Global Strength Provides New Leadership

Multi-year highs in our ACWI trend indicators reflect broad rally participation and good opportunities for global equity diversification

Key Takeaway: US leadership among global equities is deteriorating - not because the US itself is weakening, but because the rest of world is so strong.

The Rest Of The Story: The first reading of the new year for our global market trend indicator is also the highest reading since the summer of 2021. Recoveries that get through top of the transition zone (in the 40's) tend to persist. The same can be said of pullbacks that drop below the bottom of the transition zone. Right now, the recovery is being led by EMEA (Europe, Middle East, Africa) markets.

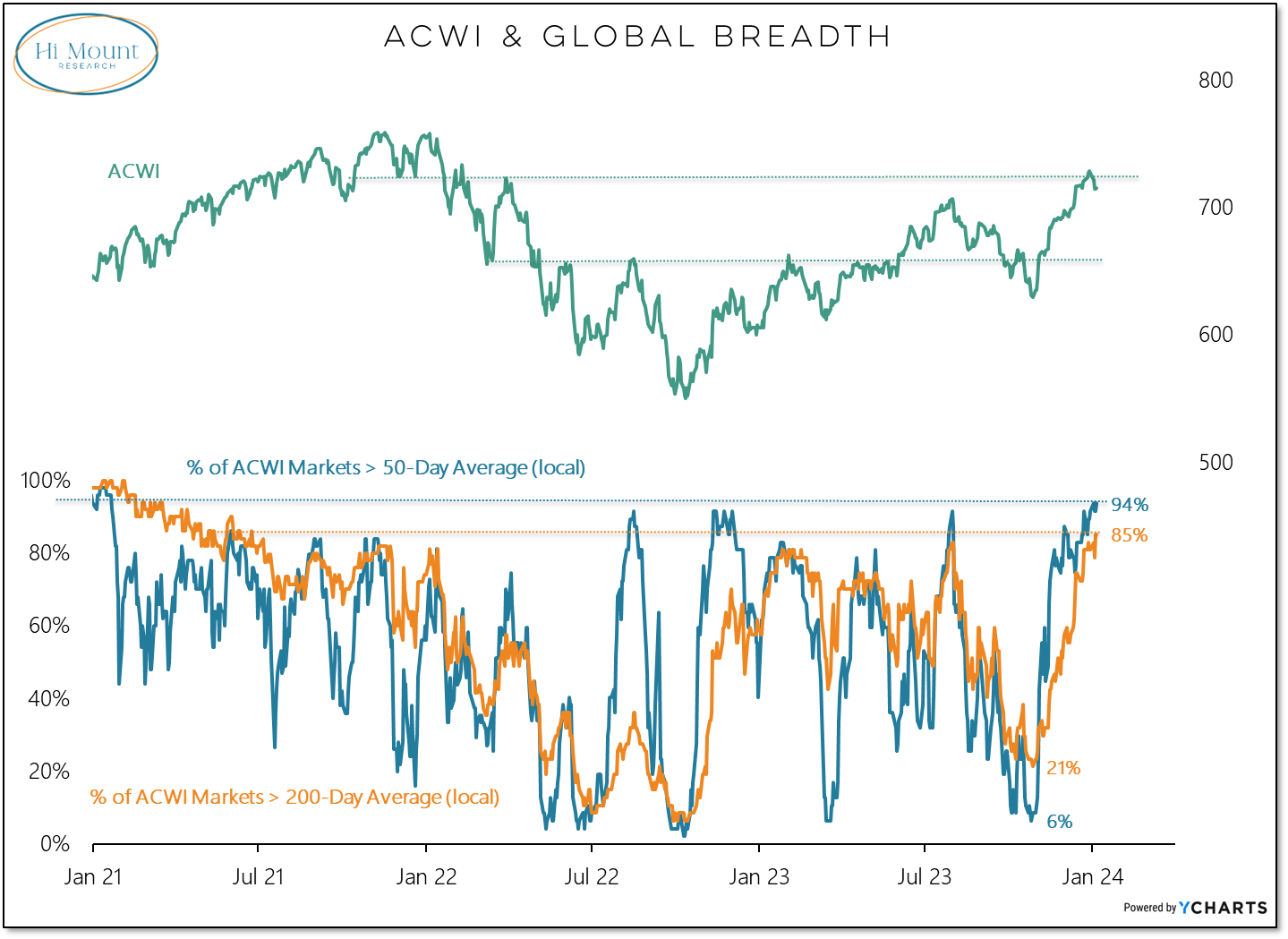

On a local currency basis, the percentage of ACWI markets above their 200-day average is at the highest level since June 2021. The percentage above their 50-day averages is at the highest since Jan 2021. These were at 21% and 65%, respectively, back in October.

Global strength is translating into some loss of leadership from the US. In our ACWI rankings, US relative strength trends are deteriorating and it is now just running in the middle of the pack.

As the "Trend Indicators" and "Highs & Lows" columns in the following tables show, there is plenty of strength to choose from when making global equity allocation decisions. Areas of absolute and relative strength that continue to catch my eye include . . .

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.