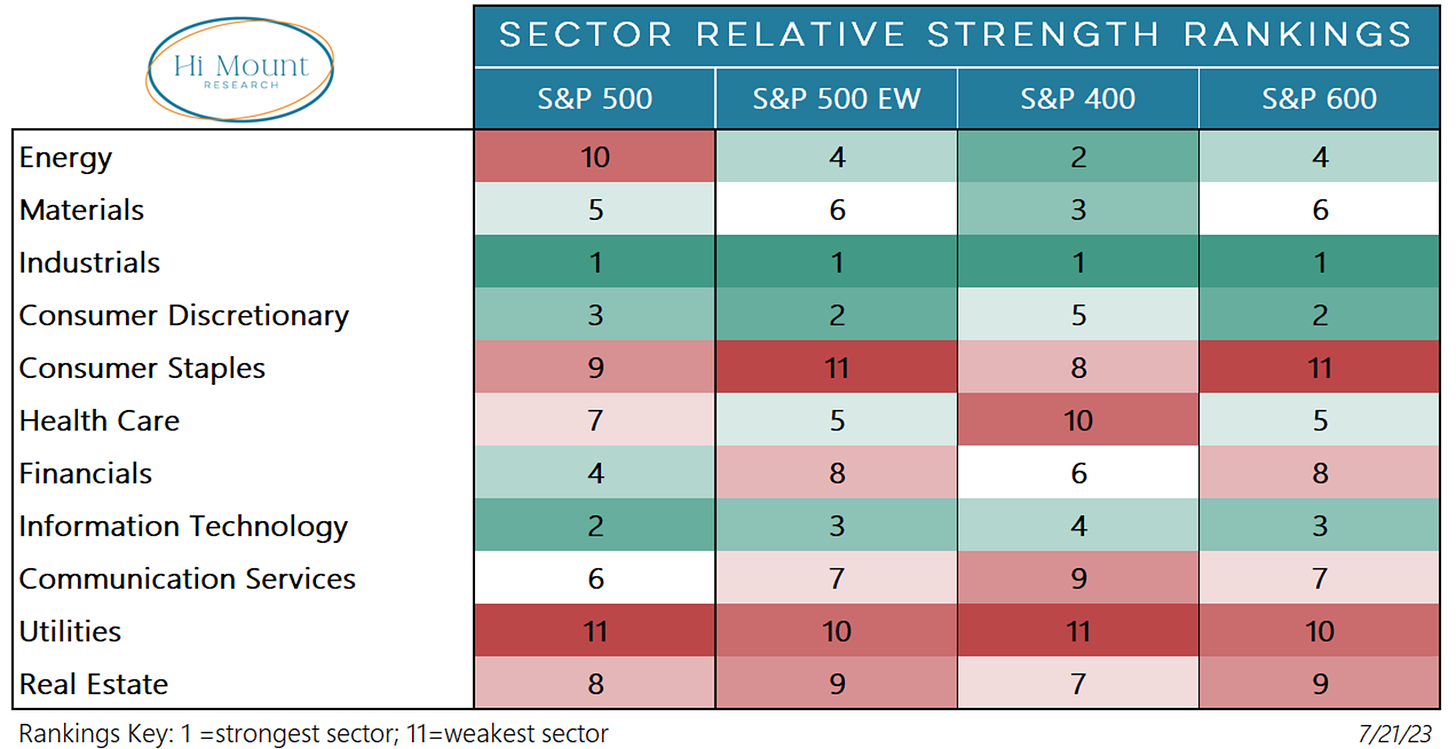

Industrials Leading The Way As US Gains Strength

Leadership from Industrials is evidence of broad participation

Ready to learn more about Hi Mount Research? Register for your free online access to our website and then ask for a chance to preview subscriber-only content.

Key Takeaway: Industrials are the top-ranked sector across all capitalization levels.

More Context: They aren't just showing relative leadership, but across the board the Industrials sector indexes reached new 52-week highs last week. Leadership from Industrials is particularly encouraging because it requires broad participation. The top holding in the Industrials only accounts for 4% of the index. No other large-cap sector has a top holding with a weighting of less than 9%, and in five sectors the top holding has a weighting of more than 20%.

