Gold Gains As Volatility Pierces Quiet Strength

Commodities are forcing a conversation about their place in portfolios

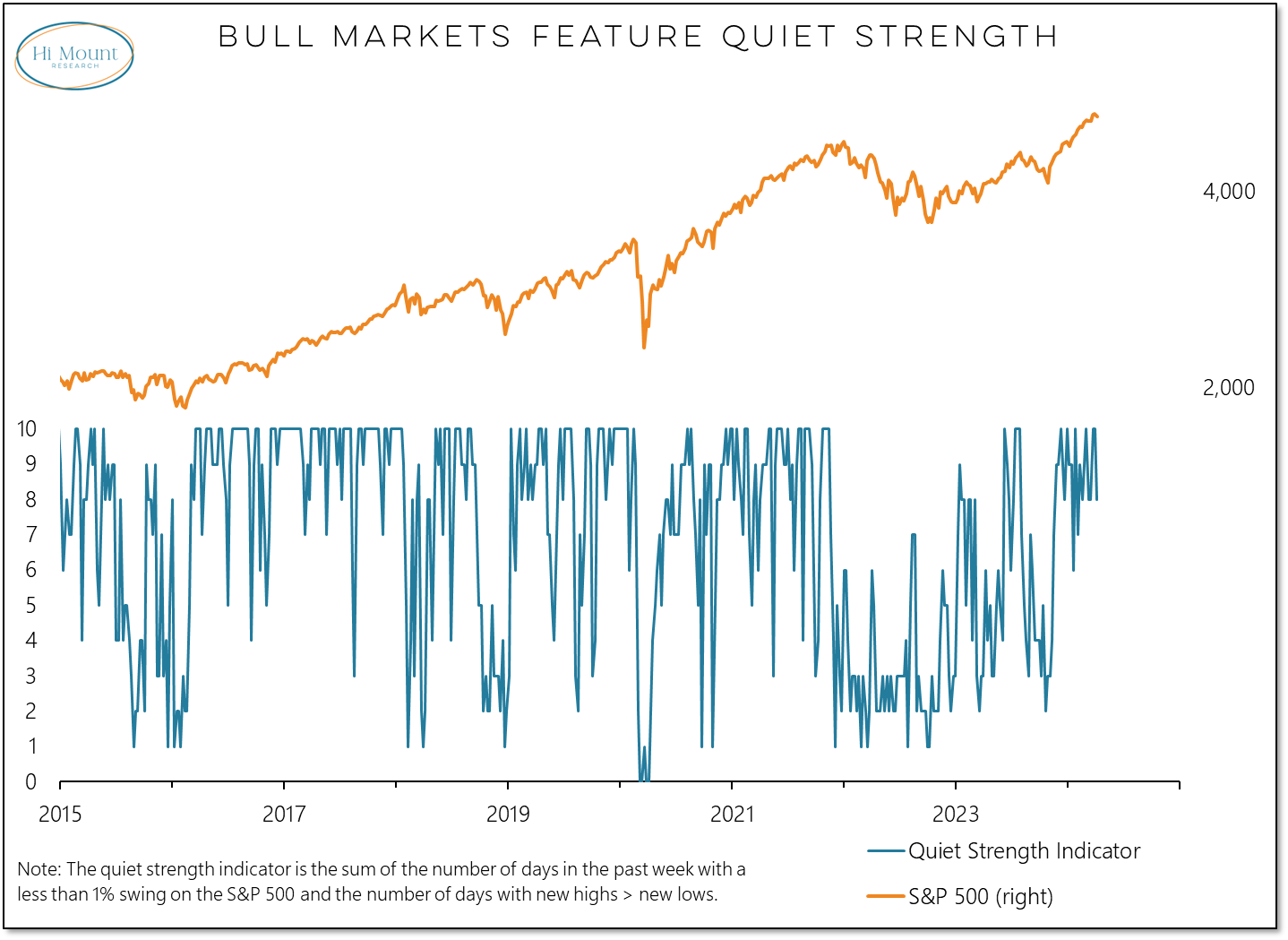

Key Takeaway: Back-to-back 1% swings on the S&P 500 pierced a period of quiet strength stocks. Even as gold shines, equities have not lost their luster.

The best bull markets border on boring. Small, consistent and persistent moves are the name of the game. Big day-to-day swings are good for headlines, but not great for investors’ nerves. If the recent period of quiet strength is coming to an end, we will likely see both volatility and internal weakness accelerate in the weeks ahead. For now, it looks more like healthy consolidation than a market that is on the brink of breakdown.

