Global Market Leadership Trumping US Market Strength

The most bullish thing stocks can do is go up

Last week I was on the Money Life show with my friend Chuck Jaffe to talk about where I see risk and opportunity in the market. You can listen to the conversation here. This week’s note will expand on a couple of the topics that Chuck and I discussed.

Note: If you want to skip the commentary and go straight to the pictures, at the end of this note there is a link to download a PDF of all the charts (in addition to the usual link to our latest Relative Strength Rankings).

In summary, we talked about US market strength in the face of volatility, whether international market leadership has run its course and where to look for the best evidence that a bull market is intact.

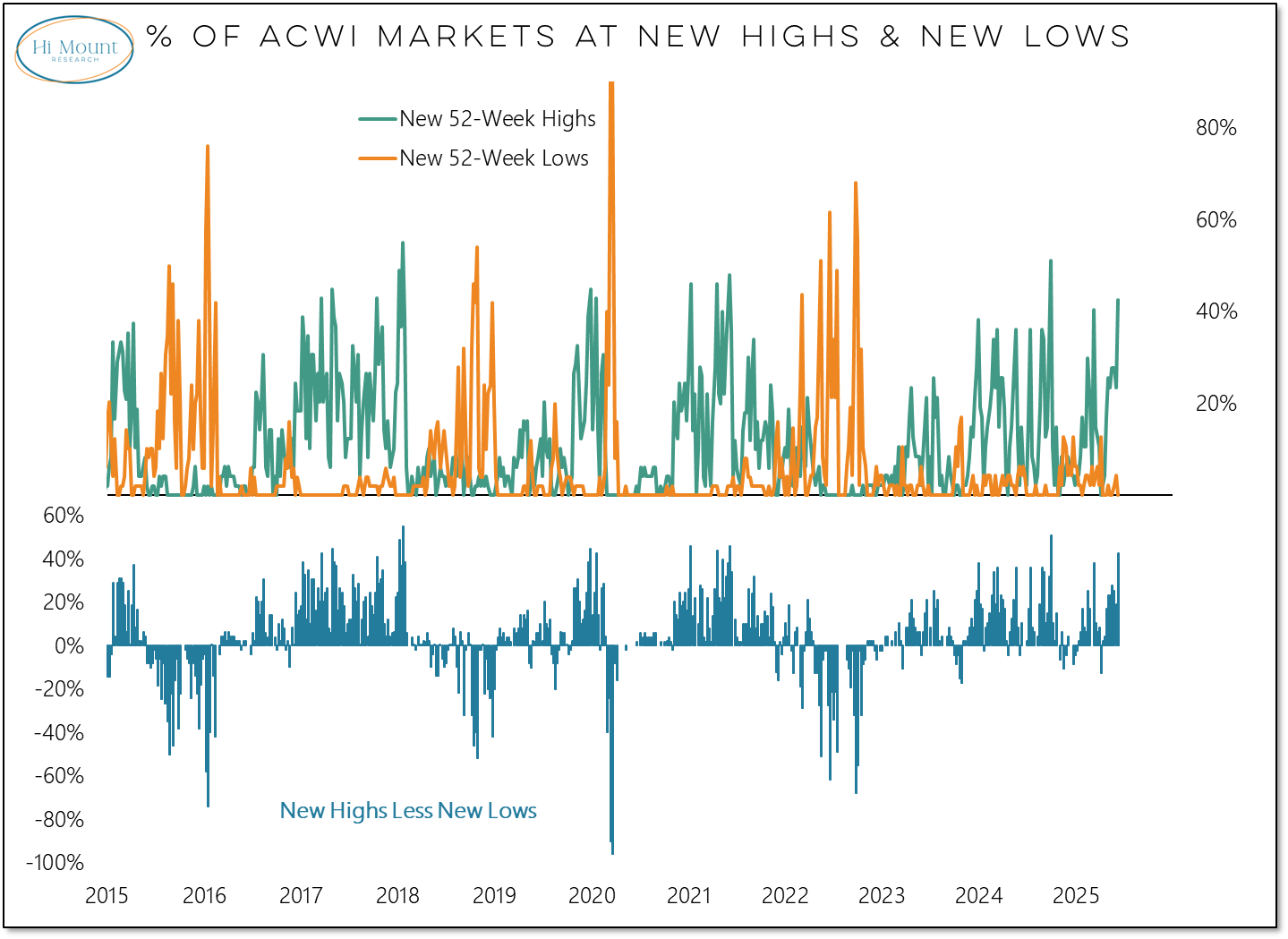

As a trend follower, I am a firm believer that the most bullish thing an investment can do is move higher. An analysis of absolute and relative price trends forms the basis of our dynamic approach to asset allocation. The goal of any trend following system is to distinguish between market moves that are just noise and those that are actually meaningful. While there are plenty of ways to measure trends, new highs are the best evidence of market strength.