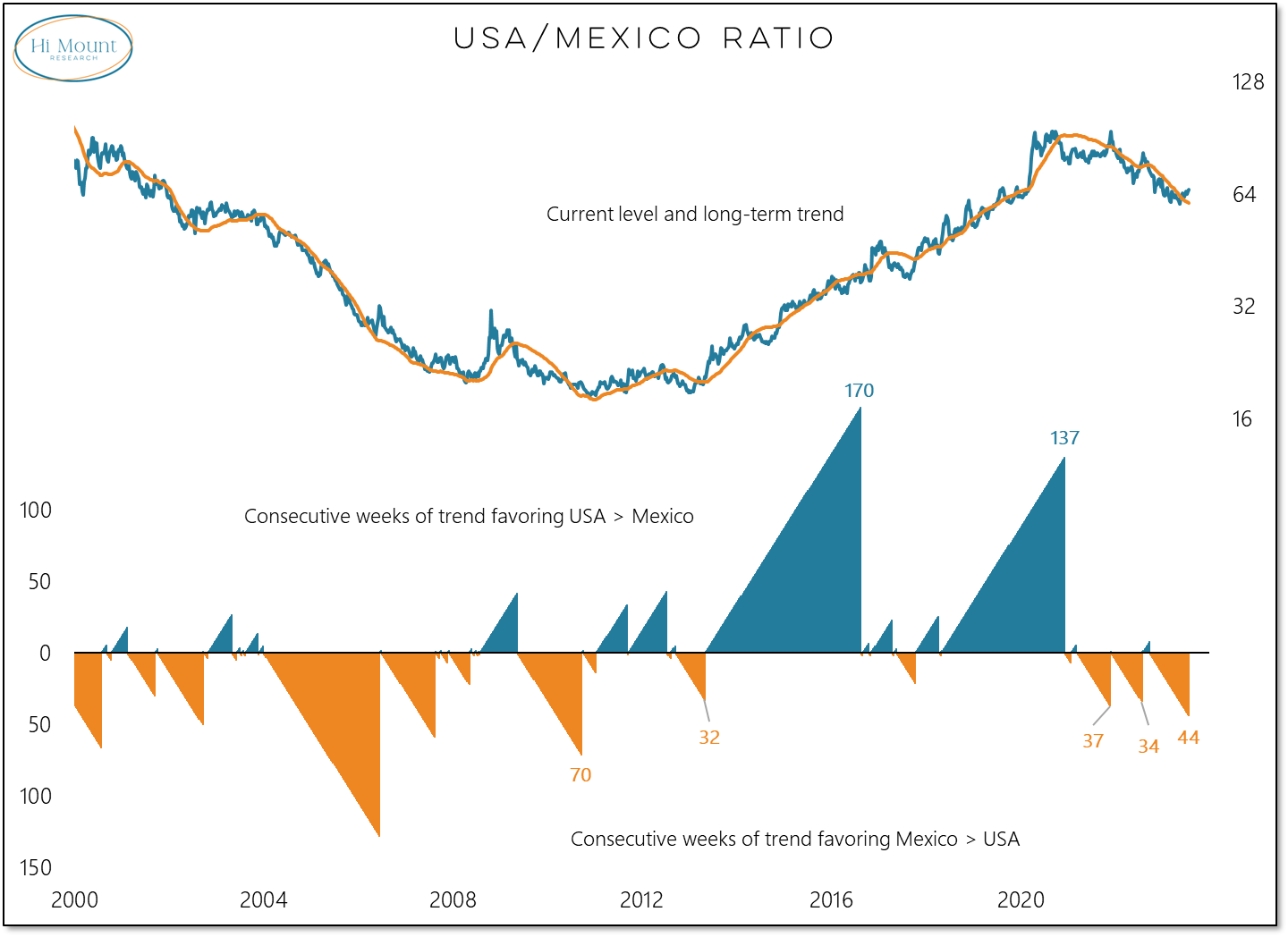

From a global relative strength perspective, the US has climbed into the top ten world markets over the past month after spending most of the year struggling just to be in the top half. While there are other specific areas of the world that are stronger than the US, the trend in the ratio between the US and the rest of the world has turned back in favor of the US. The last decade featured several extended runs (100+ weeks) in favor of US leadership. I doubt this latest turn toward the US will have the same staying power. A good individual test case may be the trend in the US versus Mexico. Mexico relative strength has cooled in recent weeks, but the long-term trend has not turned back in favor of the US.

Portfolio Applications subscribers can keep reading our latest Relative Strength Rankings and Asset Allocation Model reports.