Improving Liquidity Adds To Favorable Backdrop For Stocks

Breadth thrust regime has helped stocks surge to new highs

More than half the countries in the world made new highs in August.

Within the US the number of stocks making new highs has climbed to its highest level of the year (more on this in the details below) and the percentage of stocks in uptrends continues to expand.

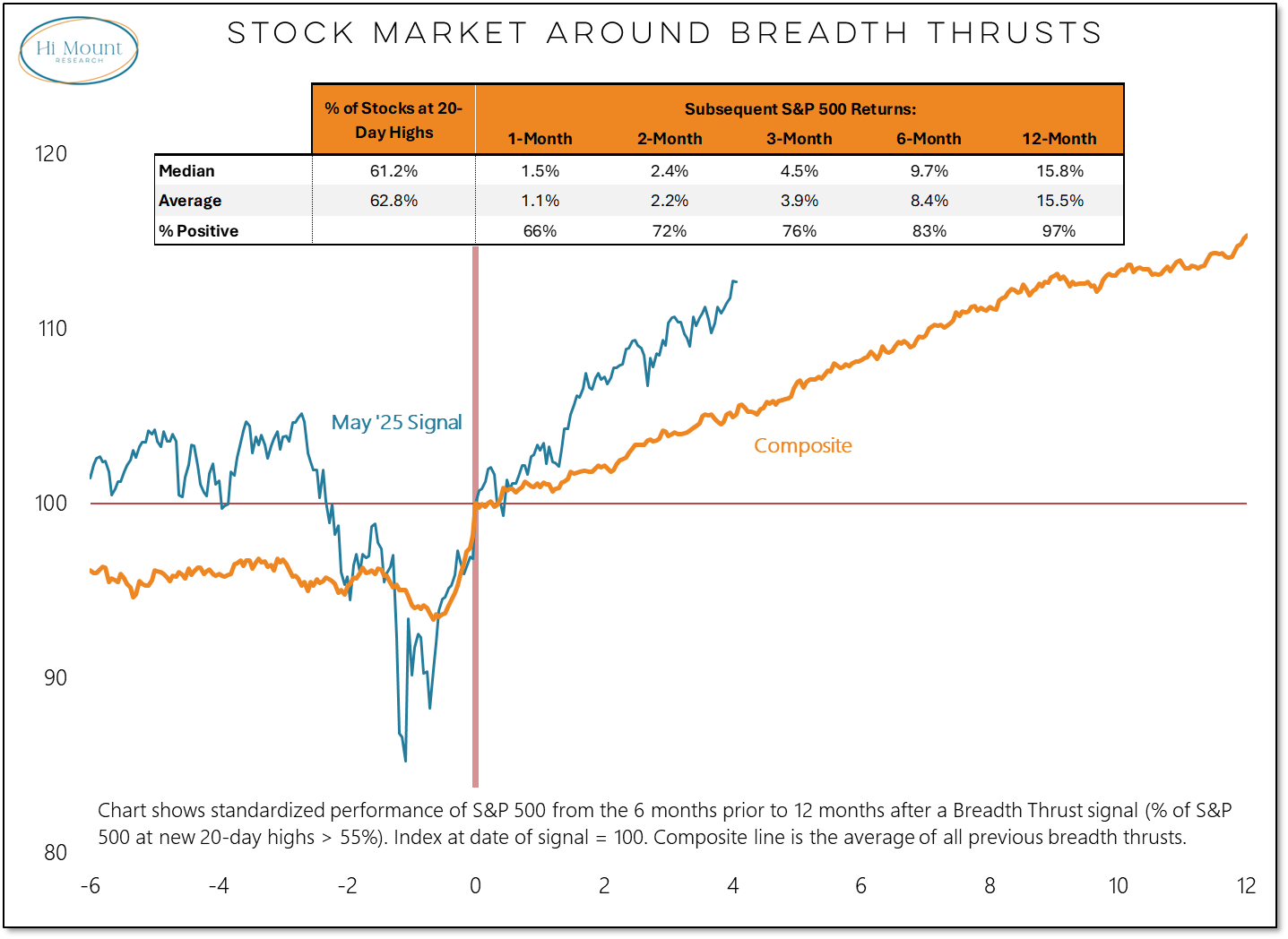

While every market cycle has its own unique contours, a consistent theme across time is that stocks tend to experience sustained rallies and limited drawdowns in the wake of the Breadth Thrusts.