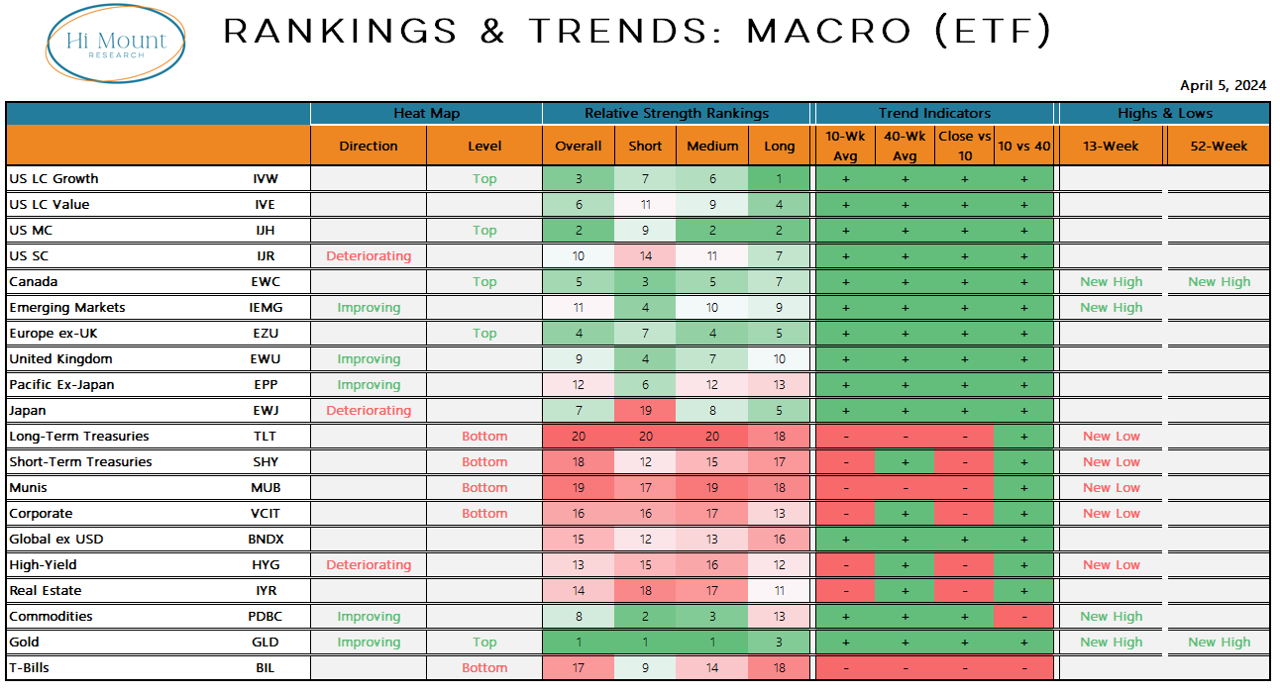

Our Relative Strength Rankings show Gold climbing to the top of the leaderboard and Commodities overall are on the rise as well.

My guess is that commodities and gold are in the early stages of big long-term moves. They are in up-trends on an absolute basis and have turned higher relative to bonds. I expect that sometime this year they will take a relative leadership position versus stocks as well. The Blue Heron Composite Allocation Model is now at 63% stocks, 16% bonds, 21% commodities.

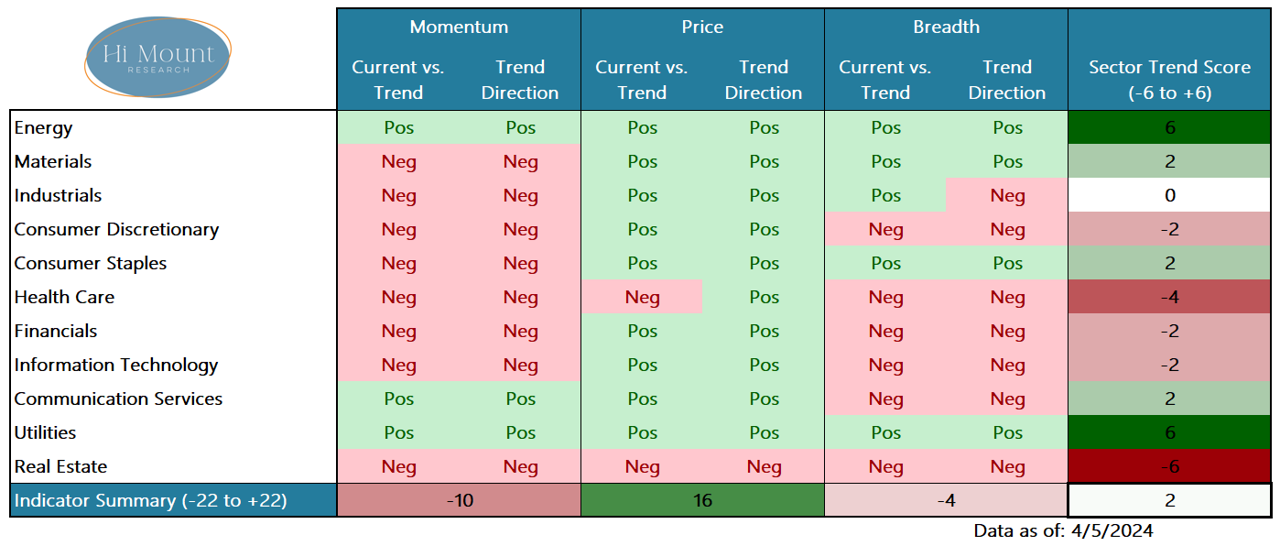

Commodity strength is building, but for many equities still dominate the conversation. While long-term price trends for stocks remain positive, shorter-term breadth and momentum trends at the sector level have cooled.

Rather than seeing that as cause for alarm, there are two reasons to believe this may just be part of a healthy consolidation:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.