapable.

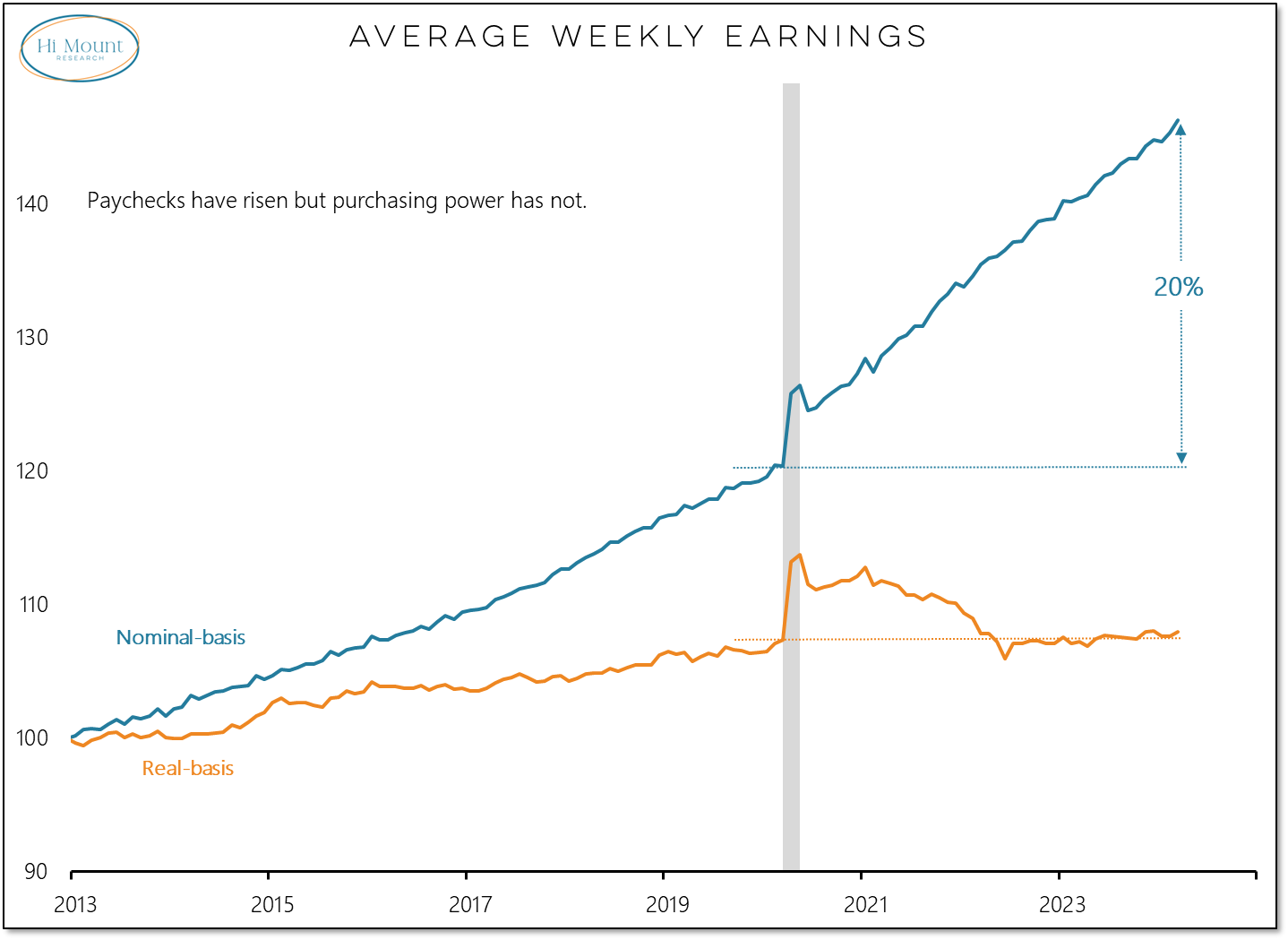

Persistent inflation is not just a financial market conundrum. It is weighing on the real economy. Nominal wages have soared in recent years, but the purchasing power of the weekly paycheck is stuck in the mud. When adjusted for inflation, weekly earnings have gone nowhere for months and are no higher than they were prior to COVID. Maybe that helps explain why the national mood is so dour.