When we look at equities from a global perspective, we are seeing a sharp expansion in the percentage of ACWI markets making new 52-week highs. Last week had the second most number of markets making new highs since mid-2021. Bull markets don’t end when new highs are being made – they are over when new highs stop being made.

It’s not just individual markets making new highs, the ACWI itself closed at a new high last week and our global market trend indicator is breaking out as well after establishing a pattern of higher lows that goes back to late 2022.

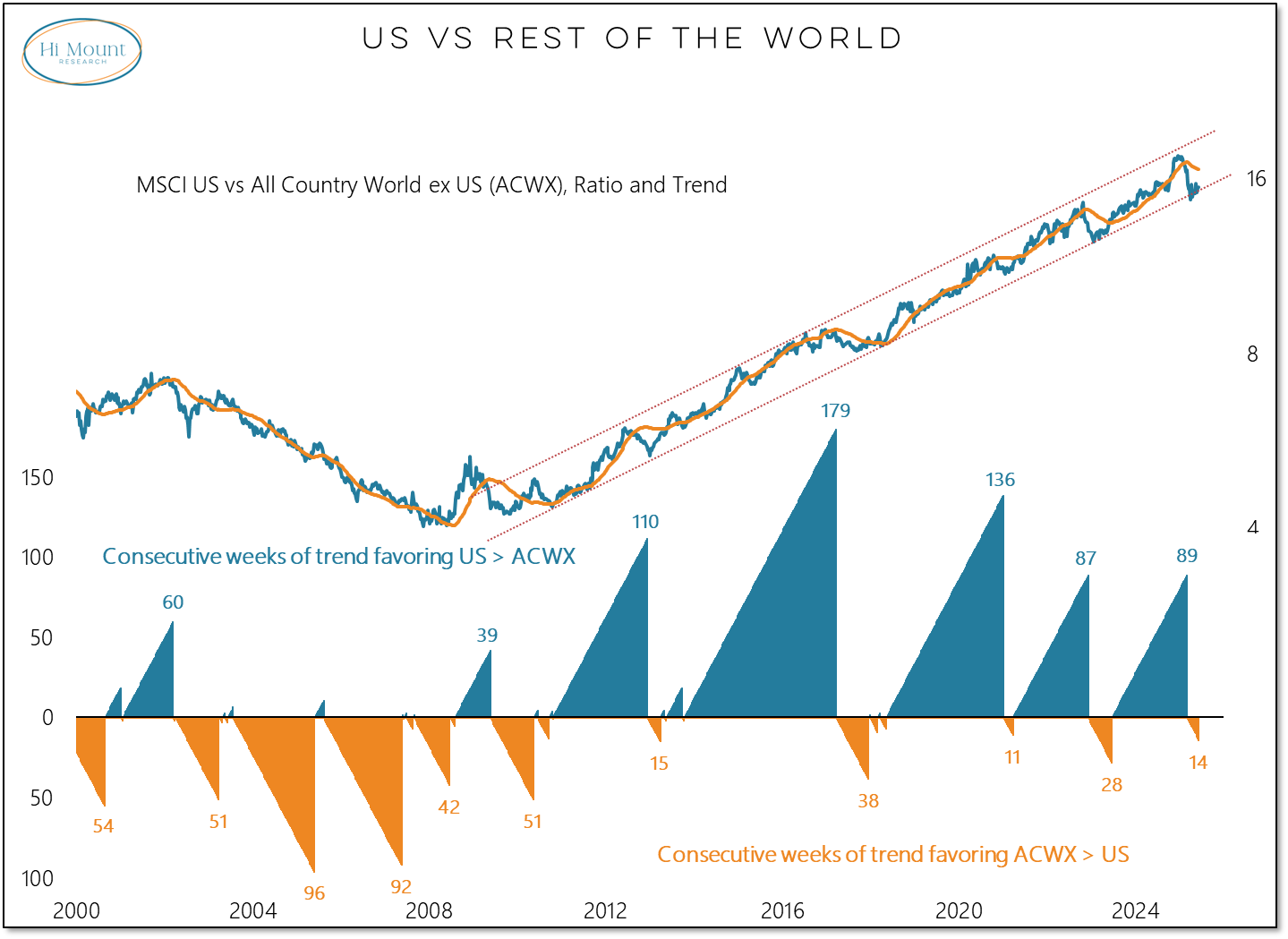

While we have seen global stocks doing better than US stocks in 2025, the relevant question for investors is whether this is the beginning of a broad shift in leadership away from the US or just a cyclical re-set within the context of a secular trend that favors the US. My guess and my gut suggest the former and not the latter. Rather than relying on either of those, we can look at the message of the market. The ratio between the US and the rest of the world is at the bottom of the trend channel that has been traced out over the past 15 years. This is a logical place for US leadership to re-assert itself if the secular trend is intact. If ACWX leadership persists going forward, we will know we are in a new investing paradigm.

Looking more closely at the US, we see a market that has shown a remarkable ability to bounce back after its early 2025 tariff-related swoon.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.