We are four months removed from the most recent Breadth Thrust (in mid-May) and this cycle is following the historical pattern.

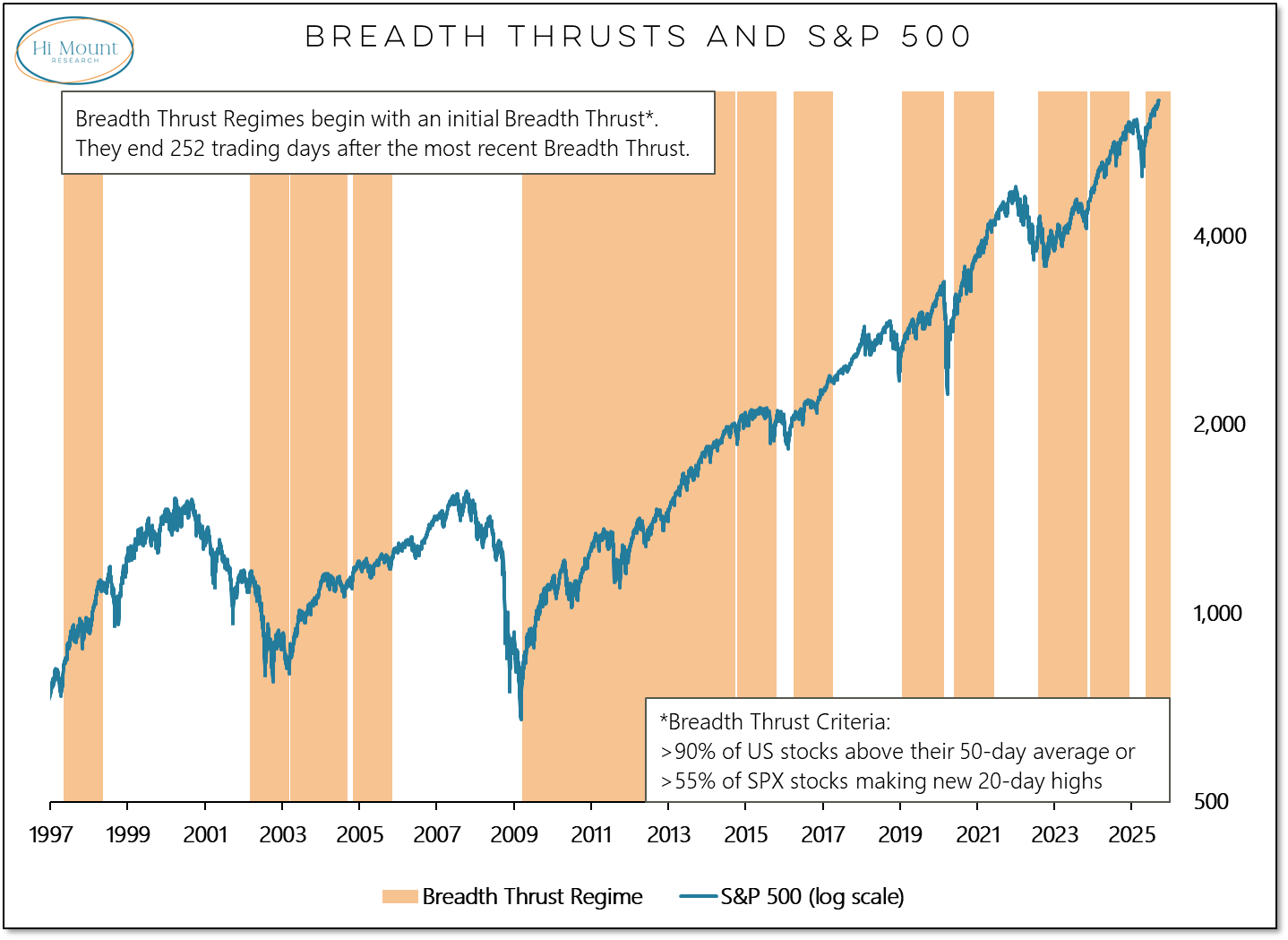

Breadth Thrust Regimes follow in the wake of Breadth Thrusts and it is historically rare for stocks to run into sustained trouble during Breadth Thrust Regimes (especially in periods when the S&P 500 is also making new highs). The current Breadth Thrust Regime is only four months old and will be active until May 2026.

