Global Equities Fuel Bounce to New Highs

Rally emerges, but lacks conviction as stocks wrestle with headwinds from bonds

In this week’s note:

Improving participation = better behavior

Sentiment shifts?

Still a lack of strength

Bond yield trend is rising

Global strength, but no gusto

Asset allocation trends favor commodities

Key Takeaway: Critical components of sustainable stock market strength still missing as commodities take a leadership role.

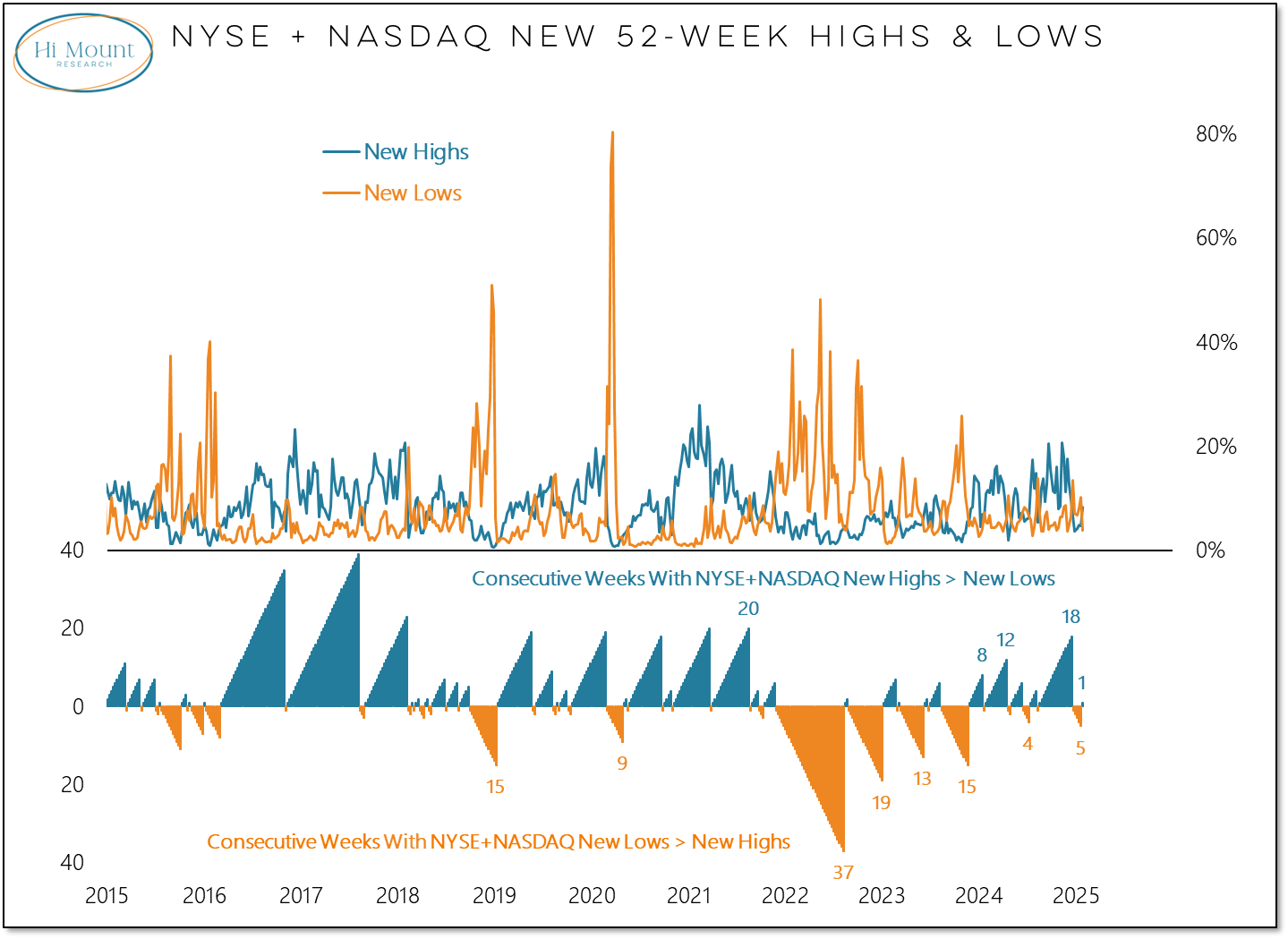

New highs on the NYSE and NASDAQ exceeded new lows last week for the first time in 6 weeks.

