Global Stocks Get In Gear

Absolute trends remain strong, but our equity models and relative strength rankings show global leadership shifting overseas.

Key Takeaway: US stock market trends remain strong, but opportunities for global equity exposure are on the rise.

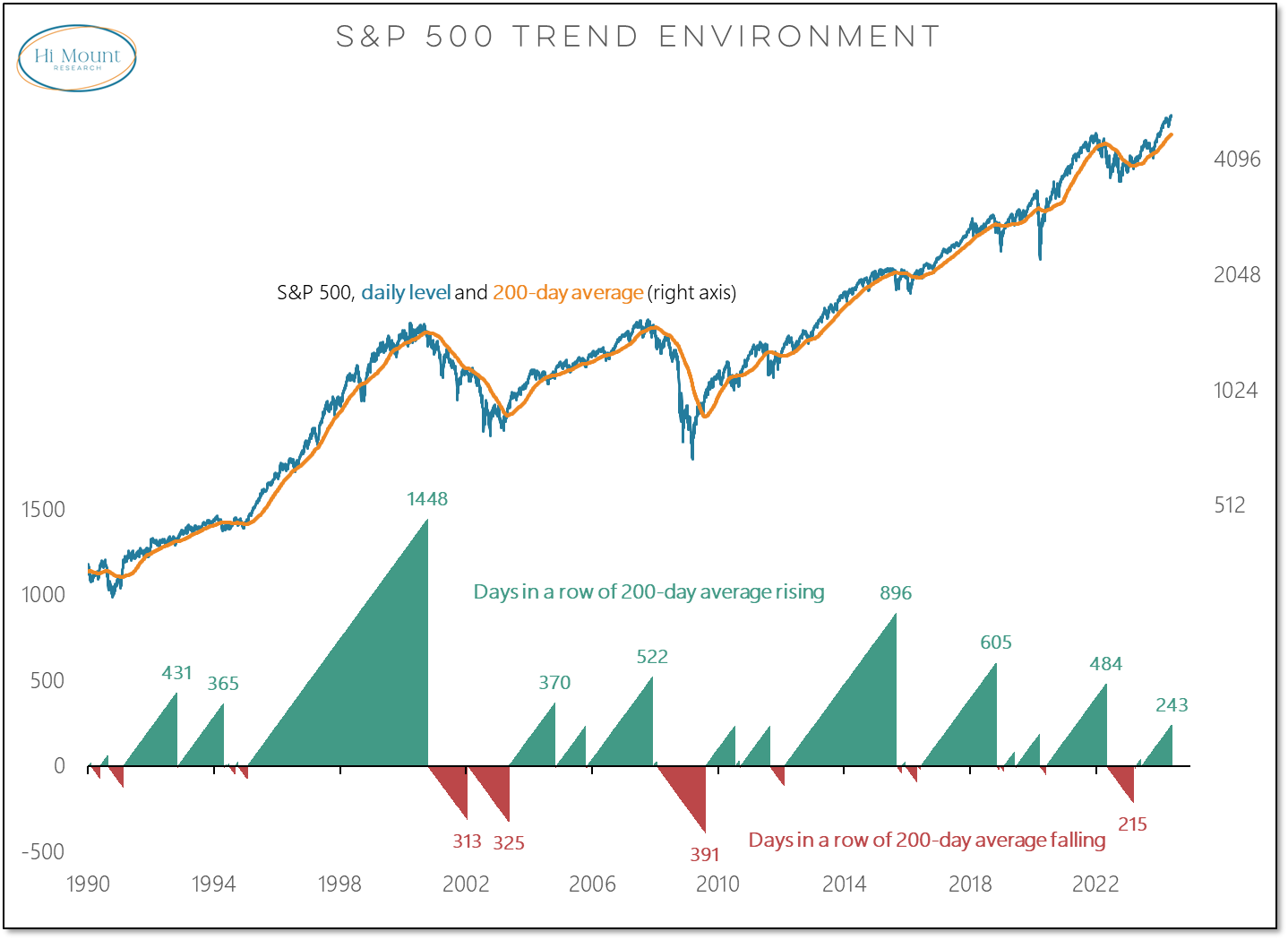

New highs exceeded new lows last week for the fourth week in a row and the 200-day average for the S&P 500 continues to rise. Following this trend (rather than anticipating turns) is a great way to capture strength and reduce volatility over the course of the market cycle. The trend is not always rising, but when it is, investors are paid to stay long.