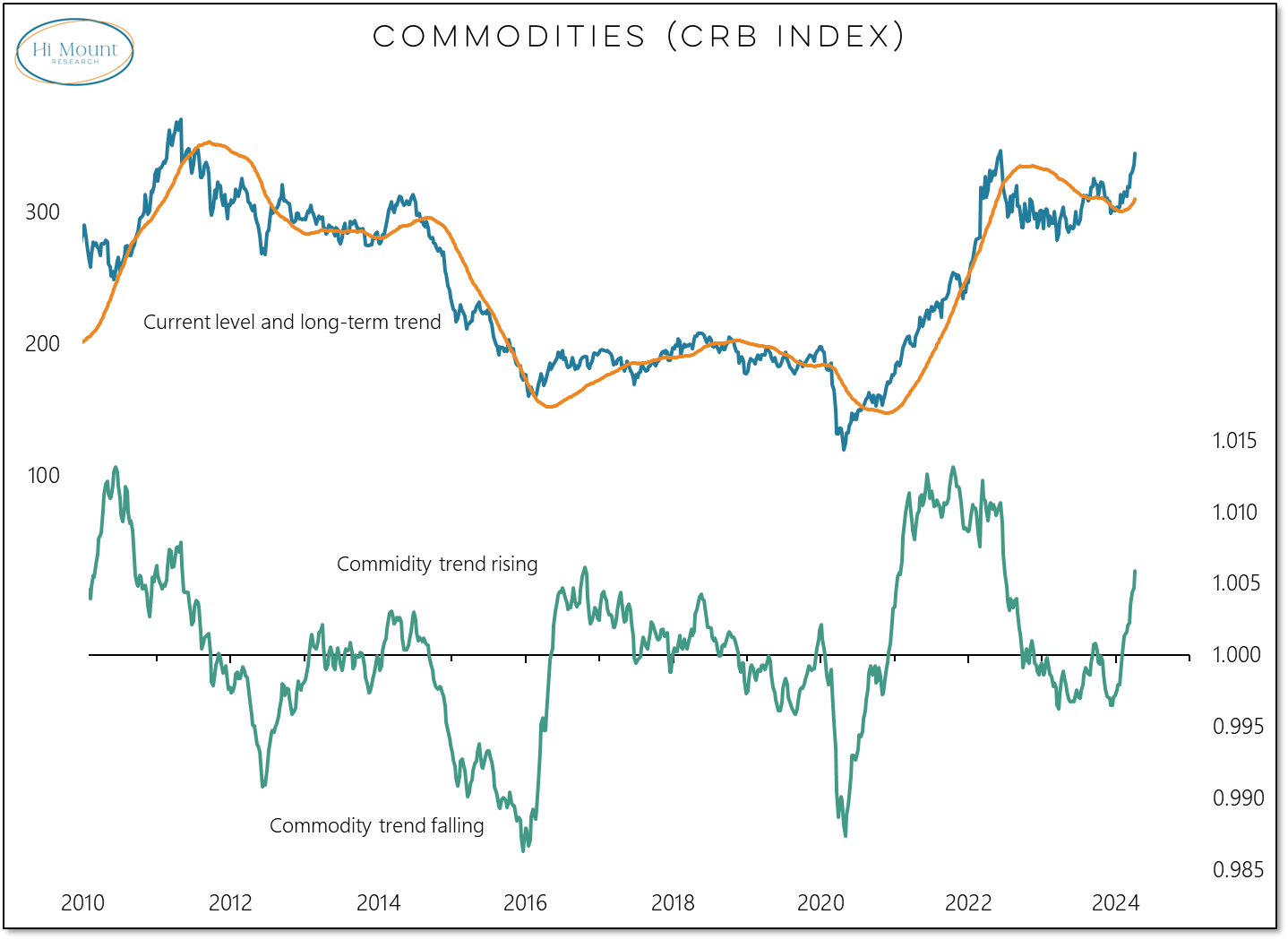

Turning back to investments . . . while many portfolios are locked into a stocks vs bonds dichotomy, commodities get overlooked and are excluded from the conversation.

As it turns out, I had a chance to talk about commodities and sentiment and more earlier this week in a conversation with Chuck Jaffe for his Money Life Show podcast.

Speaking of sentiment, our latest scorecard shows widespread optimism from a cyclical perspective to go with over-exposure and excessive valuations from a secular perspective.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.