It may not be entirely obvious from the above chart alone, but all of the net gains for the S&P 500 over the past quarter century have occurred during Breadth Thrust Regimes.

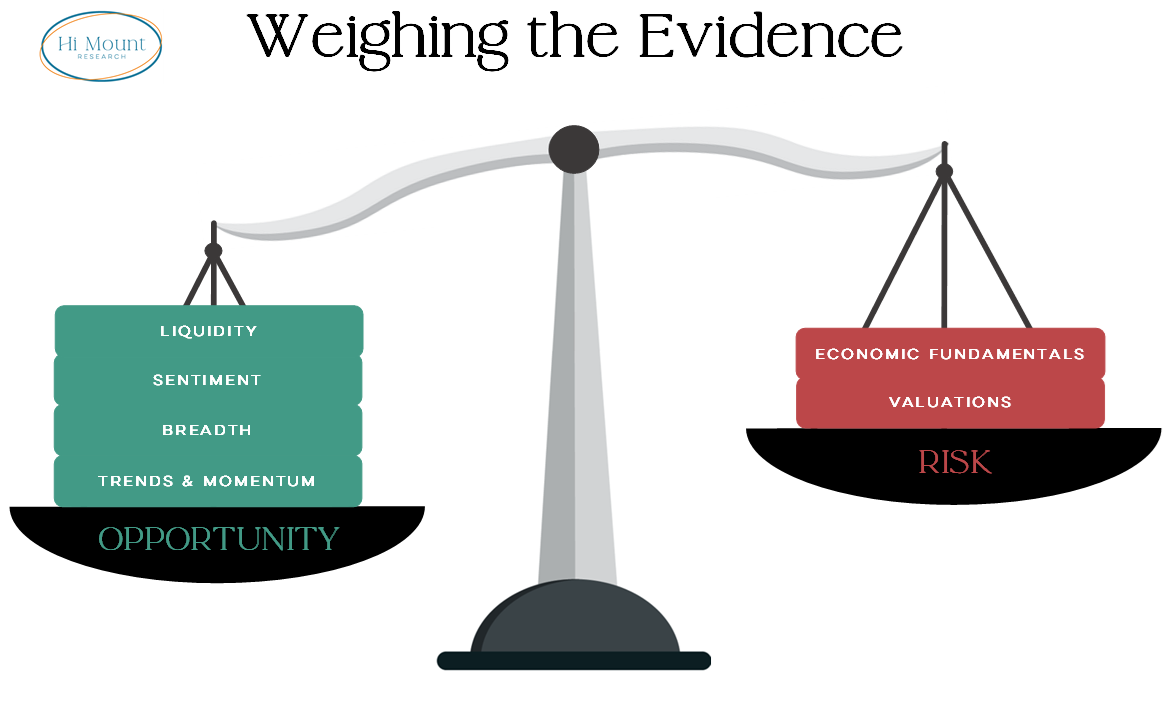

The breadth backdrop is only one factor in our consideration of the Weight of the Evidence. The overall evidence has turned more bullish this month as Liquidity has been added to the Opportunity side of the scales (i.e. moved from Neutral to Bullish).

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.