Getting In Gear

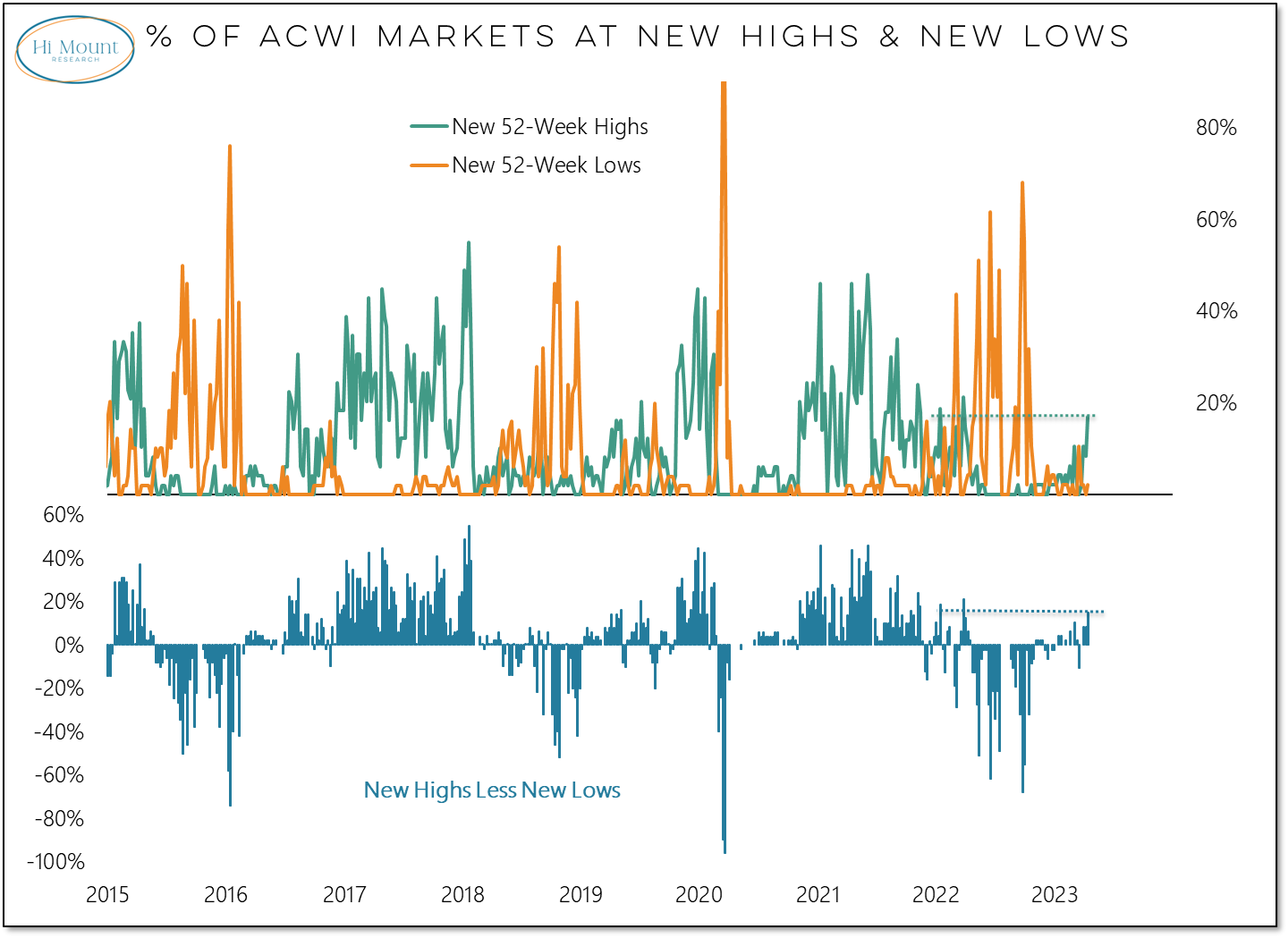

Global breadth is improving even as the US is seeing more new lows than new highs.

Of the 47 global markets in the ACWI index, 8 (17%) made new 52-week highs last week and just 1 (2%) made a new low last week. On a net basis (new highs less new lows), that’s the best reading since March 2022.

More Context: While US stocks are still struggling to exhibit bull market behavior, equities on a global basis are getting in gear. After rising relative to the US since early December, the long-term trend for the rest of the world (ACWI ex US) has now turned higher on an absolute basis. Our global asset allocation models are tilting toward equities even as they increasingly tilt away from US exposure. From a regional perspective, all 8 of the markets that reached new highs last week were in Europe.

Below, we take a closer look at the strength we are seeing overseas, the absence of strength in the US and what that means from an asset allocation perspective. We also consider the case for gold from both a technical and macro perspective.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.