Improving Liquidity & Excessive Optimism

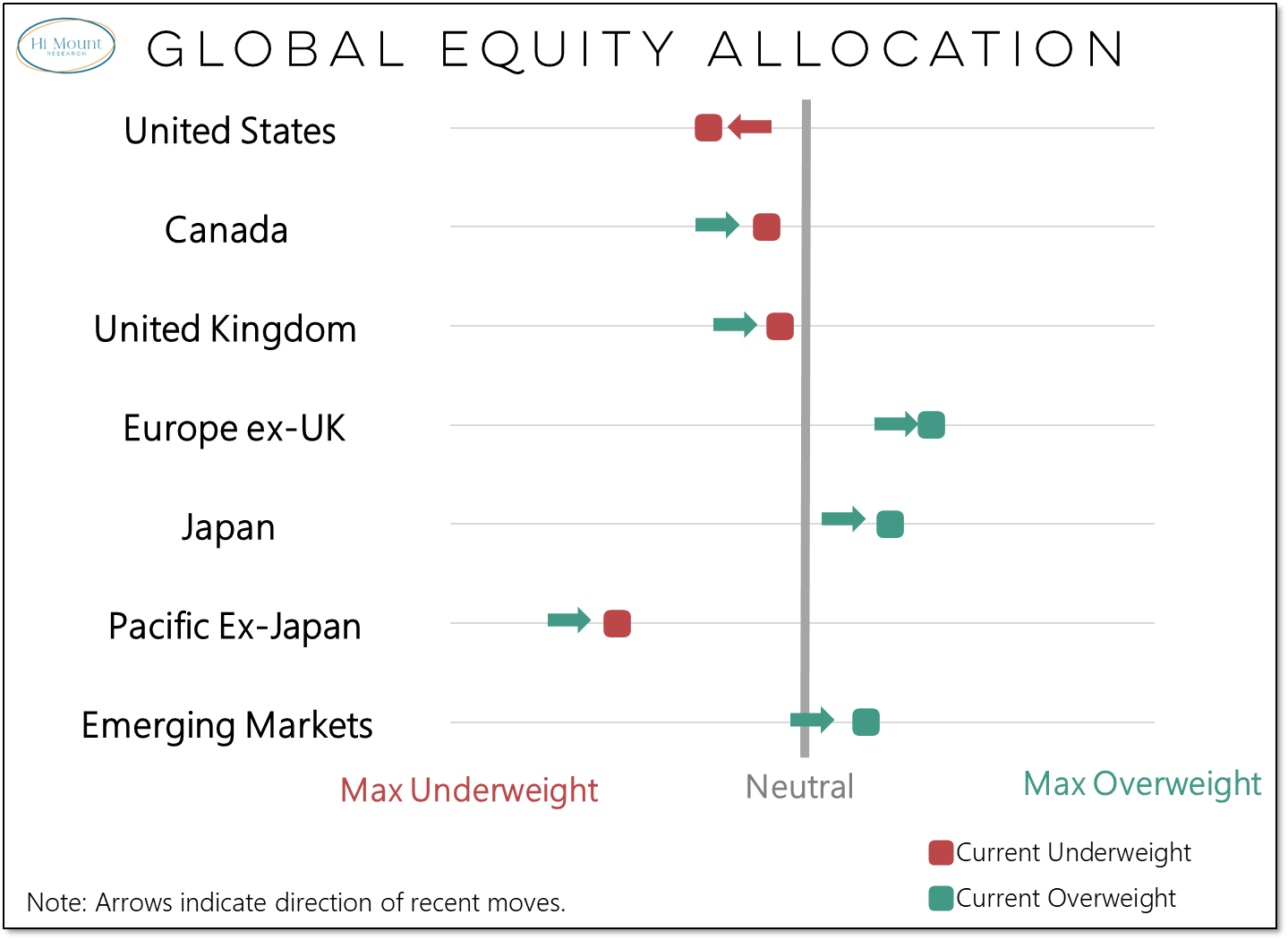

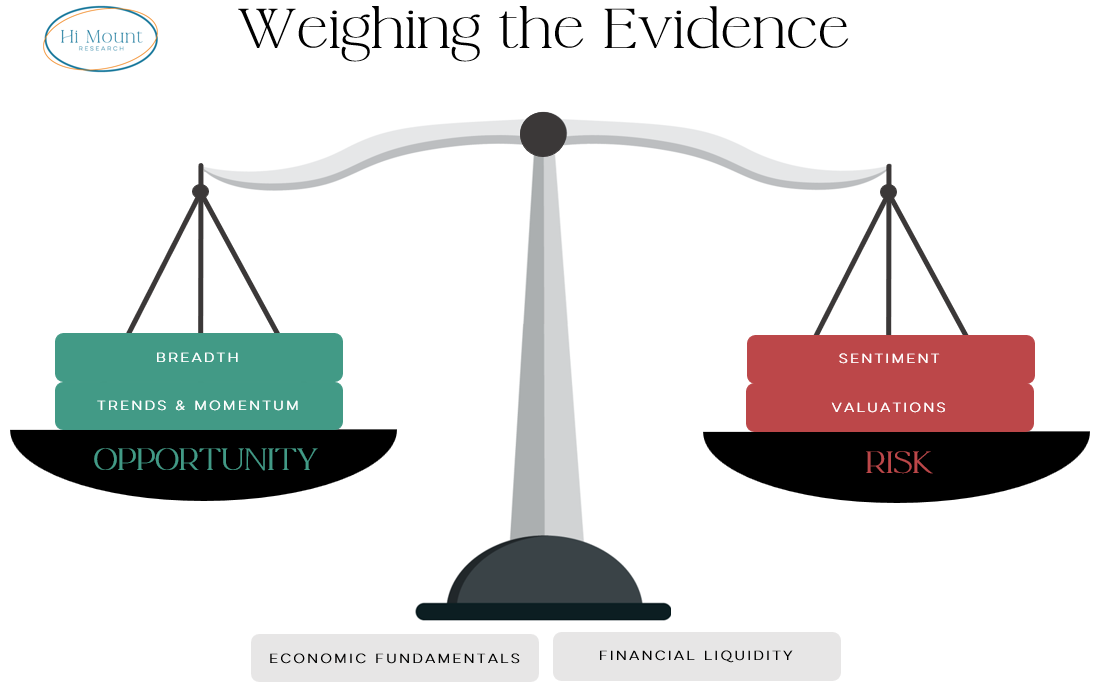

The weight of the evidence remains balanced between Opportunity & Risk while our trend following models continue to shun commodities while shifting equity exposure overseas

Note to Portfolio Applications Subscribers: The January update to the Systematic Blue Heron Model Portfolios (including the introduction of a new rules-based Sector Rotation Model) is now available. Click here to go directly to that report or see the summary table at the bottom of this report.

The Weight of the Evidence remains balanced as Financial Liquidity improves to Neutral and Sentiment drops to Bearish:

Key Takeaway: Bond yield momentum rolling over has led to improving financial market liquidity. This is offset by excessive investor optimism and other sentiment headwinds. Market breadth is strong and supportive, but stocks are neither unloved nor underowned.

More details below. . .

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.