While Bull Market Behavior is intact, we are seeing leadership rotation, around the world and within the US.

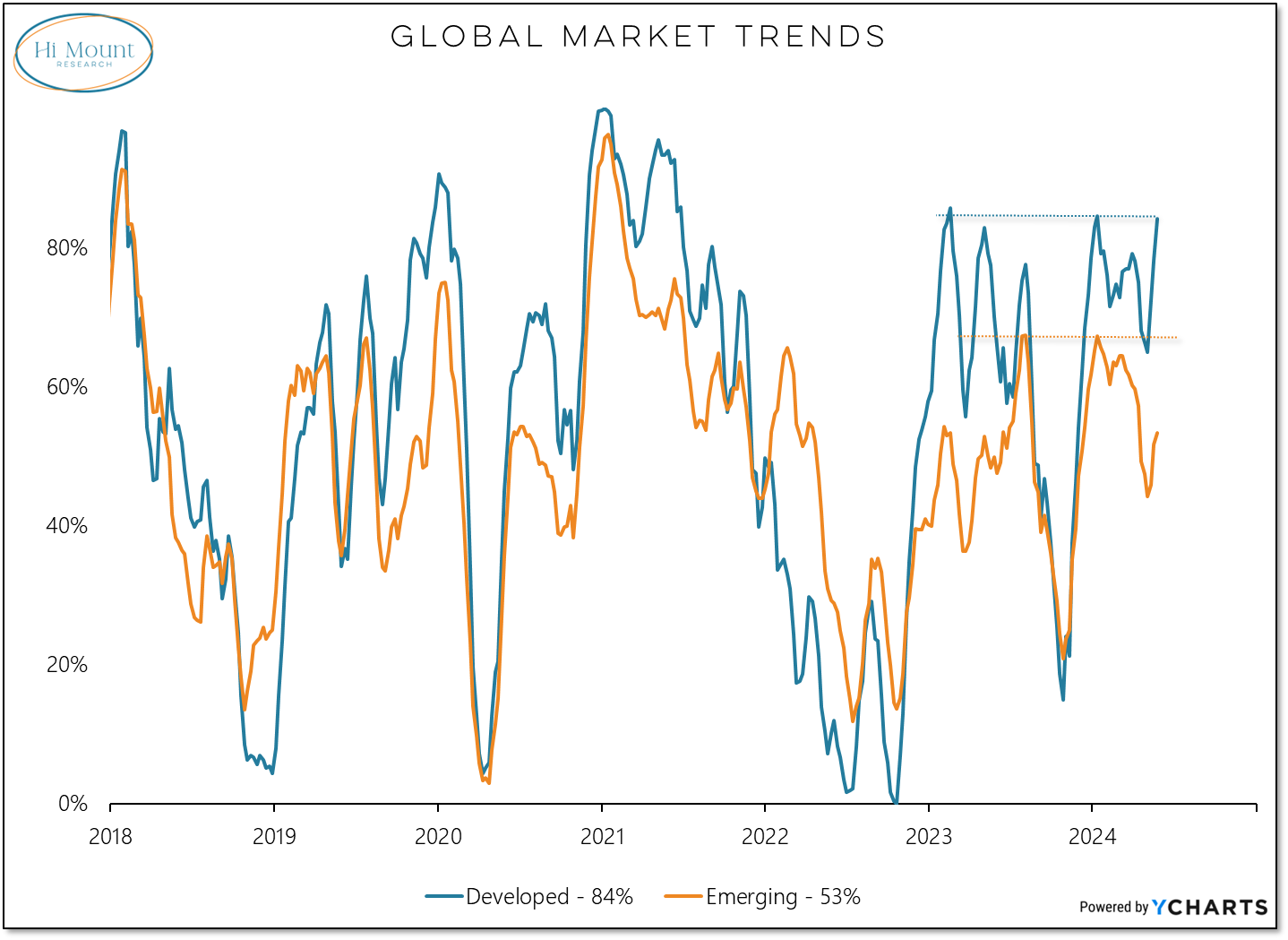

Country-level trends are improving after holding above the zone that distinguishes strong markets from weak markets. They have not yet, however, resolved the divergence that emerged earlier this year.

There is reason for optimism on this front. When we break out country-level trends on a Developed vs Emerging Market basis, we see that Developed Market trends are already near their previous peak.

Subscribers can keep reading for a summary of the latest readings from our relative strength rankings and asset allocation models (or read the entire update on our website).

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.