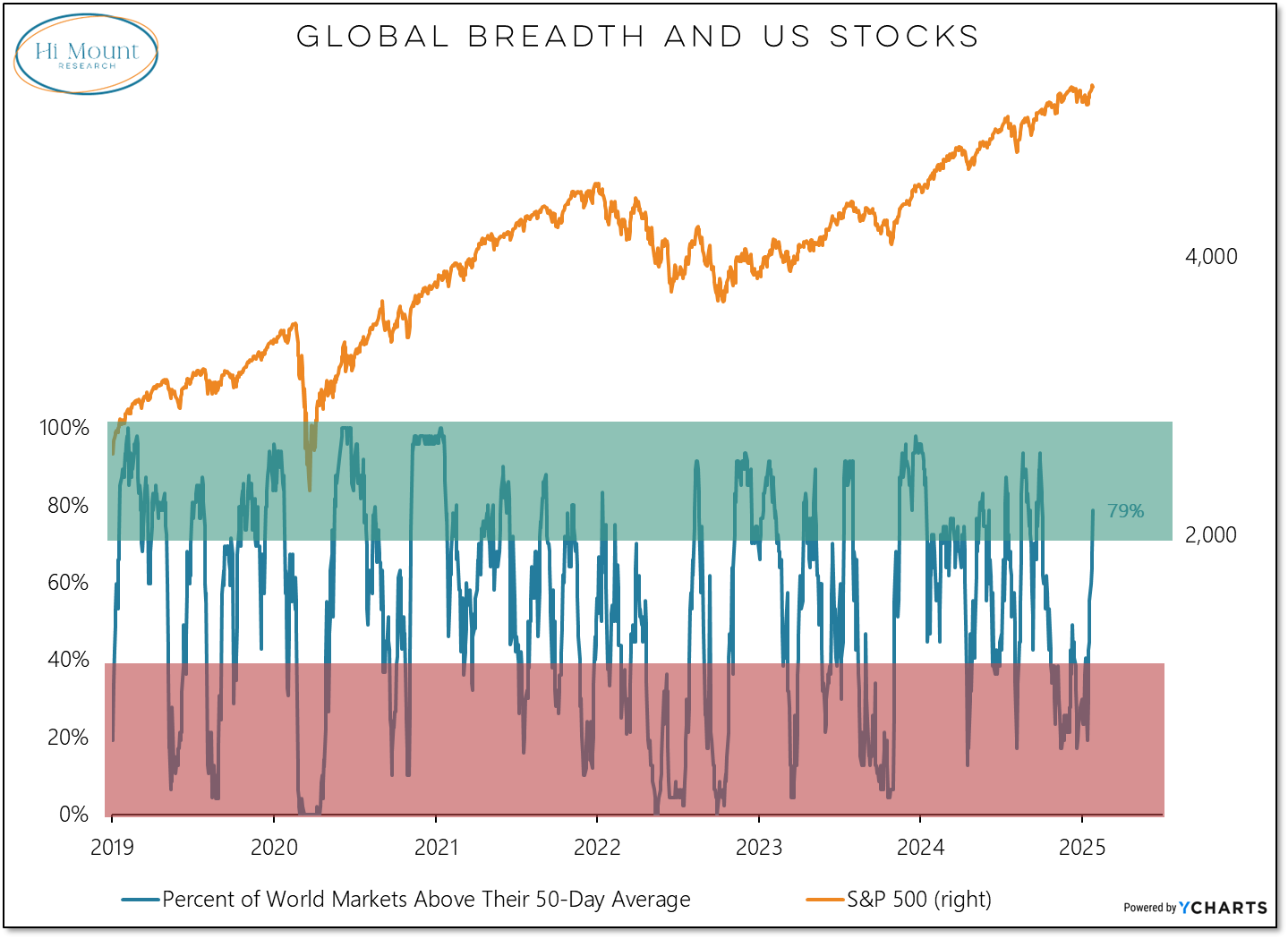

Better domestic participation was accompanied by even more impressive global strength. Global new highs surged to their highest level since October and the percentage of ACWI markets above their 50-day averages is finally back to a level that has supported stock market strength in the past.

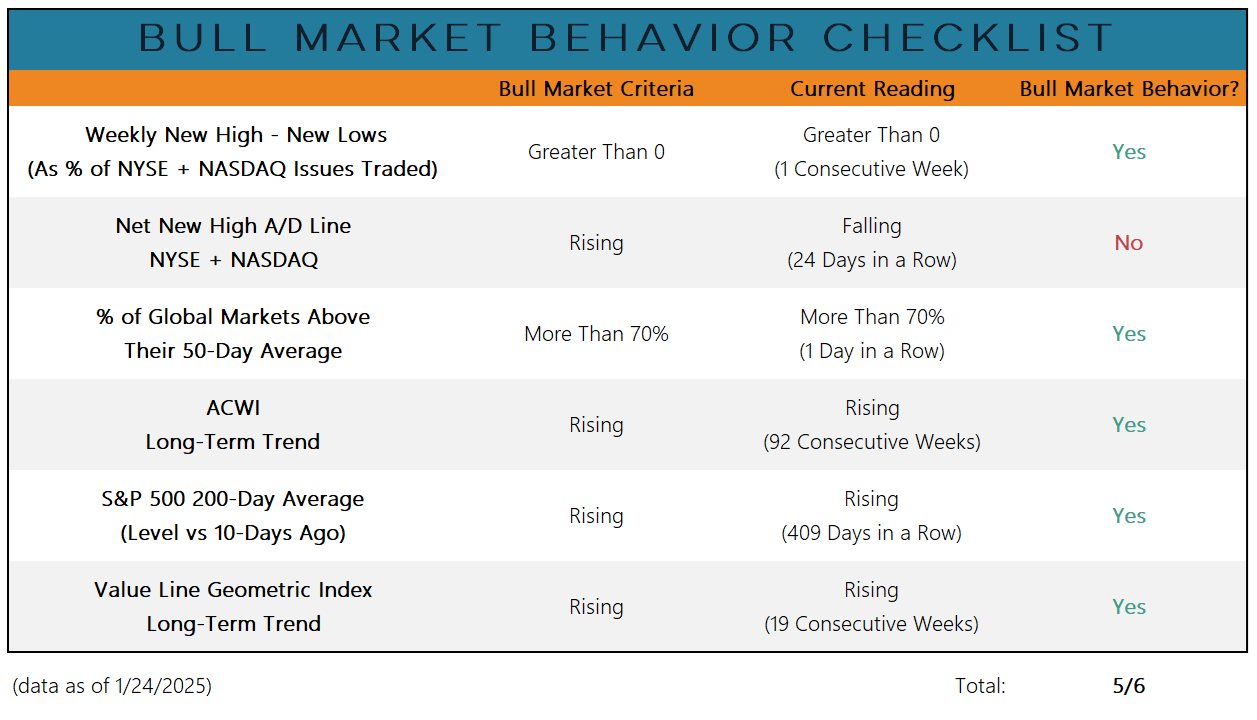

Overall, our Bull Market Behavior Checklist has improved and only the trend in net new highs remains outside of bullish territory (more on this below). While longer-term headwinds build, the market action over the past two weeks has brought new highs for the S&P 500 and other markets around the world.

While bull market strength has returned, bullish conviction is declining.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.